Investor interest in blockchain is constantly growing. Even a beginner can get income from investments in digital assets. Some traders earn decent money on cryptocurrency, while others fix their profits at the level of 5-10%. Profitability of transactions with virtual coins depends on the strategy, tools and the amount of investment.

Investments in volatile assets always carry a lot of risks. Therefore, transactions can both bring large profits in a short period of time and serious losses. It is difficult even for professionals to get a stable profit. However, a clear plan, effective tools, accurate calculation of the investment period and risk management reduce the probability of losing money.

Rudarstvo

One of the main ways of earning money from digital coins, which is considered to be profitable and reliable. While fiat currencies are issued by the government, virtual assets are mined by users. To earn money from cryptocurrency by mining, you need to install and connect equipment to the network. Video cards, ASIC stations, game consoles are often used. The assembled equipment for mining is called farms. The device produces new blocks in a network that works according to the Dokazilo o delovanju (PoW) algorithm.

It will cost several thousand dollars to create a mining farm. It will cost about the same amount to buy ready-made equipment. The interest of users in mining koins leads to an increase in the price of devices, and computing systems require a lot of electricity. These factors take away from a miner’s profits. For several years now, home farming has been unprofitable.

If a user plans to mine Bitcoin, he should keep in mind about the reduction of payments for mined blocks(halving). Its task is to slow down the emission. Halving of VTS occurs once every 43-48 months.

5020 $

bonus za nove uporabnike!

ByBit zagotavlja priročne in varne pogoje za trgovanje s kriptovalutami, ponuja nizke provizije, visoko stopnjo likvidnosti in sodobna orodja za analizo trga. Podpira promptno trgovanje in trgovanje s finančnim vzvodom, začetnikom in profesionalnim trgovcem pa pomaga z intuitivnim vmesnikom in učnimi navodili.

Zaslužite bonus 100 $

za nove uporabnike!

Največja borza kriptovalut, kjer lahko hitro in varno začnete svojo pot v svet kriptovalut. Platforma ponuja na stotine priljubljenih sredstev, nizke provizije ter napredna orodja za trgovanje in investiranje. Zaradi preproste registracije, visoke hitrosti transakcij in zanesljive zaščite sredstev je Binance odlična izbira za trgovce na vseh ravneh!

Earnings on DeFi

The main trend in the decentralized finance sector is farming (Yield Farming). In DeFi, traders earn up to 20% per annum on cryptocurrency. Liquidity mining is a form of lending. Users place cryptocurrency pairs on the platform and receive interest from the productive use of assets by other traders. This method refers to passive income. The main indicators of profit are the liquidity of the coin and the type of cryptocurrency accrued. DeFi platform can transfer rewards in its own žetoni. Re-investment is available to users.

Farming can also bring losses, usually due to:

- Hacking of the platform.

- A sharp collapse in the quotes of the digital asset.

- Changes in the rules of the platform.

- Naložbe v scam projects(fraudulent sites).

Steaking

Another 1 way to passively earn on cryptocurrency – blocking funds in the account to generate new blocks and maintain the network. This principle is used by platforms with the Proof-of-Stake (PoS) algorithm. Staking refers to the mining of coins, but without the use of equipment. The essence of the method is to send koins to validators of nodes in the chain. Users are rewarded for a validated and collected block.

Rewards and the size of commissions depend on the cryptoproject and the platform performing the steaking. In addition to rewards, the user receives bonuses.

The profitability of steaking depends on the following criteria:

- The volatility of the koin

- Contract time

- Volume of blocked coins

The main risk is a sharp drop in the exchange rate. Since the assets on the balance are locked, the user cannot react quickly and make changes. There is also a risk of hacking the platform that stores the coins.

Trgovanje

By actively trading in a day on cryptocurrency, you can earn a substantial amount. The essence of trading is to receive income from the difference between the rates of buying and selling coins. High volatility allows you to earn intraday, weekly or monthly intervals. The interest income is lower than with investments for a long term. However, the frequency of successful trades makes the earnings tangible.

Trading is a high-risk procedure. The probability of losing money is very high. Therefore, it is recommended to apply no more than 10% of the cryptocurrency portfolio in trading. To make transactions bring profits, not losses, you need to master technical and temeljna analiza.

Arbitrage

Popular digital coins are traded on several exchanges simultaneously. The rate of platforms can differ by up to 10%. Thanks to this produce it is possible to earn on the movement of coins through various services. The algorithm of actions is as follows:

- Buying a coin on the first exchange.

- Transferring the asset to the account of another trading platform with a higher rate.

- Selling coins with profit.

When calculating the potential income, you need to take into account not only the quotes, but also the commissions of trading platforms. Another important factor is the transfer time. Since rates change quickly, the user may not be able to close the transaction in time.

Posojanje

The decentralization of virtual koins and the absence of intermediaries allow users to lend to other investors. Lending is required for traders to avoid closing a trade when there is an urgent need for funds. They can pledge cryptocurrency and receive fiat money (rubles, dollars).

In this method, the cryptocurrency can be used to earn money for the lender, who lends funds at interest. On the platform, the user specifies:

- The currency of the collateral.

