Every cryptocurrency network is constantly improving. It is impossible to create a perfect system in every sense. This also applies to the Etherium blockchain. This digital network is periodically improved by developers. Ethereum EIP 1559 is one of the updates.

It brought several key changes to the system of etherium coins. The following reveals the main innovations and implications of the update for miners.

What is ETH EIP 1559

While Ethereum users are waiting for the ETH 2.0 update, Vitalik Buterin saw fit to release the London hardfork before the launch of the second phase. It took place on August 5, 2021 and included the much-talked-about Ethereum EIP 1559. This improvement caused a great response in the cryptocurrency community.

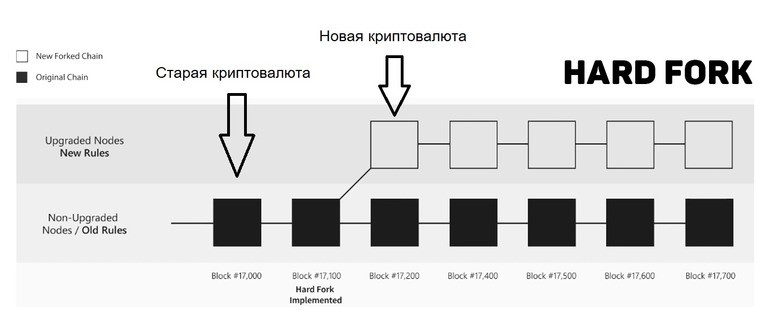

Hardfork is a hard partitioning of the blockchain. In simple words, it is an update of the network with the emergence of a new cryptocurrency. The resulting digital asset starts working in its own system.

EIP – Ethereum Improvement Proposal. From English, the phrase translates as “Ethereum Improvement Proposal”. Experts mean by this term specific point innovations that make up a major upcoming update to the system.

5020 $

yeni̇ kullanicilar i̇çi̇n bonus!

ByBit, kripto para ticareti için uygun ve güvenli koşullar sağlar, düşük komisyonlar, yüksek likidite seviyesi ve piyasa analizi için modern araçlar sunar. Spot ve kaldıraçlı ticareti destekler ve sezgisel bir arayüz ve öğreticilerle yeni başlayanlara ve profesyonel yatırımcılara yardımcı olur.

100 $ bonus kazanın

yeni kullanıcılar için!

Kripto para dünyasındaki yolculuğunuza hızlı ve güvenli bir şekilde başlayabileceğiniz en büyük kripto borsası. Platform yüzlerce popüler varlık, düşük komisyonlar ve alım satım ve yatırım için gelişmiş araçlar sunar. Kolay kayıt, yüksek işlem hızı ve fonların güvenilir bir şekilde korunması, Binance'i her seviyeden yatırımcı için mükemmel bir seçim haline getiriyor!

When the launch.

Even while testing the update, participants in the cryptocommunity felt contradictory emotions from enthusiasm to anger. The upgrade lowered fees for payment transactions, but it also reduced the reward for miners. The great controversy forced Vitalik Buterin to postpone the upgrade.

However, the hardfork was still carried out on 12,965,000 blocks. Prior to that, developers tested the update on the Ropsten, Rinkeby, and Goerli test networks.

The Efirium EIP 1559 update as part of the major London network improvement took place on August 5, 2021. It is not related to the new Beacon Chain Ethereum 2.0 blockchain under development. London was released in ETH 1.0. This is the system that the cryptocurrency community is using in 2021.

Beacon Chain is an ETH 2.0 network powered by the Proof-of-Stake consensus algorithm. Previously, Etherium used the old Proof-of-Work network support mechanism. However, the PoW algorithm lost relevance against the simplicity and reliability of PoS.

Ethereum EIP 1559 update features

Fork London is predominantly aimed at changing the principle of forming commissions in the Efirium block chain. Developers hoped in this way to improve the interaction of network participants with the blockchain. The main goal is to save costs on trading transactions.

Before the London update, the commission in ETH was formed on the principle of auction. Miners always added to the blockchain and confirmed those transactions whose initiators contributed a higher fee. For fast trading operations, users were forced to pay mining nodes noticeably more.

When the interest in the coin among investors grows, the system is under high load. Before the London update, this fact accounted for the absurdity of the high fee for simple transactions.

Ethereum EIP 1559 aims to level out this drawback. The fee is now more acceptable to users of the blockchain. However, after the network improvements, some portion of the transaction fee started to be burned.

This deflationary measure (the reverse process to the depreciation of money) was used to smoothly increase the altcoin’s exchange rate by taking some coins out of the market.

Commission reduction

The former auction model for transactions is a thing of the past. Now the Ethereum network uses a basic fee. This is the fee for payment transactions. The base fee changes its indicator in each block of the chain.

