Coinlerin ticaret platformlarında listelenmesi süreci, bir proje için geleceğini belirleyen önemli bir aşamadır. Bir kripto para bir borsada listelendikten sonra, şirket itibarını artırır ve kullanıcı sayısını artırır. Varlığın fiyatı genellikle artar.

Tüm şirketler bu aşamayı başarıyla geçemez. Açık pazara girmek - kripto para biriminin daha da geliştirilmesi için yeni fırsatlar. Lansman prosedürü, şirket için birkaç aşamaya ayrılan pahalı bir aşamadır.

Büyük değişim hizmetlerinin katı gereksinimleri vardır. Sitenin uzmanları yetersiz kalitede olduğunu düşünürse şirket reddedilebilir. İşlemlere katılmak, madeni paraya olan talep seviyesi üzerinde olumlu bir etkiye sahiptir.

Kripto para birimlerinin borsada listelenmesi nedir

İngilizcede listeleme, listeye ekleme anlamına gelir. Kripto para alanında ise dijital varlıkları borsada alım satıma bağlama prosedürü anlamına gelir. Sonuç olarak, coinler alım ve satım için kullanılabilir hale gelir. Listelendikten sonra, bir coinin fiyatı piyasa arz ve talep mekanizmalarından etkilenecektir.

Kripto para borsaya nasıl girer?

Prosedür koin geliştiricileri tarafından başlatılabilir. Bunu yapmak için, ilgili kripto borsasına bir başvuru göndermeniz gerekir. Aşamalar ve gereksinimler hizmetler arasında farklılık gösterir. Eylem sırası genellikle aşağıdaki gibidir:

- Anketin doldurulması. Projenin amacı, oluşturulma tarihi, kaynak koduna bağlantı, resmi bilgi belgesi (Whitepaper), yol haritası, geliştiricilere ilişkin veriler belirtilir.

- Talebin ticaret platformu uzmanları tarafından analizi. Uzmanlar projenin karlılığını değerlendirir.

- Özel bir komisyon, ticaret kaynakları listesine yeni bir varlık eklenip eklenmeyeceğine karar verir.

- Onaylanması halinde bir anlaşma imzalanır.

Talebin değerlendirilmesi birkaç günden birkaç haftaya kadar sürebilir.

5020 $

yeni̇ kullanicilar i̇çi̇n bonus!

ByBit, kripto para ticareti için uygun ve güvenli koşullar sağlar, düşük komisyonlar, yüksek likidite seviyesi ve piyasa analizi için modern araçlar sunar. Spot ve kaldıraçlı ticareti destekler ve sezgisel bir arayüz ve öğreticilerle yeni başlayanlara ve profesyonel yatırımcılara yardımcı olur.

100 $ bonus kazanın

yeni kullanıcılar için!

Kripto para dünyasındaki yolculuğunuza hızlı ve güvenli bir şekilde başlayabileceğiniz en büyük kripto borsası. Platform yüzlerce popüler varlık, düşük komisyonlar ve alım satım ve yatırım için gelişmiş araçlar sunar. Kolay kayıt, yüksek işlem hızı ve fonların güvenilir bir şekilde korunması, Binance'i her seviyeden yatırımcı için mükemmel bir seçim haline getiriyor!

Şirketler ilk olarak popüler olmayan borsalara başvurur. Genellikle daha yumuşak gereksinimleri ve daha basit prosedürleri vardır. Geliştiriciler, diğer platformların temsilcilerini çekecek olumlu bir sonuç ve tekliflerin büyümesi umuduyla bu stratejiyi seçerler. Ancak, kripto borsalarının çalışanları tarafından başlatılan itirazlar nadirdir.

Göstergeler

Platform uzmanları yeni kripto para birimlerini listelerken bu tür parametrelere dikkat ediyor:

- İşlevsellik. Pratik öneme sahip kripto para birimleri tercih edilir. Belirli sorunları çözmek için koin kullanımı geliştiriciler için bir artıdır.

- Güvenlik. Sitenin standartlara uygunluğu onay almak için önemli bir faktördür. Projenin güvenliğinin yetersiz olması, itibarı etkileyecek bir saldırıya neden olabilir.

- Ekibin profesyonelliği. Bazı siteler geliştiriciler ve başarıları hakkında veri talep eder.

- Projenin yasal gerekliliklere uygunluğu.

