You can make deals for any amount. Beginners start with $100-$500. With such capital, you cannot expect super profits. If a deal brings 10%, a trader will get only $10-$50. If there is no possibility to increase the starting capital, margin trading in cryptocurrency will help to earn more. Exchanges lend money, but this has a negative impact on risks.

What is margin trading in cryptocurrency

It is speculation in the market with leverage. The user enters into a transaction with borrowed funds, providing only a portion as collateral.

Different leverage formats are available:

- 1:3.

- 1:5.

- 1:10 and so on.

If you choose the 1:3 option, you can trade for an amount 3 times larger than the deposit. This format allows you to make deals for $1500 with $500, which has a positive effect on your income in case of luck.

Margin trading appeared long before Bitcoin. This tool is available on currency, stock and other exchanges.

Differences from fiat

The principle of leverage is the same for all assets. However, if we consider the process from the risk side, it is more dangerous to conclude transactions with cryptocurrencies.

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

The value of USD to EUR usually changes by several points during the day. Fluctuations of 1% are rarely observed, but already cause some excitement among forex traders.

Bitcoin and Ethereum change in price much more often and more strongly. For margin trading in cryptocurrency, it is important to guess the direction of quotes.

If the user counts on the growth of the rate and opens a long with a large leverage, he can quickly lose capital due to falling prices.

Basic concepts and terms

Before using leverage, it is recommended to learn how to invest in assets on the spot market. When a beginner familiarizes himself with orders and finds a profitable strategy for himself, he can move to margin trading.

The beginner will encounter new terminology:

- Liquidation – forced closing of a position when the price goes in the opposite direction from the forecast. So the margin will not be enough to cover the losses. For example, if you make a deal with a leverage of 1:10, then when the rate decreases by 9-10%, the trading floor will have to forcibly close the position.

- Amargin call is a notification that informs about approaching the liquidation level. Let’s assume that the rate has fallen not by 10%, but by 7%. The user can increase the amount of collateral so that the liquidation occurs later, or partially reduce the position. Most often the margin call is set at the level of 1.3-30%.

- Margin level – shows how much funds are available for new trades. If the value has reached 0-10%, the trader can no longer open new positions. The parameter is calculated by the formula: total value of assets / amount of borrowed funds + interest rate.

- Order Margin – the amount to maintain an open position.

- Stop Loss – a pending order that automatically closes the transaction when the set loss level is reached. It is not available on all exchanges. The level of stop loss is not set below the liquidation.

- Take profit – a pending order to close a position when profit is reached. This order is also not available on all exchanges.

Trading Features

When using leverage, there are 2 ways to make money – on rising and falling markets. To understand all the nuances, it is enough to consider examples of long and short positions.

On a rising market

Cryptocurrencies are characterized by a bullish trend. Most participants count on the gradual growth of key assets. Suppose a user wants to buy 1 BTC with 1:5 leverage at a rate of $60,000.

An amount of $12,000 will be enough to provide collateral. But it is possible to use more funds. In case of growth, the trader closes the transaction independently at any convenient moment.

After that, the amount of collateral and profit remain on the account. The exchange takes the commission for the transaction and the use of credit funds.

If the BTC rate falls to $51,000, the trader will receive a margin call. He can reduce the position, increase the amount of collateral, or do nothing. If the exchange rate drops to $49,000, the exchange will liquidate the trade. The user will have about $1,000 left in his account.

In a falling market

Any asset can be shorted – played on the downside. Suppose a user loans 1 BTC with a leverage of 1:3 and sells it at a rate of $60,000. An amount of $20,000 is provided for collateral.

Bitcoin has fallen to 50,000. The trader closes the trade – it brought in $10,000 with no commissions deducted. The total balance is now 30,000.

However, the rate at margin trading cryptocurrency on the exchange can go up. If the price of BTC increases to $73,300, the trader will receive a margin call. Liquidation will occur at the 78,000 mark. After that, $2000 will remain on the user’s account without deduction of commissions.

Trading Rules

Leverage is a high-risk instrument. It is not recommended to use it for beginners. If a trader takes the risk, he should follow a few simple rules.

