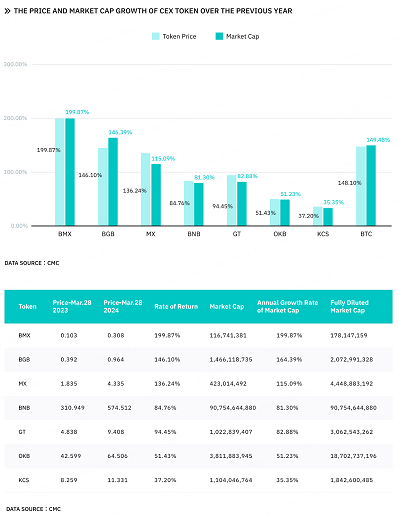

Over the past year, thanks to the entry of BTC-ETF into the US stock markets and the fourth BTC halving, the price of BTC once exceeded $73,000 and reached an all-time high. This drew global attention to the performance of the cryptocurrency market. CEX tokens, being one of the hot topics in the industry, have also shown a steady upward trend. This article focuses on seven significant CEX tokens: BNB, OKB, BGB, KCS, GT, MX and BMX. According to CMC data, the average price growth of the seven CEX tokens is around 98.35% per year, indicating stable performance overall.

There is currently a debate in the market as to whether CEX tokens are overvalued and whether they are a viable investment tool. The purpose of this paper is to offer investors a comprehensive analysis of seven selected CEX tokens, to assess their value and potential, and to review the price and market cap growth rates, repurchase mechanisms, functional rights and market performance of their issuers.

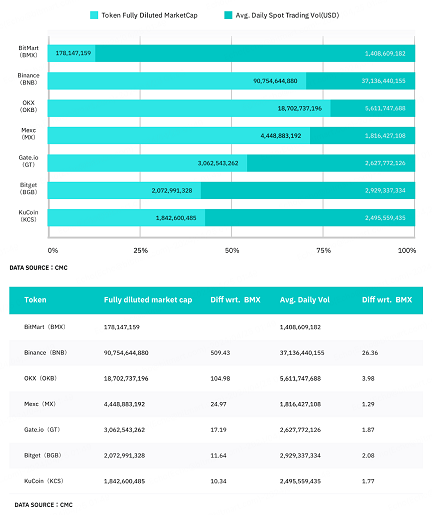

CEX token data comparison

According to CMC data, the average annual price growth of the seven CEX tokens is around 98.35%, slightly lower than bitcoin’s 148%. However, there are a few exceptions – BMX, BGB and MX – whose price growth has exceeded 100%.

Although the price growth of BNB and OKB is relatively lower (84.76% and 51.43%, respectively), this does not necessarily indicate poor performance. Such performance can be attributed to their high market capitalizations. BNB’s market capital as one of the leading CEX tokens has reached $90 billion, and OKB’s capital is also approaching $4 billion. With such high bases, the degree of price fluctuation of these two tokens is more limited, so it is difficult for them to achieve the same significant growth as CEX tokens with smaller market capital. Thus, BNB and OKB, presented as two mature CEX tokens, have relatively limited growth potential because they have already captured significant market shares. On the contrary, CEX tokens with smaller market cap, such as BMX, BGB and MX, have more significant growth potential due to their smaller market share, offering more growth opportunities.

It’s worth noting that BMX has seen impressive price and market cap growth over the past year. BMX’s price has roughly doubled over the past year, compared to its original value a year ago. Its market capital has increased by more than 249.79%. These facts may to some extent reflect BMX’s strong market performance and recognition of its potential value.

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

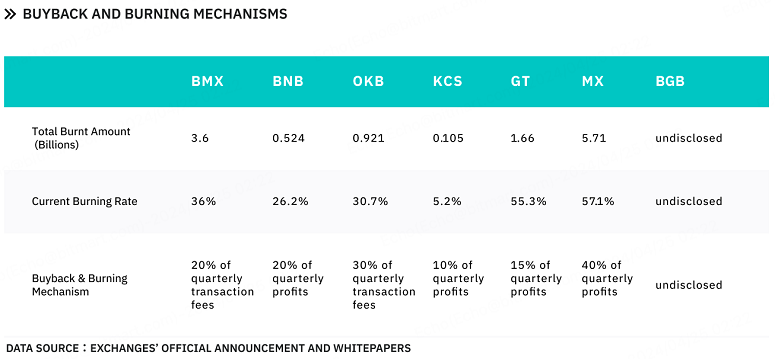

The redemption and burn mechanism is one of the main ways to increase the value of CEX tokens. Exchanges reduce the circulating supply of their tokens by regularly redeeming and burning them, thereby achieving deflation and value appreciation. According to the official announcements of these exchanges, MX and GT have the highest redemption and burn rates, approximately 57.1% and 55.3% respectively. Typically, the amount of tokens redeemed and burned ranges from 10% to 40% of their profits. For example, MEXC’s buyback accounts for 40% of its quarterly profits, while CuCoin’s is relatively lower at only 10%. This may suggest that MEXC is taking more aggressive steps to reduce the amount of MX circulating, thereby increasing its scarcity and value. In comparison, KuCoin’s redemption and burn rate is much lower, limiting the growth in KCS value. Thus, although MEXC has a smaller spot market share than KuCoin, the effective implementation of the redemption and burn mechanism has successfully curbed MX inflation, resulting in a 2.4x increase in its market capital, compared to KCS.

