Usually, users resort to spot and futures trading to make money in the cryptocurrency market. But trading requires learning the basics of technical and fundamental analysis, a lot of time and some luck. There are alternatives – financial products for passive income. In April 2023, the popular exchange Binance offers to use this tool. However, not all investors know what Binance Earn is. In this section, clients of the trading platform of the same name can zastake their coins, lend funds at interest or earn on farming assets.

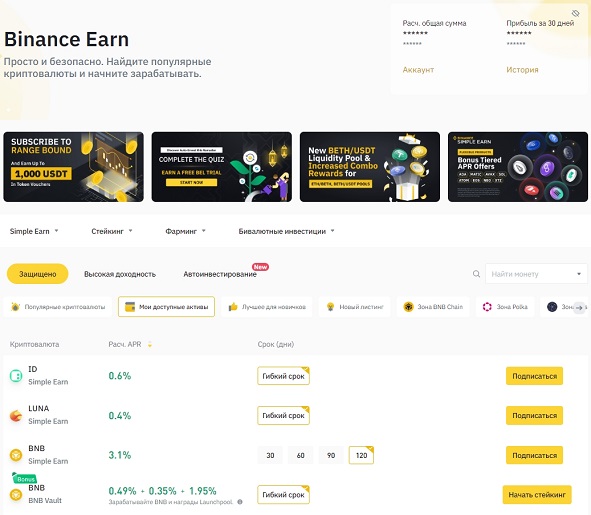

What is Binance Earn on the exchange’s website

Binance was one of the first trading platforms that “revitalized” the crypto market and provided its participants with opportunities for passive earnings. In 2020, Binance Earn (formerly Binance Savings) was launched on the basis of the exchange. In this service, users receive income on digital assets and do not trade on the market independently.

Members of the platform can invest in popular cryptocurrencies such as Bitcoin, Ethereum and Binance Coin, as well as other altcoins. To start earning on the platform, the user must choose a program. There are different offers like deposits, coin staking, farming and others.

How to access the Earn section

To join the platform, the user needs to register an account on the exchange and undergo identity verification. For all services, the participant will need only one account. You can create a personal account on the official website of Binance or in the mobile application. It will take no more than 5 minutes. The algorithm of actions is as follows:

- Click “Registration” in the upper right corner of the screen.

- Enter your e-mail address or phone number and password.

- Click on the “Create a personal account” button.

- Enter the code from the email.

After registering an account, you can proceed to verification. To do this, you need to specify personal data (full name, date of birth, address), upload photos of the document (passport or driver’s license) and face.

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

What digital currencies are possible to work with?

Earn on Binance provides several programs: steaking, farming and others. The list of available cryptocurrencies depends on the chosen direction. The most popular assets that the platform offers for investing in April 2023 are Bitcoin, Ethereum, Axie Infinity, Cardano, Tether and Binance Coin.

These are just a few of the many cryptocurrencies available on Binance Earn. The service also adds new products and coins from time to time to give users and investors more opportunities to make money. Members can choose any program and build a portfolio that suits their goals and preferences.

High returns and risks

The platform provides users with different financial instruments. The rate of return on Binance depends on the program chosen. Some of them offer high rates. However, such profitability is usually associated with risks. Users should keep in mind that the cryptocurrency market is subject to asset price volatility and can be highly volatile. This can lead to losses of invested funds.

You should also keep in mind that some programs provide high returns only for a certain period of time. Then the interest rate decreases.

In addition, the programs offered by Binance may have additional risks associated with possible hacking of platforms or other security incidents.

Advantages and disadvantages of the tool

Before you start using Binance Earn, you should look into the features and risks. The tool has advantages and disadvantages. More details are in the table.

| Pros | Cons |

|---|---|

Offers of Staking section on Binance Earn

This tool involves blocking a certain number of coins for a certain period of time. Cryptocurrency assets placed in staking cannot be withdrawn or used for trading. Funds are automatically unlocked after the token freeze expires.