Margin Call

If the quotes went in the wrong direction, the user will very soon receive a notice of possible liquidation. With a margin call, no action is required from the trader. But he has several options for risk management:

- Increase the amount of collateral. By increasing the deposit, the user pushes back the liquidation level. Along with this, the margin call marker moves.

- Reduce position. If the trader has no free capital, it is possible to partially close the transaction. He will lose part of the funds, but proportionally the amount of collateral will grow relative to the remaining assets.

- Do nothing. After a margin call, a reversal may occur. In this case, the user will not lose anything and will eventually get to the plus side. If the price continues to move, the position will be liquidated. Thus, the trader will lose most of the collateral amount.

The name Margin Call appeared in the USA, when brokers contacted investors by phone, warned about possible position liquidation and offered to increase the deposit. Today, notifications come by mail or through the terminal. The market situation changes so quickly that there is no time for calls.

Stop-loss

A useful tool in risk management when trading cryptocurrency on margin. The trader independently sets the allowable amount of losses. Let’s assume that the user bought BTC at a rate of $70,000 with a leverage of 1:5 and a collateral amount of 14,000.

At the conclusion of the transaction, the stop loss is set at $68,000. If the price of the asset drops to the specified value, the position will be automatically closed. The trader will lose only $2000 without commission.

Take Profit

This tool is intended for profit taking. When buying BTC for $70,000, take profit is set at the level of $75,000. When the quotes touch this value, the order will close and the user will receive a profit of $5000.

Stop loss and take profit are not mandatory tools. However, experienced traders prefer to use such orders for risk management.

Cryptocurrency rate changes

Digital assets differ from stocks and fiat in the level of volatility. Even large coins, such as BTC or ETH, fall or rise by 5-10% in one day. This increases the risks when trading cryptocurrency with leverage.

The price can minimally touch the liquidation level and then go in the opposite direction. However, it is no longer possible to turn back time as well as money.

Traders lost more than $2 billion at the end of March 2021. Then after the BTC rate fell to $51.5 thousand, the positions of 282 thousand users were liquidated. If they had traded on the spot market without margin, they would have been in the plus by the fall – in October, BTC broke through the $66 thousand mark.

Possible risks

Loans allow pumping liquidity. On the one hand, the volume of transactions increases, but volatility grows along with it. In such a situation a trader risks. Since the exchange will save capital due to position liquidation and commission for using credit funds. Margin trading has negative consequences:

- Total loss of capital. If you trade on the spot market, the user will lose part of the funds when falling. Because of the loan, it is possible to give the entire deposit to repay the debt to the exchange.

- Increase in volatility. Most traders prefer longing, so in the case of a drawdown there is a chain reaction. Positions are closed one after another, causing the rate to fall even more.

Example of margin trading

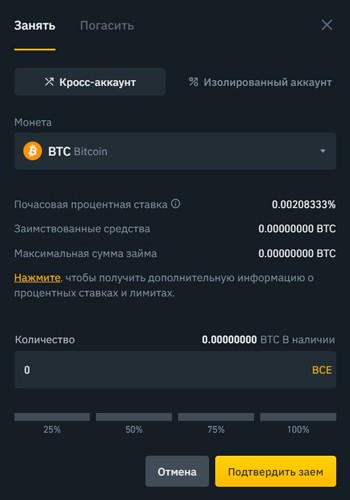

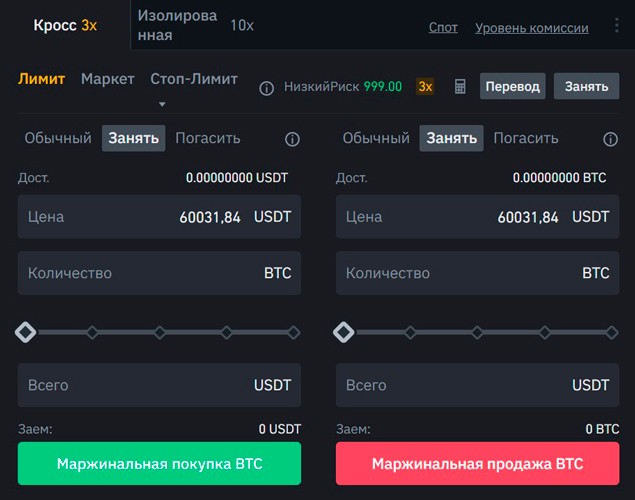

Many major exchanges offer leverage for making trades. Everyone can take advantage of this offer on Binance. To do this, you need to:

- Create an account on the official website.

