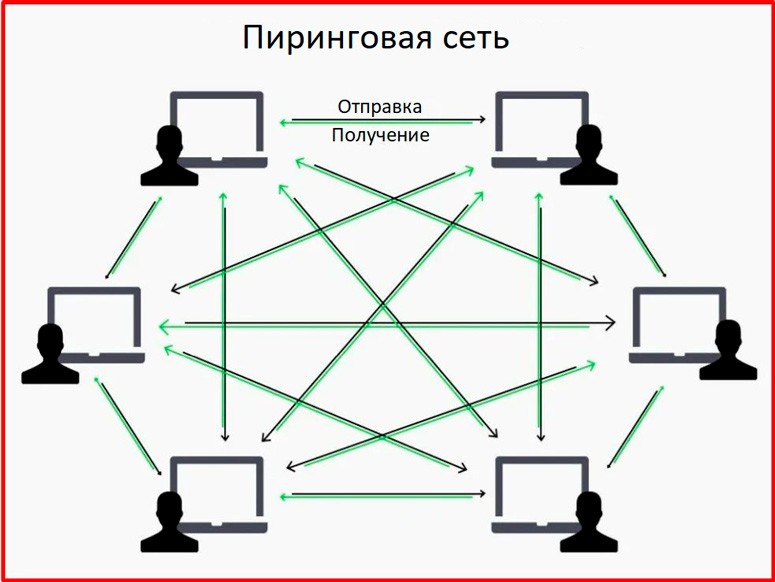

The main idea behind digital money is distributed processing of financial transactions. Blockchain functions through the actions of ordinary users. Participants of the cryptocurrency network connect to Bitcoin and other chains through a software client and becomenodes (nodes) of the system. They do the basic work – processing transactions, creating new links, and so on. This is called decentralization of cryptocurrencies. The capacity of a peer-to-peer (peer-to-peer) network depends on all nodes, not a single server.

How decentralization works

The term refers to the sharing of power between independent people. In decentralized projects, there is no body that regulates or can influence the work. Network participants make their own decisions about confirming a transaction and making changes to the protocol.

As of 2021, almost all financial and government systems operated centrally. They had a supreme authority that was responsible for governance. For example, the supply of the ruble is regulated by the Central Bank of the Russian Federation (CBRF).

However, it should be understood where and how decentralization is applied in virtual money. By the end of 2021, 5 main areas of use have emerged:

- Cryptocurrency.

- Applications (DApps).

- Exchanges.

- Organizations (insurance, financial).

- DeFi.

Cryptocurrency

The issuance of fiat is handled by the relevant government bodies. Usually these are central banks of countries. Cryptocurrencies, on the other hand, are issued by the participants of the network themselves, connected to blockchains. Independent users release new coins into circulation using different mechanisms embedded in selected projects. However, the general algorithm of connecting to the network is always similar. It is necessary:

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

- Select the desired blockchain.

- Install the developers’ client or download the source code from the repository.

- Configure the software.

- Start the operation of the node.

The most popular mechanism for issuing cryptoassets is mining. It works thanks to the Proof-of-Work (PoW) algorithm. According to the rules of this mechanism, you need to use the processing power of your own computer equipment to process data in the system.

In the Bitcoin blockchain every 10 minutes, miners form new links of the virtual chain. Valid (valid) transactions are recorded in them. Nodes are rewarded by the system for creating blocks. Miners can spend the earned assets, thereby increasing their supply. This is how the issuance of new coins occurs.

Applications

In 2015, the Ethereum project appeared. The main task of the developers was to create an ecosystem that would give users the opportunity to deploy decentralized applications (DApps) based on blockchain technology. They work in the cryptocurrency chain thanks to smart contracts. Information from DApps is processed by blockchain participants.

The client interface can be in any programming language that supports the communication protocol with the decentralized system.

Distributed registries are used in different online industries, e.g.:

- Auctions. Decentralization of cryptocurrencies guarantees strict time fixing, transparency of bidding, immutability of bids and eliminates manipulation.

- Finance. Decentralized applications in this sphere allow you to take loans, lend to users without intermediaries and so on.

- Gaming applications. Such DApps differ from traditional services in their high speed of transaction processing, inexpensive operations, and greater anonymity.

Exchanges

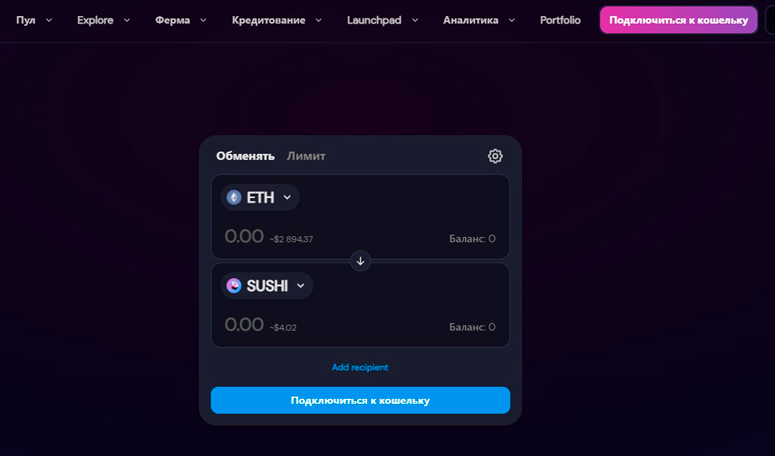

By the end of 2021, decentralized trading platforms (DEX) have become popular. Their activities are not controlled by regulators (government agencies or non-profit companies).

