Digital asset trading has many analogies with the traditional finance market. Therefore, it uses the latter’s techniques. For example, investors use the cryptocurrency index to analyze promising coins. This is a kind of indicator of the state of the market, which translates the ratio of one coin to another or to a number of assets. With its help, private investors form portfolios, and companies create funds.

The concept of the cryptocurrency index

Any market indicator is a platform that displays data on the price and kapitalisering av digital coins. The cryptocurrency index takes into account the value of a separate group of assets. However, other indicators are also analyzed:

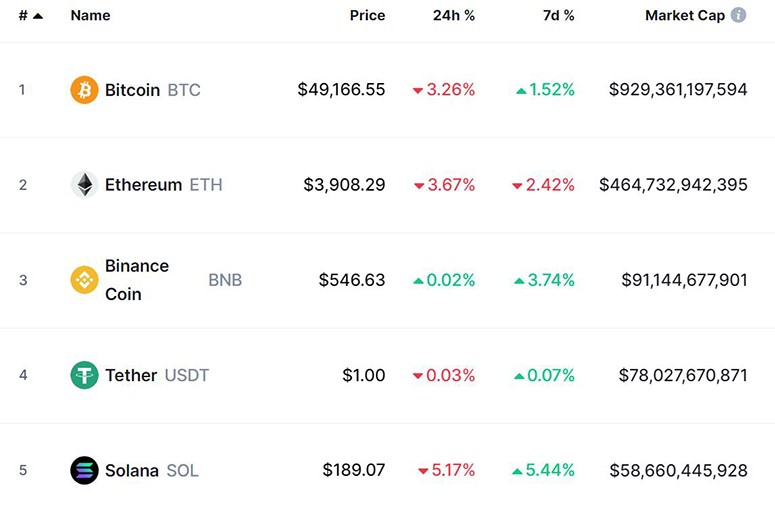

- Current market price.

- The number of coins in circulation.

- The daily trading volume of digital currencies.

The more coins in the group, the more accurate the analysis.

For example, the popular CoinMarketCap monitor tracks the dynamics of 15,118 currencies (as of December 2021). Another well-known site CoinGecko analyzes 11,356 koins. These resources allow you to observe the development of the entire market in real time.

Some tools provide information based on certain criteria. For example, the cryptocurrency exchange index displays assets on trading platforms with sufficient liquidity. Others allow you to assess the growth prospects of individual coins or the potential of a group of digital currencies.

5020 $

bonus för nya användare!

ByBit ger bekväma och säkra villkor för handel med kryptovalutor, erbjuder låga provisioner, hög likviditetsnivå och moderna verktyg för marknadsanalys. Den stöder spot- och hävstångshandel och hjälper nybörjare och professionella handlare med ett intuitivt gränssnitt och handledning.

Tjäna en 100 $-bonus

för nya användare!

Den största kryptobörsen där du snabbt och säkert kan börja din resa i kryptovalutornas värld. Plattformen erbjuder hundratals populära tillgångar, låga provisioner och avancerade verktyg för handel och investering. Enkel registrering, hög transaktionshastighet och tillförlitligt skydd av medel gör Binance till ett utmärkt val för handlare på alla nivåer!

Various methods are used to calculate cryptocurrency indicators. The most popular tools are created taking into account:

- Pris – the rates of all cryptocurrencies in the group are added up, and the resulting sum is divided by the number of coins (in the traditional market, this is how the Dow Jones indices are calculated).

- Capitalization – the sum of indicators of all assets in the list is divided by a convenient value (for cryptocurrency analogues of the S&P 500, the value is 10).

- Percentage changes in rates – the rate is taken into account, which is compared to the total price of coins in the group and assets that do not outweigh the others are added.

Market values help investors and traders assess the situation and make decisions. Big players create index funds for long-term investments. In 2017, HOLD 10, managed by Bitwise Asset Management, brought investors a 45% return already in the first 2 months of operation.

What data do indexes use

Most cryptocurrency transactions take place on exchanges. Managed and decentralized trading platforms are the main source of information for index sites. Coin rates on exchanges can vary. This depends on supply and demand at a given moment.

To get as accurate as possible, index sites collect data from many exchanges. A full list of platforms where the coin is traded is available in the Markets tab. For example, Bitcoin in 2024 is represented on hundreds of exchanges, while Chainswap is traded on only 2 decentralized resources.

The cryptocurrency index collects information through public APIs (interface for data exchange). The monitors use:

- Cryptocurrency prices.

- Amounts of certain transactions.

- Coin tickers (identifiers – BTC, ETH and others).

- Time stamps (captures the exact period of transactions).

- Cryptocurrency exchange rates.

Differences between cryptocurrency indices and stock indices

The principles of operation of indicators on the digital and traditional markets are the same. They show the current state of the industry and the direction of its development. But there are also differences.

| Cryptocurrency indices | Stock instruments |

|---|---|

| Provide data on the rates of coins of different networks | Provide information about stock prices |

| Include available assets | Focused on specific market sectors |

Analyze accurately using indices

Summary indices allow investors to assess the market outlook. Professional traders can see the moods of other participants and make decisions.