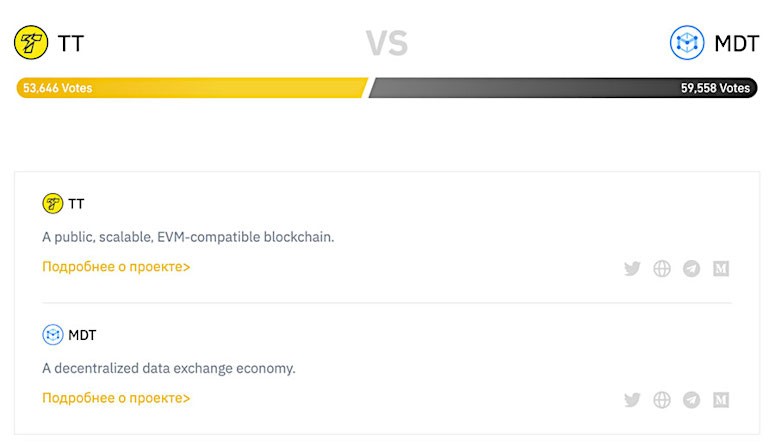

- Ön liste sonuçları. Proje uzmanlar tarafından değerlendirildikten sonra, ticaret platformunun kullanıcıları arasında bir oylama yapılır. Oylamanın sonuçları komisyon tarafından değerlendirilme hızını etkiler. Daha fazla oy alan kripto para birimleri önce incelenir.

Liste ücretleri

Bir şirketi ticaret araçlarına dahil etmek, kurucuları için maliyetli bir süreçtir. Ücretin miktarı platformun popülerliğine bağlıdır. Kripto listeleme için büyük borsaların fiyatları milyonlarca dolara ulaşabilir.

Ancak, prosedürden ücretsiz olarak geçmenin yolları vardır. Örneğin, bazı küçük borsalar ücret talep etmeyebilir. Büyük olanlar bazen hizmetin ücretsiz olduğu promosyonlar düzenler. Binance'te kullanıcılar arasında yapılan oylama buna iyi bir örnektir. Kazanan coin, ücretsiz listeleme hakkına sahip olur.

Kesin çıkış fiyatını söylemek mümkün değildir. Veriler, ifşa edilmeme koşulunu öngören gizli sözleşmelerde yer almaktadır.

Tabloda yaklaşık listeleme ücreti gösterilmektedir (forumlarda toplanan bilgiler).

| İsim | Fiyat |

|---|---|

| Kraken, Bithumb, Coinbase, Poloniex | |

| Exmo, Huobi Global, KuCoin | |

| Yobit | |

| Coinexchange | |

| Kuna, Tradesatoshi |

Binance CEO'su Changpeng Zhao yaptığı açıklamada, hiçbir para miktarının düşük kaliteli projeleri listelemelerini sağlamayacağını belirtti. Geliştiricileri, kripto para birimlerinin ilk etapta yeterince iyi olup olmadığını düşünmeye teşvik ediyor. Sözlerini kanıtlamak için Efirium, Lightcoin, EOS, Ripple gibi projelerin ücretsiz olarak eklendiğini hatırlattı.

Ancak şirketlerin kurucuları büyük meblağlar yatırmaya hazırdır. Büyük borsalarda başarılı bir şekilde listelenmesi, yeni kullanıcıları çeken coin'in kalitesinin bir işaretidir.

Listeden Çıkarma

Bir projenin bir ticaret platformunda listelenmesi, sonsuza kadar orada kalacağını garanti etmez. Hizmet, bir şirketi kaynaktan silebilir. Madeni para çeşitli nedenlerle platformdan çıkarılabilir:

- Düzenleyiciler açısından değişiklikler.

- Cryptoproject'in hacklenmesi.

- Tüccarlardan gelen şikayetler.

- Geliştiriciler imar planına uymamaktadır.

- Uzun bir süre boyunca fiyat artışının olmaması.

- Düşük likidite.

- Kripto borsasının kurallarına uyulmaması.

- Geliştiricilerin sahtekarlığı.

Varlık işlemlere dahil edildiğinde fiyat genellikle yükseliyorsa, listeden çıkarmanın döviz kuru üzerinde olumsuz bir etkisi vardır. Kripto paranın alım satım platformundan çıkarılması tüccarlar tarafından olumsuz algılanır. Kullanıcılar projenin gelecek vaat etmediğini fark eder ve varlığı satar.

