In recent years, automated blockchain services have captured the attention of users and investment by companies. Decentralized financing and lending protocols are no longer something complex and distant. The total capitalization of DeFi assets has reached $50 billion. $30 billion of these funds are created by the efforts of dozens of major projects. In this material, readers will find a list of DeFi tokens that have become popular in the industry. There is also information about what decentralized finance is and what options this part of the cryptoeconomy provides.

What is DeFi

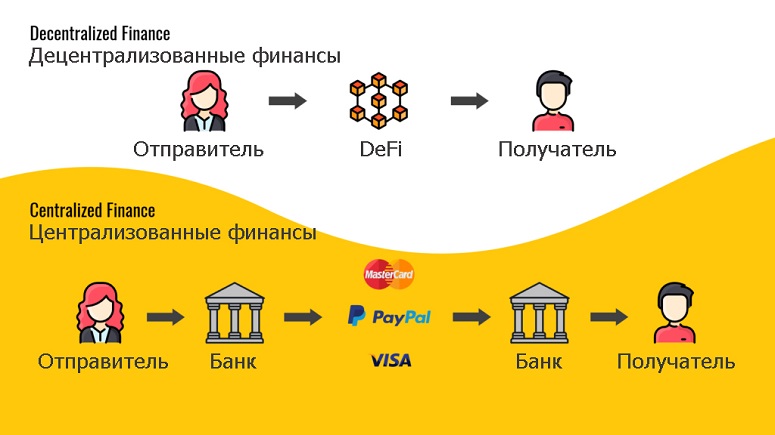

Decentralized finance (decentralized finance) is an ecosystem of blockchain-based income generation tools. The acronym DeFi is more commonly used. However, the definition is quite broad. The decentralized finance sector includes services that provide transactions using smart contract algorithms. DeFi tokens are native cryptocurrencies of such protocols.

To be clear, Bitcoin, Ethereum and other digital blockchain currencies are considered decentralized money. However, DeFi-tokens are assets with direct participation in a financial protocol.

For inexperienced users, working with DeFi seems complicated at first. It takes time to understand the principles of blockchain and decentralized applications.

However, DeFi offers a big advantage over the traditional economy – accessibility. Anyone can borrow, invest and earn on crypto-assets. There is no need to disclose personal information such as documents, credit history or residency in any country.

Principle of work

For example, the Binance exchange helps you trade cryptocurrencies and earn money. However, to do this, you need to register an account on the service, pass verification and deposit assets on the balance. In other words, you will have to entrust your personal deposit to the exchange. If suspicious activity is detected, the account may be frozen. The service openly states about this probability. This is centralization, and it is formed if the supervisor/service can exert pressure or restrict access. DeFi tools do not affect exchange transactions and do not control funds. Users connect wallets with assets and execute transactions directly from the vault.

5020 $

бонус для нових користувачів!

ByBit забезпечує зручні та безпечні умови для торгівлі криптовалютою, пропонує низькі комісії, високий рівень ліквідності та сучасні інструменти для аналізу ринку. Він підтримує спотову торгівлю та торгівлю з використанням кредитного плеча, а також допомагає початківцям та професійним трейдерам за допомогою інтуїтивно зрозумілого інтерфейсу та навчальних посібників.

Заробіть 100 бонусів $

для нових користувачів!

Найбільша криптобіржа, де можна швидко та безпечно розпочати свою подорож у світі криптовалют. Платформа пропонує сотні популярних активів, низькі комісії та передові інструменти для торгівлі та інвестування. Проста реєстрація, висока швидкість транзакцій та надійний захист коштів роблять Binance чудовим вибором для трейдерів будь-якого рівня!

The principle of DeFi is based on the use of blockchain and smart contracts. The latter organize financial transactions in the form of a program (technical algorithm). In order for an action to work in it, certain conditions must be met. For example, the user must send a deposit in cryptocurrencies to the smart contract.

The protocol automatically checks for correctness, and if authenticity is confirmed, the transfer transaction is recorded in the chain. Then the next condition is triggered – for example, unfreeze the assets after a certain period of time and accrue interest on the blockchain as a reward.

With smart contracts, developers are adapting existing traditional financial services. Among these are:

- Lending.

- Loans.

- Cryptocurrency trading and exchange.

- Insurance.

- Investments and crowdfunding.

- Derivatives.

Also based on smart contracts were made unique tools specific to the digital economy. The list includes:

- Stablecoins.

- Liquidity transactions – mining, farming, staking.

- Issuance of synthetic assets.

All transactions are performed automatically and without the participation of intermediaries. Smart contracts are stored in public repositories, and the fulfillment of conditions and each intermediate transaction takes place in the cryptocurrency chain. This ensures transparency and security of transactions, as well as decentralization of the network or, in other words, the absence of external control.