Centralized exchanges (CEX) have liquidity providers. These are large companies that cooperate with trading platforms. Liquidity providers have different assets in stock to organize sales. It is these companies that enable instant trading on the exchanges. In DEX, liquidity providers are clients themselves.

On decentralized exchanges, users lock a pair of tokens on their own wallet using a smart contract. These assets are called a liquidity pool. The counterparty deposits one type of token into it and takes away the other. The cryptocurrency exchange itself does not participate in the transactions, which is why such services are called DEX.

Decentralized exchanges do not require customers to undergo identity verification due to the use of the distribution principle. For this reason, cryptocurrency users remain anonymous on DEX. They don’t need to upload identity documents.

It is important not to confuse decentralization of cryptocurrencies with DEX exchanges. Platforms without a single server are a particular example of distributed financial transaction processing technology.

Organizations

In 2016, The DAO platform appeared in the Ethereum ecosystem. It allowed developers to create decentralized autonomous organizations (DAOs). Although Ethereum’s The DAO project was not the only one, its concept became a lasting fixture in the cryptocurrency community.

In 2021, DAOs are a popular form of running organizations based on smart contracts. Through software code, they operate in an automated manner without a central supervisory authority. In 2021, most DAOs operate on smart contracts in the Efirium ecosystem.

DeFi

Decentralized Finance are blockchain-based financial projects. Their operability is maintained by peer participants in the networks. DeFi has no ultimate controlling bodies.

To obtain the right to process transactions within the system, a Decentralized Finance participant must invest his money in the project. In return, the user is issued DeFi tokens. They confirm the participant’s right to process transactions.

In 2021, DeFi was considered one of the main ways to earn money on tokens. The price of such altcoins was actively growing. This is due to the gradual increase in the shortage of DeFi tokens.

The shortage of altcoins is due to the use of the cryptocurrency burning mechanism by Decentralized Finance projects.

Decentralized Finance started to emerge in opposition to traditional organizations. In 2021, DeFi projects were created to replace:

- Banks.

- Exchange offices.

- Credit centers.

- Payment systems.

Advantages of decentralization in cryptocurrencies

The principle of distribution in digital assets is important for various reasons. For example, the main advantage of decentralization in cryptocurrencies is the lack of government control. The table below summarizes other pros of systems operating without a single governing body.

| Advantage | Brief description |

|---|---|

| Inability to interfere | In 2021, attackers can affect the operation of a decentralized network only in rare cases, e.g., by hacking the protocol or the majority of nodes |

| Immutability of operations | Information cannot be deleted or changed on the blockchain – recorded transactions always remain permanent |

| Increased anonymity | In decentralized systems, users do not need to provide personal information. |

| Absolute control over savings | Peer-to-peer systems have no mechanism for blocking users |

Risks of working with decentralized networks

In 2021, the cryptocurrency community highlights 2 major drawbacks of peer-to-peer systems:

- Theft risk. When saving digital assets on cryptocurrency wallets that are always connected to the internet, there is a risk of losing capital. Such virtual vaults are less secure than allowing coins and tokens to be saved offline. If a PC is compromised, hackers will get this information and can steal the cryptocurrency. There is no way to get the stolen money back, as blockchain transactions are non-cancelable.

- Inattention. The inability to cancel transactions in peer-to-peer networks creates additional risks. If a person specifies incorrect details for a transfer, the money will be sent to someone else’s account or destroyed at a non-existent address.

The future of decentralized networks

Blockchain technology is being used in many areas. For example, the Estonian government is applying the distributed ledger to healthcare. One of the application scenarios of the peer-to-peer network is storing patients’ medical histories in the blockchain.

In 2024, decentralization remains an emerging technology. Its use may increase in the future. In particular, many users are waiting for the introduction of applications that allow them to quickly pay for everyday transactions with digital coins.

Summary

For the first time decentralization was successfully applied in Bitcoin. Its producer did not create a single server for management, but distributed responsibilities among equal nodes. The nodes are rewarded for maintaining the network’s performance. Distribution is reflected in similar cryptocurrency projects.

Later, developers began to apply decentralization more widely. In 2021, on the basis of the principle of distribution work:

- Cryptocurrencies.

- Apps.

- Exchanges.

- Organizations.

- DeFi.

In the future, decentralization will cover even more areas. Already in 2021, blockchain has been used in healthcare, education and other areas. Also, the cryptocurrency community believes that decentralization will remain an unchanging trend for digital assets.

Frequently Asked Questions

❓ Is decentralization possible without blockchain?

Yes, but in finance it was cryptocurrency blockchain technology that made transfers within a peer-to-peer network realizable.

🔎 Are there controlled cryptocurrencies?

In some digital projects, only trusted nodes are allowed to operate on the network. This reduces decentralization and makes cryptocurrency more controlled by developers.

🔧 How do smart contracts support distribution?

Each participant in the network can commit the terms of a transaction on the blockchain. Smart contracts are automatically executed without the involvement of third parties. This maintains decentralization and security at the same time.

📱 Why did DEX become popular?

Before the first Decentralized Exchanges, there were only centralized cryptocurrency exchanges that keep customers’ investments in their accounts. DEXs shift this responsibility to users, which increases the safety of funds.

📋 What is the main drawback of decentralized networks?

Users have to keep them running. Blockchains cannot function without connected nodes.

Is there a mistake in the text? Highlight it with your mouse and press Ctrl + Enter

Author: Saifedean Ammous, an expert in cryptocurrency economics.