One of the features of Ethereum and Tron blockchains is the ability to deploy smart contracts. Cryptocurrency is required to support their operation. Therefore, decentralized networks offer users special standards for creating their own coins. It is easier to understand them on a concrete example – the Tether project. In the material – what is the difference between USDT ERC20 and TRC20 and what is better.

What is a Tether stablecoin

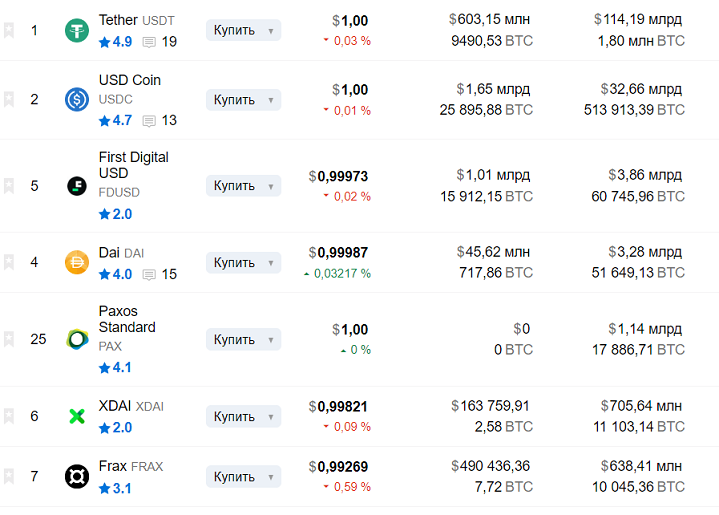

The cryptocurrency market is characterized by high volatility. Coin rates during the day sometimes change by 10-20%. Keeping savings in cryptocurrency is a high risk. To partially solve this problem, stablecoins appeared in 2014. Tether is the most popular token among similar digital currencies as of April 2024.

USDT – a stable digital currency that is pegged to the US dollar exchange rate at a 1-to-1 ratio. The issuer of the stablecoin is Tether Limited. The objective of the cryptocurrency is to provide market participants with an opportunity to store capital, reducing risks from the volatility of coins.

There is a possibility of depreciation of stablecoin. This may happen for various reasons (for example, if the U.S. declares a default).

As of April 16, 2024, Tether ranks 3rd in the ranking of digital currencies by capitalization. Its size is $113.22 billion.

Description of USDT ERC20

As of 2024, the cryptocurrency operates in 68 different decentralized networks. Most of the tokens are issued in 2 blockchains – Ethereum and Tron. To understand the difference between Tether ERC20 and TRC20, you need to consider each standard separately.

5020 $

бонус для нових користувачів!

ByBit забезпечує зручні та безпечні умови для торгівлі криптовалютою, пропонує низькі комісії, високий рівень ліквідності та сучасні інструменти для аналізу ринку. Він підтримує спотову торгівлю та торгівлю з використанням кредитного плеча, а також допомагає початківцям та професійним трейдерам за допомогою інтуїтивно зрозумілого інтерфейсу та навчальних посібників.

Заробіть 100 бонусів $

для нових користувачів!

Найбільша криптобіржа, де можна швидко та безпечно розпочати свою подорож у світі криптовалют. Платформа пропонує сотні популярних активів, низькі комісії та передові інструменти для торгівлі та інвестування. Проста реєстрація, висока швидкість транзакцій та надійний захист коштів роблять Binance чудовим вибором для трейдерів будь-якого рівня!

Their names are acronyms. ERC20 stands for Ethereum Request for Comments 20. The standard was invented in 2015. It defines the rules of tokens in the Efirium network and their basic functions:

- Transferring digital currencies between vaults.

- Obtaining wallet balances.

- Managing cryptocurrency spending permissions, etc.

According to blockchain observer Etherscan, there are 49.999 billion tokens issued on the Ethereum network as of April 16, 2024. That’s 46.3% of the total supply.

Pros and cons

ERC20 is the most popular standard for generating digital assets for 2024. Most of the blockchain projects are launched on the Efirium network. This is due to the following advantages:

- Ethereum network supports many wallets, exchanges and other services. This makes ERC-20 tokens easily available for use.

- Ethereum has a large developer community. This facilitates the development of tools for token creation and auditing.

- The blockchain is decentralized and provides a reliable environment for exchanging cryptocurrencies without intermediaries.

However, digital assets of the ERC20 standard have disadvantages:

- Users of the Ethereum network face high fees. The fee can range from $2 to $70 per transaction.

- Etherium is slower to process transactions due to the peculiarities of the blockchain architecture. Its average performance is 12-15 transactions per second.

USDT TRC20 Characteristics

The protocol for creating cryptocurrencies in the Tron system performs the same functions. The TRC20 standard allows developers to launch their own tokens with the ability to transfer them between wallets. It was launched in 2019. However, ERC20 digital currencies differ from TRC20 due to the features of each ecosystem separately.

According to the Tronscan service, as of April 16, 2024, 56.816 billion USDT had been issued in the Tron blockchain. This is 52.7% of the total cryptocurrency issuance.