The platform offers several staking programs. In April 2023, the exchange offers such instruments:

- ETH placement.

- Slot auctions.

- Fixed Staking.

- Coin blockchain on the DeFi platform.

- Deposits.

Ethereum Steaking

This option allows Ethereum owners to deposit their assets and get rewarded for processing transactions. At the beginning of April 2023, the interest rate in ETH 2.0 staking is 4.51%. This rate is constantly changing and depends on the total number of coins in the pool. To participate, you need to fulfill the following steps:

- Preliminarily send ether to the exchange account.

- Go to the Earn page and select the ETH 2.0 section.

- Click on the “Start Staking” button.

- Specify the number of coins, study the terms and conditions and click “Confirm”.

Users will be able to withdraw funds along with the earned income after the Shanghai update. It will take place on April 12, 2023. The maximum investment amount is 50,000 ETH.

Participants may lose money due to a drop in the price of the asset or in the event of an emergency during the Shanghai update.

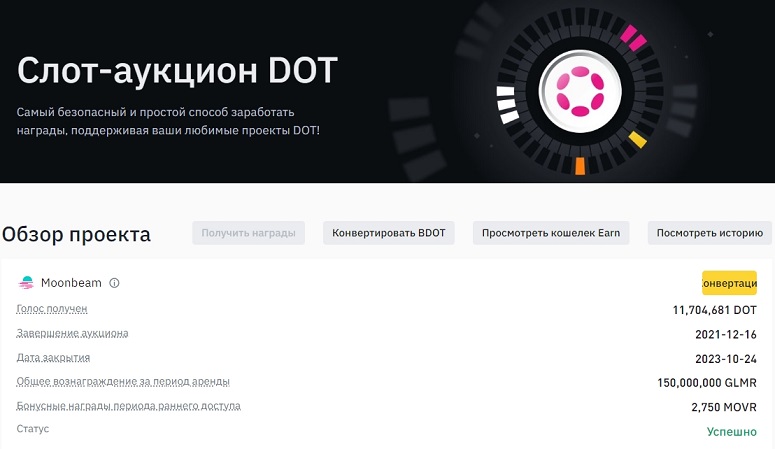

Slot Auctions

The service offers to invest in new platforms built on the Polkadot network. Users need to select a project and slot a DOT coin. If the parachain wins the slot auction, investors will be rewarded in the form of platform tokens.

The user will receive a portion of the total number of coins. The amount of rewards is calculated based on the contribution to the pool. For example, if the amount of funds blocked in the project is $1 million, and a particular participant invested $100 thousand, his share will be 10%.

Auctions were held in 2021. A total of 9 projects were added. Among them are the popular Moonbeam, Clover Finance, Acala, Parallel, Manta.

Fixed Staking

With this approach, the user needs to specify the period of coin locking in advance: 14, 30, 60, 90, 120 days. It is impossible to withdraw assets earlier than the set period. In return, token owners receive a fixed fee. The table lists the offers with the highest APR as of April 2023.

| Cryptocurrency | Percentage of return |

|---|---|

Users can choose the lock-in period based on profitability and investment goals. After the freeze period expires, coin owners receive the placed tokens and rewards in the form of the same cryptocurrency.

The main advantage is the predictability of returns.

Staking on DeFi platforms

Binance Earn users earn passive income by staking cryptocurrencies on decentralized platforms. Several DeFi projects are available, including Aave, Venus, Dydx, Hard, and MakerDAO. Most coins have flexible blockchain terms. For some you can choose the term (30 days). Popular assets are listed in the table.

| Cryptocurrency | Percentage of profitability |

|---|---|

DeFi-staking is associated with risks. These include possible losses due to price fluctuations in the cryptocurrency market and cyberattacks. A detailed study of each project is required before participating.

Deposits

In staking on Binance, the user locks his cryptocurrency for a certain period of time and receives rewards in return. The main difference from a deposit is the way the deposited assets are stored. In staking, they go to decentralized platforms and are used for lending or other services. At the same time, the exchange warns that it does not take responsibility for losses that the user may incur due to security issues with DeFi protocols. In Simple Earn from Binance, assets are stored in the exchange’s account and are always available for withdrawal.

