In 2021, the cryptocurrency market experienced a new upswing. Large companies publicly invested in bitcoin. Some countries (El Salvador, Cuba) even recognized the first cryptocurrency as a means of payment. Bitcoin remained the main market driver throughout the year. From January to December, the cryptocurrency grew by more than 60% (from $28.94 thousand in January to $47.68 thousand in December). In November, its price reached $68 thousand. Other coins have also increased in value. However, this growth is not comparable to the “altcoin season”, which investors were waiting for. At the beginning of 2022, the situation repeated itself. Only a small part of coins supported the local growth of BTC. The rest were in a slight minus. To understand why altcoins are falling and bitcoin is growing, it is necessary to find out what affects the rates of digital currencies and how they are related to the behavior of the flagship.

Correlation of the value of altcoins and bitcoin

The digital market is actively developing and becoming more mature. In 2018, research by analysts (Binance) confirmed the strong correlation of top coins with Bitcoin. When the main asset was growing, other cryptocurrencies rushed after it. A sharp decline in the price of BTC caused a collapse in the altcoin market. In such a situation, it made no sense to diversify investments – the assets from the top twenty behaved synchronously.

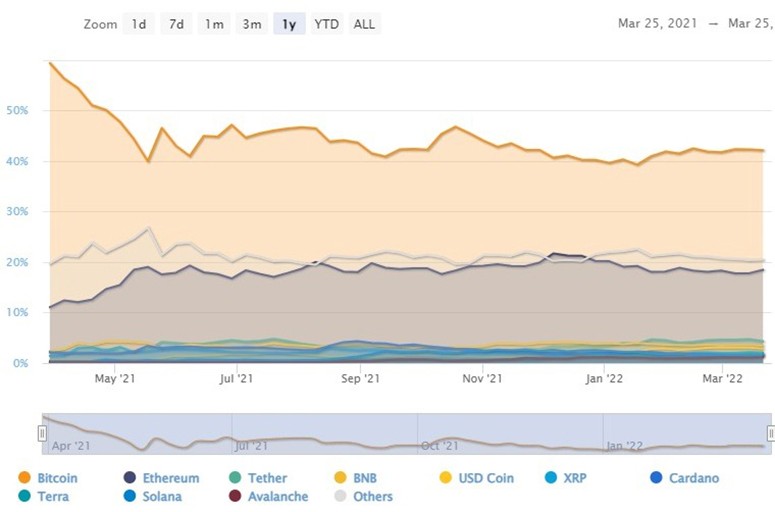

However, recently the digital market has changed a lot. Now if altcoins fall in price, Bitcoin grows, and vice versa. The first crypto coin no longer has a big influence on the other assets. At the same time, BTC’s dominance in the market is decreasing. The drop amounted from 67.8% in January 2022 to 43% in June 2022. Experts attribute such changes to the maturity of the market. There are a large number of promising projects that present new technologies. Demanded products allow them to increase their market share and depend less on BTC.

At the end of 2021, analysts from Cryptonization analyzed the dependence of altcoin prices on Bitcoin. Experts calculated the mutual correlation in pairs of the largest crypto coins by kapitalizacija.

| Assets | Correlation coefficient |

|---|---|

After that, analysts tracked the dynamics of asset rates as BTC grows. Based on the obtained data, 3 groups of alternative coins were defined:

- With a pronounced positive BTC correlation. The list includes Ethereum, Litecoin, Cosmos, Dash, Theta Coin. They can be used for pair trading and arbitrage.

- Cryptocurrencies that repeat the movement of BTC with a small lag. Experts consider such coins to be undervalued. They include Tezos, Zcash, Eos, Neo, Stellar.

- Cryptocurrencies that have a weak dependence on the BTC rate. Cardano, Solana, Matic, Dogecoin, Ripple are suitable for investment.

Reasons for the fall in altcoin prices when bitcoin is growing

In February 2020, the rates of the top coins collapsed sharply after the price of the first cryptocurrency reached a historic high of $49 thousand. In 2021, bitcoin updated records 11 times. Following the flagship, coins from the top ten became more expensive, but the rest of the market remained calm.

5020 $

bonus za nove uporabnike!

ByBit zagotavlja priročne in varne pogoje za trgovanje s kriptovalutami, ponuja nizke provizije, visoko stopnjo likvidnosti in sodobna orodja za analizo trga. Podpira promptno trgovanje in trgovanje s finančnim vzvodom, začetnikom in profesionalnim trgovcem pa pomaga z intuitivnim vmesnikom in učnimi navodili.

Zaslužite bonus 100 $

za nove uporabnike!

Največja borza kriptovalut, kjer lahko hitro in varno začnete svojo pot v svet kriptovalut. Platforma ponuja na stotine priljubljenih sredstev, nizke provizije ter napredna orodja za trgovanje in investiranje. Zaradi preproste registracije, visoke hitrosti transakcij in zanesljive zaščite sredstev je Binance odlična izbira za trgovce na vseh ravneh!

