With the development of decentralized finance, investors have new passive earning opportunities – liquid staking, yield pharming, lending, and more. In November 2023, thousands of applications are operating in this segment. To make it easier to find and analyze projects, yield aggregators were created. The developers of Cadabra Finance have gone one step further. They offered investors to rethink the approach to DeFi and created a platform based on the concept of “Put and forget”. There is no need to study the market, monitor profitability, transfer funds from one project to another. In Cadabra Finance you just need to choose a strategy. Algorithms will do the rest.

What is Cadabra Finance

This is an automated platform for investing in DeFi projects. Unlike conventional yield aggregators, Cadabra Finance offers to invest not in specific projects, but in strategies with selected risks. Investors can maximize passive income without diving deep into analytics, without the risk of making mistakes and encountering fraudsters.

Each strategy is designed to continuously generate profits.

The algorithm constantly analyzes the protocols in the strategy and allocates funds to projects with the highest APY. The portfolio is constantly balanced – to maintain the best returns.

Users are rewarded with native ABRA tokens backed by real returns. Holders of the asset can earn additional income:

- Commissions from transactions (distributed to investors).

- Derivative tokens when ABRA tokens are staked.

- Referral Fees.

Project features

Cadabra Finance is an ecosystem product created by the developers of centralized exchange Nominex and DEX Nomiswap. In November 2023, these platforms create a trading volume of $14.83 million daily.

5020 $

бонус для нових користувачів!

ByBit забезпечує зручні та безпечні умови для торгівлі криптовалютою, пропонує низькі комісії, високий рівень ліквідності та сучасні інструменти для аналізу ринку. Він підтримує спотову торгівлю та торгівлю з використанням кредитного плеча, а також допомагає початківцям та професійним трейдерам за допомогою інтуїтивно зрозумілого інтерфейсу та навчальних посібників.

Заробіть 100 бонусів $

для нових користувачів!

Найбільша криптобіржа, де можна швидко та безпечно розпочати свою подорож у світі криптовалют. Платформа пропонує сотні популярних активів, низькі комісії та передові інструменти для торгівлі та інвестування. Проста реєстрація, висока швидкість транзакцій та надійний захист коштів роблять Binance чудовим вибором для трейдерів будь-якого рівня!

At the peak of its popularity, Nomiswap had the third highest amount of blocked funds (TVL) among DEXs in the Binance Smart Chain network.

In Cadabra Finance the developers have combined all the advantages of decentralized finance (low entry threshold, passive income, transparency) and eliminated the risks – the need for analysis, overhead, scam. Project features:

- Investors are offered ready-made strategies with different risk/profit ratios. There is no need to understand the concept of DeFi and application functionality.

- Strategies work automatically. The algorithm reallocates and converts funds.

- Investors pay small deposit and withdrawal fees. Network fees for rebalancing and other transactions are minimized by pooling funds from all strategy members and are included in the performance fee (strategy participation) – 1% to 5% of profits.

- Such fees are distributed to veABRA token holders, which in turn are credited to users when they localize their ABRA tokens.

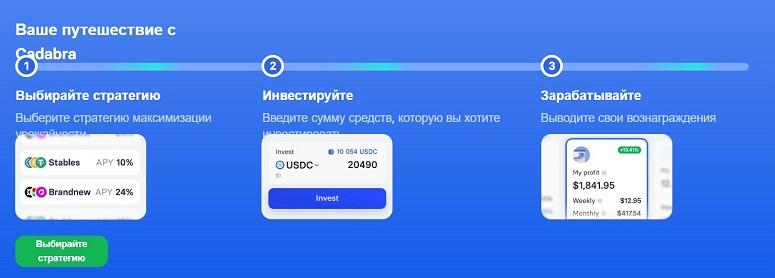

How the platform works

In traditional aggregators, clients spend time researching and selecting protocols with high APYs, perform dozens of manual transactions, and look for ways to optimize profits. Cadabra Finance works differently. Users choose a strategy, make a deposit and get passive profit. Algorithms do the rest.

Investment strategies

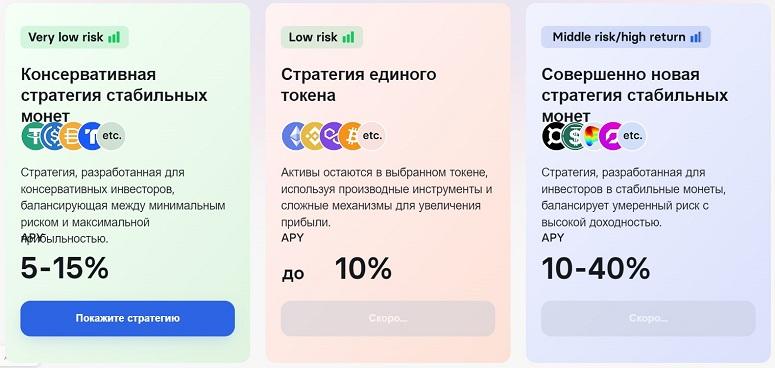

The mechanism provides optimized passive income by combining various sources. In strategies, users’ assets are balanced according to basic protocols to maximize profits. Projects in the strategy are selected based on risk to return ratio. Cadabra Finance offers 3 strategies at the start of the project with the subsequent addition of new ones:

- Conservative. The projects are selected taking into account the minimum risk and maximum profit. Here you can earn 5-15% per annum. The risk is minimal.

- Strategy of one token. The investor chooses a cryptocurrency. Asset derivatives and complex mechanisms are used to increase profits. The potential profit is 10% per year. The risk is minimal.

- An updated strategy based on stablecoins. This mechanism combines moderate risk with high returns.

