According to regulators, the decentralized nature of cryptocurrencies allows them to be used to launder illegally obtained money. Therefore, the international organization FATF requires centralized exchanges and payment services to implement measures to combat the legalization of “dirty” proceeds. AML-checking is a procedure aimed at finding illegal transactions. Algorithms analyze incoming transfers for interaction with services from the darknet and other fraudulent structures. If an order is red flagged (high risk), it is blocked and the user is asked to confirm the origin of the funds.

What is AML verification of wallet and cryptocurrency?

In 2024, the total capitalization of the digital market will reach $2.49 trillion. Governments can no longer ignore such significant financial flows, so centralized crypto exchanges and payment services have made it mandatory to implement AML filters to verify incoming transfers from customers.

The procedure stands for Anti-Money Laundering.

The international supervisory body FATF regularly improves the norms that serve as a basis for the creation of tools to combat illicit cryptocurrency trafficking. The following types of AML checks are distinguished:

- Wallet analysis. The algorithm checks the address transactions and compiles a risk profile of the client.

- Transaction verification. The program traces the history of coins in the order. If most of the cryptocurrency is received from an address spotted with illegal activity, the transaction will be flagged as suspicious.

Principles of operation

Cryptocurrency transactions are believed to be anonymous. This is not entirely true. The passage of coins can be traced due to such features:

- Transactions are recorded in the blockchain, they cannot be deleted or edited.

- Any user can verify transactions. To do this, you need to specify the TxID in the network browser. The number can be viewed in the transaction history.

- Customers of centralized crypto exchanges and payment services upload document images for verification in order to withdraw cryptocurrency to cards. This allows an anonymous wallet to be matched with a real person.

Taking these features of cryptocurrency transactions into account, programmers write algorithms that can trace the history of each coin on a user’s balance (or order). The program tags each token.

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

Cryptocurrency that came from safe sources (from miners, from crypto exchanges and payment services with KYC) – in green. Coins from the darknet, trading platforms without verification, mixers, totalizators – red or yellow.

The program counts the number of tags and gives the total result. Orders with a risk above 60% are blocked.

Why perform the check

In 2024, AML filters for incoming transfers are implemented on most cryptocurrency platforms. This allows you to identify coins associated with illegal activity.

Such cryptocurrencies will be blacklisted. If a transfer is attempted, the user’s account will be blocked. Assets can be returned if you manage to prove their legitimate origin.

How AML verification differs from KYC

These are the main tools used by financial institutions to combat illicit trafficking of digital assets. The procedures differ in their purpose and mechanisms for conducting them:

- AML-check – financial institutions analyze the sources of money flowing into customer accounts. The procedure is aimed at detecting and preventing the use of illicit funds. AML-checking is carried out on the basis of transaction analysis, risk assessment of customers, uses special programs and tools to automate processes.

- KYC (Know Your Customer) – exchanges and payment services verify the identity of customers and establish the sources of funds. The procedure is performed as part of AML measures, serves to identify users, assess risk profile and establish the legality of transactions. KYC includes verification of passport data, residential address and other information. A set of measures helps to link real identities to anonymous cryptocurrency wallets.

Does AML happen on decentralized exchanges

DeFi platforms offer users to exchange cryptocurrency without registration and account verification. Such resources do not have a single management body, and fiat is not supported on them. Therefore, the implementation of AML procedures on decentralized exchanges is currently impossible.

Governments of some countries are concerned about the fact that attackers can use DeFi services for money laundering. To eliminate the risks, it is proposed to introduce DEX regulation. So far, there are no such tools, as AML would destroy the decentralized nature of these platforms.

What money laundering means

Fraudsters cannot withdraw and use “dirty” coins in the real world. The transaction will be blocked, the cryptocurrency will be seized, and the sender will be arrested. Therefore, attackers use various tools to obtain assets with a transparent history.

How fraudsters can launder cryptocurrency

There are several ways to legalize illegally obtained proceeds. For example, methods such as:

- Mixers. These services crush the cryptocurrency that came from the user and mix it with coins from other clients. The assets are then returned to the owner in a randomized order.

- Anonymous cryptocurrencies. Attackers convert stablecoins or BTC into Monero and other confidential coins.

- Transit addresses and exchange accounts. Scammers transfer crypto assets through a complex path involving anonymous wallets, DEX, and CEX accounts registered to dropships.

- Exchanges without verification. Despite stricter AML regulations, there are still services that don’t require ID in 2024. Many exchanges use KYC optionally – only for suspicious transactions.

- Cryptocurrencies. On lending platforms, you can pledge bitcoin, ether, other top coins and receive stablecoins. Smart contracts do not verify the collateral for purity. Therefore, fraudsters can pledge “dirty” assets and get cryptocurrency with a transparent history.

- NFT. An attacker issues a non-replaceable token and buys it from himself. In case of problems, he will claim that he received income from the sale of the collection.

What measures are in place to combat money laundering

Effective monitoring of user transactions is needed to effectively prevent the illegal circulation of cryptocurrencies. AML procedures on exchanges and in payment services are carried out in several stages:

- Incoming transfers and user wallets are checked. At this stage, the risks of specific orders are assessed and a client profile is compiled.

