To make money on tokens and coins, you not only need to be able to determine which way their rate will change. There is a final stage in any trading and investing strategy. The user is obliged to fix profits on the cryptocurrency exchange before the trend changes in the opposite direction and the investment is lost. Therefore, it is important for beginners when building a strategy to learn how to find the points of closing the deal.

The concept of profit taking in cryptocurrency

Traders and investors use such methods of predicting the rate of digital assets:

- Fundamental analysis.

- Indicator strategies.

- Analysis of graphical figures and levels.

- Strategies based on the study of the order stack.

If the methodology turned out to be effective, the cryptocurrency rate changes in the desired direction for the user. The balance of the wallet or account grows, the client sees a positive result. But the transaction can be considered successful only after fixing the profit. If you sell a growing cryptocurrency too early or hold the position until the trend reverses, there is a risk of losing income. Due to the fact that the price of tokens and coins changes dramatically, instead of receiving potential earnings, you can lose all of your initial capital.

Therefore, traders and investors are obliged to fix profits on cryptocurrency exchanges, taking out of circulation the income received from transactions. There are different ways to exit a successful transaction. The main thing in this case is to follow the rule: the trading result is considered positive only after the user has transferred capital into safe assets.

How to fix profits on the cryptocurrency exchange

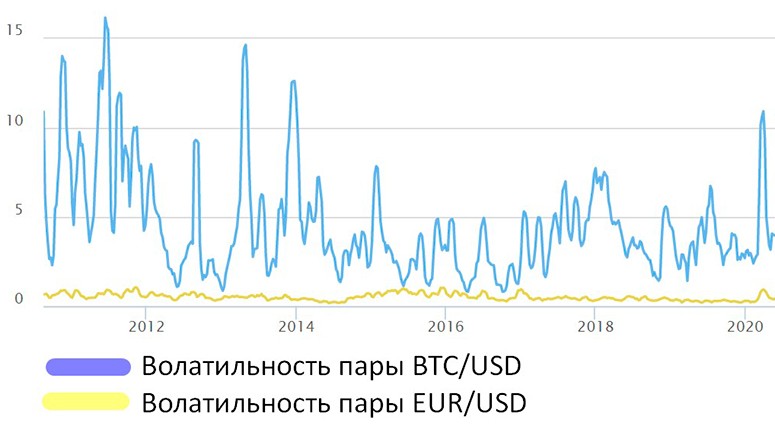

The market of digital coins is characterized by high volatility and unpredictability. In the history of quotes of Bitcoin, Ethereum and other cryptocurrencies, you can find periods during which the rate changed by tens of percent per day. Therefore, there are no general rules for setting a trade completion point. Usually, traders and investors use such methods:

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

- Forecasting based on the news background or quote dynamics (fundamental and technical analysis).

- Withdrawal of the initial capital immediately after making a profit.

- Completion of the transaction when the predetermined goal is reached.

- Gradual withdrawal of profit.

Based on forecasting

The most reliable way to find the point of income fixation is to conduct a market analysis. Users try to determine in which direction the trend will change. To do this, you can apply the techniques listed in the table.

| Name | Essence |

|---|---|

| News analysis | Traders follow economic statistics, statements of politicians and major businessmen. If there is important news for the crypto market, the user assesses the risk of a trend reversal and withdraws assets to a safe place. |

| Studying economic statistics and onchain metrics | The basis of this technique is fundamental analysis. Holders of digital currency try to assess the situation on the markets and find the most promising tokens and coins. If the situation on the exchanges is unfavorable, transactions are closed, and the capital is transferred to fiat, gold and other stable assets. |

| Technical analysis | Traders study charts and past quotes. Based on this information, it is possible to assume how the rate of cryptoasset will change in the future. Proponents of technical analysis believe that history is cyclical. Knowing past quotes, it is possible to find a trend reversal point. |

Strategy of preserving investments

The essence of this method is reduced to the fastest possible withdrawal of the starting capital. For example, if an investor invested $1000 in a crypto asset and then the price of the currency increased by 10%, the user’s balance will be $1100. In this situation, it is possible to withdraw $1000. The investor risks losing only the income received. But the strategy of preserving investments has several disadvantages:

- Inability to ensure breakeven. Not all operations on crypto exchanges are successful. If the rate of digital currency changed in the opposite direction, the deposit will decrease. Cautious strategies do not always allow you to compensate for losses from unsuccessful transactions.

- Low profitability. The larger the transaction amount, the higher the potential earnings. After withdrawing the initial capital, the profit will grow slower.

