To popularize cryptocurrencies, exchanges together with payment systems issue special virtual cards and “plastic”. With their help, miners and traders can directly use digital coins to buy goods. Visa-card from Huobi is similar to those previously released by Binance, Ledger. It is still in development, but may become available as early as 2024-2025.

Features of the card from Huobi exchange

Debit “virtual” Visa will be connected to an account on the platform. By replenishing the wallet in the personal account, the cryptocurrency card can pay for a purchase in the store. Repeated conversion will not be required. The principle of operation, speed and other technical points do not differ from conventional Visa debit cards. As Justin Sun wrote, the card is an opportunity to make virtual assets available to everyone.

“Huobi and Visa are leaders in their respective niches. With the innovation, we hope to contribute to increasing access to financial services in the world.”

So far, there is no exact information about the benefits for the user. The cryptocurrency exchange is planning to introduce cashback in Huobi Token (HT). Coins will be credited to the connected wallet for each transaction. They can be exchanged for other cryptocurrencies or fiat. As of March 20, 2023, HT is being purchased for $3.93. In addition to cashback, the company will add airdrop coupons and privileges in Huobi Earn products.

Cooperation with Visa

The payment system is actively developing the cryptocurrency direction. It has already realized such projects together with Binance, Bakkt, BlockFi, CryptoSpend and Ledger. Gemini and CoinJar have issued virtual and plastic cards in partnership with Mastercard.

5020 $

бонус для нових користувачів!

ByBit забезпечує зручні та безпечні умови для торгівлі криптовалютою, пропонує низькі комісії, високий рівень ліквідності та сучасні інструменти для аналізу ринку. Він підтримує спотову торгівлю та торгівлю з використанням кредитного плеча, а також допомагає початківцям та професійним трейдерам за допомогою інтуїтивно зрозумілого інтерфейсу та навчальних посібників.

Заробіть 100 бонусів $

для нових користувачів!

Найбільша криптобіржа, де можна швидко та безпечно розпочати свою подорож у світі криптовалют. Платформа пропонує сотні популярних активів, низькі комісії та передові інструменти для торгівлі та інвестування. Проста реєстрація, висока швидкість транзакцій та надійний захист коштів роблять Binance чудовим вибором для трейдерів будь-якого рівня!

According to Kai Sheffield, Visa plans to become a connecting element between the cryptocurrency ecosystem and financial institutions. The company is ready to cooperate with promising projects and launch new products like the Huobi Card. This will allow seamless spending of digital assets anywhere the payment system works.

What can be used for

Plastic and virtual cards are used for household payments, just like regular debit cards. They will work with all Visa terminals. There is no need to look for special cryptomats, stores or cafes that accept settlements in digital assets, since the seller will receive fiat. It is worth noting that the “virtualization” can be tied to Apple Pay and a similar service from Google.

Visa and the exchange do not plan to charge users increased commissions. The exchange will be carried out at the current rate of the platform. Because of this, the cost of the same goods in cryptocurrency will become volatile. For example, on Binance to solve the problem with volatile prices recommended miners to transfer money into stablecoins.

However, you need to take into account that a number of countries, including Russia, have taxes on the sale of digital assets. Therefore, citizens are obliged to pay part of the income to the state treasury.

In addition to purchases, the card from Huobi will give the opportunity to quickly withdraw fiat from an ATM. The fee for exchanging money will be the same, but there may be an additional payment for cashing out.

Fees and limits

So far there is no exact information about the cost of issuing and maintaining the card. In the announcement, the management of the exchange noted that 5 levels are planned – from “Scout” to “Expert”. The issue price, limits and features of plastic and virtual cards depend on them. For comparison, Binance introduced 4 products with the following limits (for a month).

| Transaction | EEA Card | Refugee Card |

|---|---|---|

The exchange takes up to 0.9% commission depending on the cryptocurrency and the country of residence of the user. The first issue is free, a repeat issue will cost €25. It is expected that the company will offer similar conditions for all users, but for large Expert level clients there will be increased limits.

How to get one

According to the exchange’s plans, the card will first become available in test mode in Europe. After the completion of the first stage, it will be able to be ordered by a person in any country where Visa is available. To get it, you just need to create an account on the site and pass the checks:

- KYC

- AML

- Creditworthiness.

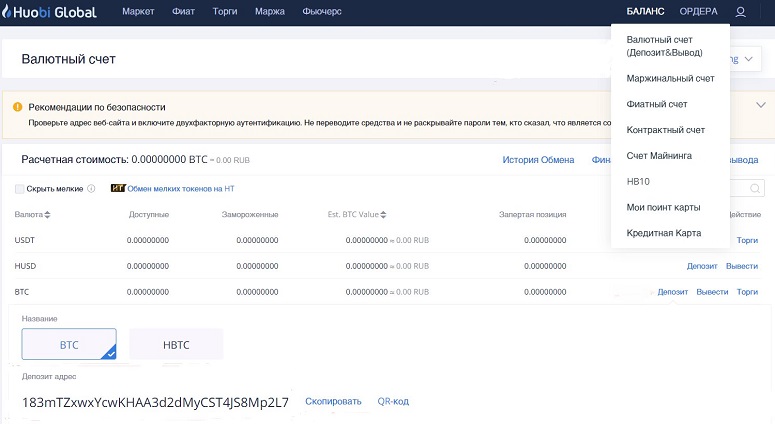

After the first deposit, the user will have access to a section where they create applications for the card. If, like Binance, Huobi provides for a “virtual card”, then its receipt will be instant. At the same time, the “plastic” will be sent by mail.

The process of card issuance is under development, so it is too early to give precise recommendations. It is known that the requisites will be filled out automatically, since the exchange will first receive all the contact information of the client. After creation, the card details will appear in the personal cabinet.

In Russia, the launch of Huobi Card is in question. The country prohibits the use of cryptocurrencies to pay for goods, although formally they are pre-exchanged for fiat. Visa has also stopped servicing Russia. Therefore, temporarily the use of cards is basically impossible.

Frequently asked questions

🔔 What coins will be exchanged for fiat?

It is not known exactly whether there will be restrictions on the choice of digital assets for settlements. Platforms with a similar offer allow any coins in the listing.

✨ Can I borrow cryptocurrency on Huobi Card?

No. The exchange will only issue debit cards. They can be used for purchases by depositing money into the account in advance.

📌 How to find a crypto machine in Russia?

It is worth using the online Coin ATM Radar card. It shows all the terminals in the world.

⚡ Is it legal to own cryptocurrency in Russia?

Yes. It is legal. People can freely trade it on exchanges, store it on wallets, and also mine the coins.

💳 What should I do if my card is lost?

It can be frozen and blocked in the personal cabinet. In the second case, it will be permanently disconnected from the wallet.

Ви знайшли помилку в тексті? Виділіть її мишкою та натисніть Ctrl + Заходьте.

Автор: Сайфедейський аммусексперт з економіки криптовалют.