The Russian Central Bank is actively testing an electronic version of the ruble. However, the definition of digital currencies is shrouded in misunderstanding. This material tells what CBDC is, notes the similarities and differences with cryptoassets. Readers will learn which countries already have a digital currency and how it is used. The reasons that prompted certain states to adopt it locally are also explained.

Which countries have a digital currency today

Central bank digital currency (CBDC) is a monetary asset on the blockchain, which is issued by a state monetary institution. In literal translation, the definition sounds like “central bank digital currency”.

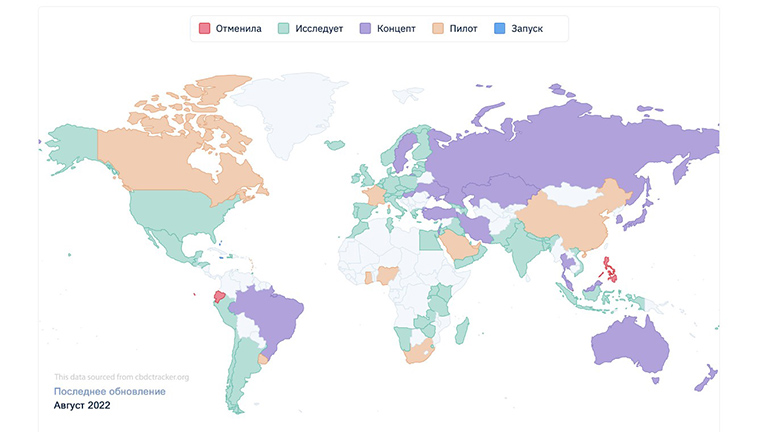

Financial regulators in many countries have announced the possibility of creating a CBDC and even started the first developments. Most have presented prototypes, but stopped after testing or did not make it to launches. There are digital currency projects in 74 countries. For example, in Uruguay CBDC was launched in pilot mode, but expectations were not met. The project was sent for finalization. Some countries are not actively developing or have suspended the direction.

In the form of a concept, there is a digital currency in 19 countries. These developments are closest to the large-scale testing of CBDC. The table lists the states in which the concept currency has been created.

| Sweden | CBDC | |

| Ukraine | Electronic hryvnia | |

| Malaysia | E-ringgit | |

| Israel | Electronic shekel | |

| Iran | Crypto-real | |

| Norway | CBDC | |

| Turkey | Digital lira | |

| Thailand | CBDC | |

| Russia | Digitálny rubeľ | |

| Norway | CBDC | |

| Hong Kong | e-HKD | |

| LionRock | ||

| Kazakhstan | Digital Tenge | |

| Hungary | CBDC | |

| South Korea | ||

| Thailand | ||

| Taiwan | ||

| New Zealand |

The most successful developments were divided into 2 unequal groups. One includes CBDC concepts that are undergoing pilot testing. There are test projects to launch digital currency in 12 countries:

5020 $

bonus pre nových používateľov!

ByBit poskytuje pohodlné a bezpečné podmienky na obchodovanie s kryptomenami, ponúka nízke poplatky, vysokú úroveň likvidity a moderné nástroje na analýzu trhu. Podporuje spotové a pákové obchodovanie a pomáha začiatočníkom aj profesionálnym obchodníkom vďaka intuitívnemu rozhraniu a návodom.

Získajte bonus 100 $

pre nových používateľov!

Najväčšia kryptoburza, kde môžete rýchlo a bezpečne začať svoju cestu vo svete kryptomien. Platforma ponúka stovky populárnych aktív, nízke poplatky a pokročilé nástroje na obchodovanie a investovanie. Jednoduchá registrácia, vysoká rýchlosť transakcií a spoľahlivá ochrana finančných prostriedkov robia z Binance skvelú voľbu pre obchodníkov akejkoľvek úrovne!

- Russia

- Čína

- Brazil

- Uruguay

- Canada

- Caribbean Islands

- France

- Tunisia

- Singapur

- United Arab Emirates

- Saudi Arabia

- India.