Strategies are created according to the principle of sameness. They select projects with similar characteristics – for example, stablecoins with the same risk profile or underlying tokens and derivatives derived from them. This allows you to quickly change protocols within a strategy to get higher returns. The asset allocation rules are written into smart contracts.

Profit accrual

Developers are proposing a fundamentally new rewards model that can qualitatively improve the DeFi sphere. In the traditional approach, users are incentivized to supply liquidity and receive protocol tokens in return. High APRs are supported by issuance, resulting in falling asset prices.

Cadabra Finance introduces a single ABRA token backed by real returns and a portion of the liquidity of the strategy itself. Investors receive returns in native cryptocurrency. Technically, it looks like this:

- Rewards from the underlying protocols are traded, aggregated, and used to buy back ABRA from the open market.

- Profits in the form of native tokens are distributed among the participants of the strategy in proportion to the contribution.

The platform combines a large number of protocols, so income is not accrued immediately. It takes a few days to collect rewards and exchange them for ABRA. The profits are then distributed among the strategy participants. Rewards are paid every second for 7 days. This is how the developers insure against fraud.

If new income accrues during the payout period, it is distributed over the next 7 days.

Sources of revenue

Investors’ money is distributed according to the protocols specified in the strategy’s information card. Developers select projects in two ways:

- Manually explore the DeFi space.

- Run automatic monitoring.

New protocols undergo security evaluation and technical validation. They also introduce adapters that may have the following states:

- Active – used to distribute liquidity. Investments can be made.

- Inactive – can hold liquidity but does not accept new deposits.

- Uncommitted – an inactive adapter.

Commissions

The platform charges small transaction fees and distributes them among users. See the table for details.

| Transaction | Fee (%) | Коментар |

|---|---|---|

Native token

The underlying cryptocurrency serves as the centerpiece of the platform. ABRA is a crosschain token built on the LayerZero Omnichain standard. The asset will function on multiple networks:

- Binance Smart Chain.

- OP Mainnet.

- Polygon.

- Ethereum.

The developers plan to issue 13.33 million tokens at one time. No additional issuance is envisioned. ABRA token performs the following functions:

- Payment of rewards. Only the actual profit from participation in strategies is distributed.

- Management. The blockchain accrues veABRA derivative tokens, which provide voting rights.

- Profit accumulation. ABRA holders receive a share in proportion to the amount of veABRA.

- Capital savings. The tokens are fully backed by the liquidity of the strategy. A deflation mechanism is used for future price growth. ABRA acts as an income-generating multichain index.

- Participation in a referral program. Holders take a percentage of the rewards that first and second level referrals receive for their personal locking of ABRA tokens.

- Managing funds within strategies. It is possible to adjust position balances, increase profits, and change risk.

Staking (locking) of ABRA tokens

For locking native cryptocurrency (ABRA tokens), veABRA derivative tokens are accrued. They can be used to participate in voting. Holders also receive:

- Commissions and liquidity rewards – distributed in proportion to the strength of the vote.

- Personalized betting bonus – additional tokens from a special pool.

- Referral payments.

Deflationary mechanism

The developers provided for a one-time issue of ABRA. Most of the asset is distributed on the free market and is available for trading. Cadabra Finance tokenomics is based on this. Unlike other DeFi projects, ABRAs are redeemed on the market and only then distributed to investors. Other components of the deflation mechanism:

- The ABRA token is backed by the yield of integrated protocols.

- Price manipulation protection is provided (deposit fees, use of Uniswap pools).

- Blockchain and vesting mechanics are built in.

Реферальна програма

Cadabra Finance rewards users for referring new investors to ABRA steaking. You need to block your own tokens to participate in the program. Referrers are paid a percentage:

- On the number of tokens blocked by invitees (Level 1).

- From the number of tokens that are blocked by users on the second level – brought in by referrals of the first level.

Rewards are one-time, accrued immediately. The size of the payment depends on the status of the user. Details – in the table.

| Status | Number of tokens in steaking | Reward at 1st level (%) | Payout at 2nd level (%) |

|---|---|---|---|

*The column “Number of tokens in locking” means how many digital assets the creator of the referral structure should lock in order to get a referral rank (“beginner”, “adept”, etc.). And further on, this rank gives an opportunity to receive referral rewards when tokens are locked by referrals of the first and second levels.

Referrals receive an additional 2% to uAPY. It should be noted that these rewards are given simply for the fact that they are someone’s referrals. The program rewards are paid out of a special pool in which 15% of the ABRA offer is reserved.

Pros and cons

Cadabra Finance offers a new approach to earning in yield aggregators. The fully automated platform allocates assets to the protocols with the highest APY and balances when financials change. Other advantages and disadvantages can be compared in the table.

| Плюси | Cons |

|---|---|

| You can invest in ready-made strategies | The project is under development |

| The algorithm tracks projects in various networks and connects to them thanks to the system of cross-chain transfers | |

| Small commissions | |

| You can earn in steaking | |

| Profitable referral program |

Висновок

In November 2023, the project is running in a test (beta) version, the team is preparing to launch a native cryptocurrency – digital asset ABRA. Most of the ABRA tokens will immediately enter the market, where initially there will be no sellers. This is generating investor interest. The developers are set for long-term development, so they have provided a mechanism for the repurchase of coins.

The prospects of the project are also evidenced by the innovative idea, which is based on the desire to improve the user experience in the DeFi segment. The team is creating a platform that has no analogues so far. Other advantages include a strong technological base and community support.

Помилка в тексті? Виділіть її мишкою та натисніть Ctrl + Увійдіть

Автор: Сайфедейський аммусексперт з економіки криптовалют.