Binance’s deposit offers

These methods are suitable for beginners who don’t want to risk their assets. In Simple Earn, users can use products with different yield levels and lock-in periods. At the same time, it is possible to withdraw assets before the maturity date.

Only the body of the deposit can be withdrawn, early redemption will result in loss of rewards.

Floating rate

These products offer yields that vary depending on market conditions. Floating rate deposits are a more risky way of earning profits than fixed rate deposits. They are not suitable for all investors.

Participants should carefully consider the terms and risks before investing money.

Any assets presented on the platform are available to users. The percentage of profitability depends on the coin. Rewards are accrued every minute and added to the total balance of the cryptocurrency.

Fixed rate

These are deposits whose yield is determined in advance. Participants deposit coins into a Binance account and lock them for a certain period of time. The percentage of profitability depends on the duration of the asset freeze. For example, for ATOM, the minimum APR is 12.1% (30 days) and the maximum APR is 21.9% (120 days).

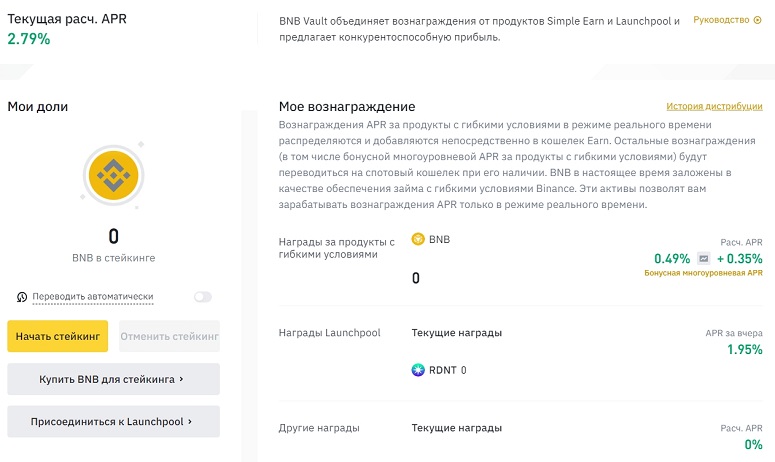

Vault

This is a yield aggregator. The tool works like this: owners of the native BNB token place coins in Vault, then the exchange uses the deposited assets in different investment strategies. These include Launchpool, Simple Earn, DeFi protocols, and others. As of April 4, 2023, the APR in Vault is 2.64%.

Auto-Invest feature

This feature was added to the platform in November 2021. It allows you to set up an automatic, recurring investment plan. The intervals available are 7 days, 3 and 6 months, 1 and 3 years. A five-year plan can be set up for some coins.

The auto-invest feature allows you to manage cryptocurrencies without having to actively participate in every transaction. A total of 82 coins are available. Among them are Bitcoin, Ethereum, Binance Coin, Dogecoin, Arbitrum, Magic and others.

