As of October 2021, there are more than 7,000 virtual assets. Sometimes beginners confuse a token with a coin. Beginners investing in assets don’t notice the difference between these two instruments because they are similar on a fundamental level. Both crypto-assets have value and can be used as a means of payment. They can also be exchanged between each other. In simple terms, cryptocurrency digital tokens are a unit of account for an electronic asset whose circulation takes place in decentralized networks. For a deeper understanding, it is necessary to understand in more detail how transactions are carried out in peer-to-peer payment systems.

What is a token

Transactions with cryptocurrencies are carried out in a decentralized network – blockchain. A user can make a transaction only if his wallet has the required asset. Tokens serve as units of accounting for the balance of a cryptocurrency network participant. Unlike coins (koins), these assets do not have their own blockchain and are transferred between counterparties using smart contracts.

On some websites, there is wording like Bitcoin tokens. This is a mistake as Bitcoin is a coin that has its own blockchain.

Tokens are aptly compared to vouchers for going to a restaurant or tokens for playing the machines. For example, you can dine at a cafe with a gift voucher. But the voucher is valid only in a particular establishment.

Platforms deployed on blockchain issue their own “tokens” that customers use to receive benefits or invest in their networks.

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

What it’s for

Cryptoassets are used within the project ecosystem as:

- A payment instrument.

- Currency for transactions between ICO (initial coin offering) participants.

- Confirming the rights to the assets of the instrument.

- Analog of securities.

- A tool for raising funds for development

- A financial asset.

- A user identifier.

Units of account have found their use in decentralized applications (dApps). They are usually built on top of an existing blockchain and take advantage of it.

Such programs are easier to develop than coins. This has led to some interesting applications, such as decentralized finance(DeFi) and non-fungible tokens(NFT).

How it works

With “virtual tokens” a user can:

- Receive them as a reward for participating in an ICO.

- Make purchases within the ecosystem, pay for services.

- Store them for investment.

- Receive a share in the capital of the project.

They perform the functions of securities, but in the digital space. Units of account are recorded on the blockchain. Management is realized by smart contracts.

Many cryptoassets comply with the ERC-20 standard and function on the Ethereum protocol.

The difference between a token and a cryptocurrency

When Bitcoin first emerged, it set the standard for what it means to be a coin. There are characteristics that distinguish crypto from units of account similar to real money.

Coins are distinguished by these characteristics:

- It operates on a blockchain. All transactions in which the coin is involved are tracked there. When a user makes a payment using Ethereum, a check is sent to the Ethereum blockchain. If the same person later pays with Bitcoin, the receipt goes to the Bitcoin network. Each transaction is protected by encryption and is available to any participant on the blockchain.

- Works like money. Bitcoin was created to replace traditional currencies. Transparency and anonymity spurred others to develop new coins including ETH, NEO, and Litecoin. In 2021, cryptocurrency can be used to buy products from many major corporations (Amazon, Microsoft, and Tesla). Recently, BTC became the official currency of El Salvador along with the US dollar.

- It can be mined by mining and steaking. The Proof-of-Work algorithm is used to maximize revenue. However, there is not much BTC left to mine, so the process becomes more difficult. The Proof of Stake algorithm is a different approach to earning coins. It is not as energy-consuming, as it does not require the connection of powerful computing equipment.

The units of accounting determine such parameters:

- Lack of their own blockchain. They work in the networks of other cryptocurrencies, for example, Ethereum. The most famous units of account that function on Efirium are the currency tokens NEO, WBTC, Tether.

- Relying on smart contracts. These are codes that enable transactions or payments. Each blockchain uses a different standard of smart contracts. For example, Ethereum runs on ERC-20, while NEO runs on Nep-5.

- The ability to move from one place to another (between wallets or records in the blockchain). NFT trades are an example. They are unique, so changing ownership must be done manually.

- They denote assets or actions. They have more functionality than coins.

- Can be used on different blockchains. For example, USDTs are issued on the Tron and Ethereum protocol standards. This provides flexibility, simplifies trading, increases speed and reduces costs for users.