How to use

You only need an internet connection to access the blockchain space. It is worth researching projects with new DeFi tokens in 2024, as well as assessing the relevance of existing solutions. To use decentralized finance protocols, you need to take a few steps:

- Create a cryptocurrency wallet. It is better to engage non-custodial types of storage. The form of the wallet does not matter. It can be a hardware solution, an application for a mobile device or an online service. The choice depends on the user’s preferences.

- Send to a cryptocurrency wallet. Digital assets can be transferred from an exchange or other storage account, or bought in an exchanger for fiat funds.

- Connect to the DeFi protocol. Decentralized applications (dApps) are used for this purpose – for example, SushiSwap, Aave, Curve.

- Choose an option and transfer the deposit through the service’s functionality. The goals and objectives of the protocols differ, but all of them are aimed at creating income.

As with the traditional option, risks should be managed when trading in DeFi. On the one hand, this relates to cybersecurity, as full control of the user over his funds means, among other things, responsibility for their safety. On the other hand, the risks of DeFi token trading must be assessed. The threats remain as high as in the case of traditional digital blockchain coins.

At any time, a user can withdraw from DeFi protocols and return their assets to their cryptocurrency wallet.

List of DeFi tokens by market capitalization

In August 2023, the decentralized finance sector includes protocols, infrastructure solutions for their deployment, and native cryptocurrencies of these projects. The list of coins and tokens in the DeFi economy is in the table.

| Protocol name | Token | Price as of July 31, 2023 | Market capitalization size |

|---|---|---|---|

Uniswap

The first place in the ranking is occupied by a decentralized exchange protocol. Uniswap was launched in 2018 on the Ethereum blockchain. Since then, the protocol has become the most popular and innovative platform in the DeFi segment. The UNI native token is involved in all the operations of the exchange. It is received by users for providing liquidity. In terms of capitalization, the token ranks 1st in the DeFi segment – $4.9 billion. Daily trading turnover exceeds $150 million.

UNI holders can make decisions within the DAO and vote on protocol development issues.

Wrapped Bitcoin

The second most capitalized DeFi token is a wrapped version of bitcoin. With a total value of $4.75 billion, Wrapped Bitcoin is created by a smart contract on the Ethereum network, but does not belong to a specific parent DeFi protocol. WBTC is traded primarily on the DEX service Uniswap. At the same time, exchange transactions are also carried out on most other decentralized platforms of the Ethereum ecosystem.

The daily trading volume of WBTC is $180.26 million. The asset is blocked as collateral to get a loan or credit.

Maker DAO

On the 3rd and 9th places are two assets of DeFi service. The development of the Maker DAO decentralized finance protocol on the Ethereum network began in 2015, but it was launched in December 2017. The smart contract mechanics helps to blockchain ETH coins and receive loans and credits in stablecoin. For this purpose, a native digital currency Dai (DAI) has been created, which has a peg to the US dollar. Wrapped Bitcoin (WBTC) is also blocked as collateral within the protocol.

DAI is both a DeFi-stablecoin and a DeFi-coin, as it is issued by the protocol.

MakerDAO uses a voting management system to involve the user community in decisions on protocol updates and other important issues. The right is available to holders of the protocol’s second native DeFi token, Maker (MKR). It is not involved in the mechanics of loan disbursement.

In August 2023, DAI’s capitalization size is $4.57 billion and trading volume exceeds $205 million per day. MKR’s total cash supply is another $1.15 billion, and daily turnover is over $117. In total, the performance of both assets of the protocol exceeds similar data for UNI and Uniswap.

Avalanche

The 4th position of the list of the best DeFi tokens is occupied by an unusual project. Avalanche is an L1 network that is actively used for deploying DeFi products. Therefore, the native AVAX coin supports the operation of the blockchain and payment of transaction fees in it. At the same time, users blockchain the token in the form of collateral within the ecosystem’s DeFi services. AVAX’s capitalization is $4.53 billion, with daily volumes exceeding $126 million.

Proof-of-Stake has been launched within the network. Coin holders can be rewarded in AVAX for blockchain.

Chainlink

The sixth place went to another infrastructure project. Chainlink was launched in 2017. The protocol in its pure form is not aimed at the DeFi sphere, but links data from the external Internet space with smart contracts in the blockchain through a system of oracles. This technology is used by various crypto startups, including in the development of decentralized financial services.

Chainlink’s native token is called LINK. The asset pays for the services of oracles and incentivizes their correct work. LINK owners participate in voting on improving the protocol and making decisions on its development.

The capitalization of the native Chainlink token is $4.09 billion. The trading volume for the day was $235 million.