The smaller group includes states that managed to make CBDC a full-fledged part of the economy. In 2023, the digital currency is introduced in 3 countries:

- Nigeria

- Bahamas

- Jamaica.

Russia

About the possibility of creating a digital ruble as another form of national currency, representatives of the Ministry of Finance started talking in 2019. In 2020, the program for the development of the CBDC concept was launched.

In parallel, the legislative base was created. By 2023, the project was technologically prepared for launch. In April of the same year, the organizers shared that they were waiting for the final adoption of legislative acts.

The amendments were approved in the State Duma in May. After the document is signed by the President, the acts will come into force, but the date has not been announced yet.

The CBDC concept in Russia is one of the most ambitious in the world and is aimed at domestic application. The digital ruble is planned to be used in all mutual settlements between citizens. The tokenized version of the national currency will be stored on a blockchain wallet developed by the Central Bank of Russia. Residents of the country will be able to create it with the help of popular banking services. The final list of accredited financial institutions has not yet been announced.

By the end of 2023, it is planned to launch a pilot project to establish the new system. Further rollout depends on the success of the test period. With the most optimistic results CBDC will be introduced everywhere not earlier than 2025.

Čína

The concept of the digital yuan, as well as a similar version of the ruble, is aimed at widespread use. However, its Chinese counterparts have already launched its pilot use. The first statements about the possible creation of e-CNY appeared in the country in 2014. But the project was launched only 3 years later – in 2017. The People’s Bank of China (People’s Bank of China) activated the development to the beginning of the planned Winter Olympics in Beijing, which were to be held in 2022.

The concept of the digital yuan (e-CNY) was published in December 2019. China became the first national economy to test the technology in a global application. The issued currency received official status and was equated to the physical yuan.

At the time of testing, payments were made by 4 state-owned banks and telecom companies. Among them are China Telecom, China’s largest operator, and Huawei, a private technology corporation.

The banks adapted e-wallets to use CBDC. The AliPay payment system and the country’s leading cloud messenger WeChat took part in the development of the vaults.

According to official statistics, in 2022, payments equivalent to $2 billion were made in digital yuan. In May 2023, it became known that from June, employees of public services of Changzhu city will be paid for labor in e-CNY.

Brazil

In August 2017, the Brazilian central bank (Central Bank of Brazil) first talked about the possibility of creating a CBDC-analog of the national currency (real). The development of the project did not start until 2020, 3 years later than planned, just like in China. The ready concept of the digital real was presented in 2022, and the pilot version is expected to be launched in June 2023.

The technology is based on the AAVE cryptoprotocol.

At the moment, the CBDC variant of the Brazilian real will be used for international settlements with large companies. Their list includes 14 organizations, including:

- Microsoft Technology Corporation.

- Visa payment system.

- Brazil’s major financial banks – Itau Unibanco, BTG Pactual and Banco Bradesco.

Uruguay

Another South American nation has also implemented a pilot version of the digital peso. The e-Peso was disclosed in 2014. The issuer was the Central Bank of Uruguay (Central Bank of Uruguay). The technological component was performed by ANTEL, and IBM is responsible for data storage. In October 2017, the pilot version was launched. As part of the testing, the first part of the issue in the amount of 20 million pesos was issued.

However, the development did not bring the desired success. In 2023, the CBDC variant of the peso is practically not involved in payment transactions. The project has been sent for finalization.

Canada

In January 2016, the management of the state Bank of Canada announced plans to launch the Jasper cryptocurrency. However, this turned out to be not the only initiative in the field of digital money creation. In January 2017, another project – E Dollar – was also presented. The development of both concepts took place in parallel.

E Dollar was based on Ethereum blockchain technology and R3 Corda Quorum, but the project was never realized by 2023.

The developers of Jasper went further than their counterparts. In January 2020, the concept was launched as a pilot project. But in the end, it did not grow into a full-fledged government initiative. The Bank of Canada has no plans to launch a CBDC at this time.