In March 2022, there is a local growth of VTS. The main crypto-asset seeks to restore its positions. At the same time, only 20% of altcoins support the growth on bitcoin. Ripple returns to the top 6 digital currencies, with Shiba Inu targeting $0.01. However, Solana, Cardano, Polkadot and other coins remain in a slight downside.

The fall in the price of altcoins and the rise of BTC are related for several reasons:

- While the first crypto coin dominates the market, the rates of other assets decline.

- When Bitcoin rises, investors transfer capital in altcoins into it.

Bitcoin’s sustained dominance

In 2021, each new BTC price record attracted additional capital into the asset from private investors and companies. The major cryptocurrency was bought by Tesla, LG Electronics, MicroStrategy and other giants. Ilon Musk’s company holds $2.7 billion in Bitcoin and promises to resume accepting digital currencies as payment for cars in June 2022. According to analytics firm Campden Wealth, about 30% of the world’s richest families have invested in bitcoin. Another 43% plan to do so in 2022.

Investor confidence supports bitcoin’s market dominance, so other cryptocurrencies are not growing.

During 2021, the coin’s dominance level exceeded 40%. In January 2022, the asset’s share fell to 39.65%. Already in a few days, Bitcoin recovered its position. Since February, there has been an increase in the dominance of the coin. In June, the flagship occupies 43% of the market.

Transferring capital from altcoins to bitcoin

When bitcoin is on the rise, a lost profit syndrome prevails among retail investors. Owners of alternative coins, succumbing to panic sentiment, seek to reallocate assets into Bitcoin.

Institutional investors see Bitcoin as a tool to hedge against inflation risks of national currencies. Large depositors are also looking to make money. However, they will not make emotional decisions and will hold promising coins until they see a certain yield.

Reasons for the rise in the value of Bitcoin

Analysts assess the growth of the crypto market in 2021 in different ways. The investment company Invesco called the next bitcoin rally “inflating the bubble”, and the subsequent decline in November – the expected pattern. According to the forecast of experts, in 2023, the price of BTC may fall below $30 thousand.

But most experts do not agree with Invesco’s assessment. Artem Deev, head of the analytical department of AMarkets, characterizes 2021 as a period of organic growth of the main digital asset. Cryptocurrency was bought by institutions and individuals, as well as companies from certain sectors. Professional investors used BTC as a tool to hedge inflation risks.

By the end of 2021, the situation changed. When inflation in the U.S. and Europe reached alarming levels, the outflow of money from the crypto market began. In order to reduce risks, investors went into less dangerous assets (gold, commodities). According to Artem Deev, this is a normal correction of cryptocurrency on the background of the growth of the dollar index and treasury bonds. Director of the exchange service Alfacash Nikita Soshnikov believes that Bitcoin was overvalued, and its real current price is $47-55 thousand.

Since January 2022, the digital currency’s exchange rate has started to recover. In March, VTS was traded for $44.41. The main reasons for the growth of the asset experts call the increase in the interest rate in the United States and the syndrome of lost profits. Many investors are confident that the coin has found the bottom, which means that it should be bought. However, Bitcoin continued to decline. In June, the coin fell below $20 thousand.

Increase in the interest rate of the US Federal Reserve

At the beginning of March 2022, the BTC rate was falling to $37.35. But after a week, the price returned to $40 thousand and began to grow. The capitalization of the main cryptocurrency during the month increased by 16% and amounted to $840.92 billion. According to analysts, the market was on the upswing.

Roman Nekrasov, co-founder of the ENCRY Foundation, attributed the growth to an interest rate hike in the US. Investors expected the Fed to take active measures to combat inflation risks. The obvious way is to accelerate the key rate hike. In the meantime, investors are redirecting capital into protective assets – gold, government bonds and Bitcoin.

Recognition of institutional investors

Experts claim: in 2021, the cryptocurrency market received a record inflow of capital. According to the investment platform CoinShares, institutional investors invested $9.6 billion in digital assets. This is 36% more than in 2020 ($6.8 billion). BTC continues to dominate purchases by professional investors. For the year, net capital inflows into bitcoin totaled $6.3 (16% more than in 2020).

The exponential growth of institutional investment in Bitcoin was also announced by Dimitrios Kavvatos, head of Amber Group, and Kalin Metodiev, managing partner of Nexo. During the 8th International Blockchain Africa Conference 2022, experts noted that professionals evaluate profit and risk differently than retail investors.

It is more important for institutional investors to enter the market to place billions of dollars that will generate a stable return of 8-12% per annum. Unlike private investors, they are not interested in chasing a 70-80% return.

