The emergence of Bitcoin in 2009 marked the beginning of a new stage in the development of world monetary relations. For a long time on the market, the first cryptocurrency has gained great popularity among large investors. This is due to the stability of the algorithm put into it by its creator. So far, no critical blockchain vulnerabilities have been found that could jeopardize the existence of the entire crypto market.

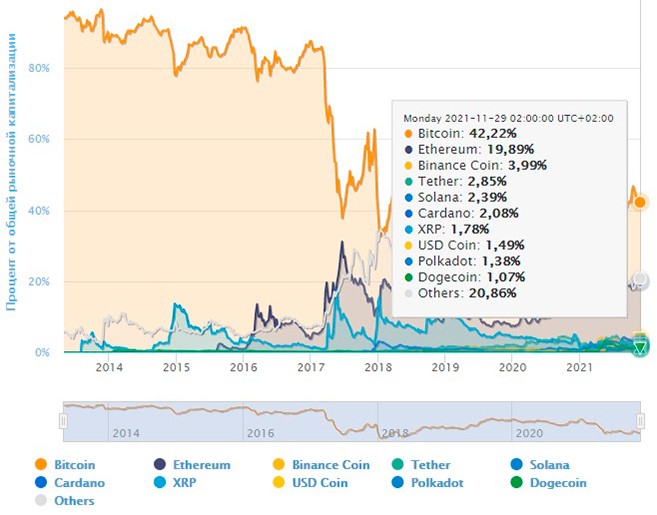

Altcoins are dependent on bitcoin because of the formation of the primary demand for digital currency around it. BTC accounts for almost half of all coin investments. Large investment portfolios include Bitcoin as an underlying asset.

Relationship between bitcoin and other cryptocurrency rates

The first coin that paved the way for altcoins is the leader for 2024 in terms of market capitalization. All major exchanges hold the bulk of their liquidity in Bitcoin, as the largest transaction volumes occur in trading pairs with BTC. Although the Bitcoin Dominance Index has shown a steady increase in altcoin investments since 2017, the flagship asset still holds 40% of the entire market. Its closest competitor, Ethereum, lags behind it by a factor of 2.

High demand among investors and limited issuance explain the rising price of BTC. Major payment systems add support for Bitcoin first and altcoins later. Also, the rate of cryptocurrencies depends on other factors:

- The sentiment of large investors. Digital assets are increasingly being used as a defense mechanism against inflation. This causes increased demand for coins during stock market and index declines.

- Intra-species competition. Improvements in protocol algorithms lead to capital flows into new industries. For example, the emergence of the decentralized finance market(DeFi). In a few years, it has grown to $100 billion and continues to show positive dynamics. Thus, the demand for coins that do not meet new market requirements will decrease and may lead to the complete disappearance of certain digital assets.

- Lack of real value. It is not easy for traders to determine a fair price for a high-tech product when the only tangible parameters are supply and demand. This has led to many cryptocurrencies being valued in relation to bitcoin, which also has no attachment to physical objects.

What other factors influence the altcoin exchange rate

Price formation relies on several fundamental driving forces. Exchange quotations depend on such factors:

- News background. Media publications serve as a powerful short-term price driver. This is especially true for negatively colored news, such as the fact that China’s ban on mining caused the market to fall.

- Government policy. Legalization of the circulation of digital assets leads to increased demand and proliferation of tokens and coins as a means of payment. Cryptocurrency becomes familiar not only to enthusiasts, but also enters everyday life for mutual settlements.

- Public trust. The expansion of the field of application of digital coins increases their popularity. This is due to new technological processes aimed at reducing transaction fees and increasing speed. Society is showing interest in tokens and koins, and their exchange rate is increasing.

- Security. The inability of modern computing power to hack the blockchain is a positive incentive to increase demand for such assets.

