Bitcoin was created in 2009. Since then, there have been many attempts to make something technologically new: from the traditional BTC competitor (Ethereum) to the Chinese coin Chia. But can any cryptocurrency repeat the fate of bitcoin? Experts’ opinions are divided. Some predict a change of leader and prophesize the primacy of etherium. Others predict further growth of the BTC rate up to $250,000.

The main characteristics of the cryptocurrency to replace bitcoin

Bitcoin is the first and most expensive cryptocurrency (as of November 2021). It remains the main asset that has made the world aware of digital coins. But BTC’s technology is not perfect. The most notable problem remains the difficulty of use, which may hold back the coin’s widespread adoption. There are others:

- Low transaction speeds. The Bitcoin blockchain confirms 7 transfers per second (Ethereum – 26, EOS – 50,000).

- High fees. As the number of transfers increases, users increase fees to attract miners to their transactions.

- Low privacy. All transactions in the network are public, any user can learn the data of the sender and recipient of the payment.

In November 2021, the developers of the first cryptocurrency activated the Taproot update, which improves the scalability and privacy of the blockchain.

However, bitcoin’s followers and competitors are already ahead of it in terms of technical specifications and features:

- Anonymity. According to CryptoState, there are 79 private cryptoassets trading on exchanges in 2021. Some are anonymous by default (Monero). Others feature on-demand activation (Dash, ZCash).

- Scalability. The value of a network is determined by the number of transactions and smart contracts it can verify. New projects use vertical and horizontal scaling technologies. The first adds capacity to nodes. The second increases the amount of resources through additional computers. For example, the Solana blockchain validates 50,000 transactions per second.

- Investment opportunities. Altcoins that allow earning from madencilik, Staking and borç verme are very popular (BNB, EOS).

A recent report by the World Economic Forum (WEF) highlights 6 high bandwidth digital currencies:

5020 $

yeni̇ kullanicilar i̇çi̇n bonus!

ByBit, kripto para ticareti için uygun ve güvenli koşullar sağlar, düşük komisyonlar, yüksek likidite seviyesi ve piyasa analizi için modern araçlar sunar. Spot ve kaldıraçlı ticareti destekler ve sezgisel bir arayüz ve öğreticilerle yeni başlayanlara ve profesyonel yatırımcılara yardımcı olur.

100 $ bonus kazanın

yeni kullanıcılar için!

Kripto para dünyasındaki yolculuğunuza hızlı ve güvenli bir şekilde başlayabileceğiniz en büyük kripto borsası. Platform yüzlerce popüler varlık, düşük komisyonlar ve alım satım ve yatırım için gelişmiş araçlar sunar. Kolay kayıt, yüksek işlem hızı ve fonların güvenilir bir şekilde korunması, Binance'i her seviyeden yatırımcı için mükemmel bir seçim haline getiriyor!

| Madeni Para | Transaction Processing Speed, TPS | Capitalization in November 2021, $ billion |

|---|---|---|

| Algorand (ALGO) | 1000 | 12,25 |

| Cardano (ADA) | 257 | 61,04 |

| Celo (CELO) | 1000 | 1,76 |

| Ripple (XRP) | 1500 | 50,03 |

| Solana (SOL) | 50 000 | 61,53 |

| Stellar (XLM) | 250 | 8,03 |

Which cryptocurrency could repeat the fate of Bitcoin (BTC)

