In the time that has passed since the emergence of Bitcoin, users in different countries have learned about making profits on the purchase of cryptocurrency. The exchange rate fluctuations of the main coin BTC are constantly in the trends of the world media. Thanks to its development, Bitcoin trading is available to anyone with both large and small capital. For Russians, it is possible to buy BTC for rubles.

Features of the cryptocurrency market

The world has not yet established universally recognized rules for working with bitcoin. In some countries, it has already been recognized as a unit of account (Germany) or means of payment (Japan). In China, banks cannot work with cryptocurrency, but it is available to individuals. According to the new Law on Digital Financial Assets in Russia, which came into force in early 2021, BTC can be used for investments, but it cannot be used to pay for goods.

Due to the difference in legislation, users have unequal opportunities to work with Bitcoin (depending on the country of residence). The

digital asset is very volatile

.

Its price per day can change by more than 10%. This creates good opportunities for earning and attracts traders. However, BTC is beginning to be used as a means of payment. Solutions with the issue of plastic cards and linking them to accounts on cryptocurrency exchanges are suitable for this purpose. As a result of payment, the asset is exchanged for fiat money at the market rate, and these funds are received in favor of the seller.

Types of exchanges

For Bitcoin trading, traders choose platforms that purchase coins directly from the platform, or exchanges with other users. According to the type of assets needed for purchase, exchanges are divided into:

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

- Fiat – the ability to transfer ordinary money to the account, among which are rubles, euros, dollars and others. For this purpose, plastic cards and electronic wallets are used. Bitcoin is purchased with fiat money.

- Cryptocurrency – trade is conducted only between BTC and altcoins.

Recently, exchanges have made significant progress in buying coins. Initially cryptocurrency platforms are introducing fiat money deposit methods. An example is Binance.

According to the ownership structure and management system, exchanges are divided into:

- Centralized – have an owner in the form of a company or a group of persons. Traders are charged a commission for services.

- Decentralized (DEX) – do not have one management body. A distributed network is created for the system operation, and trading is carried out by smart contracts. Clients do not need to replenish the account of the exchange, because on DEX the exchange is made between the connected wallets of users. This reduces the commission, and participants do not need to register and confirm their identity. On DEX, tokenized BTC is traded.

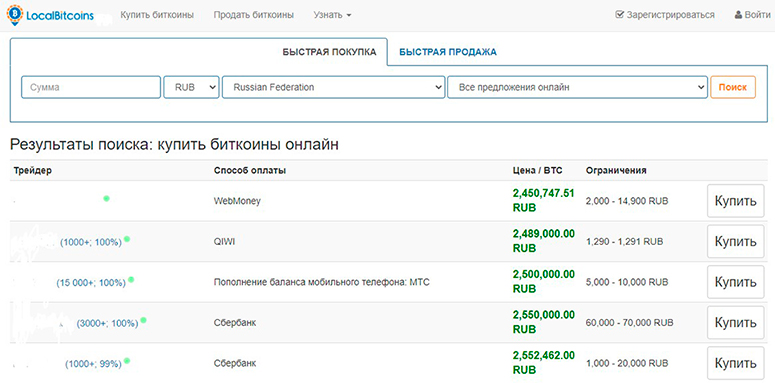

Trading Bitcoins on the exchange in Russia allows P2P-platforms. On such platforms, offers to buy or sell are put forward by users themselves. Other clients choose a favorable rate and exchange Bitcoin by means of transfers to Visa and Mastercard bank cards and via WebMoney, UMoneu and other e-wallets.

Money

Differences of cryptocurrency exchanges from stock and currency exchanges

Because of the high volatility, entering the business with bitcoin and other cryptocurrencies can bring a participant even with a small deposit a good profit. In a month, the price of a coin can both rise and fall. In this case, traders earn both on the increase in value and on the decrease. However, there are high risks of losing everything when choosing the wrong direction. There is no such volatility in the currency and stock markets. There you can rarely see sharp rises or collapses of the rate. Because of this, traders have to invest much more money to get a serious profit. Then, if the rate of an asset rises by a few percent, you can earn a good profit. When trading stocks and fiat currencies, information plays a significant role. Whoever gets it first can buy or sell a falling asset in time. In cryptocurrencies, events also play a role, especially concerning the development of altcoin projects. If a new stage of the roadmap is fulfilled, there is an increase in value. However, in the cryptocurrency market, including for Bitcoin, it is possible for individual groups to influence the price of the coin. As a result, inexperienced traders may detect an intensification of trading but draw the wrong conclusions. This results in losing money.