It is easier for beginners to invest in the proposed index portfolio of coins, saving time.

However, the price of the same currency in several monitors may differ. This happens because some index platforms collect data from many exchanges. On each platform, the asset can be traded in pairs with different fiat currencies (USD, EUR, RUB, GBP and others). Indices calculate the value of the coin in their own way. The final price is influenced by such factors:

- The nature of the market.

- Trade turnover.

- The liquidity of the currency.

- Commissions.

- Frequency of requesting information via API.

It is difficult to show the exact rate of an asset in real time on all exchanges. But it is not necessary. It is enough to know that the price corresponds exactly to the specific market.

Well-known cryptocurrency indices

Instead of analyzing promising coins, users can buy a cryptocurrency index. Such a transaction will reduce time and financial costs when investing. Only technical analysis of currencies will be enough for a professional participant. Beginners can make investments from any amount.

Index trading is more convenient than trading individual coins. The user can:

- Evaluate the market as a whole without having to open a trade for each asset. When it grows, the index increases more smoothly than individual coins and goes into stagnation faster than other cryptocurrencies.

- Spread some of the risk by rebalancing the portfolio. Timely market assessment allows you to quickly sell weak instruments and profit from growth leaders.

Such instruments are balanced by capitalization and are rebalanced once a day, week, month or quarter.

Coinbase Index Fund

The index fund from the largest American crypto exchange is available only for professional investors from the United States. The site tracks the Coinbase Index. This indicator determines the overall performance of cryptocurrencies listed on the GDAX exchange, a division of Coinbase. The index includes 12 digital coins weighted by capitalization in December 2021. Assets may not be included in the overall top. The company only focuses on the currencies listed on GDAX. Therefore, this indicator may not be effective during the “altcoin season”.

Coinbase Index takes into account not only the change in the price of the coin, but also its continued growth. Analysts rebalance the portfolio every time the exchange adds or removes an asset. The current supply is estimated as of January 1 of the year of cryptocurrency placement on GDAX, This value is revised every 12 months, multiplying the past figure by the growth percentage.

The minimum investment is $250 thousand, the maximum amount is limited to $1 million. The fund’s commission is set at 2%. Correlation with the market (Pearson coefficient) is 97%.

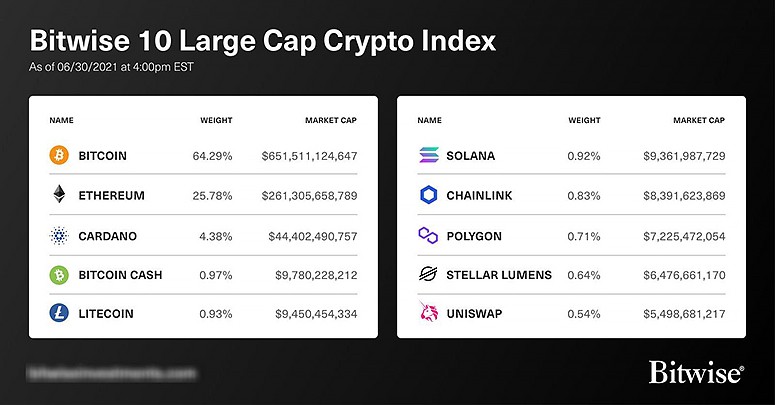

Bitwise10

One of the popular index funds was founded in 2017. For Bitwise Asset Management, this is another project focused on US investors. Bitwise 10 Crypto Index Fund includes the 10 largest digital currencies. Rebalancing is done once a month after risk assessment. Investors’ assets are stored on cold wallets of a company accredited for securities and cryptocurrencies.

Bitwise 10 is interesting because it predicts the volume of coins that will not go on exchanges. The index does not take them into account when calculating the price. The tool also adjusts for inflation based on the total value of assets that are expected to be in circulation in 5 years.

In 2020, Bitwise 10 was added to the OTCQX OTC market under the ticker BITW. At that time, the fund had $120 million under management, which generated 184% returns for investors at the time of listing (January through November 2020). By comparison, bitcoin rose 175% over the same period. In 2021, the index is 75% BTC, 13% ETH. The remaining 12% is distributed among the top 10 assets. Bitwise 10 has a 99% correlation with the rest of the market.

HODL10.

This tool is used for automated trading on Binance, Kraken, Bittrex, Kucoin exchanges. It is part of the HodlBot solution that facilitates portfolio creation and rebalancing. HODL10 is available for everyone. To connect the bot, you just need to have an account on an exchange and buy a subscription (from $3 per month). The developers also offer to test the tool for free for 7 days.

The minimum investment in HODL10 is $50. The tool determines the price of the current offer based on a moving average. This reduces the volatility factor.

Portfolio rebalancing can be set up individually. By default, it occurs every 28 days. The correlation with the market is 99%.

Crypto20.