Listeden kazanma stratejileri

Varlığın fiyatında bir artış bekleyen tüccarlar, koin açık piyasaya girdiğinde kar edebilirler. Kazanç ilkesi basittir:

- Haberleri takip ediyor ve listeye girmeyi planlayan şirketleri arıyor.

- Varlığı borsaya girmeden önce satın almak.

- Koin listelendikten sonra satılması.

Zamanlamayı doğru yapmak önemlidir. Yeni başlayanlara, coin piyasaya girdikten sonraki birkaç gün içinde coin satmaları önerilir. Kullanıcı nasıl analiz edeceğini biliyorsa Düzeltme aşamasında daha yüksek bir fiyat beklemek mümkündür.

Yatırımcıların riskleri değerlendirmesi ve dikkat etmesi önemlidir:

- Ticaret platformunun popülerliği. Madeni paranın küçük borsalarda piyasaya sürülmesi, kotasyonlarda beklenen büyümeye neden olmayabilir.

- Madeni paranın beklentisi. Açık piyasaya girmek madeni para satış dinamiklerini her zaman etkilemez.

- Haber ve yayınların güvenilirliği. Duyuru doğru olmayabilir. Bilgilerin kontrol edilmesi ve resmi kaynaklara güvenilmesi tavsiye edilir.

Para kazanmak için en iyi borsalar

Hizmetler, yeni varlıkları farklı şekillerde kabul etmek için stratejiler oluşturur:

- Binance. Platformun amacı mümkün olduğunca çok sayıda kaliteli coin eklemek ve likidite yaratmaktır.

- Kraken. Kaynak, ticaret için birkaç araç sunar. Madeni paralar dikkatlice seçilir. En yüksek ciroya sahip kripto para birimlerine dikkat edilir.

- Bitstamp. Hizmet Avrupa dijital varlıklarına odaklanmıştır ve bu bölgede çalışmaktadır.

385

103

Bazı kripto borsaları, projeyi düzgün bir şekilde analiz etmeden piyasaya herhangi bir coin getiriyor. Önemli olan bir tüccar kitlesini çekmektir. Genellikle bunlar Asya hizmetleridir.

Bir kripto borsası seçerken, geliştiriciler şunlara bakmalıdır:

- Kaynağın güvenilirliği ve güvenliği.

- Platformun sınırlamaları.

- Hizmetin verimliliği ve küreselleşmesi.

- Prosedürün fiyatı.

Özet

Kripto para biriminin ticaret için mevcut kaynaklar listesine dahil edilmesi, projenin gelişimindeki diğer eğilimleri büyük ölçüde belirleyen bir olaydır. Listeleme sayesinde şirketler şunları yapabilir:

- Yatırımcıların koin'e olan ilgisini artırın.

- Kullanıcı tabanını genişletin.

- Projenin itibarını ve güven düzeyini artırın.

- Artış büyük harf kullanımı.

- Gelişim için yeni beklentiler kazanın.

Yatırımcılar için kısa vadeli yatırımlardan kazanç elde etmek için harika bir fırsattır.

Sıkça Sorulan Sorular

💵 Listeleme ücreti ne kadar?

Prosedürün fiyatı bireyseldir ve borsa ile platform arasında müzakere edilir.

🤝 Tüm başvuru sahipleri açık pazarda listeleniyor mu?

Bir kripto borsası, doğrulama aşamalarından herhangi birinde bir şirketi reddedebilir.

🔻 Listeden çıkarıldıktan sonra coin'in döviz kuru düşecek mi?

Büyük olasılıkla bu sürecin varlığın fiyatı üzerinde olumsuz bir etkisi olacaktır.

😟 Borsalar hileli projeler ekleyebilir mi?

Ticaret platformu başvuru sahiplerini dikkatli bir şekilde seçmezse, bu durum mümkündür.

🤔 Hangi dijital para birimlerinin önde gelen kripto borsalarına girme olasılığı daha yüksek?

Kullanışlı işlevselliğe, kendini kanıtlamış bir geliştirme ekibine ve geniş bir topluluğa sahip coinler doğrulama prosedürünü başarıyla geçer.

Metinde bir hata mı var? Farenizle vurgulayın ve Ctrl + Girin

Yazar: Saifedean Ammouskripto para ekonomisinde bir uzman.