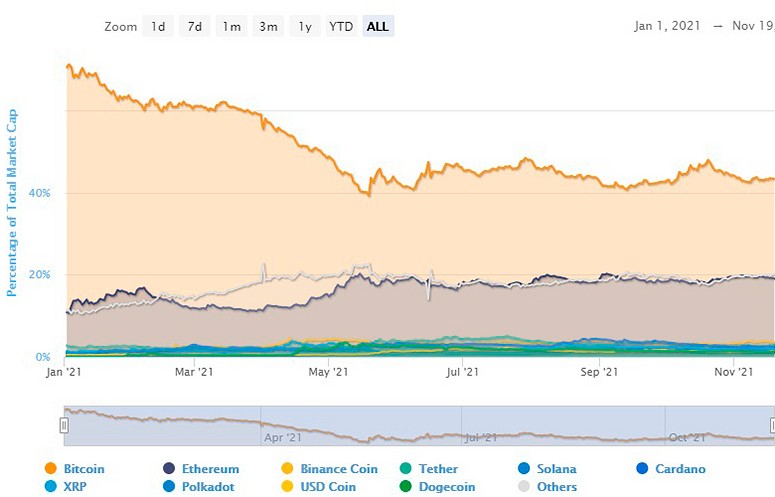

According to CryptoProGuide.com, there are 1,443 crypto coins on the digital market in November 2021. But not all of them can boast working ecosystems. According to the resource CoinMarketCap, since the beginning of 2021, the market capitalization of altcoins has increased by 86% (from $226.85 billion in January to $1.62 trillion in November). Bitcoin’s dominance index has fallen 26.1% over the same period (from 69.7% to 43.5%). The reason is not only because BTC has already exhausted its annual growth potential after rising in price by 300%. One of the drivers of change experts call the increasing role of the first tier assets: Ethereum, Litecoin, Polkadot, Monero, XRP and others.

Ethereum

Analysts almost unanimously believe that if anything can squeeze bitcoin from the market, it is ETH. According to Michael Ross-Johnson, CEO of P2P platform Chatex, the main coin will hold its position firmly in 2021. But in 2 years, Ethereum cryptocurrency could replace Bitcoin. The ETH infrastructure is technically more advanced. Thanks to a large number of projects and constant updates, the price of the asset is growing. Given the unlimited issuance, etherium has every chance (19.1%) to overtake bitcoin in terms of capitalization.

In the first 11 months of 2021, Ethereum’s rate has grown 5.5 times. In January, the coin was worth $750. In November, it traded for $4296. The capitalization of the asset is $479.08 billion (19.1% of the total market). The stock of ETH is not limited. But the issue is regulated: no more than 18 million coins per year. Developers also plan to burn a certain amount of the asset.

The Efirium blockchain is open source and is used as a platform for creating decentralized applications and projects. The most popular in 2021 are the DeFi platforms Uniswap, Maker, and Aave.

The market of decentralized finance grew actively in 2020. The total amounted to $13 billion. But in 2021, the trading volume increased by another 550%. According to Chainalysis, the capitalization of the DeFi sector reached $274 billion in November.

Cardano

ADA regularly ranks among the top 5 coins in terms of capitalization. In November 2021, the total market value of the crypto asset’s current supply is $59.49 billion. The coin is trading at $1.78, having shown an increase of more than 600% since the beginning of the year. In early November, the Cardano network recorded a transaction volume of $18.24 billion and ranked 2nd after bitcoin, ahead of Ethereum ($9.31 billion). Meanwhile, the amount of ADA in staking reached $53.5 billion (72.17% of the total).

Cardano claims to be a 3rd generation blockchain that solves the problems of its predecessors – Bitcoin and Ethereum (scalability, resilience). The project also aims to embrace the PoS part of the blockchain. To this end, it has launched a platform for developing decentralized applications and smart contracts.

Other pluses of ADA include unlimited scalability potential and high transaction speeds. The cryptocurrency’s blockchain has a throughput of 257 TPS. This allows it to compete with Ripple in the sector of international transfers.

Ripple

XRP is a completely different kind of cryptocurrency. It is an alternative payment system that uses its own unit of settlement. It transforms payments, making them fast, secure, and virtually free. The speed of transactions in the XRP network is 3-5 seconds. The transfer fee is $0.01. The network operates on distributed ledger technology (DLT) and is managed by a private company (Ripple). The project cooperates with major banks (Bank of America, HDFC Bank Limited and others).

XRP cryptocurrency is a popular instrument for private investments. Since the beginning of 2021, the coin has grown by more than 500% (from $0.22 in January to $1.11 in November).

The current capitalization of the asset is $49.11 billion. The issue of Ripple is limited to $45 billion crypto coins. There are 33.31 billion coins freely available.

Developers have issued 100 billion XRP coins, but most of them are blocked. New units of account are sent to the network in limited quantities (controlled issuance). In November 2021, there are 47.16 billion XRP in circulation (47% of the total).

Solana

Some experts believe that SOL cryptocurrency could replace bitcoin in the next 3-5 years. The Solana blockchain is one of the largest in the DeFi sector in terms of resources ($917 million). The developers managed to create a network capable of conducting up to 65,000 transactions per second without the use of sharding technology (data distribution).