- An account with red flags is blocked. The user loses the ability to withdraw money and replenish the account.

- The financial organization prepares a suspicious activity report (SAR).

- The document is sent to the relevant authorities. They conduct their own investigation of the incident. If evidence of guilt is obtained, the user will be arrested. If possible, the stolen funds will be returned to the owners.

FATF

Financial Action Task Force on Money Laundering is an international organization created by the G7 in 1989. FATF issues recommendations for financial companies around the world to prevent illegal money trafficking.

In 2024, more than 200 countries have committed to follow the standards of the international group.

Exchanges and payment services can develop their own AML rules, which must include the main points from the FATF recommendations. For example, platforms are obliged to implement an AML filter for receipts to customers’ wallets.

What services can be used to verify a transaction

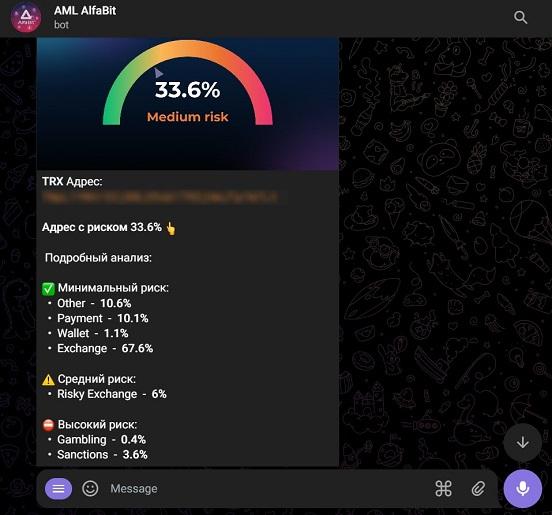

Researchers say: more than 40% of digital coins have been involved in illegal transactions. Therefore, users can be blocked even if they have not committed illegal actions. To avoid this, you need to perform AML transaction verification. The algorithm will trace the history of each token and assign a label according to risk levels. See the table for more details.

| Flag | What it means |

|---|---|

Algorithm calculates the total risk of the transaction. AML services take a commission (up to $2 per transaction). The first few transactions can be verified for free. In 2024, such services are popular:

- AMLBot.

- GetBlock.

- Chainalysis.

- Crystal Blockchain.

- AlfaBit.

- Traceer.

How artificial intelligence is used for AML verification

New technologies are actively used in anti-money laundering activities. One method is automated anomaly detection. Artificial intelligence is trained to analyze large amounts of data and look for deviations from typical user behavior. These may indicate financial crimes.

Automation significantly reduces time and effort compared to manual verification and classification of transactions. AI also helps to improve the quality of analysis, reducing the number of false positives and false negatives. Using artificial intelligence in AML verification requires vigilance, deep understanding of algorithms and techniques. Incorrect training or improper program setup can lead to erroneous conclusions.

How to minimize risks when accepting and transferring cryptocurrencies

AML algorithm databases are updated daily. If yesterday a wallet had a low risk, today its owner could make a transfer to a blacklisted address. Therefore, before every cryptocurrency acceptance and transfer to a personal wallet, you should perform an AML check.

You can also reduce risks in other ways. Among them, for example, are the following:

- Accepting funds from an unknown source to a new address. After that, you can perform a purity check. If the risk is small, create a transaction to send to the main wallet.

- Regularly check your personal account with AML programs. This will avoid blocking in exchangers and crypto exchanges.

- Do not publish the wallet address in open sources. You should use separate accounts for different purposes.

What to do if a risky transaction is detected

If the transaction does not pass the AML-check of the exchange or exchanger, the cryptocurrency will be immediately blocked. The user will have to prove his non-involvement in illegal actions. Therefore, it is safer to conduct your own checks of counterparty wallets or payments from unfamiliar addresses. If high-risk transactions are detected, it is better to refuse the transaction or not use the funds received and change the wallet address.

Frequent questions

💡 Can AML-checking be done anonymously?

You can create an account by email address, verification is not required. For verification, you need to provide the wallet or TxID of the transaction.

⚡ What is KYT?

Know Your Transaction is a basic FATF recommendation that involves tracking customer balances. The company should know the sources of funds in users’ accounts.

🔔 Which coins can be verified for purity?

Cryptoplatforms more often offer AML procedure for USDT, BTC, ETH. You can also check other popular cryptocurrencies – TRX, BCH, ZEC, LTC.

✨ How much does the AML procedure cost for a single transaction?

You will need to pay $1-2 to assess the risk of a cryptocurrency transfer. Some services check the transactions of beginners for free (AMLBot, GetBlock). If you need to analyze transactions regularly, it is better to buy a package for $300-500. In this case, one check will cost $0.1-0.2.

📌 What is included in the AML wallet analysis report?

The user learns from what sources money comes to the address, the percentage of “clean” and “dirty” coins. The report displays the overall wallet statistics, the amount of cryptocurrencies from untrusted services and the overall risk assessment.

A mistake in the text? Highlight it with your mouse and press Ctrl + Enter

Author: Saifedean Ammous, an expert in cryptocurrency economics.