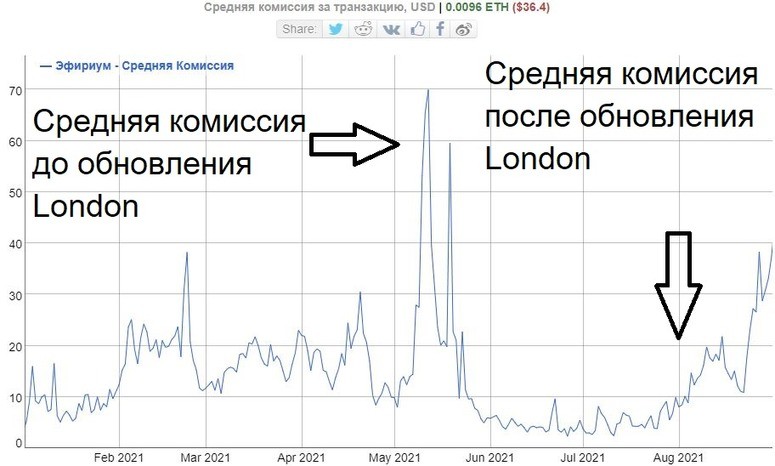

The main characteristic is the workload of the system. The higher it is, the higher the fee. However, Efirium EIP 1559 sets limits on the change of the fee – its maximum increase and decrease is equal to 12.5% per block. This approach smoothed out the greater volatility of the fee and made it more predictable for blockchain users.

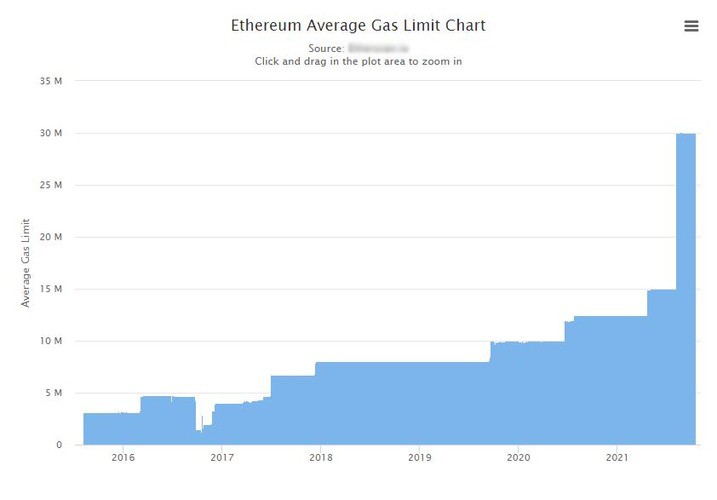

The London update also revised the maximum limit of Gas (Gas is the unit of payment for a fee on the ETH network). After the update, it can rise from 12,500,000 to 25,000,000 per blockchain.

The target chain link utilization is set at 50%. The growth of this parameter increases the commission. Users, on the other hand, reduce the number of transactions and the situation stabilizes.

Participants of the Efirium network can leave the miner a fee for priority processing. It is called priority fee. In fact, it is a tip to the miners.

Etherium EIP 1559 also brought the most controversial innovation. Now the system burns the base commission, and mining nodes receive only tips. The developers explained this by creating a self-regulating mechanism that should limit coin issuance and reduce cryptocurrency inflation without damaging the security of the blockchain.

All these measures leave decentralized projects at an advantage. The majority of users have also reacted positively to the updates. London has spared them from the high volatility of commission and overpayment for Gas.

Reduced inflation

ETH EIP 1559 is considered a deflationary improvement, because coin issuance became unpredictable. The rate of issuance has changed because of the new basefee (base commission) burning mechanism. Now the number of available coins on the market can go up and down. It depends on the number of transactions in the Efirium system and the amount of the commission fee.

In the first few hours immediately after the hardfork, the altcoin burn rate exceeded 4 coins per minute. Sometimes during this period, more cryptocurrency was destroyed than miners mined.

The next few days after the London update, the number of coins burned decreased. Soon, the total number of cryptocurrency assets destroyed dropped to 4,300 in 24 hours. However, the mining reached 12,900 Ethereum per day. Bottom line – basefee’s annihilation mechanism reduced daily issuance by 33%.

Update London could not make the blockchain of the altcoin ETH completely deflationary. But the significant reduction in the coin issuance rate laid the key prerequisites. Now participants of the ETH 1.0 blockchain are predicting a full-fledged deflationary tokenomics in Ethereum 2.0.

Experts put a special meaning into this term. Tokenomics is a kind of business plan for the cryptocurrency to be improved. To some extent, it takes into account the interests of users of the system.