Lost Profit Syndrome

Experts’ predictions for 2023 are optimistic. Many analysts claim that Bitcoin will not only return to growth, but is also capable of making a powerful leap. According to observers, the current market situation can be characterized by the term Buy the dip. This trend denotes investors’ desire to buy the asset, which has reached the lowest point and is able to rise significantly in price in the near future. Analysts call this condition the lost profit syndrome.

What asset owners should pay attention to

While BTC dominates the crypto market, other coins receive little attention from investors. To understand why altcoins fall when bitcoin grows, it is worth finding out what influences the growth of digital currencies and how they are related to the movement of the main coin.

The level of dominance of BTC (Bitcoin)

According to the editorial, Bitcoin has a 43% share of the digital market in June 2022. In 2021, amid the growth of DeFi projects, the dominance of the first coin decreased to 39%. At the same time, the share of Ethereum, on which the field of decentralized finance is based, increased to 21.7%. In 2023, the flagship continues to build its presence, while the second most capitalized cryptocurrency holds 15% of the market.

DeFi and NFT still generate large returns for private investors, but the interests of institutional players are centered in Bitcoin. The first digital currency has gained recognition as a risk hedging tool on par with gold, bonds and other protective assets.

Correlation

Between January and July 2019, Bitcoin rose in value by more than 180%. At the same time, the analytical service CoinMetrics recorded a weakening correlation between bitcoin and the rest of the crypto coins. In July 2019, a Binance report was released, in which experts confirmed the trend towards a decrease in the dependence of altcoins on the market flagship. The correlation of ETH with BTC decreased from 0.889 to 0.81, XRP – from 0.85 to 0.69. A similar situation was experienced by cryptocurrencies from the top ten.

In subsequent years, the correlation coefficients of alternative coins with BTC continued to decline. However, the dependence of altcoins on the main cryptocurrency is still high. According to reports, assets with a correlation level of 0.5 or more are considered closely related. An index below 0.5 indicates a lack of correlation. Altcoins are still lagging behind BTC in terms of growth cycles. But historical data suggests that they will catch up sooner or later.

Market movement

Another bitcoin rally in 2021 has attracted a large number of newcomers to the crypto industry. Investors often overvalue a rising asset. They open a long position when the coin appreciates by 20-30%, seeking to maximize profits.

This behavior is common in the digital market and is even reflected in cryptocurrency prices. When Bitcoin rises, investors move money into it from alternative coins. Cryptocurrencies that trade in pairs with BTC suffer the most. New coins and žetoni listed on decentralized exchanges (DEX) survive any Bitcoin movements with relative ease.

Cryptocurrency adoption

At the beginning of 2022, bitcoin remains the most in-demand cryptocurrency. As of June, the asset has a market capitalization of $386.29 billion. Ethereum, the second largest coin, has a total valuation of $133.85 billion. The gap between the two largest cryptocurrencies is closing rapidly. At the end of 2020, the capitalization of ETH ($66 billion) barely exceeded 20% of the volume of all mined BTC coins ($358 billion). However, bitcoin still dominates the industry.

Thirteen years after the creation of the first cryptocurrency, the digital market has expanded and already holds more than 17 thousand coins and tokens. However, bitcoin is still the measure by which other assets are valued. States are adopting rules to regulate BTC on par with other financial instruments. Large companies and funds place billions of dollars in the digital currency. The support of institutional investors also helps popularize Bitcoin.

Povzetek

When new money appears in the crypto market, it is very likely to move to bitcoin. The first cryptocurrency remains the leader and sets the direction for the rest of the assets. BTC dominates the market, but its share is decreasing. At the same time, the dependence of altcoins on the main cryptocurrency is decreasing. However, the critical level has not yet been passed, and the correlation between the flagship and other assets is still high. In 2023, altcoins are already lagging behind Bitcoin in growth, but sooner or later they will take their own.

Pogosto zastavljena vprašanja

❓ Why are altcoins dependent on BTC?

Bitcoin is the largest cryptocurrency with over 40% of the entire crypto market. The movements of the flagship are invariably reflected in the state of the rest of the assets. But the level of correlation can vary.

💲 When will the “altcoin season” come?

According to experts’ forecasts, bitcoin has all the prerequisites for setting another price record in the coming months. After that, the consolidation of the asset at a new level will begin, and then the “altcoin season” will begin.

❗ When will the last bitcoin be mined?

According to experts’ calculations, BTC mining will end in 2140.

✅ Which digital currencies are growing following Bitcoin?

In 2023, XRP, Shiba Inu, and other coins are supporting the upward trend.

💰 Which cryptocurrencies are the least dependent on BTC?

According to the calculations of Cryptonization analysts, Solano, Cardano, Matic, Dogecoin demonstrate a weak correlation with bitcoin.

Napaka v besedilu? Označite jo z miško in pritisnite Ctrl + Vnesite

Avtor: Saifedean Ammous, strokovnjak za ekonomijo kriptovalut.