Advantages and disadvantages

Because of the protocols’ functional similarities, it is worth comparing the Ethereum and Tron ecosystems. TRC20 digital assets have the following advantages:

- Transaction fees are lower in Tron, ranging from $0.9 to $2. This is the main reason for the popularity of USDT TRC20 cryptocurrency.

- Blockchain performance is higher at 2000 transactions per second.

- The Tron system is decentralized.

Disadvantages of TRC20 crypto tokens:

- Less developed ecosystem, which reduces the availability of cryptocurrency usage. The Tron network supports fewer wallets, trading platforms, and services than the Ethereum blockchain.

- There is a smaller developer community represented in the ecosystem. This slows down the development of tools for generating digital currencies relative to Ethereum.

Other USDT standards

As of April 2024, more than 90% of Tether’s supply is represented in the Ethereum and Tron systems. However, developers issue tokens in 66 other blockchains. The largest networks are discussed in the table below.

| Блокчейн | Protocol | Number of USDT, billion |

|---|---|---|

How USDT ERC20 differs from TRC20

The main difference between Tether on the Ethereum and Tron networks comes down to the specifics of the blockchains and their ecosystems. To make the comparison clear, below is a table.

| ERC20 | TRC20 |

|---|---|

Which standard to choose

USDT is a popular stablecoin that has been issued in 68 different blockchains as of 2024. More than half of the total token supply circulates on the Tron network (56 billion).

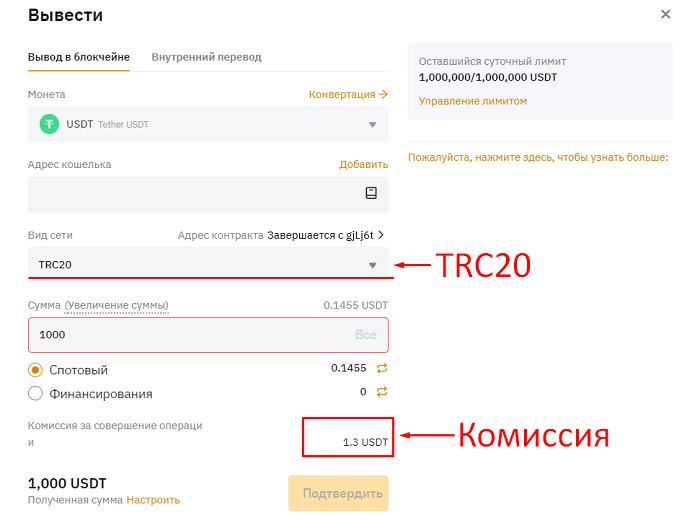

The popularity of the TRC20 standard among users is due to its low transaction fees.

Most centralized cryptocurrency exchanges charge $1 for token transfers, and the fee does not depend on the transaction volume.

Tips for USDT transfers

Beginners in the cryptocurrency market make mistakes when conducting transactions with Tether. The most popular one is specifying the wrong wallet address when transferring. In these cases, users permanently lose USDT due to the irreversibility of transactions in blockchains. To exclude such situations, you need to carefully check the sending address and do not confuse standards. Asset Transfer Instructions:

- Open the page to withdraw assets from the wallet.

- Select USDT.

- Specify the number of tokens.

- Enter the address of the wallet to which the transfer is being made.

- If the transaction is performed from an exchange, select a standard, for example TRC20. On some trading platforms it is specified automatically.

- If the entered data is correct, confirm the operation.

The asset will arrive on the wallet within 5-10 minutes. Usually it happens faster, but with rare exceptions.

Wallets

To interact with digital assets, the user needs a cryptocurrency storage. This is a special program that works with blockchains. For example, to store Tether ERC20, you will need a wallet with Ethereum support. Popular among market participants are:

- Metamask

- MyEtherWallet

- Trust Wallet

These wallets are not suitable for storing Tether TRC20 (except for the last one). The following programs are popular for the Tron system:

- TronLink

- Atomic Wallet

- Exodus

You can store tokens of both standards on almost any centralized exchange. For 2024, users are active with OKX, Bybit, and Bitget trading platforms.

Frequent questions

💡 Is it possible to create a cryptocurrency from scratch?

Yes. However, it is significantly more complicated and expensive. Developing a digital asset in an existing blockchain with some knowledge will not create difficulties.

📌 Which Tether standard provides the lowest transfer fees?

According to the Bybit exchange, it is more profitable to exchange cryptocurrency in the KavaEVM and Binance Smart Chain at the beginning of 2024. The transaction price is $0.3.

✨ What is the asset value of Tether secured?

As of early 2024, the digital currency was backed by real US dollars, securities and precious metals.

📢 What happens if you enter the wrong wallet address when making a transaction?

The sent coins will disappear forever. You won’t be able to get the cryptocurrency back.

🔎 Are there any alternative stablecoins?

With a peg to the US dollar, USDC, DAI, FDUSD are popular. There are also stable assets backed by euro, gold, silver.

⚡ Can the rate of a stablecoin fall?

Yes. There have been similar situations in the cryptocurrency market. The most significant example is the UST asset from the Terra project. The coin lost its peg to the US dollar and collapsed to $0.05 in 2-3 days.

Ви знайшли помилку в тексті? Виділіть її мишкою та натисніть Ctrl + Увійдіть

Автор: Сайфедейський аммусексперт з економіки криптовалют.