Bitcoin emerged as an alternative to the outdated financial system with faster and more transparent transfers. Special exchanges were created to buy and sell digital coins. Over 14 years, they have transformed into multifunctional platforms where you can trade cryptocurrency using various tools, invest and participate in the launch of new projects. The largest exchanges work under the control of regulators, ensure the safety of transactions and teach beginners the basics of trading.

Rating of the best platforms for cryptocurrency trading

In July 2024, the monitor tracks the trading performance of 1407 digital exchanges. According to various estimates, Russians account for 20-25% of traffic on the largest platforms in 2024, so many of them offer Russian-language versions of interfaces. Some crypto exchanges have retained ruble support in P2P services. In the table you can compare the platforms available in the Russian Federation by trading indicators. The rating is compiled in July 2024.

| Exchange | Trading volume per 24 hours, $ | Number of visits per month, mln | Verification |

|---|---|---|---|

OKX

The crypto exchange was established in 2014 in the United States and was originally called OKCoin. In 2017, the founders moved the headquarters to Hong Kong and renamed the platform due to claims from the US regulator. This is how the modern name OKX appeared. In the following years, the jurisdiction was moved twice more – first to Malta and then to the Seychelles. These states are known for their cryptocurrency-friendly laws.

OKX is one of the best cryptocurrency trading platforms in 2024 with extensive functionality and high liquidity. Users have access to:

- Spot trading and leveraged trades.

- Derivatives trading.

- Express purchase of cryptocurrencies from bank cards.

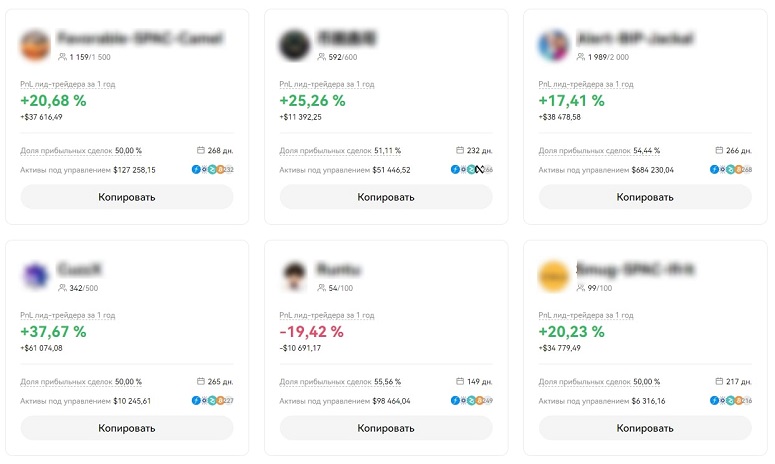

- Copytrading.

- Trading with bots.

- Investments.

- Loans.

- Participation in launching new projects on Jumpstart platform.

Beginners can test the crypto exchange capabilities in a demo account before starting real trading. The “Academy” – a separate section with tutorials on the market structure and guides to trading on OKX – has been created to help beginners.

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

Bybit

The trading platform was founded in 2018 in Singapore. In 2023, the developers moved the headquarters to Dubai. This was a strategic decision that opened a promising market in the Middle East for Bybit. The UAE is positioning itself as a future hub for projects in the cryptocurrency and blockchain segment. The Bybit platform aims to be at the forefront of innovation in the region.

In 2023, the exchange ranked second on the list of the best cryptocurrency buying and trading platforms among 400 companies in the UAE. After Binance left the Russian Federation, the Bybit service also held leading positions in the Russian market, but soon lost them to OKX due to higher trading commissions.

In 2024, the platform is in the eighth place in the world in terms of spot transactions with an indicator of $4.06 billion per day. Bybit trades 512 coins in 598 pairs. Most assets can be bought and sold for USDT. There are also pairs with BTC, USDC.

The main direction on the platform is derivatives trading. Bybit’s futures market is second only to Binance in terms of scale. The amount of open positions for the last 24 hours is $13.6 billion.

HTX

The exchange was created in 2013 in China. At first, the platform was called Huobi and focused on the domestic market. After the tightening of the rules of cryptocurrency trading in the country, the developers switched to the international segment, and the prefix Global was added to the name of the exchange.

Read also

In 2022, Huobi became part of the TRON ecosystem. A year later, the new owners rebranded the site and renamed it HTX. In 2024, the exchange ranks fourth in the world in terms of the volume of transactions on the spot. HTX offers a wide range of trading and investment tools:

- Spot and margin trading.

- Quick purchase of digital coins from cards (not available for Russians due to provider restrictions).

- Transactions with futures contracts and options.

- OTC transactions (OTC).

- Crypto-loans.

- Investment products.

- Coin distribution to users and other options.