- Make a deposit.

- Open a margin account and transfer money to it. At this stage, the user additionally agrees with the rules of the exchange.

- Go to “Trading” – “Margin”.

- Take a test. It is necessary to answer 12 questions.

- Borrow the required amount.

- Conclude the deal.

The best exchanges with support for margin trading

Large platforms are interested in providing loans for making deals. Due to this, they increase liquidity and earn interest.

| Name | Year of opening | Number of pairs | Leverage | Fiat support |

|---|---|---|---|---|

| Binance | 2017 | 1495 | х10 | + |

| KuCoin | 2017 | 1205 | x10 | + |

| AscendEX | 2018 | 286 | x25 | + |

| Huobi | 2013 | 976 | x3 | + |

| Currency.com | 2019 | 337 | x100 | + |

Binance

The exchange has been operating since 2017. Its founder is Changpeng Zhao. Almost immediately, Binance broke into the first places of many independent ratings. As of October 2021, it is the largest exchange in terms of daily transaction volume.

The platform was promoted thanks to favorable trading conditions – from one transaction Binance takes 0.1%. Users are offered a 50% discount when paying the commission in BNB koins.

Among other features:

- Options to improve account security: two-factor authentication, a whitelist of addresses for withdrawal and so on.

- Large assortment of trading pairs.

- Additional tools for earning: mining, referral program, deposits and more.

KuCoin

The development of the trading platform began back in 2013. At first, it was under the jurisdiction of Hong Kong. But later the main office was registered in the Seychelles. The official launch took place in 2017.

Now confidently occupies high positions in terms of trading volume. KuCoin provides a secure exchange of funds. In 2020, the site’s servers were hacked. But the exchange managed to return most of the stolen money. KuCoin has an insurance fund for such cases.

In the third quarter of 2021, the popularity of the exchange grew rapidly. During this period, the daily trading volume increased by 720%. Traders began to use robots more often – the indicator increased by 49%.

AscendEX.

The exchange appeared in 2018. It was founded by investors and traders from Wall Street. They chose cryptocurrencies because of their transparency and efficiency.

Initially, the platform was called BitMax, but after rebranding in 2021, it became AscendEX. The main office is registered in Singapore – the local legislation is loyal to digital assets.

AscendEX trading platform has its own token. It allows you to increase the status of the user, get a discount on the commission and provides other benefits.

Huobi

Huobi is another major Chinese marketplace. It started operating in 2013. At first, registration was open only to the local population.

After 4 years, Huobi entered the global market. Its interface is available in 12 languages, including Russian. The platform provides the necessary set of tools for quick and safe transactions.

Currency.com.

The trading platform began operating in 2019. It offers to buy not only cryptocurrency, but also other assets, for example, stocks, gold and others.

The main office is located in Belarus – the government has legalized digital assets at the legislative level. Currency.com provides a maximum leverage of x100. To take advantage of the offer, traders should definitely activate the stop-loss option to prevent capital loss.

How to choose the best exchange

In total, there are more than 600 trading platforms on the market. When searching for an exchange, pay attention to a number of parameters:

- Fiat support. If the site offers deposit and withdrawal in USD, it facilitates the purchase of cryptocurrency. Otherwise, the trader will have to use third-party services to first purchase a digital asset, and then replenish the account.

- Reputation. Before registering, you should familiarize yourself with the reviews of other users. The more traders trust the platform, the better.

- Regulation. The main office of the exchange should be under the jurisdiction of a country that is loyal to cryptocurrencies. If local authorities prohibit the exchange of digital assets, it will lead to the blocking of investors’ accounts.