Internet Computer

The 7th place of the list of cryptocurrencies in DeFi was occupied by L1-blockchain. The launch of Internet Computer took place in 2021. As in the case of Avalanche, it is primarily a cryptocurrency to realize the needs of any blockchain projects, including those from the DeFi sector. The capitalization of the native ICP coin is much inferior to the previous participant of the rating and is equal to $1.89 billion. Daily trading is conducted in a small volume – only $18 million.

Lido Finance

In 8th place is the DeFi protocol. Lido Finance launched in 2020 to provide Ethereum 2.0 steaking liquidity.

In the Lido protocol, users send ETH to a Lido contract, in return they receive steak tokens (stETH) that validate a stake in the steaking. StETH is an ERC-20 standard asset that is exchanged and traded on decentralized ecosystem exchanges.

The protocol operates with a native DeFi token LDO. On the one hand, it is involved in steaking and supporting the operation of the project, on the other hand, it is related to attracting liquidity. LDO holders can contribute their tokens to pools on decentralized exchanges (DEX), such as Uniswap. This allows participants to earn passive income in the form of trading commissions and other rewards.

LDO’s capitalization is $1.87 billion, with a 24-hour trading volume of $51 million.

BitDAO

On the penultimate line of the top 10 was DeFi platform. The BitDAO protocol was launched on the basis of the Ethereum network in 2021. The service’s activity is related to investments in other projects. Funding from BitDAO can be in the form of investments or providing liquidity. Also, start-up projects get access to the resources and community of the protocol, which attracts new users and investors.

BitDAO has a native token that participates directly in the investment. The capitalization of the BIT asset is $1.44 billion. However, it is practically not traded, the volume of transactions in 24 hours is less than $100 thousand. This is a critically low indicator for a project with such a significant capitalization.

Aave

Closes the top ten DeFi-tokens asset of a decentralized cryptocurrency lending platform. The protocol was implemented in 2017 under the name ETHLend. In 2017, a rebranding was carried out. The service became known as Aave. The platform works on the Ethereum blockchain. It took one of the leading places among the participants of the ecosystem.

Users lend each other assets – for example, ETH, BTC and ERC-20 tokens – through a smart contract.

Lenders receive interest income for providing liquidity. Users also borrow assets by providing cryptocurrency as collateral.

The mechanics of the protocol involves the eponymous native DeFi token AAVE. In it, holders receive a portion of transaction fees and a share of interest rates on lending programs. The token entitles the holder to participate in the distribution of additional piercing fees.

The total cash supply of AAVE is $1.03 billion. Daily turnover is $168 million.

Whether bitcoin is part of DeFi

One of the first manifestations of decentralized finance was wrapped BTC. Blockchain has disadvantages, among others. One of them is the technological incompatibility of networks. This made transferring digital coins between blockchains impossible – for example, BTC cannot be directly transferred to the Ethereum chain. However, with the advent of smart contracts, an unusual solution emerged – to create a derivative cryptocurrency clone. Wrapped Bitcoin is an imitation of BTC on the Ethereum network, in an absolute sense a DeFi token. It is actively used as collateral for loans.

Differences between coins and DeFi tokens

The terms “coins” and “tokens” are often used synonymously in the DeFi environment, but their meanings are different. In both cases, these assets are the underlying cryptocurrency of a decentralized protocol. The difference lies in the method of creation. Coins are issued by the protocol, tokens are issued by a smart contract.

Both are assets that exist on the blockchain and fulfill certain functions within the DeFi platform.

Where tokens are used

DeFi capabilities have duplicated the functions of financial instruments and services of the traditional economy, especially types of credit and derivatives. Also tokens of decentralized protocols act as an asset for investments on par with cryptocurrencies.

Decentralized exchanges

Trading platforms are considered one of the main elements of DeFi. On DEX exchanges, participants sell and buy cryptocurrencies directly from their wallet, bypassing intermediaries. The list of the largest decentralized trading platforms includes:

- Uniswap. Deployed on the foundation of the Ethereum network.

- SushiSwap. It is a fork of Uniswap to improve and expand the functionality of the original exchange.

- PancakeSwap. Powered by the Binance Smart Chain (BSC) blockchain.

Derivatives

This type of financial instrument is considered synthetic. It is borrowed from traditional stock trading. Derivatives are an opportunity to sell not an asset, but a change in its price. Each of these value derivatives has peculiarities and narrow application, but significantly expands investment horizons.

Among the available DeFi derivatives:

- Futures.

- Options.

- Permanent and credit default swaps.

- Index-based derivatives.

- Synthetic assets.

- Collateralized debt obligations.

