With the advent of decentralized finance, the opportunities for making money in the crypto market have greatly expanded. For example, classic staking has been transformed into liquid staking. While the first involves simple interest income for blocking assets in the Proof-of-Stake network, in the second case, users receive derivative tokens in return. They can be withdrawn from the protocol at any time and used on other platforms for additional income.

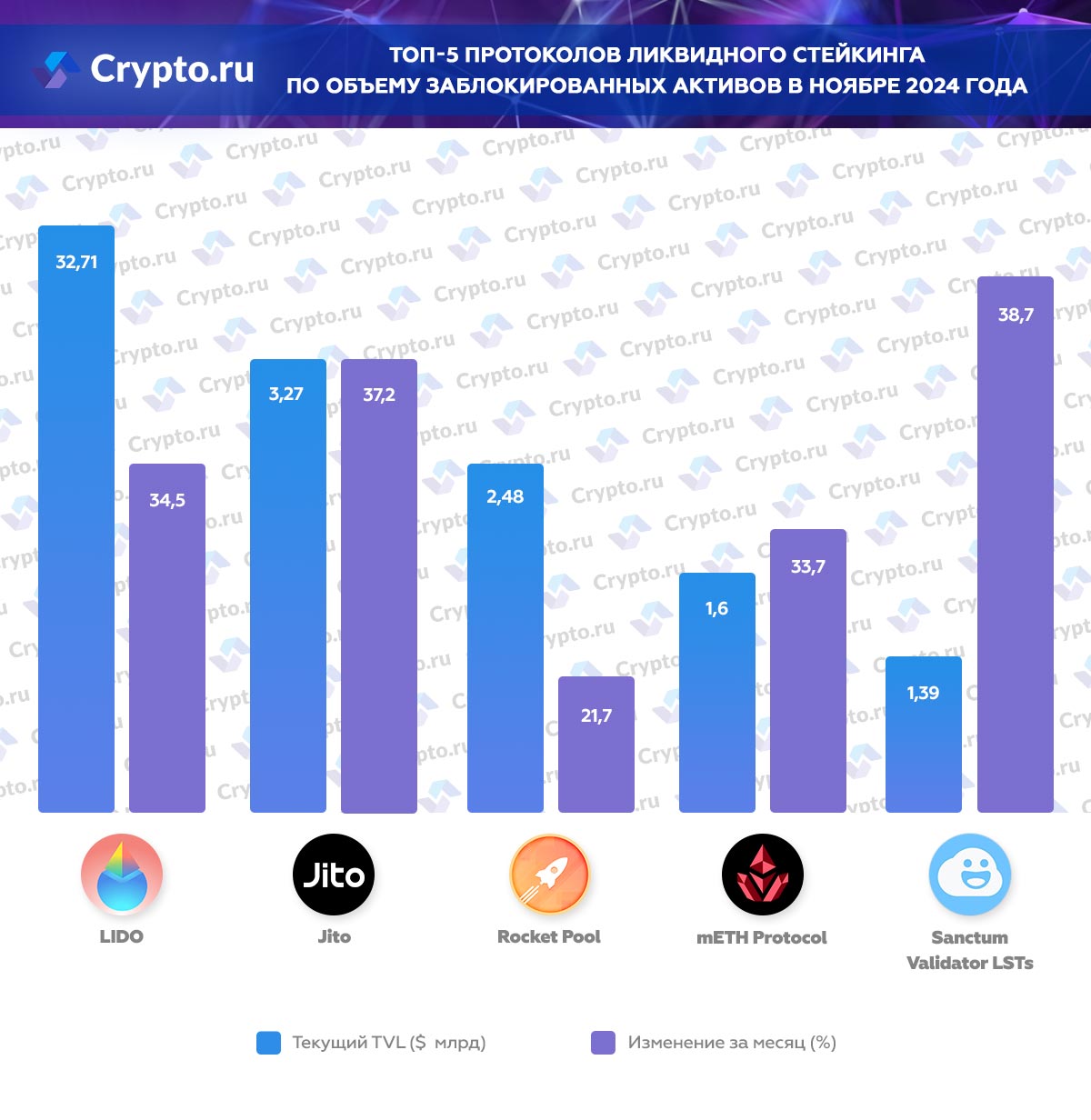

In November 2024, the liquid-stake market is estimated at $59.29 billion, making it the largest segment of decentralized finance. Over the month, the volume of assets locked in protocols increased by 25.9%. Since the beginning of the year, this indicator has grown 1.75 times.

The market leader remains the LIDO protocol, launched on Ethereum in 2020. In November 2024, $32.71 billion worth of assets were blocked on the platform – 34.5% more than last month.

LIDO’s decentralized protocol is community driven. Holders of the LDO native token can participate in voting. On the back of the success of the native platform, the cryptocurrency rose in price by 59.5%. However, since January 2024, the price of the asset has almost halved.

The second place in terms of blocked value in the liquid staking segment is occupied by Jito with a figure of $3.27 billion. Over the month, the protocol’s TVL grew by 37.2%.

Jito operates on the Solana blockchain. For blocking SOL coins, users are doubly rewarded in the form of interest in steaking and increased fees for validators. In addition, in return for the delivered cryptocurrency, the protocol generates derivative JitoSOL tokens that can be used for additional earnings.

5020 $

yeni̇ kullanicilar i̇çi̇n bonus!

ByBit, kripto para ticareti için uygun ve güvenli koşullar sağlar, düşük komisyonlar, yüksek likidite seviyesi ve piyasa analizi için modern araçlar sunar. Spot ve kaldıraçlı ticareti destekler ve sezgisel bir arayüz ve öğreticilerle yeni başlayanlara ve profesyonel yatırımcılara yardımcı olur.

100 $ bonus kazanın

yeni kullanıcılar için!

Kripto para dünyasındaki yolculuğunuza hızlı ve güvenli bir şekilde başlayabileceğiniz en büyük kripto borsası. Platform yüzlerce popüler varlık, düşük komisyonlar ve alım satım ve yatırım için gelişmiş araçlar sunar. Kolay kayıt, yüksek işlem hızı ve fonların güvenilir bir şekilde korunması, Binance'i her seviyeden yatırımcı için mükemmel bir seçim haline getiriyor!

The third place in the ranking of liquid steaking platforms with the highest TVL is occupied by Rocket Pool. In November 2024, it blocked $2.48 billion worth of Ethereum coins. Compared to the previous month’s figure, the protocol’s TVL decreased by 21.7%.

Rocket Pool makes it easy for regular users to participate in ether staking by offering to bet from 0.01 ETH. Validators only need to deposit 8 coins into the protocol to receive commissions and RPL derived tokens.

The top 5 liquid staking protocols with the highest TVLs in November also included:

- mETH Protocol – $1.6 billion.

- Sanctum Validator LSTs – $1.39 billion.

It is worth noting: earlier Crypto.ru published an infographic on meme tokens with the best returns for November 2024.

Metinde hata mı var? Farenizle vurgulayın ve Ctrl + Girin

Yazar: Saifedean Ammouskripto para ekonomisinde bir uzman.