BTC cryptocurrency ranks first in popularity and sets the direction of development of the entire market. The number of investors, including large companies, payment services, is only increasing. But not everyone knows why Bitcoin is growing now in 2024. Understanding the reasons is important for profitable investing.

Why Bitcoin is growing in value

To identify the preconditions and reasons for the increase in the cost of the first cryptocurrency, analysts study the events of two periods when BTC had historical maximums recorded. The first significant increase in the rate occurred in 2017. A record of $19,783 per 1 coin was set. The second jump occurred in 2021.

On April 14, 2021, a new all-time high of $64,863 per 1 BTC was set.

The reasons why Bitcoin is so expensive during these periods varied. In each of them, investors played an important role:

- In 2017, the market was most influenced by individual retail investors who bought other coins with Bitcoin and participated in ICOs. For large players, there was no infrastructure for easy “entry” into the market at that time.

- In 2020 and 2021, it was institutional investors, who were set up for long-term investments, who began to “push the rate” up. Increasingly, the media expressed opinions that BTC is an effective means of saving, which will help to preserve savings during the period of inflation and tight monetary policy of states.

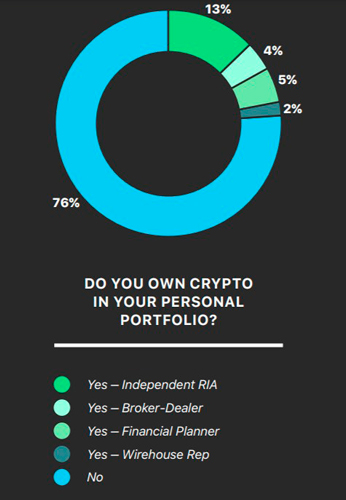

According to Bitwise’s research, the number of financial advisors who invested their clients’ money in cryptocurrency in 2020 grew by 49% over the year. And 25% of them said they were attracted to the coin because of its ability to hedge inflation.

One of the reasons for the sharp increase in the interest of large companies in “digital gold” in 2020 and 2021 and the answer to the question “Why Bitcoin rose today” is the additional issue of government currencies, which inevitably provokes their weakening. The U.S. Federal Reserve has let in $3+ trillion dollars in circulation for 2020. That’s about ¼ of the amount of all bills issued in the history of the central bank.

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

Trader and billionaire Paul Tudor Jones predicted that unchecked money printing to stimulate the economy would devalue the dollar and euro, in which it was previously cost-effective to store savings.

To hedge macroeconomic risks (insure savings), large institutional investors began to turn to precious metals and cryptocurrencies. That is, in 2020, a new principle was already established: Bitcoin is not a means for speculation and quick earnings, but a tool for long-term savings during negative trends in the economy. Examples of major investors:

- Payment firm Square invested $50 million, with the owner calling the coin a tool that brings new economic opportunities and access to the global system of finance. There have been earlier statements from CEO Jack Dorsey that BTC will one day be the only coin used on the web.

- MicroStrategy, a large software provider whose shares are traded on the Nasdaq exchange, bought $175 million worth of coins. This was the first large public company to decide to store capital in BTC. They made the investment back in August 2020.

Analysts from Deutsche Bank predict an increase in the number of institutional investors, as the crypto-asset will attract those who previously insured themselves against the weakening of the dollar by investing in precious metals. Thanks to this, the coin’s exchange rate could reach $318,315 as early as the end of 2021 or 2022.

In general, Bitcoin and cryptocurrencies are growing in value due to the influence of such factors:

- Falling confidence in fiat money (dollars, euros, ruble), traditional markets and central banks. Crises provoked by depreciation, high inflation, make people look for new ways to save money. Cryptocurrency is an alternative to precious metals.

- Support of large depositors. For example, billionaires Paul Jones (invested over $100 million), Stanley Druckenmiller (he recognized the advantages of bitcoin over gold as a means of saving), Ricardo Salinas Pliego (keeps 10%+ of capital in BTC). Their media, social media posts encourage other investors to invest in Bitcoin.

- Partnerships with large companies. In 2021, the number of partners accepting the cryptocurrency has passed 100,000+. The list includes eBay, KFC, and Microsoft. The appearance of each new company can lead to an increase in price.

- Legislative support for cryptocurrency. The more states recognize the coin, allow transactions with it, change legal regulations, the faster the price rises.

- Simplification of the purchase process. The acceptance of cryptocurrency by the payment service PayPal led to the growth of the rate. According to the Pantera Capital fund, in 2021, users will buy through the system approximately 70% of all coins issued. Another contribution was made by the Cash App mobile application. The growing number of Bitcoin ATMs through which it is possible to buy the coin with fiat currencies is also positive.

- Protocol updates. Each fork improves the system and increases investor interest.

Protocol updates are rare. This is due to the decentralization of the system. To accept an update, you need the support of most miners.

- Limited issuance + reduction of rewards to miners for the block found. This is an inherent mechanism designed to prevent inflation and lead to an increase in price.