Judging from the information published in the BMX white paper, BitMart’s quarterly buyback is 20% of transaction fees. Since BMX’s release, the burn rate has been around 36%. Under the buyback plan, BitMart will continue to redeem BMX until the number is down to 500 million (the total supply of BMX is 1 billion).

Tokenomics

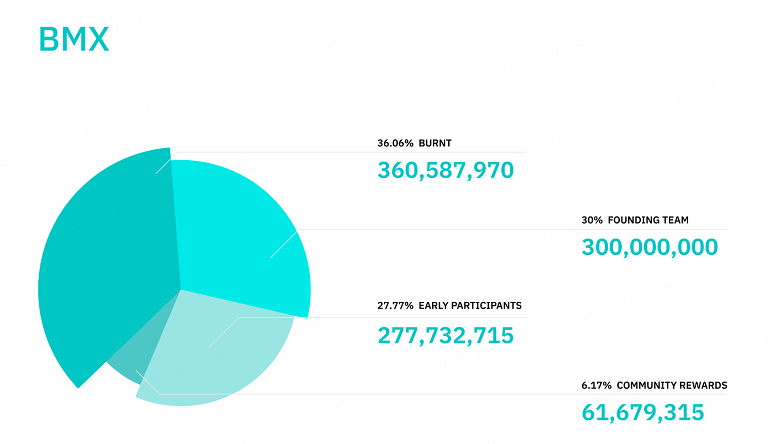

Due to the long issuance history, detailed information about the tokens of some of the seven centralized exchanges has not been disclosed. Among them are BMX and BGB, which have officially published their token unlocking plans and distribution structure. It is believed that such detailed and unique economic models of tokens can promote user engagement, market liquidity and asset value.

BMX has a total supply of 1,000,000,000,000. Tokenomics provides for a deflationary mechanism through redemption, token burn and a reward mechanism. As of April 26, 2024, BMX’s current circulating supply is 324,281,616 tokens:

- 36.06% will be redeemed and burned.

- 6.17% is set aside for community rewards.

- 30% is set aside for team incentives, and 75% of BMX is locked down for three years.

- As of April 26, 2024, these shares remain locked (0x865acE374B47fCBFB41Ac458260a30ac4F3231C6).

- 27.77% is allocated to reward early entrants.

The total number of BGBs is 2,000,000,000,000 of which 25% will be exchanged for BFTs. The remaining 75% will be allocated to community acquisition, branding and growth, environmental investment funds, core team motivation and investor protection. Specific schedules and terms and conditions apply for each distribution. Bitget does not currently disclose the mechanism for burning and redeeming BGB. Distribution:

- 25% – BFT replacement, used to exchange existing BFT tokens.

- 20% – employee investment, 2% unlocked every 6 months, fully unlocked within 5 years.

- 15% – user contribution, release up to 4% per year.

- 15% – promotion, release up to 3% per year.

- 15% – ecosystem investment, released to the Bitget ecosystem investment fund.

- 10% – allocated to reward early adopters.

Analyzing token functionality

Currently, the main application scenarios of CEX tokens can be categorized into the following three: exclusive rights, trade exclusivity, trading rights, and native blockchain asset. Below are detailed explanations and examples of these categories.

Exclusive rights

On most exchanges, the total number of CEX tokens on the registry is often the criteria for determining an account’s membership level or user privileges. Token holders enjoy priority service, exclusive access to events, or special privileges when withdrawing funds from a given platform. These benefits are often linked to the number and length of time tokens are held in accounts. Exchanges use this feature to increase user loyalty and incentivize daily activity on the platforms.

Trading rights

Compared to exclusive rights, trading rights are directly related to the core business of exchanges – trading. Platform token holders can receive discounts on trading fees, as well as more favorable trading tiers and priority access to newly listed coins. In addition, exchanges can give token holders greater access to riskier derivatives products (e.g., margin trading, futures and options). These benefits are designed to increase trading volume and strengthen user attachment.

Native blockchain asset

In the case of exchanges developing their public blockchains, such as Binance Smart Chain (BSC), OKChain and KuCoin’s KuChain, BNB, OKB, KCS and GT tokens become native assets in their respective protocols. They serve a dual purpose:

- A universal gas resource. It is usually the only transaction fee payment mechanism on the blockchain.

- Network management. Token participants will be responsible for various governance decisions, such as voting on protocol updates and policy adjustments.

The continuous development of these blockchains can help increase the usability and demand for their native tokens as more developers and projects choose to build applications based on them, thus expanding their usage scenarios.

Owing to the above mentioned features, CEX tokens play a crucial role in their dominant ecosystems. All these features extend their utility and theoretically increase the demand for them. As a consequence, the value of CEX tokens is closely related to the development of the protocols they manage.