The process of trading Bitcoin on the exchange

For transactions with BTC, the user needs to choose a platform and open an account on it. To protect the account, security settings can be connected in the profile. Trading becomes available after funding the account with fiat money or other cryptocurrencies. On DEX exchanges, you can act without an account, but perform transactions only with tokenized BTC.

Registration and account creation

To open an account on the site, the user needs to find the “Registration” button. It is usually attached in the upper right corner. To bind an account, the form offers to specify a phone number or email. Any option will do, because later when filling out the profile, all the missing data are entered.

For verification, a letter with a link to go to e-mail, and to confirm the phone number send an SMS with a one-time code. It must be inserted on the site of the exchange.

Identity verification

Immediately after opening an account, traders can replenish the account and proceed to the purchase of cryptocurrency. However, limited functionality is available for unverified users. For example, exchanges do not allow such customers:

- Refill the balance with fiat money – you can’t use bank cards.

- Withdraw assets for a larger amount than specified in the limits. Restrictions also apply to the deposit.

- Perform margin and futures trading with BTC. Other restrictions are also possible.

For verification, a member in myAlpari needs to upload a scanned copy of a document, such as a passport or driver’s license. In addition, it may be required to upload selfies with it. Other procedures are also found on exchanges: video call via messenger or similar methods.

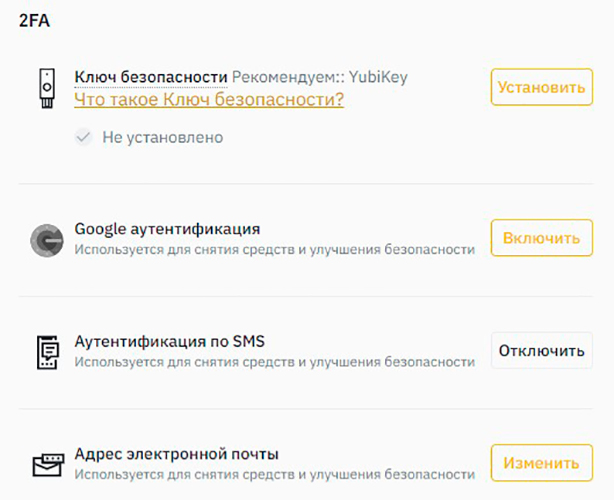

Account protection

On trading platforms, clients are offered to apply security settings for the safety of assets. The user can choose to enable the following options:

- Two-factor authentication by code in SMS or through one of the services, for example, Google Authenticator. In the second case, the program constantly generates a new code, which is valid for a minute.

- Confirmation of operations by e-mail. A code is sent in e-mails.

- Hardware authenticators in the form of customizable electronic keys like YubiKey.

These settings can be used both when logging in to an account and to confirm withdrawals.

.

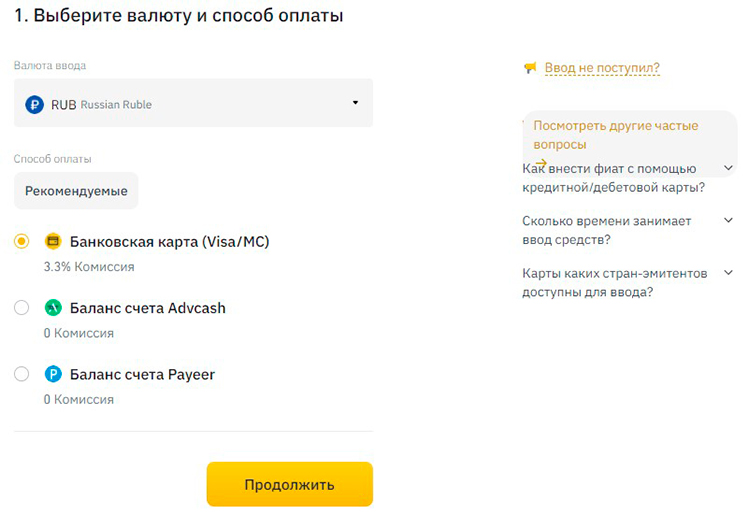

Adding a payment method

To deposit funds, a client needs to go to the wallet overview section. Deposits in all cryptocurrencies that are offered to trade on the site are available to users. To deposit funds, the trader needs to click on “Enter” opposite the coin. Next, a cryptocurrency address is generated, which is copied and used for the deposit. After confirmation from the blockchain, the coins will reflect on the balance. Fiat crypto exchanges offer deposit methods using rubles, dollars, euros, and so on. The trader chooses the currency, which affects the list of available methods for deposits. Usually bank cards and e-wallets are offered. Funds arrive on the account almost instantly.