Implications for miners

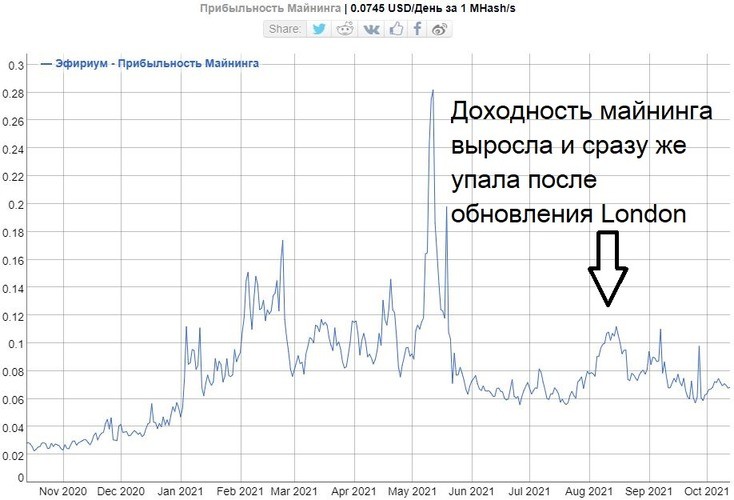

ETH miners were doing just fine before the network upgrade. Previously, miners were rewarded per block and transaction fees. The peak of network utilization in 2021 was making them a lot of money. In February, profits from commissions exceeded the system’s own reward per block.

ETH EIP 1559 has changed the miners’ revenues a lot in a smaller way. Now miners take only tips for their work – about 20% of the total imposed fee. According to the resource BitInfoCharts, after the hardfork, their income fell by 18%.

A lot of participants in the cryptocurrency community expected a reduction in profits by 50 percent or more. The worst fears did not come true. However, miners still reacted negatively to London.

In early 2021, it became known about the impending upgrade. Large mining centers and services for participation in pools began to actively seek ways to compensate for the decline in profits. The solution was found – MEV (Miner Extractable Value). The term stands for “miner extractable value”.

The solution includes a number of methods of generating additional income through the use of pools with unconfirmed trades. In them, the miner is able to change, include and exclude transactions in the generated blockchain links.

Miners are able to perform arbitrage. This is the trading of assets at price differences on different platforms. In mining, the term means confirming pending transactions with an obviously inflated commission.

The Future of Etherium

After the merger of Ethereum 1.0 and 2.0, Proof-of-Work consensus mining will disappear in the system. The end of using this coin issuance mechanism will put mining nodes facing tough choices:

- Selling computational hardware.

- Switching to mining another cryptocurrency.

Analyst Justin Drake of the Ethereum Foundation predicts a future of only issuing 1,000 coins daily and burning 6,000 etheriums per day. This will allow ETH to become a deflationary digital currency.

Justin Drake expects a rapid increase in the number of validators in the Ethereum 2.0 Beacon Chain. This process will create a negative change in the system’s annual coin supply. Every 365 days, the number of digital assets in the Ethereum blockchain will decrease by about 1.6 million. The scarcity of the coin will increase demand and trigger a price increase.

Özet

Ethereum EIP 1559 has been met with a strong reaction from the entire cryptocurrency community. Some users are happy about the update, while others are outraged about the London hardfork. Great controversies forced the developers to postpone the improvement of the blockchain until better times. However, on August 5, 2021, the update was included in the network.

Updates to the system have pros and cons.

| Advantages | Disadvantages | |

|---|---|---|

| Decrease in fees | Increased stability of the trading fee. Smoothing of commission volatility. | The magnitude of the imposed transaction fee still depends on network congestion. |

| Decrease in inflation | Artificially creating scarcity pushes the coin up. | Because of the burning of the underlying imposed fee, miners earn less revenue. |

The London update does not make Ethereum a completely deflationary asset. However, the improvement has been able to set the stage for it. Most of the users are expecting a full deflationary model to be implemented after the merger of Ethereum 1.0 and 2.0. This will create an even greater shortage of altcoin, and coin burn will exceed issuance. The cryptocurrency’s exchange rate will begin a steady rise.

Sıkça Sorulan Sorular

❓ When to expect the merger of Beacon Chain and the ETH 1.0 network?

In his interview, Vitalik Buterin talked about the connection of the systems in 2022. The exact date was not named.

💰 How much can a miner earn thanks to MEVs?

As of October 2021, the total profit of miners thanks to the so-called invisible tax amounted to more than $689 million. The exact income of each miner is very difficult to determine.

💵 How much will you need to invest for staking in Ethereum 2.0?

To become a validator, you will need to freeze at least 32 etheriums. As of October 14, 2021, this amount is more than 8,650,000 rubles.

🔍 After the London update, can the fee increase indefinitely?

The imposed fee can grow until it reaches the congestion limit of the Ethereum network. Once this figure is reached, the commission will be very high, and users will stop conducting transactions in Ethereum en masse. This is exactly the idea that was originally laid down by the developers.

💎 Is it profitable to be an ETH miner in the fall of 2021?

Mining coins in this system brings good profits even after the London update. It is recommended to use MEVs to increase your income. As of October 2021, pools with unconfirmed transactions are used by many mining centers.

Metinde bir hata mı var? Farenizle vurgulayın ve Ctrl + Girin

Yazar: Saifedean Ammouskripto para ekonomisinde bir uzman.