Until 2023, Binance was the largest exchange on the Russian digital coin market. After the company left Russia, the balance of power in this segment changed. Platforms registered in loyal jurisdictions came to the forefront. They did not impose broad restrictions on Russians and were able to significantly increase their client base thanks to competently organized marketing.

Bybit remained the only platform that retained full P2P functionality in the Russian Federation and support for the ruble. Therefore, the founders’ decision to almost double commissions on the futures market for clients from the Russian Federation and other CIS countries was unexpected. In March 2024, Russian traders are once again facing the choice of an exchange for trading cryptocurrencies. In the article – about what options there are.

Increase in commissions on Bybit

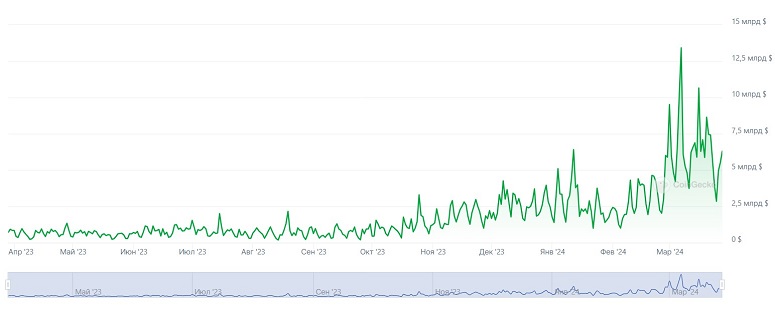

After the sale of the Russian business of Binance, part of its traffic moved to other exchanges. In a few months, these platforms have significantly increased trading volumes. In particular, on Bybit in August 2023, about $517 million was traded per day. In March 2024, the daily turnover of transactions exceeds $5.5 billion. At the peak at the beginning of the month, the figure reached $13.4 billion.

In order to preserve the RF market, the owners of the platform moved their headquarters from Singapore to Dubai in 2023. Bybit conducted an active marketing campaign to attract the Russian-speaking audience. For example, under the referral program, the exchange paid bloggers from 30% of the commissions of invited clients. Thanks to such efforts, Bybit soon became the market leader, even despite high (compared to fees on other platforms) commissions.

Presenting the headquarters in Dubai, the exchange’s executives confirmed the strategy of expansion to the East. In the same year, 2023, the platform received authorization to operate from Kazakhstan’s regulator AFSA.

In general, the audience from CIS countries ranks 2nd in terms of trading activity on Bybit.

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

However, in March 2024, representatives of the crypto exchange announced an increase in commissions. The rate for takers without VIP status on perpetual and futures contracts was increased from 0.02% to 0.036%. The fees for takers increased from 0.055% to 0.1%. The changes apply to users from Russia and other CIS countries.

What was the reason for this decision is not yet known. Surely the Bybit team objectively assesses the situation and the expected losses from the reduction of the audience. Many traders are already transferring assets to other crypto exchanges. Among the world’s largest platforms, there are still those that continue to provide services to Russians.

Analyzing the case of futures trading after the increase in commissions

At the beginning of 2024, Bybit ranks 3rd in terms of futures trading turnover, besides Binance and OKX. However, after the increase in commissions, transactions on the exchange became unprofitable for customers. As an example, we can consider a standard transaction to buy the DOGEUSDT contract without leverage:

- To open a position for 10 thousand USDT, a trader will have to pay a 0.1% taker’s commission – 10 USDT. For comparison, the fees for a similar transaction on OKX and KuCoin will be 5 and 6 USDT respectively.

- To close the position when the marked price is reached, the trader places a second order. If the position has increased to 15 thousand USDT, the fee will be 15 stable coins.

- The user can also increase the open position and partially close it. A commission will be deducted for each placed order.

The amount seems small, but with active leveraged trading, the total costs increase significantly. For a similar transaction with a leverage of x10, the commission will be $100.