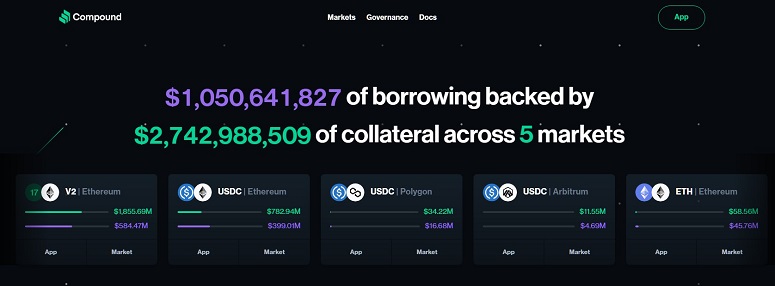

Lending

In DeFi services, users borrow assets in two ways. The mechanics of borrowing in them are the same and are done through smart contract protocols. The difference lies in the collateral. The first type of operation is lending: the user borrows a larger amount of assets and leaves a deposit as collateral. In the second variant, a loan is carried out. For him, the deposit of collateral is not necessary.

In both cases, investors get quick access to funds and use them for their own purposes – trading, investing or performing other financial actions.

Borrowed assets are taken from the liquidity fund. It is organized by a smart contract from the deposits of some users and disbursed to others. This process ensures that loans are affordable for borrowers and earnings opportunities for pledgers.

In DeFi lending, there is a risk of default or non-payment by private users. If this happens, smart contracts automatically sell collateral and return deposits to pledgers (liquidity providers). Therefore, careful consideration of the terms and risks is required before using credit services.

Asset Management

DeFi platforms can be used to invest in different ways. However, there are also full-fledged services for asset portfolio management – for example, TokenSets. With its help, you can automatically create an investment portfolio with one of several strategies in mind. The smart contract programmatically adjusts the deposit in the current time depending on the market situation.

Similar operations are performed in Yearn.Finance protocol. The algorithm automatically manages users’ assets and can transfer funds to the most profitable liquidity pools to increase profitability.

Ways to make money on decentralized assets

Each DeFi protocol transaction allows you to lock in a deposit for a different purpose and earn rewards in the form of interest or other tokens. Popular ways to make money in decentralized finance include the following:

- Staking. Blocking coins or tokens in a smart contract to keep the network running. Stakers are rewarded in the same asset.

- Farming. Helps generate liquidity for decentralized exchanges and protocols. Users contribute their crypto assets and receive rewards for activity. This method allows you to make money on the difference in rates and trading commissions.

- Derivatives. The use of value derivatives is associated with greater risks, but brings increased returns. Derivatives are considered to be instruments of speculative trading on changes in the price of assets.

- Participation in crowdfunding. Through DeFi services, investments in new crypto projects are made. This happens through fundraising and the initial sale of tokens – ICOs and IDOs. Users buy tokens of the projects and, if the startup successfully develops, get profit from the sale of assets at a higher rate.

How and where to buy tokens

The easiest way to buy cryptoassets is on decentralized exchanges (DEX) – Uniswap, SushiSwap, PancakeSwap and others. To trade, users create a blockchain wallet and replenish its balance. On DEX platforms, users exchange cryptocurrencies and tokens without creating a profile, as it is enough to connect the wallet address. Verification is also not necessary.

However, when investing in DeFi, it is worth remembering the risks associated with the high volatility of the crypto market, as well as the possibility of errors in smart contracts. It is better to do your own research and analysis before deciding to participate in a DeFi project.

Поширені запитання

📌 What is liquidity?

In general economic terms, it is the ability of an asset to be exchanged for cash quickly and without significant changes in price. In the crypto segment, it refers to the supply of available digital currencies on a CEX exchange or protocol.

✨ Who are liquidity providers?

They are participants who contribute their deposits to the exchange’s fund. Large pools of enrolled funds allow for active trading, traders or borrowers.

🔔 Where are the assets after a blockchain in the DEX protocol?

Cryptocurrencies do not become the property of the decentralized exchange, but remain in the management of the smart contract.

🔥 What are synthetic assets and are they considered DeFi tokens?

Such tokens are similar to a wrapped bitcoin. They mimic an asset in a specific environment. The tokens can be created in the Syntetyx protocol. They are related to DeFi assets.

📢 Is it safe to use decentralized finance?

DeFi protocols are programs that operate large amounts of cryptocurrencies. This makes them a target for cybercriminals. If a vulnerability is found in the protocol, it is possible to lose your deposit with no recovery. The largest hack occurred in 2021 in the Ronin protocol, leading to a leak of more than $500 million.

Missing text? Highlight it with your mouse and press Ctrl + Увійдіть

Автор: Сайфедейський аммусексперт з економіки криптовалют.