Access to making deposits with fiat money requires verification.

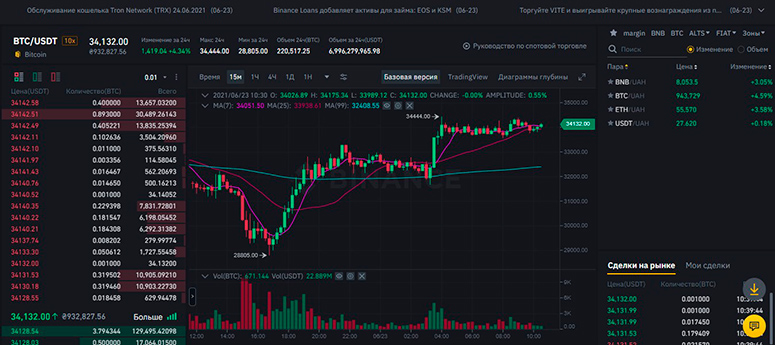

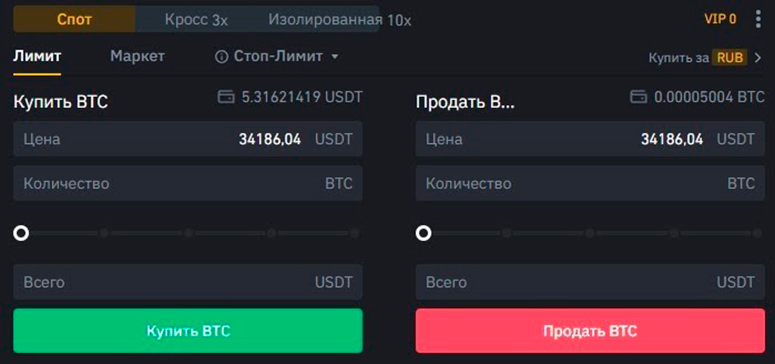

Trading terminal interface

To buy and sell Bitcoin on the websites and applications of cryptocurrency exchanges, you will have to switch to the Exchange section. The trading terminal is displayed on the screen. The design may differ, but its functional areas are the same. The terminal consists of:

- Graphics. This is the main part of the interface, which shows the change in the value of the coin. On the chart you can select time segments from one minute to a month, as well as include different indicators and technical analysis tools.

- Zones for selecting a trading pair.

- Exchange stacks. Data in them are formed on the basis of current orders to sell and buy BTC. In the stacks you can define the walls, see the total number of coins and price levels of closing the orders placed.

- History of transactions of all traders.

- Area for opening orders. There you select the type (market or limit) and specify the price and number of coins.

- Block for viewing active trader’s offers, transaction history and idle available funds.

Buying cryptocurrency

The scheme of trading Bitcoins on the exchange in Russia looks like this: after entering a deposit on the balance, the trader can purchase cryptocurrency assets. To do this, you need to go to the trading terminal and select a pair. Then you can proceed in one of the following ways:

- Buy at the market price. The order is closed instantly at the current rate.

- Create a limit transaction. The trader specifies the price at which he wants to buy the asset. When the price reaches the specified value, the transaction is carried out automatically.

If the purchase is made to hold the asset for a long time, then it is better to withdraw the coins to a cryptocurrency wallet outside the exchange. This is not necessary when wishing to sell in the short term at a more favorable rate.

Bitcoin to altcoin conversion

Bitcoin acts as a market indicator. The behavior of its price traders take into account when entering other cryptocurrency assets – altcoins. These coins can earn more than BTC, as they have a much lower value and grow faster.

Many altcoins are traded as a pair to bitcoin. Traders with experience in the growing market favor them. In the case of growth of the asset, an increase in the deposit in BTC is obtained, while the main cryptocurrency can rise in price in parallel.

Buying altcoins is performed in a similar way

.

To execute a transaction, you need to:

- Open the trading terminal.

- Select a pair to BTC.

- Place a market or limit order.

As soon as the price reaches the required level, the transaction will close. Further the asset can be left on the balance of the exchange or transferred to a wallet for long-term storage.