Which altcoins are least dependent on bitcoin

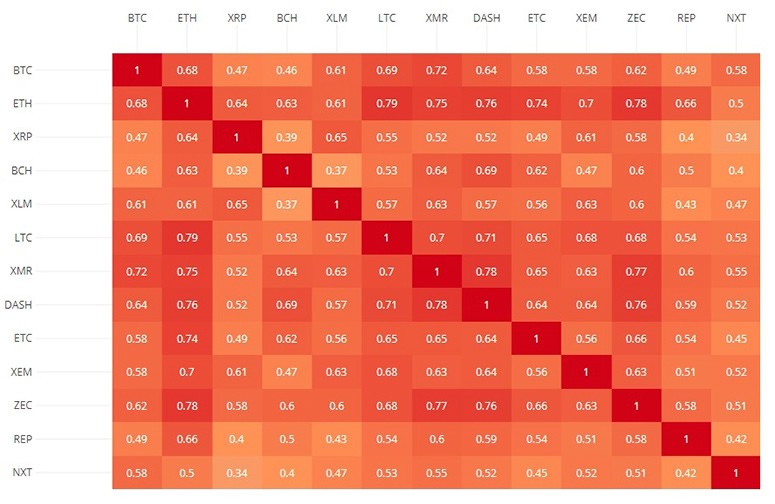

When a change in one value is reflected in another – this is called correlation. It is standardly measured between -1 and 1.

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

| Value | Description |

|---|---|

| 1 | The movement of assets is synchronized and they react to external factors in the same way |

| 0 | Quotes fluctuations are completely independent of each other |

| -1 | Movement in opposite directions |

Based on statistical data, special tables of the correlation of cryptocurrencies are calculated, which are freely available for study.

According to the analysis for 2021, the following altcoins were least dependent on the movement of the bitcoin price:

These are the only coins on the market with high liquidity that show a moderate correlation (less than 0.5). One way or another, all cryptocurrencies are dependent on bitcoin, where any movement of BTC strongly affects their price.

However, the market has an inverse correlation with commodities and stocks. When traditional indices fall (S&P 500, Dow Jones), there are inflows of investments. The market capitalization of tokens and coins also increases.

Methods of prediction and analysis

The choice of tools for predicting future movement depends on the goal pursued by the investor or trader. If it is a long-term investment, fundamental analysis to determine the global trend will be an important factor. When speculating for one day, traders use technical analysis tools.

To form a long-term portfolio, capital is allocated among assets with negative correlation, which reduces the overall risk. Cryptocurrency, which is very dependent on the bitcoin rate, is used by traders for day trading, when market entry signals on one currency pair, are automatically duplicated in others.

Technical analysis does not seek to establish a fair price: it is based on the statement of repetition and cyclicality of the market.

With the help of mathematical models, graphical indicators are built, which determine the current state based on the history of past quotes. It is assumed that traders make the same decisions in similar conditions.

Fundamental analysis is based on general economic factors that allow to determine the intrinsic value of the product. If there is an imbalance between the market price and the calculated price, a forecast of the rate movement is made. If an asset is overvalued, then it will become cheaper, and vice versa.

Frequently Asked Questions

💰 Which cryptocurrency should I buy when BTC is growing?

You should choose digital assets from the correlation matrix that have a close to unity correlation coefficient. This does not guarantee a profit, but it increases its probability.

❓ What are cryptocurrency indices?

A derivative exchange instrument that displays the aggregate price of coins based on some attribute. For example, the Coinbase Index Fund includes the 12 largest assets weighted by their capitalization.

❗ How does the stock market decline affect the crypto market?

They have an inverse relationship, i.e. when traditional indices fall, investors, to avoid capital loss, buy digital coins, increasing demand for them.

✅ How to use correlation data?

To reduce risk, a cryptocurrency with a coefficient below zero relative to the underlying asset is chosen. For additional profits, the closer this value is to one, the better.

💡 Is there a secured cryptocurrency?

Yes, it is called stablecoin and it is tied to monetary assets (gold, US dollar).

Is there a mistake in the text? Highlight it with your mouse and press Ctrl + Enter

Author: Saifedean Ammous, an expert in cryptocurrency economics.