Profit threshold

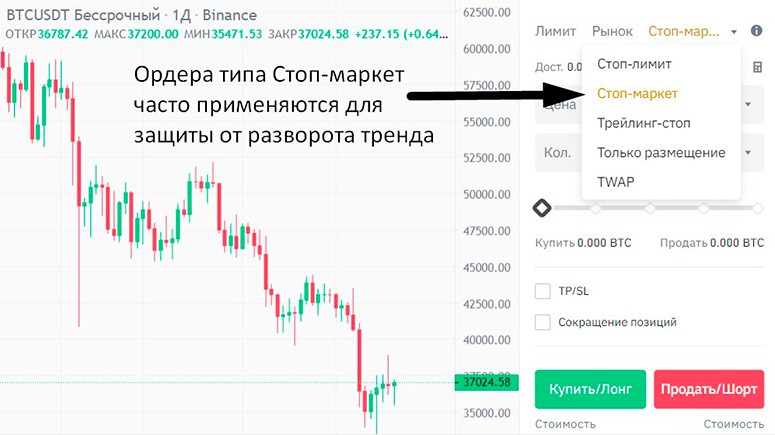

The most common method in the community of crypto traders. The user determines in advance the price level to which quotes are expected to grow. The trader plans to fix the profit in cryptocurrency after the rate of the asset reaches the specified mark. Usually on exchanges for this purpose pending orders are placed. In this case, after filling out the

, the user can close the browser or mobile application and allow the platform to fix the income on its own if the price goes in the right direction.

.

As profits are made

This method is the opposite of the strategy of preserving your investment. If a transaction on a crypto exchange is successful, the user withdraws the income received, not the initial investment. For example, if a trader bought $1000 worth of Bitcoin and the price of BTC increased by 10%, the balance will be $1100. The user withdraws $100, leaving the rest of the coins on deposit. Sometimes this strategy involves placing stop-loss orders. If the trend reverses, the transaction will be automatically closed at the breakeven point.

Methods of fixing

The main volume of transactions with cryptoassets occurs on the spot market. The buyer receives real tokens and coins, which are stored on his wallet or exchange account. Profit fixation in cryptocurrency is carried out in several ways.

Transfer to fiat

The simplest method to protect investments from depreciation. Cryptocurrency exchange customers sell tokens or coins, receiving fiat currency in return. This money can be left on deposit for the next transaction or withdrawn to a card or bank account. The disadvantage of the method is the impossibility of exchanging cryptoassets for fiat on some exchanges. The client needs to send koins or tokens to a personal wallet and look for a counterparty for conversion.

Transfer to another cryptocurrency asset

The most aggressive and risky method of investment protection. Provides for the constant exchange of one cryptoasset for another. For example, if an investor made a profit by holding bitcoins, at the next stage he can convert them to Ethereum or Solana. The disadvantage of the method is the high volatility of the cryptocurrency market. If the user performs a failed transaction, he risks losing all the capital, despite past successful transactions.

.

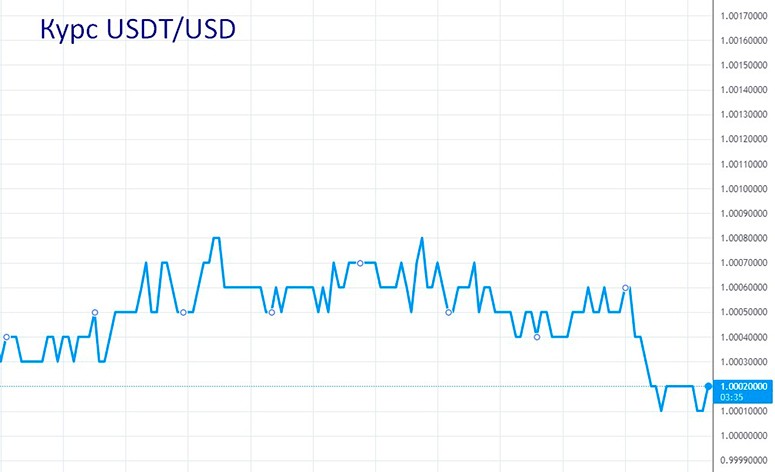

Stablecoin fixation

The disadvantage of most digital currencies is sudden changes in quotes. To protect against fluctuations, stablecoins were created – tokens, the price of which is linked to fiat or gold. For example, the rate of cryptocurrencies Tether and USD Coin refers to the American dollar in the proportion of 1:1. In fact, stablecoins are the digital analog of fiat.

The

TheProfit fixing in stablecoins can be applied if the exchange has trading pairs that include USDT, USDC and similar tokens. The advantage of these cryptoassets, compared to fiat, is the ability to directly withdraw money to another wallet. Most stablecoins circulate on the blockchain using smart contracts; the methods of storing, transferring them and the rest of the digital currencies are identical.

Helpful tips for novice investors

Many beginners make two opposite types of mistakes:

- They stop trading too quickly, trying not to miss out on even minimal profits.