Republic of the Caribbean Islands

The country is characterized by several unique aspects. On the one hand, the economy suffers from the common problems of island nations – dependence on foreign trade and dollarization. On the other, loyal legislation has made the jurisdiction attractive for hosting offshore accounts. The subsequent tightening of economic policy towards Caribbean banks plays an important role. It has not helped the country to get off the gray lists. This makes foreign economic relations more difficult.

Payments from the Caribbean zone are still subject to additional money laundering checks. This delays transfers and makes bank fees higher.

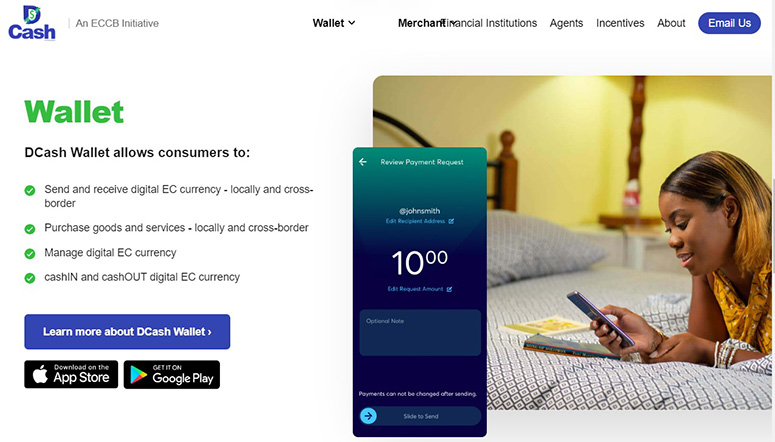

The use of CBDC has opened up a new opportunity for the government. The launch of the DCash cryptocurrency was led by the Eastern Caribbean Economic and Currency Union. The technology backing was handled by Emtech. The same team helped to implement CBDC projects in other island countries – Haiti, Bahamas, Jamaica, and Ghana.

The Caribbean DCash pilot project started in March 2019. DCash launched in April 2021, but stopped functioning 10 months later. The technology did not work for almost 2 months. The official reason was suspension amid a ban by the Caribbean Central Bank.

France

European countries participated to varying degrees in the creation of CBDC-analogs of national currencies – especially the euro. Finland was one of the first, but the project was terminated before the concept was finalized. France only became involved in the creation of a CBDC variant in 2019, which is much later than its progressive EU partners. Nevertheless, in a short period of time, the country has proposed 5 projects, 3 of which have been launched for testing as pilot programs.

The state-owned Banque de France supports the following initiatives:

- Digital Euro for retail transactions. Development started in 2021, currently used in test payments.

- Digital euro for wholesale transactions. Planned as an independent payment instrument at the same time as the retail version of CBDC. Also running in test mode.

- Stella token in partnership with the Bank of Japan. The project remains in the development stage.

- Jura token – with Swiss National Bank. Under development since 2021, test version not yet prepared.

- CBDC currencies for wholesale settlements with Singapore and Tunisia. Projects are in pilot mode.

Tunisia

The country’s state-owned Central Bank (Banque Centrale de Tunisie) is also working on an e-Dinar currency. The first reports about it appeared in November 2019. The e-Dinar project is not actively developing and is still in the development stage by 2023.

Tunisia was formerly a French province. Despite the current independence, the countries are still economically in close contact.

In 2021, France took the initiative to introduce CBDC in interstate settlements with Tunisia. The project has already worked in pilot mode.

Singapur

A similar initiative from the Bank of France was supported in the city-state of Singapore. Part of mutual settlements between the countries is carried out using CBDC within the framework of the pilot program.

Also, since 2022, a separate development of the token Project Ubin+ has been underway in Singapore. It is supervised by the state Monetary Authority of Singapore. A test version of the currency has not yet been unveiled.

