In 2024, the Bybit exchange is among the top 5 largest platforms for trading and investing in cryptocurrencies. It is visited by more than 7 million users every week. The platform offers clients different trading options – spot, futures, margin, P2P, and algotrading. Spot on Bybit is operations with cryptocurrency using your own funds. In the article – on how to earn on transactions without leverage (from registering an account to choosing a trading pair, creating an order and fixing the profit).

What is spot on Bybit

In 2024, the Bybit crypto exchange offers users an extensive set of options. The simplest and most demanded is the sale and purchase of digital coins without leverage. The asset is delivered immediately after the order is executed.

Users can immediately dispose of coins – transfer them to another platform, place them at interest, use them as collateral or exchange them. Spot on Bybit has such features:

- Price transparency. The rate is regulated only by supply and demand. On futures, however, it is necessary to track different prices (marking, last, average). They, in turn, depend on the funding rate, index and basis moving.

- No margin call risk. The trader trades with his own funds, so the position will not be closed even if the price drops significantly.

- Only long trades are available. Users do not apply margin lending, so they cannot borrow coins from the broker to play on the downside.

- Easy calculation of risk and profit. It is enough to multiply the lot size by the expected price move.

Top crypto exchanges

How to trade on the spot on Bybit

Access to the trading terminal is provided to all customers who have created and verified an account. There is no need to undergo additional testing. To make money on spot is enough:

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

- Log in to the account.

- Refill the balance in a convenient way.

- Go to the trading terminal.

- Select a cryptocurrency.

- Open a transaction to buy (sell) coins.

- Wait for suitable conditions and lock the profit.

Registration

To start working on the platform, you need to create an account. The order of actions is as follows:

- Go to the main page and click on the “Register” button.

- Choose a way to create an account – by email or cell phone number. Subscribers of some operators may receive security codes with a delay, so it is recommended to register by e-mail. You can also authorize on the exchange using Google, Apple, Telegram accounts.

- Enter your e-mail address / mobile number and come up with a password. If available, enter the referral code in the corresponding field.

- Click on the “Create an account” button.

- Check for bots (put together a puzzle).

- Enter the security code from e-mail or SMS to confirm the account.

The account is created. Bybit gives 20 USDT vouchers to new clients. They can be used to trade derivatives.

Verification

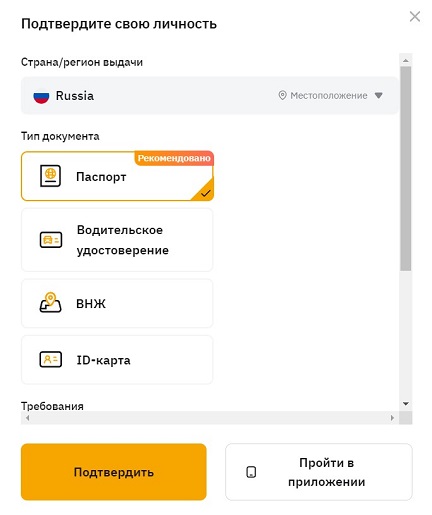

You can’t trade on a spot on Bybit without verifying your identity. To fund an account, conduct transactions on the futures and spot markets, and research investment instruments, you need to get a KYC-1 level or higher. To do this, you need to:

- Open your profile, go to the “Account and Security” section.

- Click on the “Pass” button in the “KYC Verification” field.

- Select country and type of document. Photos of passport, driver’s license, residence permit, ID card are accepted.

- Upload a photo or scan in good quality.

- Verify your identity using a webcam. If there is no corresponding functionality on the PC, you can continue in the mobile client. To do this, click on the “Go to the application” button at the bottom of the page.

- To send the data, click on the “Next” key.

After successful verification, a green icon will appear near the KYC-1 level details in the “Account and Security” section. If the identification is rejected, you can upload the document photo again.

It is allowed to make up to 10 attempts per day.

Then you need to wait for 24 hours. The most frequent reasons for refusal:

- Re-verification (passed for another account). If necessary, you can transfer KYC data to the correct account.