What crypto exchanges are left in Russia

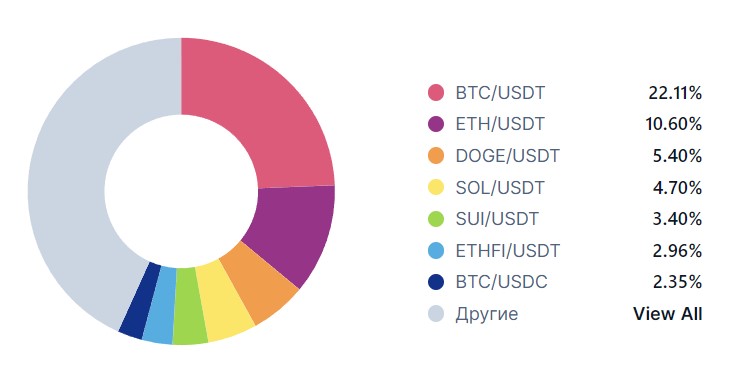

In March 2024, the CryptoProGuide team monitors the performance of 1.2 thousand platforms for trading digital currencies. Of the ten most liquid exchanges, 7 are available to Russians. In the table you can compare the commissions of the top platforms.

OKX

The platform was founded in 2017. It is managed by the OK Group company. Registration in Seychelles makes OKX relatively free from the requirements of European regulators and loyal to Russian clients. Nevertheless, the exchange has closed the possibility of P2P trading using the ruble.

Citizens of CIS countries can conduct direct transactions with counterparties in national currencies. Spot and futures trading and a wide range of investment instruments are available to Russians. It is possible to buy cryptocurrency from foreign cards and participate in the launch of new coins.

In 2023, the number of users from the Russian Federation on the exchange increased almost 5 times. The number of visits grew from 250,000 to 1.25 million. In March 2024, OKX is fifth in the world ranking in terms of spot trading volume ($4.91 billion) and second in terms of derivatives transactions ($30.84 billion). Users can trade more than 320 coins on PC, browser and mobile app.

Bitrue

The crypto exchange was established in Canada in 2018. Later, the developers moved the headquarters to Singapore. Bitrue offers a large number of tools for spot trading and derivatives transactions. Holders of the BTR native token receive a discount on commissions and can participate in the management of the platform.

Clients from the Russian Federation have the right to use all the exchange’s functions. The only restriction is the absence of the ruble in the listing. In March 2024, the platform ranks 6th in the world in terms of spot transactions ($3.17 billion) and 11th in terms of derivatives transactions ($14.29 billion).

Gate.io

The exchange was founded in 2013 and relaunched through a rebranding in 2017. Gate.io supports all types of cryptocurrency trading: spot, futures, transactions with ETFs (tokens with built-in leverage), and copy trading. Users have the right to connect and independently create bots.

The crypto exchange did not introduce restrictions for Russians. Almost all functions are available to residents of the Russian Federation in full. Only the purchase of coins from the card does not work. As an alternative, you can use a native P2P platform.

In the ranking of the largest crypto exchanges, Gate.io holds the 7th line by spot turnover ($3.08 billion). In terms of derivatives trading volumes, the platform is in 22nd place with an indicator of $3.65 billion.

Bitget

The trading platform has been operating since 2018, registered in Singapore. The developers have obtained MSB licenses from the US and Canada, as well as a crypto exchange permit in Australia. As an international platform, Bitget offers several ways to buy digital currencies, trading on the spot and futures market, and copying transactions. OTC transactions are available to large clients, while private clients can use a large arsenal of investment instruments.

Bitget supports trading in ruble pairs via P2P. There are no restrictions for residents of the Russian Federation and other CIS countries.

According to current trading indicators, the crypto exchange ranks 7th on the spot ($3 billion) and 4th on the futures market ($25.04). The total amount of confirmed reserves in March 2024 is $13.68 billion. 83.4% of them are stored in BNB.