UAE

The Central Bank of the United Arab Emirates has also joined the development of its own CBDC-currency. Its name is Abel. The pilot version was released in November 2019 – just six months after the announcement of plans for the creation. At the same time, another Arab country, Saudi Arabia, joined its testing.

The pilot project is testing bulk transfers between the United Arab Emirates Central Bank (UAECB) and the Saudi Arabian Monetary Authority (SAMA).

Abel’s CBDC currency is planned for mutual settlements between local financial institutions and the states’ central banks. In the future, cross-border payments can be conducted with the participation of monetary institutions of any countries.

Saudi Arabia is not independently developing a CBDC.

India

The digital rupee project was proposed by the Reserve Bank of India (RPI) in 2020. The country’s monetary and currency policy is characterized by mutually exclusive recommendations regarding cryptotechnology. At first, the project did not receive support and was put on hold. Later, work on the Digital Rupee resumed. In 2023, there is a major shift in the adoption of the CBDC variant of the national currency.

Indian government officials are negotiating cross-border government transfers in CBDC with several countries at once – UAE, Singapore and Mauritius. With the digital rupee, India wants to move away from traditional US dollar settlements and strengthen the domestic currency.

Nigeria

The country is among the three states that managed to introduce CBDC-currency into the national economy. This happened in 2021. Nigeria has the highest level of adoption and digitalization compared to the rest of the African continent. The country ranks 11th in the world in the adoption of cryptocurrency exchanges.

Despite the technological superiority in the field, Nigeria adopted the electronic version of the national currency because of the negative factor. The country has a critically high inflation rate of about 20% annually.

The uncontrollable situation with rising prices forced citizens to look for alternative ways of mutual payments. Crypto-assets turned out to be more stable than the national currency. The government lost control over financial flows between Nigerians. To regain it, the digital naira was introduced into the economy. On the other hand, government regulators tightened policies on cryptocurrency exchanges and made it more difficult for the public to use them.

However, the scenario did not materialize. In its first year of existence, eNaira did not get the support that government economists expected. Only 0.5% of the population started using the digital version of the national currency. Others started looking for workarounds to apply crypto-coins.

Nigerian authorities continue to develop methods to motivate and pressure the population to make eNaira more popular. For example, in mid-2022, a restriction on cash withdrawals from ATMs was introduced. Amounts over $225 can only be transferred to CBDCs.

Bahamas

Another 2 participants that have introduced electronic options into the national economy are dwarf states. The Bahamas is similar to the Caribbean in this regard. With the help of the digital Sand Dollar, they are trying to strengthen the domestic economy and lose dependence on settlements in US dollars.

Development of the CBDC began in 2017 under the leadership of the state-owned Central Bank of Bahamas. A pilot project was unveiled in July 2019, which has grown into full use. Sand Dollar is accepted in all shopping centers in The Bahamas from 2021. It has also become partially used to pay employee salaries.

Jamaica

The country has introduced a CBDC currency called Jam-Dex. The state-owned central bank (Bank of Jamaica) said it will replace 5% of Jamaica’s physical dollars with its digital counterpart each year. One of the main reasons, as with the Caribbean, was the country’s poor reputation.

In 2020, Jamaica was placed on a sanctions list because of financial assets with criminal records. The restrictions made cross-border payments difficult. The goal of the Jam-Dex currency is to make financial exchange between nations more accessible.

The difference between digital money and cryptocurrency

CBDC is essentially fiat (fiduciary) money, despite the blockchain component. They are issued by the state central bank. This type of digital currencies can be categorized as fiat by 2 main features:

- CBDC is centralized – that is, it is issued and controlled by a specific (state) authority.

- It isbacked by the same factors as the issuance of cash – monetary as well as economic policy and the authority of the country.

But to understand the difference between CBDC and cryptocurrencies, we need to start with the peculiarities of traditional money and blockchain assets. The emergence of the latter has shown a radically different way of mutual settlements. With the help of crypto transactions, it is possible to transfer money directly from the sender to the receiver without the participation of third parties. The circulation of fiat funds requires monetary, banking and payment intermediaries.

