The market capitalization of digital assets has shown significant fluctuations since 2017. Recently, bitcoin has grown in value more than 60 times. Traditional investment instruments do not reach such indicators. The sharp collapse of the virtual coin market in the spring of 2021 showed the instability of the sector. The high volatility of cryptocurrency and changes in quotes by 5-15% within a day attract traders who want to make a quick profit. Ordinary investors treat the new trading instrument with distrust.

The concept of cryptocurrency volatility

Volatility translates from English as “instability, variability”. Cryptocurrency volatility is an increase or decrease in the price of an asset for a certain period of time. Different factors influence the movement of quotes. Unlike stocks, digital coins show sharp and significant changes in the direction of trends. Therefore, virtual financial instruments are recognized as high-risk investments.

Changes in quotes within a day or during the week are referred to the current trend movement. The volatility parameter of cryptocurrencies is considered when there is a sharp fluctuation over a long period.

The calculation of the variability of rates is made on the basis of such indicators:

- The price of the asset at the current moment.

- Historical variability of quotes.

- The liquidity of the project.

- The general mood of the crypto market.

- News background.

- The prospects of the project and statements of the developers.

- Coin capitalization.

Given these parameters, traders understand what movements in the market to expect. Some investors buy less stable koins in order to make money in the shortest possible time. Others choose assets without significant rate dynamics and follow different trading strategies.

5020 $

бонус для нових користувачів!

ByBit забезпечує зручні та безпечні умови для торгівлі криптовалютою, пропонує низькі комісії, високий рівень ліквідності та сучасні інструменти для аналізу ринку. Він підтримує спотову торгівлю та торгівлю з використанням кредитного плеча, а також допомагає початківцям та професійним трейдерам за допомогою інтуїтивно зрозумілого інтерфейсу та навчальних посібників.

Заробіть 100 бонусів $

для нових користувачів!

Найбільша криптобіржа, де можна швидко та безпечно розпочати свою подорож у світі криптовалют. Платформа пропонує сотні популярних активів, низькі комісії та передові інструменти для торгівлі та інвестування. Проста реєстрація, висока швидкість транзакцій та надійний захист коштів роблять Binance чудовим вибором для трейдерів будь-якого рівня!

If the deviation from the current rate is 10% – high.

Price fluctuations in the digital coin market are of 2 types:

- Historical. Deviations from the average value during the previous period.

- Expected. Forecasted changes that are made on the basis of analyzing and calculating previous trends.

Main reasons

Quotation indicators depend on different factors. Cryptocurrencies are a young financial instrument. Investors are skeptical, state regulators introduce new bills, companies are rapidly developing, the market is exposed torisks – these are some reasons that affect the fluctuations of rates.

Lack of trust

Almost all digital coins are not linked to physical values. They are not backed by gold, other precious metals, minerals or fiat money. There is no government backing. This negatively affects users’ trust in transactions with cryptoassets.

In addition, the market is saturated with companies that do not fulfill their obligations to investors. They are called scam projects. Unscrupulous developers may not pay out money, make false promises. Such companies start aggressive marketing, get enough funds and quickly close down. Fraudulent projects cause investors to distrust transactions with virtual coins in general.

Information field

The news background affects both cryptocurrencies and individual virtual assets. To make a forecast, the information field is analyzed. For example, the news that a coin is listed on a major trading exchange will provoke an increase in quotations. The statements of opinion leaders and experts also affect the price. In 2021, a few tweets of Ilon Musk about Dogecoin caused a 1000% increase in quotes.

News also causes the market to fall. For example, restrictions on видобуток корисних копалин in China in May 2021 caused a sharp decline in the bitcoin rate.

There are many such events. The trader in the analysis observes the reaction and behavior of other investors.

Lack of regulation

Decentralization is an important difference between virtual funds and fiat money. There is no loyalty from the government. If the dollar exchange rate is held by US regulators who do not allow strong fluctuations, digital coins are provided only by the promises of the creators, investors’ faith in the project and news background. This contributes to the high volatility of cryptocurrencies in general and individual projects in particular.

The lack of regulation also causes the emergence of fraudulent companies and is the cause of market manipulation.

Decentralization is a feature of virtual asset technology. How to regulate the crypto market is a question that many countries are considering.

Low liquidity

Large trading volumes, high number of participants in transactions characterize the markets from a good side. Compared to traditional investment applications, the cryptosphere has low liquidity. The reasons for this are the nascent stage that the decentralized asset market is in and the slow adoption.

Low liquidity contributes to large fluctuations in exchange rates. A large transaction can cause a sharp rise or a significant fall in quotations. This is one manifestation of market manipulation.

Supply and demand

The use of cryptocurrencies as a means of payment is still prohibited in various countries. Digital coins cannot be used in international trade. Their importance in the economic sector is low. The lack of possibility of using cryptocurrencies by large companies affects the demand of virtual assets. The supply is determined by the need of the market.

Fiat money, shares, securities are not only investment instruments, but also ways to save money from inflation. The high volatility of crypto-assets does not allow them to be used for the latter of these purposes.

Sales market

The field of digital currencies is still a new trend that is fueled by people’s faith in development. However, it is not yet possible to widely use the technology and coins in traditional industries. The sales market is not established. The strong volatility of indicators does not allow large companies to accept cryptocurrencies as payments.

Speculation

The price of a coin depends on its usefulness and acceptance by the community. Many projects are in the development stage and belong to startups. Investors need to evaluate the prospects of the coin and its future use. Such analysis allows you to anticipate the movement of quotations and subsequently earn on the purchase or sale of coins.