HTX

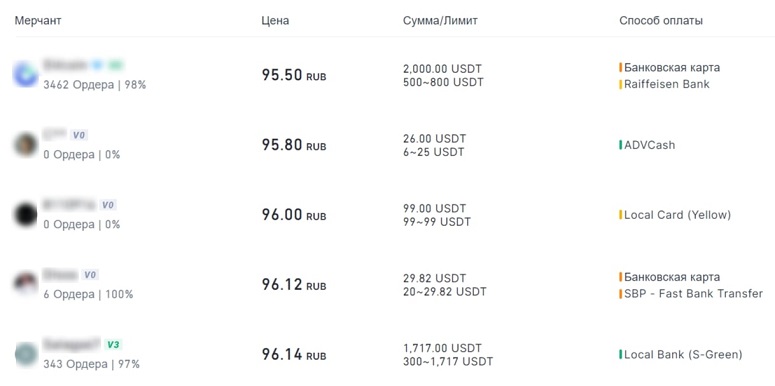

This exchange did not introduce restrictions for Russians. Traders can make ruble deposits via AdvCash and buy cryptocurrency on the P2P platform without commissions. Verification is required only for fiat transactions.

Available options on HTX:

- Spot trading.

- Derivatives trading.

- Copytrading.

- Trading with the help of bots.

- A line of tools for passive earnings.

In the world ranking HTX is the ninth in spot turnover ($2.74 billion). The volume of derivatives trading is $2.81 bln.

MEXC

The crypto exchange has been operating since 2018. MEXC is headquartered in the Seychelles. MEXC provides a full range of services for traders and crypto investors: it is possible to trade digital currencies on spot and on margin, conduct transactions with futures, invest in products with different yields.

MEXC is one of the few Tier-1 exchanges without mandatory verification. KYC will be required to increase transaction limits and conduct operations with fiat. There are no restrictions for Russian citizens. Through P2P you can buy more than 10 popular digital coins for rubles.

In March 2024, MEXC closes the top ten largest crypto exchanges in spot trading ($2.32 billion). In the derivatives market, the platform ranks 23rd with an indicator of $5.23 billion.

How to choose an exchange for cryptocurrency trading in Russia

Over the past few years, interest in digital assets in Russia has grown significantly. According to Sberbank, 13 million citizens of the country used cryptocurrency in 2023.

Russians conduct most of their transactions on centralized exchanges. Representatives of the Central Bank named the average number of CEX visits as 39.5 million.

Among the large number of crypto exchanges, Russian traders prefer Tier-1 platforms. The selection criteria are as follows:

- Loyal jurisdiction. In light of the unstable economic situation, exchanges are moving their headquarters to countries with favorable regulation of the crypto market. For example, Singapore and Seychelles support the international anti-money laundering (AML) policy, but the European regulator’s ban on trading in Russia does not apply to them.

- High security. Market leaders use the latest encryption technologies to protect personal data and clients’ money. This is an unconditional confirmation of the exchange quality.

- Anonymity of trading. Few Tier-1 crypto exchanges have retained the ability to conduct transactions with cryptocurrency without KYC. The feature ensures the freedom of financial transactions. At the same time, transactions pass the AML filter to control security.

- High liquidity. Large trading turnovers allow you to quickly buy any volume of cryptocurrency with a minimum spread.

- Trading conditions. Profits from trading are affected by the amount of commission and available leverage. Users should also have a choice of trading instruments and investment opportunities.

- User-friendly interface. Trading success depends on the speed of decisions. Traders need to have quick access to tools and analytics.

Conclusion

After Binance left Russia, traders moved to other platforms. Bybit quickly rose in the ratings due to active marketing and favorable trading conditions. But in 2024, the exchange is losing ground in the CIS market. Frequent blocking of accounts and scammers on the P2P platform, problems with withdrawals, as well as a sharp increase in commissions made most users again look for an alternative.

Meanwhile, among the exchanges of the first echelon, there are options with more loyal conditions, which are not inferior to Bybit in terms of functionality and reliability. For example, Gate.io offers the lowest commissions on futures. MEXC has retained the possibility of anonymous cryptocurrency trading, but despite this, the exchange has repeatedly caused concern among traders due to the listing of dubious projects. If we compare the top platforms according to a combination of criteria, OKX wins. This exchange has never been hacked, and in terms of futures turnover it is second only to Binance.

Error in the text? Highlight it with your mouse and press Ctrl + Enter

Author: Saifedean Ammous, an expert in cryptocurrency economics.