Bitcoin halving

Analysts believe that the increase in the BTC rate is due to the embedded mechanism. Halving is a reduction in the remuneration for the generation of blocks. The table shows these values.

| Period | Reward for generating 1 block in BTC |

|---|---|

| From 2009 to November 2012. | 50 |

| From November 28, 2012. | 25 |

| From July 9, 2016. | 12,5 |

| Effective May 11, 2020. | 6,25 |

In 2031, the reward will be less than 1 coin and then drop to 0.

Halving makes cryptocurrency more scarce, and therefore more expensive. This is especially noticeable against the backdrop of depreciating fiat money. Declining issuance and its limited availability provide the preconditions for a constant, long-term increase in price. Also, as the reward decreases, the influence of miners on the market decreases.

But a portion of contributors believe that halving doesn’t play a role. Nick Carter, who founded Coin Metrics, says the catalysts driving the price increase are outside the market. Halving, on the other hand, was known from the beginning, so it can’t change the rate significantly.

Sustainability of growth

After the rate soared in the spring of 2021, there was a correction (the price fell to a low of $29k on July 29, 2021). Then the price started to rise again. By August, crypto investors got tired of the uncertainty and began to actively invest in BTC again.

Nick Carter believes that this growth is more sustainable than the jump seen in 2017.

As cryptocurrencies are adopted by large private or institutional investors and governments, the price increase becomes more predictable, giving reason to believe that more times than not a new all-time high will be set.

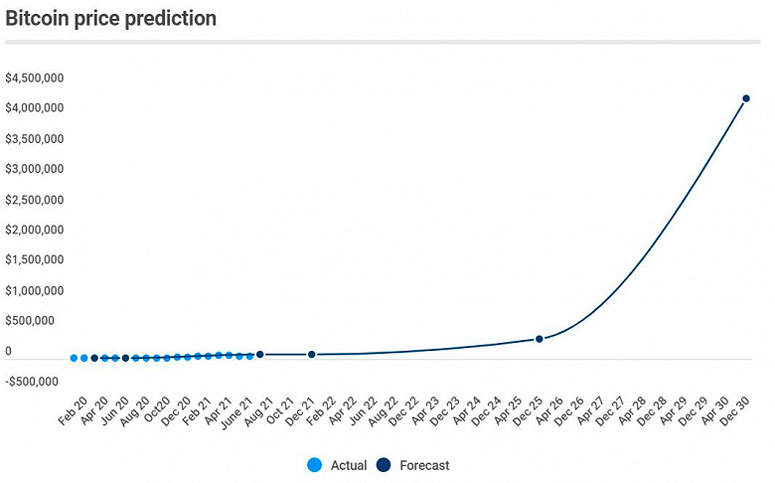

What to expect from BTC prices in the future

Experts predict an increase in demand for the coin, the emergence of more investors who will want to store funds in cryptocurrency rather than in dollars, euros or precious metals.

Bitcoin has every reason to officially establish itself as digital gold and the best tool for hedging risks.

In August 2021, the exchange rate has not yet risen to the all-time high recorded in the spring, but the market is gradually recovering. By the fall, investors expect a steady rise in the koin. Popular predictions:

- Anthony Poliano (co-founder of Morgan Creek Digital) and venture capitalist Tim Draper expect BTC to be worth $250k by late 2022 or early 2023.

- An analyst from Bloomberg named a price of $170k in 2022.

- According to a survey of experts (financial industry workers, academics, institutional investors), the coin is undervalued. It is getting more expensive, but slowly. By the end of 2021, the rate should reach $66,284. And from 2022 to 2025, they expect a gradual rise to $318,000.

What investors should do today

The cryptocurrency market has already started to recover by the end of summer 2021, but clear short-term predictions are still difficult to make. That said, many large investors are confident in Bitcoin’s long-term outlook and that the price of the first crypto will rise significantly.

A director at Goldman Sachs believes that the support of large companies has brought the project to the stage of maturity. With wider adoption, it will become an even more stable financial market tool. Grayscale CEO Michael Sonnenschein emphasizes: a large number of investors confirms the coin’s capacity.

Therefore, BTC can be used for long-term investments or trading. Compared to June 2021, the digital currency has already increased in value.

Summary

BTC is the first and most popular cryptocurrency that sets the mood of the whole market. Why it is rising is due to a complex of reasons: from halving to the support of large investors. It is impossible to predict the exact change in the rate and the general trend with a 100% guarantee, but the forecasts of most crypto experts are optimistic.

Frequently Asked Questions

💸 Why do other cryptocurrencies rise in price after BTC?

Because the coin influences the general state of the market. It is the main pair on exchanges, it is what most investors buy.

❓ How to buy Bitcoin?

The transaction can be concluded through the exchange (Binance, OKEx). You can also buy coin through a payment service (PayPal, Payeer, WebMoney), exchanger.

🔼 Why the price may increase in 2024?

This is possible due to the increasing number of investors announcing protocol updates that will allow the creation of complex smart contracts, increase the speed and security of transactions (forks MAST, Taproot).

⛏ How to mine BTC?

To mine coins, you need special ASIC devices.

❕ How many Bitcoins exist?

By August 2021, 18+ million have been created. That’s 89% of the maximum issue (21 million).

Is there an error in the text? Highlight it with your mouse and press Ctrl + Enter

Author: Saifedean Ammous, an expert in cryptocurrency economics.