- Trading volume. The higher the liquidity on the exchange, the faster transactions for a large amount are concluded. Take into account not only the total indicator, but also data on individual pairs.

- Interface. Not all sites provide information in Russian. Beginners may have difficulties when concluding the first deals.

- The number of coins. Large exchanges offer to trade not only bitcoin, but also more rare tokens. Their volatility and growth potential are sometimes higher than the first cryptocurrency.

Pros and cons of leveraged trading

When choosing between the spot and margin market, pay attention to the advantages and disadvantages. This will help the trader to make a decision.

| Pros | Cons |

|---|---|

| Increase in potential profit | Risk of complete loss of capital |

| Opportunity to play on the downside and make money on rate drops | Payment of additional commission for the use of credit funds |

Tips for traders to minimize risks

Cryptocurrency trading with leverage is usually thought about after several successful trades. The brain instantly turns on and counts the lost profit. The desire to increase the income from the transaction by 10 times takes over common sense. A trader opens a margin account.

In a couple of weeks the dreams of a new Mercedes quickly evaporate, and the account balance shows zero. A few tips will help to avoid bankruptcy when trading cryptocurrency with leverage. It is more important for beginners to preserve capital and learn how to use different strategies.

Do not start trading with large bets

Traders are guided by an unspoken rule. Large leverage is for a small deposit, small leverage is for a large one. When trading an amount of $500, you can use a margin of 1:10. And for $10,000 it is better to favor 1:3 or 1:5.

Traders should not invest all their savings in digital assets. It is reasonable to allocate 10-25% of free capital.

Do not ignore the news

In the cryptocurrency market, important events occur regularly. They can be divided into several categories:

- Regulation. Countries make official statements and adopt laws on digital assets. If a major state prohibits operations with cryptocurrency, it always has a negative impact on quotes.

- Opinion leaders. Scientists, celebrities and bloggers are interested in bitcoin and other coins to varying degrees. Their statements influence the audience. A famous personality can quickly promote a cryptocurrency to the TOP. Recently, a Twitter user asked Ilon Musk about the number of SHIBA INU tokens. When the entrepreneur replied that he does not keep a single coin, the asset’s rate plummeted by 20%.

- Finance. The willingness of investors to invest in cryptocurrency is influenced by different indicators: the inflation rate in the country, the situation in other markets and so on.

Set stop losses

Many exchanges are obliged to use such options when concluding transactions with a large leverage. Due to this, potential losses are limited. The trader will determine in advance how much he will lose in case of failure.

Fix profit

A person cannot monitor charts around the clock. To close profitable positions, this does not need to be done. With the take profit tool, it is possible to fix a certain percentage of income when the quotes touch the set value.

Manage risks

The volatility of cryptocurrencies is too high, so it is not recommended to use leverage above 1:5. If you make a deal with a margin of 1:100, liquidation in the cryptocurrency market can happen instantly due to large fluctuations. Such leverage is suitable for trading hard currencies, such as USD and EUR. The exchange rate of these assets rarely changes by 1% or more during the day.

Conclusion

Margin trading is more of an enemy for beginners than a lifeline in the market. It is recommended to use such tools after several years of successful application of strategies on the spot exchange. When a trader gains confidence in his own forecasts, it is possible to take risks and increase the potential profit.

Frequently Asked Questions

✅ Do I need to be verified to trade cryptocurrency with leverage?

Personal identification is optional on some exchanges. If the trader confirms personal data, the size of leverage and transaction limits can be increased.

❔ What is the difference between a cross-margin and an isolated one?

In the first case, the user can freely change the asset for other coins, and in the second case, the user trades within one pair.

💵 What is the minimum amount of collateral?

It is set by the rules of the exchange. For example, on Binance, $10 is enough for collateral.

📉 Can I go into a minus?

The exchange will liquidate the position before the amount of loss is greater than the collateral.

⛔ Does the account get blocked for unsuccessful leveraged trades?

No, as liquidation allows the exchange to avoid losses. The platform always provides a margin account against any collateral.

Is there a mistake in the text? Highlight it with your mouse and press Ctrl + Enter

Author: Saifedean Ammous, an expert in cryptocurrency economics.