- Selfies do not match the photo in the document.

- Poor photo quality (blurred letters, can’t see corners).

After passing the first level verification, you can use the full functionality of the exchange, deposit up to $50 thousand per day and withdraw up to 1 million. To expand the limits, you will need to obtain KYC-2 status (confirm your residential address).

Deposit and withdrawal methods

Bybit is a centralized exchange, so to start trading, you need to deposit funds to your personal account balance. You can use such methods:

- Crypto transfer from another wallet. The exchange accepts any digital coins from the listing. The address can be found in the “Deposit cryptocurrency” section, then you need to select the asset and network.

- Replenishment with the help of a P2P platform. This method is convenient for purchases for fiat. Rubles, dollars, more than 50 other national currencies are supported. The application can be paid from a card or e-wallet.

- Direct deposit. Visa, Mastercard, JCB cards are supported.

Users can withdraw money in cryptocurrency or fiat. In the first case it is necessary to create an outgoing transaction to the wallet or to another platform, in the second case – the operation is made with the use of peer-to-peer service. Direct withdrawal to a card or EPS is not available.

Trading functionality

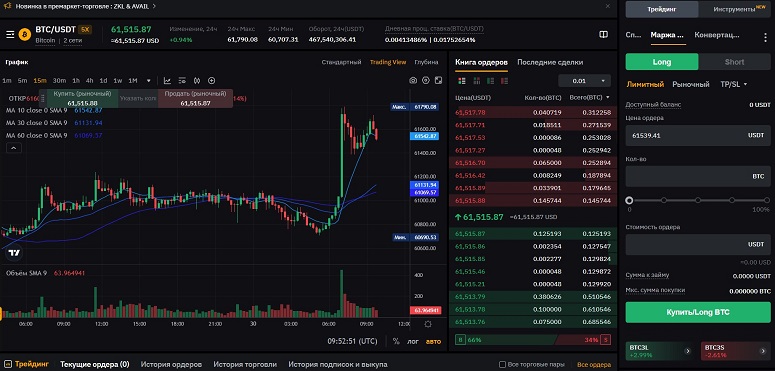

To view cryptocurrency quotes and place an order, you need to go to the terminal. To do this, you will have to open the main menu and select the item “Spot Trading”. The page for trading consists of such blocks:

- Cryptocurrency chart.

- Order book / recent transactions.

- Active orders. The window can also display the history of trades, placed but not executed orders.

- Creating an order.

- Additional tools (making an auto-investment plan, grid trading).

Chart customization

Traders use the standard interface of the trading terminal or switch to the TradingView version. In the simplified mode it is possible to change the view (candlesticks, bars, area) and timeframe of the chart. The TradingView interface allows traders to use drawing tools and popular indicators.

You can switch to the full-screen mode if necessary. Other chart settings are also available. To open the menu, you need to click on the wheel icon at the top of the window. In the tab there will be such items:

- “Tool”. You can change the color of rising and falling candles (body, borders or tails), set price lines (last value, extrema), rate accuracy, time zone.

- “Status bar”. Users can add or hide the necessary data at the top of the chart – title (ticker, description), minimum and maximum, open and close, bar volatility, volume. Changing the background and captions of indicators is also available.

- “Scales. You can display price labels, indicator names and their values, change the format of date and time on the chart.

- “Appearance”. Users can customize the appearance of the chart to their taste. You can change the color, scales and background, add a session section, grid, adjust the size of fields.

Order Book

The block is located to the right of the chart. Users can switch between the order book and the latest trades on the asset. Several stock picker interfaces are available:

- Vertical and horizontal buy and sell formats.

- Long orders.

- Short orders.

Traders can customize the lot size. Values from 0.01 to 100 are available. In this case, out-of-range trades will be hidden. A bar is displayed at the bottom of the window, which shows the ratio of buy and sell orders (in percent).

Deal histories

The block with placed and executed orders is located in the trading terminal at the bottom of the chart. To display all placed orders, one should select the “Orders History” tab.