Low liquidity, decentralization and lack of regulation contribute to the emergence of artificial manipulations. Organized shares are called pumps and dumps. The essence of the process is the mass purchase or sale of a particular cryptocurrency by traders who own a large number of assets. This is how market participants influence the rate of the coin and use the reaction of small investors to make money. The organizers of the action make a profit after an artificial reversal of the trend. Pump and dump speculation works like this:

- Information noise around a cryptoasset appears.

- Large investors (“whales”) sharply buy the coin in large volumes.

- Small traders buy the coin on the rise or already at the peak of demand.

- “Whales” massively sell virtual currencies after a significant increase in quotations.

- The rate of the cryptoasset falls to the previous values.

- Private investors close deals with losses.

Top 5 most volatile cryptocurrencies

Sharp price volatility is inherent in almost all virtual coins. In addition, digital assets depend on the main cryptocurrency – Bitcoin. Rising and falling BTC prices often have a similar impact on altcoins.

Біткойн

BTC tops the ranking of cryptocurrencies by market capitalization. From its release until the fall of 2021, the koin has risen more than 102.3 million times. No stock in the traditional market has reached such a figure over a similar period. In April 2021, the crypto asset reached an all-time high – the bitcoin price was $63,314. After 2 months, the behavior of the chart changed, and the value fell to $30,817. In November 2021 BTC set a new record – $66,971.

Significant price fluctuations make cryptocurrencies attractive for investment and at the same time highly risky.

Ethereum

The second most capitalized crypto asset also succumbs to the general movement of trends. Etherium reached its first peak in January 2018 and was in a виправлення phase for 2 years. In May 2021, ETH showed a short-term spike to $4168. A couple months later, etherium was trading at $1817k. In November 2021, the crypto asset reached a new all-time high of $4812.

Ripple

XRP is an interesting example of the volatility of quotations. In December 2017, the chart showed a sharp increase. The price of the coin increased from $0.22 to $3.37 in 1 month. In the fall of 2018, the values almost returned to the December level. Within 12 months, the price was in a correction phase. In the spring of 2021, Ripple showed upward trends.

Litecoin

Altcoin LTC can be called a virtual asset with relatively high liquidity. Traders’ confidence in the project is confirmed by the rating – according to CryptoProGuide.com, Litecoin is among the 30 best cryptocurrencies. However, this coin is also characterized by significant rate fluctuations. Since 2017, LTC has traded at a minimum of $3.8 and a maximum of $386.45. The daily variability keeps within 2-4%. In September 2021, due to the news that Walmart will accept payments in LTC, the price of Litecoin soared from $175 to $223 in 1 day. The company denied the information. The next day, the chart returned to its original range.

Shiba Inu

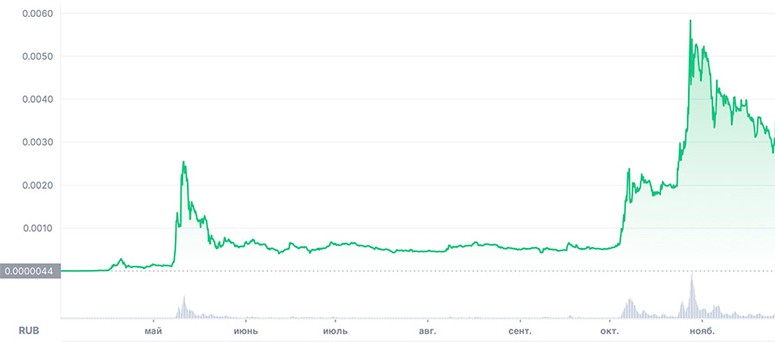

The influence of the information field is demonstrated by the changes in the quotes of meme-coin after the published tweet of Ilon Musk. In a few days, the crypto-asset rose in price 10 times, and its capitalization amounted to $41 billion. The movement of the Shiba Inu chart in October 2021 is an example of speculation by traders who want to get a quick income.

Pros and cons of high token volatility

Frequent significant fluctuations in the crypto market prevent it from developing. Users investing in traditional funds treat the digital industry with distrust and fear high risks.

| Плюси | Плюси |

|---|---|

| Opportunity to earn significantly in a short period of time | High risk of losing investments |

| Gradual increase in liquidity | Large companies cannot use virtual currencies as payment |

| Increase in trading volumes | Low demand among institutional investors |

| Increasing popularity of cryptoassets | Difficult to make predictions |

Висновки

High volatility of cryptocurrencies will be observed until the direction becomes more mature. Until then, the digital market will be attractive to traders who, taking great risks, want to maximize returns. A sharp change in quotes is seen as an unstable behavior of the sector. The usefulness of virtual currencies will suggestively contribute to the development of the market. Then crypto-assets will become not a speculative tool, but a source of savings and investment.

Поширені запитання

✅ How to invest in digital coins with minimal risk?

You need to make a diversified portfolio. Analysts recommend not to invest more than 20% in 1 crypto asset.

💰 Which virtual coin is the most stable?

Stablecoins are tied to real assets. Their volatility is more predictable. The most famous stablecoin is Tether (USDT).

💵 Is it possible to make money on pampa?

There is a chance to profit from participating in market manipulation. You need to buy and sell a digital asset in time.

❓ Why traditional investors do not trust virtual currencies?

Price fluctuations and rate volatility are high risk for those who want to save money.

📊 Is it worth buying bitcoin on the growth of quotations or is it better to wait for the fall of indicators?

BTC and other altcoins should be purchased after careful analysis. It is necessary to evaluate what caused the growth. Perhaps it is a general trend.

Ви знайшли помилку в тексті? Виділіть її мишкою та натисніть Ctrl + Заходьте.

Автор: Сайфедейський аммусексперт з економіки криптовалют.