- The term of the loan.

- The annual percentage.

A private person acts as a bank. Rates reach 6-8% per annum. Risks are not excluded. For example, the borrower may not repay the money, and the pledged koins will fall in value.

Rudarjenje v oblaku

The method does not require the purchase of farming equipment. Computing power can be rented from a company that is engaged in cloud mining. This method requires less investment than home farming. With an initial investment of $5000, you can get about $10,000 in a year. The exact amount depends on service fees and changes in quotes. Comparison of popular services is given in the table.

| Company name | Investment amount | Rental fee | Service fee | Purchased capacity | Revenue for 1 year |

|---|---|---|---|---|---|

| CryptoUniverse | $5000 | $60 | 4,60% | 83 TG/s | $9160 |

| IQMining | $95 | $0,03 | 53 TG/s | $9950 | |

| HashShiny | $69 | $0,28 | 72 TH/s | $12 600 | |

| Hashing24 | $1.2 | $0,0015 | 42 TH/s | $14 700 |

The first few months profit goes to compensate for the money spent. Then farming starts to bring net income. Profit depends on the rate of virtual currency, the amount mined and the amount of money invested.

Investments in cryptocurrency projects

It is possible to profitably fold into a startup before its release to the exchange and expect the price of the koin to rise. Even 3-4 years ago, many traders dreamed of repeating the success of those who invested in Bitcoin in the early days. After listing, prices were rising by at least 100%. However, the number of projects being released has noticeably increased. Many startups do not “shoot out” and traders lose money.

To reduce the risk of losses, you should pay attention to the choice of the project. A startup can be evaluated by such criteria:

- Composition and reputation of developers.

- Availability of a white paper and roadmap.

- Practical significance of the project.

- Support from the community.

If you competently make an assessment, you can increase profits at least 15 times in a few months.

Posojanje

This method is related to lending, but loans are given not to individual users, but to trading platforms. Lending is safer because the collateral is backed by the trader’s account balance, and the exchange acts as an intermediary. The income percentage can reach 200-350% per annum. Features of lending:

- Minimal initial costs.

- A large list of coins.

- No requirements for knowledge and experience.

- Relatively safe passive earnings.

- Supported by a small number of major exchanges.

Igre s kriptovalutami

You don’t always need an initial investment to make a profit. Almost every month new games with the possibility of withdrawing coins are released. However, with this method, you can earn only pennies per month on cryptocurrency. Before choosing a game, it is worth evaluating:

- Entry threshold. Some games, such as casino games, may require a deposit.

- User reviews. It is better to find out in advance about the problems that other people have had.

- Withdrawal methods. For this purpose, a separate cryptocurrency wallet should be started. Among the games there are often fraudulent applications.

Earnings without investment

It is possible to getcoins without spending money. However, you will have to invest another resource – time. There are the following options for obtaining coins:

- Performing tasks on the faucet.

- Participation in airdrop programs.

- Distribution of referral links.

- Getting digital assets for freelance work.

Žerjavi

There are sites that pay for performing simple actions. It is not possible to get a large profit – cranes accrue exclusively satoshi (an indivisible part of bitcoin). Such sites often earn by promotion and advertising. Examples of tasks:

- Watch the video

- Enter captcha

- Follow a link

- Click on the banner

According to the type of accrual of rewards, faucets are divided into 2 types:

- Accumulative. The amount of reward is constantly multiplied.

- Discrete. Payments are made for a certain period.

With bitcoin faucets, it is necessary to observe simple safety rules:

- Do not connect to the site wallet, which is the main storage of coins. It is better to start a separate application.

- If payments are delayed, it is pointless to continue working on the crane. Most likely, the reward will never accrue.

- Do not enter bank card details, details of access to exchanges or crypto wallets.

- Regularly check your computer with antivirus software.

Airdrops

Another way to get free coins is to participate in marketing programs. Airdrops are conducted by startups. To attract new users and promote the koins, developers organize free giveaways. However, the value of these coins is unknown until the project is released on the exchange. There is no guarantee that a startup will be in demand. Many projects are abandoned, not listed and disappear from the market.

To get koins on the free giveaway, the user performs a task for the developers. Often you only need to register on the project website and confirm your e-mail address. Coins arrive in the account instantly.

Lockdrop

This is a variation of airdrop. The task of the method is to attract users without funding. To get new coins, the owners block funds on crypto wallets for a certain period of time. After the launch of the project, the user is credited with tokens, and the blocked funds become available again.