You can view transactions for a certain period (7, 30, 180 days) or orders of a specific type (limit and market, TP/SL, conditional, OCO).

To display executed orders, one should go to the “Trade History” tab. In the table you can view trades for 7, 30 or 180 days. The following parameters are displayed:

- Cryptocurrency.

- Order type.

- Direction.

- Executed value and price.

- Lot size.

- Commission.

- Transaction and order ID.

Selecting a trading pair

There are 665 coins available on the Bybit crypto exchange in 2024. To select a trading pair you need to:

- Go to the platform’s website or open the mobile app.

- Authorize in the account. Go to the spot terminal.

- Click on the drop-down list near the ticker of the crypto pair to view the available options.

You can sort the results – select instruments with USDT, USDC, USDE, EUR, BTC, ETH, DAI, BRZ or coins of a certain category (“New”, “Adventure Zone”, “SOL/ETH/BTC Ecosystem”, “AI”, “Modular Blockchains”, DePIN and others). To quickly find a pair, you need to use the corresponding function. Frequently used assets can be added to “Favorites”.

Filling a buy order

The window for placing orders is located in the trading terminal to the right of the chart. To buy cryptocurrency, you need to:

- Make sure that the desired trading pair is selected. In the order window, the “Spot” tab is set, the direction of the transaction is “Buy”.

- Determine the type of order. Most often market and limit orders are used. Traders also open conditional, sliding, TP/SL, OCO-orders.

- Enter the desired transaction price and lot size.

- If necessary, specify additional parameters – trigger price, top and bottom of the range, stop rate and others.

- Confirm the order placement.

Cryptocurrency sell order

On the spot market, you can open orders of this type only for coins that are on the balance. Transactions in the “short” format are not supported. To create an order, you need to:

- Open the trading terminal and select a cryptocurrency from the portfolio.

- Make sure that the “Spot” tab is displayed in the order window and the trade direction is “Sell”.

- Select the order type, specify the desired price and lot size. If necessary, specify additional parameters.

- Confirm the order creation.

Determining profit and commission

On the spot market traders do not have access to margin crediting. To calculate the profit on a deal, multiply the lot size by the distance from the entry to the take, and the commission rate.

The fee for spot trading on Bybit depends on the level of the user’s account. Details – in the table.

Tips for spot trading on Bybit

In the summer of 2024, crypto exchange Bybit is the 2nd largest crypto exchange in terms of spot trading volume ($3.97 billion). The platform is second only to Binance.

Trading without leveraging is considered the safest.

However, many novice traders lose money due to rash actions. Here are some tips on how to make money on spot trades:

- Create your own strategy, test it on history and clearly follow the rules. Trading on the advice of experts or acquaintances in most cases leads to losses.

- Do not invest all capital in one coin. If growth expectations are not met, the user will have no funds left to continue working.

- Make a conservative portfolio. At least 30% should be occupied by liquid cryptocurrencies, and new projects – no more than 5%.

- Regularly fix profits. If you put too high take-outs, there is a high probability to miss the growth phase and get losses.

Frequently Asked Questions

📌 What is the minimum transaction amount on Bybit?

Experienced traders recommend depositing at least $100.

✨ Why collect a crypto portfolio?

It’s a way to diversify risks. If one cryptocurrency collapses, the overall loss will be small. It can be covered by profits from other assets.

💡 Can robots be used on the Bybit spot?

Yes. The exchange offers free programs (bot-networker or for auto-investment). You can also connect your own algorithms via API.

🔔 What is the advantage of TradingView charts in the Bybit interface?

In this mode, you can use indicators from a popular terminal or create a trading idea with one button and send it to your friends.

📢 How do I get back the basic cryptocurrency chart settings on Bybit?

All interface changes will be reflected the next time you log in. To roll back to the basic chart, you need to open the settings and click on the “Template” button. Next, it is worth clicking on “Apply default”.

An error in the text? Highlight it with your mouse and press Ctrl + Enter.

Author: Saifedean Ammous, an expert in cryptocurrency economics.