- Forgetting to fix income, losing money after a trend change.

In the first case, beginners fear that they have incorrectly determined the entry point. For example, if a trader bought Bitcoin at a rate of $50,000 and the price of the crypto-asset increased to $50,500, such a transaction will bring the user less than 1% of income. But when beginners do not know whether they have performed the analysis correctly, they have a desire to complete the operation as soon as possible. Such a strategy is unprofitable, because sooner or later the client will receive a loss that exceeds the previous earnings. The opposite mistake is called “over-sitting” in traders’ slang. It consists in a beginner’s desire to earn more than the market situation actually allows. A trader opens a deal and leaves it active for too long in the expectation of increasing the deposit. But digital currency cannot constantly rise in price or become cheaper. Sooner or later there is a trend reversal, and the beginner loses his investment. All trading and investment operations should be based on a thorough market analysis, not on intuition or the desire to earn more.

Risk minimization

An important element of any strategy is the protection of capital from sharp market fluctuations. To minimize risks, you can apply the methods shown in the table below.

| Method | Essence |

|---|---|

| Limiting the volume of transactions | The higher the transaction amount, the more risky the trader is. It is not recommended to open transactions for all the money available to the user. |

| Refusal of leverage | Most crypto exchanges have a margin trading option. The platform provides clients with borrowed money that can be used in exchange transactions. But if the trader’s forecast turned out to be wrong, losses grow faster. For beginners it is desirable to trade on the spot market. |

| Setting Stop Loss and Take Profit orders | It is impossible to accurately predict the dynamics of the cryptoasset rate. It is necessary to take into account the risk of a sharp change of trend and to place pending orders in advance to fix the trading result. |

| Refusal to trade in unfavorable periods | The volatility of cryptocurrencies increases after the release of important news, political statements, market manipulations. In such situations, it is recommended to temporarily refuse from operations on exchanges. |

Gradual increase of the budget

The main goal of trading and investing is to increase capital. In the network you can find strategies that provide for a fixed percentage of profit that the client expects to receive from the transaction. For example, some methods suggest selling assets after they rise in price by 5%. Orientation on profitability is not always justified. The first priority should be to gradually build up the total capital without overestimating the risks.

Maximizing returns

As of January 2023, more than 7,600 tokens and coins were traded on the markets. While some cryptocurrencies are collapsing, others are reaching record highs. The task of traders and investors is to maximize returns from changes in the quotes of digital assets. Therefore, after completing another transaction, you should look for new opportunities to buy or sell cryptocurrency. Experienced users continuously analyze the market, looking for the most promising tokens and coins and invest in their growth. This strategy is more complex than passively holding a single crypto asset. But this approach to earning allows you to maximize your profits.

Short-term and long-term goals

Transactions on crypto exchanges should not be spontaneous. It is better to make decisions guided by careful analysis and calculation, not emotions. To properly capture profits in cryptocurrency, you need to plan the final result in advance. As a short-term goal, you can consider a successful operation to buy or sell an asset. In this case, traders and investors act according to the following algorithm:

- Select a promising digital currency.

- Conduct a market analysis and determine to what value the price of the asset will grow.

- Create an order with the required parameters, including volume, opening and closing rates.

- Watch the situation on the markets and adjust the trading plan.

- Timely close the transaction, fixing the profit.

On crypto exchanges, it is possible to earn money not only during the growth, but also during the fall of digital currencies. In this case, users open short positions and wait for a decrease in quotations. With long-term planning, investors try to increase the starting capital due to the stable growth of the price of cryptocurrency. Traders have different methods, they conduct continuous trading, alternating between buying and selling assets on exchanges.

Frequently Asked Questions

💰 How to learn how to fix profits in time?

It is better to train on a demo account without investing real money. Many exchanges offer such an opportunity to all visitors.

🔑 In which currency is it better to keep savings in between trading cryptoassets?

There is no one absolutely stable currency. The rate of fiat, gold, silver is also constantly changing. Therefore, investors try to choose assets with minimal current volatility.

📲 How to determine the optimal profit taking point?

It depends on the trading strategy. Usually, users follow the quotes and withdraw money when they see signs of a trend change.

💡 Is it possible to protect capital from depreciation if tokens and coins are stored in a crypto wallet and not on an exchange?

Yes. At the risk of a collapse of quotations, you should immediately sell the digital currency on a trading platform or through exchanges.

💻 Is it safe to keep savings on crypto exchanges?

Developers of trading platforms take measures to protect customer deposits. But sometimes attackers manage to hack the exchange protocol and steal savings. Therefore, it is better to store crypto-assets on personal software, hardware or paper wallets.

Error in the text? Highlight it with your mouse and press Ctrl + Enter