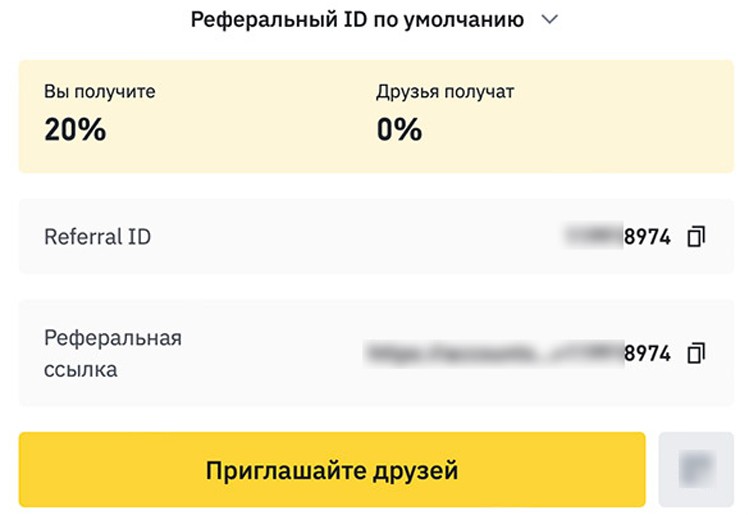

Partnerski in priporočilni programi

The user’s income depends on recommendations and the number of attracted traders. Within the framework of the affiliate program, a referral link is formed. It is distributed among other market participants.

Referral links can be placed:

- In social networks.

- In messengers.

- Among the audience of a blog.

- On YouTube channel.

Only bloggers with multi-million audience can get significant income from affiliate programs. A couple of registrations on a referral link will bring a few cents.

Freelance

Using professional skills and knowledge, the user can receive cryptocurrency for the work done. Many companies and services are ready to pay for freelancing with coins. The user can face such tasks:

- Writing texts.

- Create banners.

- Mount videos.

- Create content.

Find employers who pay in digital koins can be found on special sites. For example, Ethelance or Cryptocurrencyjobs.

Long-term investing

Holding assets for a long time is a popular way to multiply funds. The cyclical development of trends allows you to count on the growth of quotes. For holding, it is better to choose well-known projects that occupy the top lines of ratings. Startups are recommended to avoid. This is due to the fact that there are no guarantees of the project’s existence in 3-5 years.

Profit from long-term investment can reach hundreds of percent. The longer the coins are kept, the higher the chance of high income.

Masternode

This is a technically complex way of earning interest from actions in the main node of the network. For example, glavna vozlišča perform private and instant transactions. The remuneration depends on:

- The features of a particular project.

- The blocks found when mining.

- The level of volatility of the coin.

- The settings of the mining protocols.

Before investing money in the masternode, the user should analyze the payback.

To start a node, you need to:

- Buy and block coins.

- Rent a server.

- Configure the network node.

- Launch a cryptocurrency wallet.

NFT tokens

The technology of digitizing unique data is gaining popularity. NFT-tokens confirm ownership of various objects:

- Umetniški predmeti

- Gaming artifacts.

- Real estate

- Patents

You can get an NFT-token in 4 ways:

- Buy on the marketplace.

- Purchase for bonuses.

- Win in a promotion.

- Develop your own token.

The obtained unique unit can be sold on special platforms (OpenSea, Superfarm, Rarible).

The best crypto exchanges for earning

Trading platforms offer different tools for investing in digital coins. Before registering on an exchange, you need to know the list of methods offered. Using multiple tools increases the chances of making big profits.

How much you can earn on cryptocurrency

It is impossible to give a specific answer. Income from operations with virtual assets depends on such factors:

- The amount of investment

- Trader’s skills

- Investment strategy

- Successful transactions

Often investors use several instruments at once:

- Create a cryptocurrency portfolio to hold coins for a long period of time.

- Blockchain funds for staking and lending.

- Participate in airdrop programs.

- Buy startup coins.

- They use referral programs.

On average, the profit from transactions with digital koins is 10%. There is always a risk of losing money. To avoid losses, you need to improve your skills and control emotions.

Basic mistakes of beginners

Everyone can lose investments. To avoid popular mistakes it is recommended:

- Avoid coins about which nothing is known.

- Create a diversified portfolio.

- Use different investment instruments.

- Do not give in to emotions and follow the strategy.

- Take into account the risks and the possibility of losses.

- Pay attention to the terms of services and commissions.

- Fix profits and reinvest funds.

However, even if these simple rules are followed, there is a risk of losing money. Long-term investment does not guarantee that in a few years the project will be interesting to users. It is possible that new measures may be taken by regulators, which will limit the development of the coin. The crypto market is subject to manipulation by large investors. This should be taken into account when actively trading.

No way to profit from digital assets does not guarantee the safety of investments. Due to the popularity of virtual currencies, cases of fraud are becoming more frequent. It is impossible to foresee all possible variants leading to losses.

Pogosto zastavljena vprašanja

💵 What amount allows me to start investing?

You can buy coins even for 1000 rubles. There is no minimum threshold.

⏳ Is it too late to invest in Bitcoin?

The sphere of digital assets will continue to develop for a long time. Bitcoin is not too late to buy.

📈 Why is the price of virtual koins rising?

Supply and demand determines the quotes. The scarcity of deflationary bitcoin provokes growth.

✅ Which way of passive earning is safer?

Investing in digital projects is always a risk. One of the safest ways of passive income is lending. This is due to the use of an exchange as an intermediary and guarantor.

❓ How much can you get bitcoins on a faucet?

Profits usually do not exceed a few satoshis.

Ali je v besedilu napaka? Označite jo z miško in pritisnite Ctrl + Vnesite

Avtor: Saifedean Ammous, strokovnjak za ekonomijo kriptovalut.