Withdrawal of BTC and exchange to fiat

Since exchanges are sometimes hacked, it is better to transfer them to wallets outside the platform, including hardware wallets, for the safety of BTC for long-term retention. To do this, you need to:

- Copy the address of the wallet to which the withdrawal from the crypto exchange will be made.

- Go to the account menu of the platform.

- Find Bitcoin.

- Insert the address.

- Click on the button for payment.

- Depending on the enabled settings, confirm the transaction by entering a code from SMS, from an email and/or two-factor authentication service.

After that, the application is sent for processing. When the exchange staff approves the withdrawal, the cryptocurrency is sent to the wallet. If the platform supports fiat currencies, the trader can sell his BTC for RUB, EUR, USD. Further funds are available for sending to a card or e-wallet. P2P platforms also allow you to convert Bitcoin into fiat currencies.

The best exchanges for trading Bitcoin

The experts of our website have prepared a list of verified platforms where you can buy Bitcoin. These platforms have been operating for several years, and for the past time managed to earn a good reputation among traders. On exchanges available registration of users from Russia, some sites offer methods of replenishment in rubles and other fiat currencies.

Commissions of exchanges

For access to their services, centralized platforms charge a small fee. Commissions on exchanges are withheld at:

- Deposits and withdrawals of assets. The amount of the fee varies depending on the cryptocurrency. At the same time, there are platforms that do not charge a commission. In this case, only the blockchain fee for confirming the transfer is withheld for payments. On the FTX exchange, clients are compensated even for these funds.

- Closing a sell or buy order. The size is affected by the status of the user.

- Using borrowed funds for margin trading. Money is provided to the client at a certain percentage.

- Trading futures. Funding rates can be positive and negative. If the participant closes the futures on the due date, no commission will have to be paid.

Commissions for spot trading:

| Level | Trading volume 30 days (BTC) | and/or | BNB Balance | Maker/Taker | BNB Maker/Taker 25% Discount |

|---|---|---|---|---|---|

| VIP 0 | or | ≥0 BNB | 0,1000% / 0,1000% | 0,0750% / 0,0750% | |

| VIP 1 | ≥50 BTC | и | ≥50 BNB | 0,900% / 0,1000% | 0,0650% / 0,0750% |

| VIP 2 | ≥500 BTC | и | ≥200 BNB | 0,800% / 0,1000% | 0,0600% / 0,0750% |

| VIP 3 | ≥1500 BTC | и | ≥500 BNB | 0,700% / 0,1000% | 0,0525% / 0,0750% |

To reduce order fees, you can apply these methods:

- Utilize exchange tokens, due to which a discount is obtained.

- Maintain a set trading volume for a certain period.

- Get the status of a VIP-client.

Types of trading

There are different variants of Bitcoin trading. Each of them has risks and profitability, but they differ in technical implementation. The main types are broken down below.

Spot trading

This is the safest option for buying and selling coins. In this trade, the participants in the transaction commit to transfer the asset to the other party at the market rate, which is referred to as the “spot” rate.

Derivatives trading

To make a profit, you may not buy and sell cryptocurrency directly. For experienced traders, derivatives trading is available. They mean financial contracts between several parties with the determination of the value of the underlying asset. Participants in the transaction are obliged to buy or sell at a set price.

The main reason for the use of derivatives is the desire of private and legal investors to reduce risks from price fluctuations.

There are several types, including: futures, options, CFDs

.

Futures

This type of contract implies a trading operation with an asset in the future, but the price is specified in advance at the time of conclusion. Futures are offered on many cryptocurrency exchanges, with the platform acting as an intermediary. Once the contract is concluded, the terms cannot be changed. Some platforms offer open-ended types that can be traded at any time.

Options

If in the case of futures, both parties to the transaction are obliged to fulfill the terms of the contract at a certain time, then in options only one party receives restrictions, and the other – decides to buy out or sell already after the expiration date. The trader, who is in a privileged position, pays a certain amount for this.

CFD

Contract for difference is a speculative instrument that allows you to make money on fluctuations in the price of the underlying asset without directly purchasing the cryptocurrency. When the value increases, the difference is paid by the seller, and when it decreases – by the buyer. Access to cryptocurrency CFDs can be obtained through brokers. The entry barrier to this instrument is much lower than for futures.

Margin trading

This type of operation involves borrowing cryptocurrency or fiat funds from the exchange to conduct a transaction. This increases the amount of the asset, which the trader will use to trade Bitcoins. If the user’s calculations turn out to be correct, he will get a higher profit than on the spot. In margin trading, the trader chooses leverage. This is a coefficient with which the amount of borrowed funds is calculated. As collateral, the client gives his coins – margin. If the direction is chosen incorrectly, the order is liquidated, and the trader’s funds go to the income of the exchange. Interest is charged for the use of leverage.