HTX service is also among the exchanges on which it is best to trade cryptocurrency for Russians. This platform did not introduce restrictions for the Russian Federation for a long time, but had to remove support for the ruble from P2P.

How to choose a platform where to trade cryptocurrency

Exchanges for transactions with tokens work similarly to traditional services. Since the digital asset market is in its infancy, many instruments from stock exchanges are being adapted to trade crypto. The best exchanges offer a wide range of methods for trading and investing.

The main criteria for safe operation are reputation and an effective security system. You can then choose a service with your own goals in mind.

Liquidity

This indicator depends on the attendance and trading activity of users. High total turnover indicates the financial stability of the crypto platform and attracts traders. The more buy and sell orders are in the order books, the faster the program will find a counter offer to close the transaction.

Commissions

Crypto exchanges set fees for order execution. On average, it is 0.1-0.2%. The lower the commission, the more the trader will earn. For one-time transactions, the amount may be insignificant. But if a trader conducts several transactions per day, there is a risk to lose most of the profit on commissions.

For example, OKX service charges 0.08% on spot trades from makers and 0.1% from takers. The Bybit platform, on the other hand, has raised commissions. In 2024, makers and takers without VIP level pay the same – 0.1% of the transaction amount.

There are usually no fees for deposits. There are network fees for withdrawing assets. Some platforms also charge transaction fees.

Trading pairs

Major crypto exchanges support a large number of top and promising new coins. For example, there are 323 tokens trading on the OKX platform in July 2024. Most of them are in pairs with USDT and BTC. Trading for fiat – USD, EUR – is also available.

To get listed, projects undergo a strict selection process. Experts evaluate the team, roadmap, availability of a minimum viable product (MVP) and other parameters.

Supported trading instruments

Usually, several types of orders are used for trading:

- Market – allows you to buy or sell an asset at the current price.

- Limit – triggers when the rate set by the trader is reached.

- Stop Loss – helps to limit the possible loss.

- Take profit – fixes the profit.

In addition to standard orders, there are other professional orders (trigger, trailing). With their help you can increase profits and minimize risks. Exchanges also offer additional tools for trading – leverage, derivatives, etc.

How to trade on the stock exchange

To get started, you need to create an account on the crypto platform. You can link your email or authorize with an account on Google, Apple, Telegram.

In 2024, many centralized platforms require identity verification. Usually you need to specify personal data, confirm the information with a document (attach a scan copy of your passport or ID-card), and take selfies.

After the first login to the account, it is recommended to set the security settings. Then the order of actions is as follows:

- Go to the trading terminal.

- Enter ticker in the search line, select a pair.

- Fill in a buy or sell order – market or limit. You can use additional orders.

- Confirm the action by clicking on the “Buy” or “Sell” button.

Market order will be executed at the best current price, limit order – after reaching the set rate. Assets will be credited to the exchange account. Further they can be withdrawn to your personal wallet or used in the next transactions.

Frequently Asked Questions

🏢 Where can I find a list of all crypto exchanges?

The list of active trading platforms is better to look at major information portals.

✅ What are the most important qualities of crypto exchanges?

It is better to pay attention to the safety of investments, convenience of the terminal, the level of work of technical support and liquidity.

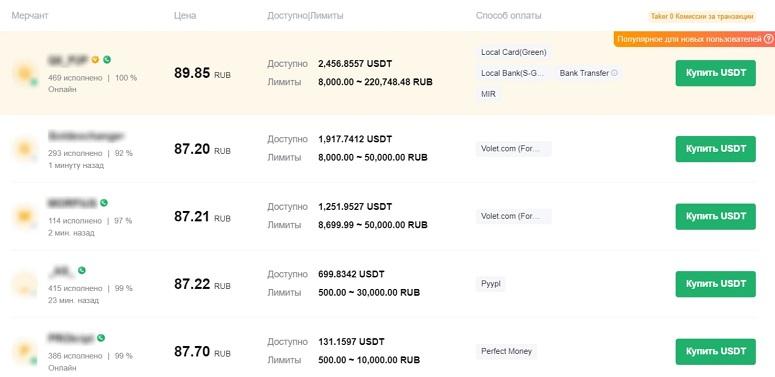

❓ What criteria should be used to choose P2P platforms?

It is important to pay attention to the number of available assets (cryptocurrencies and fiat), the number of payment methods and the maximum commission.

📲 Which exchanges can be trusted?

Only those that have a lot of positive reviews and high ratings. It is also recommended to check for licenses from government regulators.

💳 Do I need to link trading accounts to Telegram bots?

In most cases, it is necessary. Only for some programs in messenger the binding is not required.

Is there a mistake in the text? Highlight it with your mouse and press Ctrl + Enter.

Author: Saifedean Ammous, an expert in cryptocurrency economics.