High scalability is achieved by implementing a hybrid consensus model that combines Proof-of-History and Proof-of-Stake. The Solana protocol simplifies the creation of decentralized applications (DApps) and provides broad access to DeFi for institutional and private investors. In October 2020, Solana developers launched an interconnect bridge with Ethereum that allows for the transfer of assets between blockchains.

Over 2021, the SOL coin has increased in value 121 times (from $1.65 in January to $200.51 in November). In the fall of 2021, Solana has a market capitalization of $60.85 billion, with 303.5 million coins in circulation.

Stellar

XLM is an updated decentralized version of XRP, created by Jed McCaleb after his departure from Ripple in 2013. In this project, the developer realized the idea of parallel use of fiat and digital currencies with low fees and without the complexities inherent in international transfers. McCaleb also addressed the shortcomings he saw in Ripple. The result was a network that allows money to be transferred and stored. The domestic cryptocurrency XLM serves as a bridge that reduces the price of international transactions to 0.00001 XLM. The technology easily enables 1,000 transactions per second.

Stellar is backed by large technology companies (IBM) and funds (Y-Combinator). The project is also sought after by private investors. This provides XLM with a place in the top 30 largest coins and a capitalization of $8.07 billion. The coin is trading at $0.33 in November 2021. There are 24.28 billion coins in circulation (49% of the issue).

Chainlink

Repeat the success of bitcoin is capable of any promising project that solves the problems of existing networks and facilitates the interaction of users with digital products. For example, LINK cryptocurrency can grow as BTC. It is an internal coin of the decentralized oracle network. Chainlink’s platform allows blockchains to receive information from external sources. The data is validated by all nodes in the network before being approved and reaching the consumer.

The project cooperates with well-known operators Brave New Coin, Huobi. Chainlink supplies data for DeFi services (Compoud, Aave). Private investors can earn income by participating in the network as validators of nodes, or earn on the growth of the rate of the asset. Over 2021, the cryptocurrency has doubled in value. In November, the coin traded at $26.74. In January, it cost $12.29.

Litecoin

LTC is a full-fledged alternative to Bitcoin with some improvements. Developer Charlie Lee took the blockchain of the first cryptocurrency as a basis and made changes to the underlying algorithm to increase the speed of transactions. Litecoin is a lightweight coin that is 4 times faster than Bitcoin. Transactions on the LTC network take 2.5 minutes with a small fee. At the end of 2020, the MimbleWimble (MW) test network was released, which increases the privacy of transfers on the network.

Technologically and functionally, LTC almost completely repeats the prototype. It is an ordinary digital coin designed to store and transfer value. The asset is issued by miners. A total of 84 million units will be issued. In November 2021, 69 million coins have already been mined. This is the basis for analysts’ forecasts that to grow as bitcoin can cryptocurrency Litecoin. In the fall of 2021, the asset occupies the 14th line of the world ranking and is worth $202.9.

Özet

Every year new projects and technologies appear on the market of digital assets. Many of them have already surpassed bitcoin. But the first cryptocurrency remains the most reliable and resistant to any risks. BTC is time-tested, it is trusted by institutional investors. There is no cryptocurrency on the market yet that can boast the same state of affairs. This means that bitcoin will remain the largest coin in terms of capitalization in the coming years. But things could change in the future.

Sıkça Sorulan Sorular

💰 How many BTC crypto coins have already been issued?

As of November 2021, there are more than 18.8 million units of the asset in circulation.

❓ Where can you buy Chainlink?

The cryptocurrency is traded on Binance, Huobi, Coinbase, FTX, Kucoin and other exchanges.

🔎 How much do transactions in Ripple cost?

The fee on the XRP network is $0.001.

❗ What is Taproot?

It is an update to the Bitcoin blockchain that took place on November 14, 2021. It made the network more scalable, faster, and private.

💡 What can be done with cryptocurrency in Russia?

Users were allowed to buy, sell, and store koins. Assets can also be lent, invested. It is forbidden to use them as a means of payment. Such operations are regulated by the Law on Digital Financial Assets.

Metinde bir hata mı var? Farenizle vurgulayın ve Ctrl + Girin.

Yazar: Saifedean Ammouskripto para ekonomisinde bir uzman.