Popular

In the fall of 2021, the most popular cryptocurrency units are recognized as:

- AAVE (Aave) – a decentralized finance lending service.

- LINK (Chainlink) – a network of oracles (applications that feed information from the outside world into the blockchain).

- USDT (Tether) – a stablecoin pegged to the U.S. dollar.

- UNI (Uniswap) – a native “token” of a decentralized exchange.

- WBTC (Wrapped Bitcoin) – ERC-20 standard token tied to the BTC rate.

Varieties

There are 6 main variations:

- App Coins. Used to access services within the ecosystem.

- Security tokens. Used to confirm ownership of assets, distribution of profits and other benefits.

- Debt tokens. Used for loans with further payment of commissions.

- Asset backed tokens. Secured by real values (gold, shares).

- Governance tokens. Allow making decisions on project development by voting.

- NFT. Used to confirm ownership of digital art or property.

Buying tokens

You can become the owner of digital tokens in 4 ways:

- Buying on an exchange.

- Conversion in an online exchange.

- Purchase at an ICO.

- In the application of the project.

Ways to earn money on tokens

Similar to coins, cryptocurrency units of account are assets. They can be stored in wallets to earn income from price growth, traded and invested to earn interest.

Crypto tokens are needed for such purposes:

- Investment. Holding assets in wallets for a long period of time in the hope that their price will rise.

- Trading. Active trading requires knowledge of technical and fundamental analysis. Involves high risks.

- Staking. Delegating assets to validators to ensure production of new units.

- Lending. Users can buy and lend accounting units to earn higher interest rates than banks offer

- Airdrop. Participating in project shares earns “tokens” for active users.

- Liquidity mining. Temporary storage in the pool to provide the market with a trading pair.

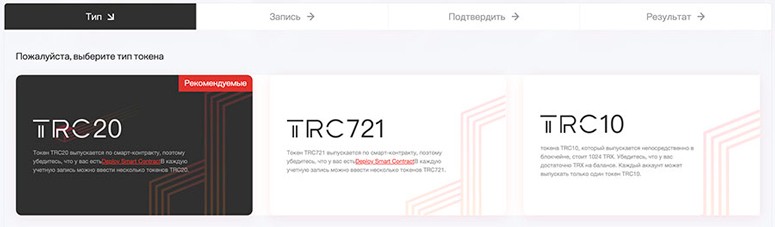

Ways of creation

An interesting point is that “tokens” are very easy to develop. Some networks, such as Ethereum, provide templates. On them, you can create your own units of account and start trading. Thus, anyone without technical knowledge can become a market maker. This way of earning is actively used on decentralized exchanges.

Wallets

Since most of the virtual cryptoassets meet the Ethereum ERC-20 protocol, it is possible to hold assets in storages that support this standard. Any separate wallets are not necessary.

Advantages and disadvantages

The owner of virtual value can face such positive and negative factors:

| Advantages | Disadvantages |

|---|---|

| Speed of exchange | Risks of fraudsters in an ICO |

| Digital form of value | Unfair distribution |

| Careful verification when transferring “tokens” | Storage space required |

| Many people do not understand the difference between tokens and coins when investing in a project |

Frequently asked questions

❓ What is tokenization?

The process of replacing real assets with digital assets.

✅ Can a “token” be developed?

Some networks provide services and templates for creating virtual valuables.

❔ What is tokenization?

An economic model for the application of digital assets.

💵 How much is 1 virtual unit of account worth?

The price of each crypto asset depends on the market situation and is constantly changing. Only stablecoins – currencies whose rate is tied to fiat or gold quotes – have a fixed value.

🤔 Is it safe to buy “tokens” on ICO?

The cryptocurrency boom is increasingly attracting scammers. In addition, many startups turn out to be scam (failed projects). Therefore, investing on exchanges carries the risk of losing money. To buy an asset more safely during the ICO period, you should choose the project carefully.

A mistake in the text? Highlight it with your mouse and press Ctrl + Enter.

Author: Saifedean Ammous, an expert in cryptocurrency economics.