CEX market performance comparison

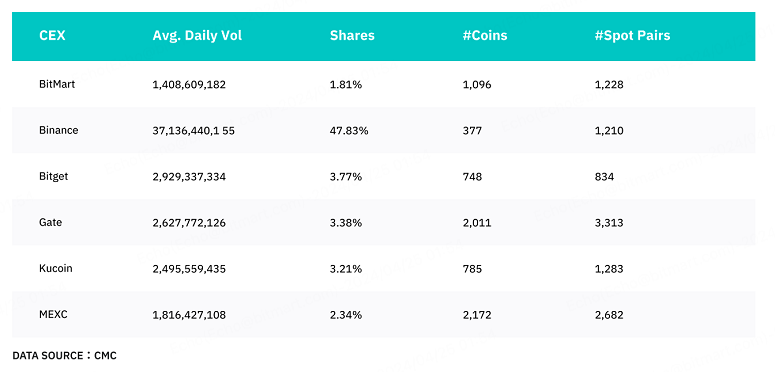

According to CMC data, Binance leads in market share as measured by trading volume, capturing the majority of trades in the market. With the exception of Binance and OKX, the other exchanges have similar and relatively close market shares, roughly 1.5% to 4%.

BitMart has a market share of about 1.81%, which is close to that of MEXC, and is considered a tier two exchange. The marketplace is ahead of most of its competitors in terms of the number of coins represented.

Supported spot currencies and spot trading pairs

In terms of the number of supported spot currencies and spot trading pairs, Gate and MEXC take 2 first places. Gate supports 2011 spot currencies and 3,313 spot trading pairs, while MEXC supports 2,172 and 2,682 respectively. BitMart supports over 1,000 spot currencies and spot trading pairs, providing a variety of trading opportunities.

Exploring the potential of BMX

According to CMC, BMX has a market cap of only $178 million, which is significantly lower than the other 6. BMX’s price does not reflect its value – it is significantly undervalued. For example, MEXC’s average daily spot trading volume over the past month was about $1.81 billion, 29% more than BitMart.

However, MX’s market capital is 23.9 times larger than BMX’s. Despite the relatively low market capital, market activity and demand for BMX is increasing, and the market has begun to realize its potential value. In the last year, the market capital of BMX has increased by about 249% and its price has increased by almost 200%.

BMX V2.0 and V3.0 update: further increasing the value of BMX

Based on the technical description of BMX, BitMart will launch a brand new layer 2 blockchain, Web3 wallet and decentralized exchange. BMX will act as the core asset of this network, used for payment transactions and smart contracts. In addition, BMX plans to collaborate with more games, DeFi protocols and other agreements in Q2-Q3 2024, thus applying BMX in more scenarios and becoming a consumption token, helping the ecosystem thrive.

BMX V2.0.

BitMart’s Web3 wallet will connect centralized digital asset services to the Web3 world, with BMX as the native token. The Web3 wallet will provide a secure way to store, manage and transfer digital assets, giving users control over their private keys.

The BMX ecosystem will create a decentralized exchange combining liquidity and data with CEX and DEX. BitMart aims to provide traders with a platform to help evaluate asset price correlations and formulate hedging strategies. BMX will act as a key underlying asset and token with a trading commission on DEX.

BMX V3.0.

Layer 2 solutions are set to play a crucial role in the widespread adoption of blockchain technology. The BMX ecosystem will launch a new Layer 2 blockchain. BMX will run on the new Layer 2 blockchain in the same way that ETH runs on Ethereum, and will be used for payment transactions and smart contracts.

Brief Description

BNB and OKB are the two leading CEX tokens with the largest market cap. However, this leads to the fact that the growth potential of these two tokens is limited as they have already taken significant market shares. On the contrary, BMX has attracted a lot of market attention due to its significant price increase. Despite the low market cap, the analysis found a lot of potential. Upcoming upgrade plans will improve BMX’s functionality, potentially boosting price and market capital in the future. Key Highlights:

- The CEX token has shown significant fluctuations in performance over the past year. Only a few CEX tokens, such as BMX, BGB and MX, have gained more than 100% over the past year. In contrast, BNB and OKB have shown comparatively less growth due to high levels of market capital.

- The redemption and burn mechanism plays a crucial role in the value of CEX tokens. CEX tokens such as MX and GT recover their scarcity and thus retain value by strictly following the established redemption and burn rate schedules with high burn rate. Conversely, KuCoin’s burn rate is relatively modest, limiting its growth potential.

- As native assets on the blockchain, CEX tokens have better application prospects. Coins of centralized exchanges, BNB and OKB being prominent among them, have evolved into native assets created by exchanges on public blockchains, playing a key role in their ecosystems and increasing their utility and demand.

- BMX looks undervalued. According to BitMart’s spot market share, the market capital of its CEX token seems much lower than other mainstream CEX tokens, likely indicating that BMX is undervalued.

- BitMart’s modernization plans will further fuel BMX’s growth. The utility and value of BMX is expected to increase with the exchange’s next steps, such as BMX modernization, the launch of Web3 wallets and Tier 2 solutions.

Is there an error in the text? Highlight it with your mouse and press Ctrl + Enter

Author: Saifedean Ammous, an expert in cryptocurrency economics.