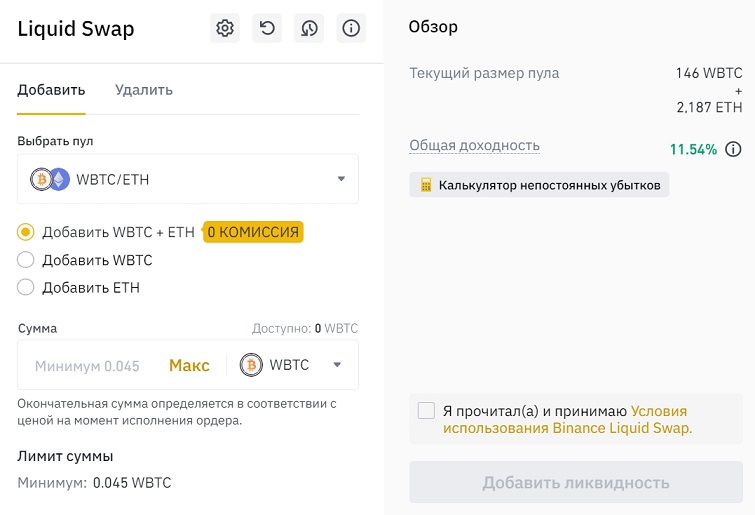

Farming on Binance

This is another way of passive earning. The platform offers registered users to engage in farming. This feature is implemented through the provision of liquidity pools on the decentralized exchange Binance Liquid Swap. Swaps on DEX and classic farming in the form of Launchpool are also available.

Liquidity pools

This one of the most popular ways to make money. Binance gives you the option to deposit either one specific coin or choose a pair of tokens. An example showing how Binance Earn works in liquidity pools:

- A participant deposits equal amounts of BNB and USDT into the BNB/USDT pool.

- Another user performs an asset swap on Liquid Swap.

- The liquidity provider is rewarded with a portion of the transaction fees.

The amount of accruals depends on the number of coins added to the pool. This data is displayed on the right side of the trading terminal. You should also take into account that liquidity farming can be a risky practice. If the market price of the asset falls sharply, the user will lose money.

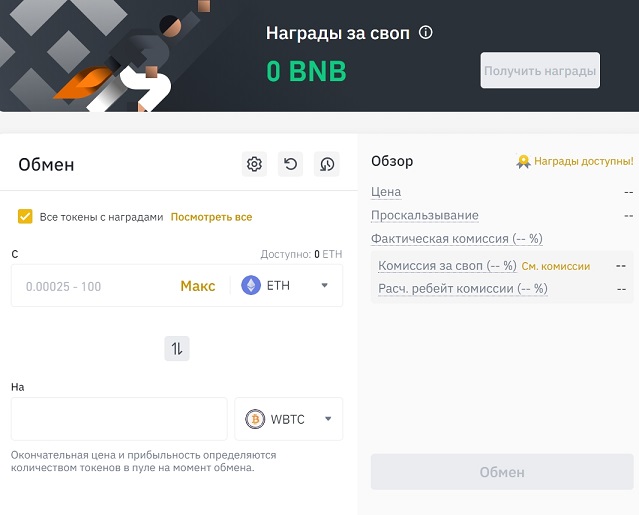

SWAP

Binance offers a safe alternative to DeFi venues – Liquid Swap. The automated market maker allows users to trade digital assets from a pool of liquidity instead of transacting with other users or parties.

The decentralized exchange supports over 180 coin pairs and rewards traders and investors for exchanges on the platform. Rewards come in the form of commission discounts and are paid out in BNB. However, not every asset qualifies for the discount. To get rewards, you need to:

- Check the box next to the item “All tokens with rewards”.

- Select cryptocurrencies from the list.

- Specify the number of coins.

- Press “Exchange”.

Classic farming

For this purpose, the Launchpool program was created. It provides users with the opportunity to participate in new projects at the initial stage of their development. Classic farming on Binance Earn works as follows:

- The exchange selects a startup that will be presented on the platform.

- Deposits are opened. Usually, users need to place a BNB coin in the staking.

- Participants deposit assets on the Launchpool.

- Once the farming is over, Binance uses these tokens to develop the startup and provide the necessary liquidity.

- Investors receive new coins. Their number depends on the amount of cryptocurrency in the staking.

- Trading is opened.

- The holder can sell the token or store it on the exchange account.

Like any other type of investment, participation in startups involves risks. It is important to research each project before backing it.

Bi-currency investments in Earn

This feature allows users to plan the purchase or sale of a cryptocurrency asset according to pre-specified triggers. The principle of bicurrency investments on the Binance exchange:

- A participant selects a coin and sets a desired price or date to buy or sell the asset.

- Binance locks tokens for a certain period.

- If the cryptocurrency rate turns out to be at the level of the set values, a transaction is carried out. If the token does not reach the target price, the transaction is canceled and the user receives the coins back into the account.