This index fund offers to invest money in the C20 coin, which combines 20 major currencies. The simple format reduces portfolio analysis and rebalancing requirements. Assets in Crypto20 are placed so that one digital currency makes up no more than 10%. In this way, risks can be reduced.

The portfolio is reviewed weekly. To calculate, the system takes the total number of coins issued and multiplies it by the average price of C20. In November 2021, the platform’s cryptocurrency is traded on the HitBTC and P2PB2B exchanges. The index has a low correlation index compared to other instruments (96%). The reason is that the price of C20 is not always equal to the net value of the assets in the portfolio. However, investors can sell symboler for Ethereum on the exchange.

CCI30.

The tool was created in 2017 by American developers. It is aimed at professional investors from the United States. The portfolio includes 30 top cryptocurrencies, each of which is assigned its own weight. Rebalancing of the index basket is performed once a month. The weight is recalculated every week.

A moving average is used to determine market capitalization. This reduces risk, volatility and creates a balanced portfolio. CCI30’s correlation with the rest of the market is 99%. Crypto Fund uses it to track digital currency quotes.

CRIX

One of the first index sites was created in 2016 by programmers from Germany and Singapore. CRIX uses a weighted average accounting of indicators. Unlike other indicators, it does not include a certain number of currencies. The calculation is based on data from cryptoassets, the trading turnover of which accounts for 25% of the total market volumes.

CRIX is calculated in real time. Assets are reallocated on a quarterly basis. Depending on market conditions, the number of currencies in the index basket can change. This reduces the impact of volatility. A similar method is used in CRSP indexes for the US stock market. The ratio of coins in the basket is adjusted each month.

CRIX is created in such a way that only the growth or fall of the cryptocurrency rate can change its value. The system does not react to an increase in the current issue or the inclusion of a new asset in the index. Correlation with the market is 99%.

Bloomberg Galaxy Crypto Index

The tool was launched in 2018 to track the 10 most liquid currencies. The developers are Bloomberg and the company Galaxy Crypto. The index basket includes the largest assets by capitalization. The share of each of them is 1-30%.

Bloomberg Galaxy Crypto Index is recalculated every month. The system selects digital currencies with trading turnovers of $2 million or more. Prices are calculated based on the average supply and demand on platforms approved by Bloomberg. The cryptocurrency index can change only under the influence of the growth or fall of coin rates. The correlation coefficient with the market is 99%.

Analyzing and applying the obtained data

Different index platforms provide information focused on the needs of users. Traders are interested in the highest and lowest prices of a currency over the last day. Long-term investors more often use technical indicators of the asset for analysis: the algorithm of operation, transaction fees and others.

All services also show basic information about the digital currency:

- The exchange rate.

- The current price of the circulating supply.

- Total trading volume for the last 24 hours.

Cryptocurrency price calculation

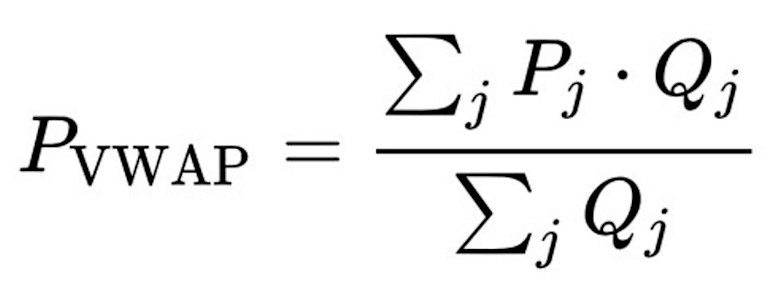

Usually, indices show daily changes in the digital asset. The system calculates the volume weighted average price of the cryptocurrency (VWA), the rate at which it is traded in a particular period:

The formula assumes the values:

Pvwap – volume weighted average price.

Pj – transaction value.

Qj – number of units of the asset in the transaction.

j – each transaction carried out in a certain period.

∑ – the amount of the transaction.

Slutsatser

Cryptocurrency index is an effective tool for an investor regardless of strategy. With its help, you can choose an asset for any purpose. The tool can be used to analyze digital currencies or as an investment solution. Portfolios reduce the time and money required to enter the market. However, many funds are only available to accredited investors.

Vanliga frågor och svar

📑 Which indices can be used to trade on exchanges?

Many funds are aimed at accredited investors. But there are offers for private users: HODL10, Crypto20 and others.

💼 Why do you need portfolio rebalancing?

Timely rebalancing of initial shares allows you to follow the chosen investment strategy.

🤷♂️ Which tool is more efficient: HODL10 or HODL30?

Both solutions determine the value of the current volume of coins in circulation based on moving averages. But HODL10 has a low entry threshold and allows you to work with small investments.

🤔 What does a market index consist of?

It is a set of digital coins weighted by market capitalization.

🔍 What are some other solutions for tracking digital currencies?

DeFi Pulse, S&P Bitcoin, NYSE Index, Bit20, DLT10, and others.

Finns det ett misstag i texten? Markera det med musen och tryck på Ctrl + Ange

Författare: Saifedean Ammous, en expert på kryptovalutans ekonomi.