There are a couple of other important features of cryptocurrencies:

- Transaction authenticity and transparency becomes part of the transaction. Without receiving confirmation on the network, the block will not be closed and the transfer will not complete.

- Speed of transfers. Transactions on the blockchain are not instantaneous – time must be spent proving on the network. However, they are faster than in banking because they eliminate intermediate steps between sender and receiver.

Such a financial system is more advanced than current monetary policy. The latter is complicated by bone-headed rules, a huge number of intermediate steps, and a peg to and settlement in the U.S. dollar.

Issuing, recycling, and backing cash is time-consuming and costly to the government in the current reality.

These and other problems of the traditional monetary system can be solved by blockchain currencies. Therefore, central banks in different countries want to utilize the technology to update monetary policy.

However, there is another side – decentralized crypto-technologies can completely eliminate the role of the state from financial flows. The task of a central bank in an ideal world is to form a safe environment for participants. To this end, laws are written and supervising authorities are created. Compared to traditional stock assets, decentralized blockchain money (Bitcoin, Ethereum and others) is immune to government control of any particular country.

Therefore, classic cryptocurrencies will likely never be officially accepted as a means of payment in the economy.

CBDC is a compromise between two worlds. It is issued and controlled by a monetary and currency institution, which also creates the rules of use. At the same time, CBDC has a number of features and attributes of blockchain technology:

- Fast transfers with no extra steps.

- Transparent transactions.

Which countries are planning to use digital money

The countries closest to adopting CBDC are the United Arab Emirates, France, Russia and China. However, only the latter two countries are talking about the domestic economy. In the UAE and the European Union, digital currencies are partially introduced for financial flows between states. However, in all 4 countries there is a high chance that pilot projects will turn into regular practice.

Pros and cons of digital currencies based on user experience

CBDCs are the next level of cashless payments on a potentially more secure basis. Even a partial transition to such currencies carries benefits:

- Savings on printing banknotes.

- Security in storage and transportation.

- Ability to track movement (transparency).

- Independence from the dollar or other intermediary currency.

- Ability to automate tax collections and financial flows.

Regardless of which countries have and use digital money, central banks face a technological disconnect. Now, as in the case of France, each CBDC exchange channel between states has to be set up independently – going through long testing and refinement procedures.

When used in the domestic economy at the population level, the application of CBDC requires even longer preparation. It is important to change intermediate factors – payment systems, general level of awareness and motivation of people.

Riziká

The establishment of CBDC comes with concerns about technological vulnerability. Hacking in a government system is as likely as in decentralized protocols. This factor casts a shadow over the adoption of digital currencies.

For the public, the introduction of CBDC into widespread use on par with traditional forms also brings risks. The main one is the reduction of economic freedom.

This is the main difference between CBDC and cryptocurrencies. At any moment digital assets of citizens can be blocked – due to an attack of cybercriminals or by decision of a supervisory authority.

Často kladené otázky

📍 Can CBDC be stored on popular crypto wallets?

As a general rule, no. For example, the Russian Central Bank has announced an independent storage for the future placement of the digital ruble.

❌ Will banks close down after the implementation of CBDC?

No. The project of the new version of the ruble is actively linked to the use of the system. Banking structures provide and will continue to verify customer data and issue loans.

❓ Who can create a wallet for the digital ruble?

The action will be available to Russian citizens – individuals and legal entities.

🔎 Where will the tokenized ruble be applied first?

After successful testing of initial transfers, the digital version of the national currency is planned to be used to charge salaries to public sector employees.

👛 How many wallets can be created for the digital ruble?

There will be only one vault, but access to it will be possible from the applications of all accredited banks. Now residents have to open accounts in each institution separately. The digital ruble should eliminate this inconvenience for users.

Chyba v texte? Zvýraznite ju myšou a stlačte tlačidlo Ctrl + Vstúpte.

Autor: Mgr: Saifedean Ammous, odborník na ekonomiku kryptomien.