Bi-currency investments can help exchange customers protect their assets and reduce the risks associated with fluctuations in coin exchange rates. This strategy is useful for users who anticipate a certain market trend.

It is not possible to cancel or change the subscription. It will be active until orders are executed or expire.

How to use Binance Earn

To get access to investment tools, you need to create an account, verify your identity and replenish the balance of the exchange. But there are some restrictions. For example, participants will need to pass a product knowledge test before using it.

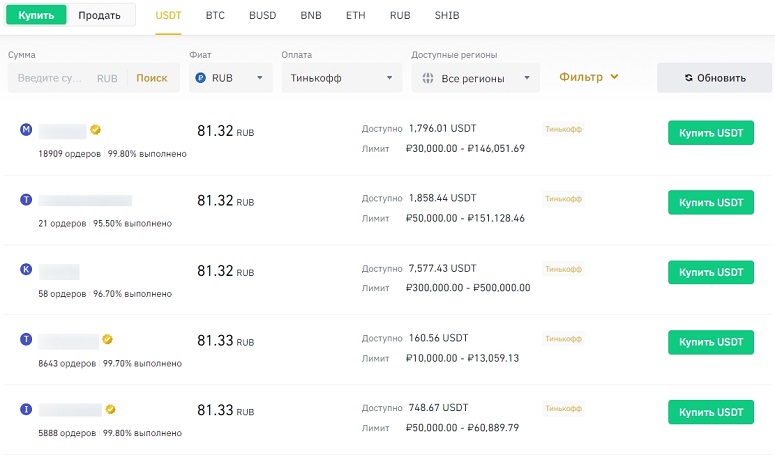

How to deposit money to the account

You can replenish the balance of the platform in several ways. P2P service, buying cryptocurrency with a card or EPS directly or transferring assets from another wallet are available to users. The most profitable and convenient way is a peer-to-peer platform. The algorithm of actions is as follows:

- Put the cursor on “Trade” and click P2P.

- Click “Buy”.

- Set the details of the transaction: coin, amount, payment method.

- Select a counterparty and go to the exchange.

- Follow the instructions of the platform.

Funds do not need to be sent to a special wallet. Assets will be deducted automatically from the spot storage.

Tracking statistics

This is a very important part of investing. You can track statistics on the Binance Earn page. The top right corner of the screen shows the total assets on the balance and the 30-day profit. There you can also explore the details of all subscriptions and investments by clicking on the “History” button and selecting the program tab. The section shows how fast the capital is growing, how much has been earned, how many coins have been invested.

How to withdraw cryptocurrency

To withdraw assets, you need to perform the following steps:

- Open the “Wallet” section, and then the Earn tab.

- In the “Action” column, click “Close”.

- Set the type of redemption. If you specify “Quick”, the funds will go immediately to the balance of the exchange. If you choose “Standard”, the money will be returned to the wallet at 00:00 Moscow time.

- Enter the number of coins.

- Press “Confirm”.

Each product has its own conditions and terms of deposit. Some instruments may have restrictions. In this case, it will not be possible to withdraw assets from Binance Earn before the expiration of a certain period of time.

Frequently Asked Questions

📌 What is the minimum investment amount for Binance Earn?

The amount depends on the specific product. Most require between $10 and $50 in cryptocurrency or fiat equivalent.

🔔 When are rewards accrued after opening a position?

Profits start to be calculated from 03:00 (Moscow time) of the following day.

📢 Can I set up automatic deposit extension?

Yes. To do this, you need to enable the “Auto-renewal” function. If the deposit expires, it will automatically renew the same day.

✨ What happens if there is not enough money in the spot wallet to perform an auto-investment?

In this case, the system will try to write off the assets on the next date set by the user.

🔥 For what period are the funds in Vault blocked?

This product has flexible terms and conditions. You can close your subscription on any day.

Error in the text? Highlight it with your mouse and press Ctrl + Enter.

Author: Saifedean Ammous, an expert in cryptocurrency economics.