Trading strategies

In working with cryptocurrency, traders adhere to the rules. Numerous Bitcoin trading strategies have been created to generate profits. The main ones are described below.

Hodl

This is the simplest method, which is used by both novice traders and institutional investors. The strategy is designed for a long-term perspective and consists of a simple purchase of Bitcoin. The bet is made on the growth of the price. If the user is going to hold the asset from several months, then it is better to withdraw the coins from the exchange to the wallet.

Daily

The strategy involves opening positions for realization during the day. Suitable for experienced traders because of the high workload and skill requirements. For profit, users work with price fluctuations during one day.

Trending

Otherwise, this strategy is also called a positional strategy. When using it, traders conduct much fewer transactions than in the case of the daily strategy. Before creating an order, the client of the exchange needs to determine whether the trend is upward or downward. For this purpose, levels, figures, indicators are used. After confirmation, the user enters the transaction, which can take up to several months.

Swing trading

This strategy is ideal for beginner traders who are trying to master volatility levels, technical and fundamental analysis. Trades take from a few days to a month. Indicators and chart patterns matter.

On the breakout

The strategy involves placing an order as early as possible before the value of the asset moves from one level to the next. As soon as resistance or support is broken through, volatility increases. You can then make a substantial profit on price fluctuations.

Buy and sell orders

On the cryptocurrency exchange, the trader himself sets the conditions for making a transaction. To do this, he puts out any of the types of orders:

- Market. The operation is marked by instant execution at the current rate on the market.

- Limit. With the help of such an order, you can buy or sell an asset at a price that differs from the market price at the moment of placing it. Thanks to a limit transaction, a trader can make a more profitable purchase. This type of operations is used in cases when the client can not be in front of the trading terminal, for example, at night.

- Stop-limit. The order is opened when the set price level is reached. Such transactions are used as a failsafe in case the value of the asset went in the wrong direction. The execution price usually differs from the one at which the order is placed by 5-15% for guaranteed closing.

The above examples refer to the basic types of trades. You can find a much larger selection on exchanges.

Scalping

The most dynamic strategy of trading cryptocurrencies. The client of the platform makes many transactions during the day. Orders can be opened and executed in a few seconds. In each operation, the participant strives to get 1-2% of profit. According to the results of the day, you can get a good income.

Fundamental and technical analysis

At each moment of time, the current price of an asset can significantly differ from the real one. Studying the development of the project, implemented improvements, increasing bandwidth and tracking news is called fundamental analysis. This also includes understanding the macro-financial indicators of the market. The

differences in the real and current prices of the coin suggest that they will level off. This means that you can see the possibility of making money.

Because of the large number of factors, it is difficult for beginners to qualitatively conduct fundamental analysis, so it should be handled by professionals. It is easier to assess the potential of the current market trend. For this purpose technical analysis is carried out. It is based on the understanding that the graph of changes in the price of a coin can determine the future behavior of the value. For technical analysis, levels, figures, indicators and many other tools are used.

Trading bots

To help in making transactions, traders develop programs that, depending on the set parameters, place buy and sell orders in automatic mode. Exchanges allow connecting bots via API. The use of programs helps traders to gain profit around the clock. Examples of bots are Apitrade, Revenuebot and others.

Investment model and trading

Bitcoin trading brings substantial profits to the clients of exchanges, but at the same time contains significant risks for inexperienced users. Therefore, in order to make trading a mainstream job, it needs to be learned. It is possible not to analyze in detail all the existing strategies, but to focus on one or two. The investment model contains less risks. Since the leading coins are growing over the long haul, you can invest in them. Also suitable are investments in new projects with a strong team, an interesting product and a list of well-known funds that sponsored in the early stages. Experienced traders advise beginners to use the 40-30-20-10 scheme. With its help, the following investment portfolio is formed:

| Share of assets, % | Explanation |

|---|---|

| 40 | Top assets that have already announced themselves on the market. Bitcoin is one of them. |

| 30 | A reserve of funds that can be used in case of a drawdown. |

| 20 | Medium-risk coins, which include altcoins with great potential. |

| 10 | Promising but little-known assets. Investments in them are associated with high risk. |

Tips for new traders

New clients of stock exchanges need to develop their own rules and stick to them. Here are the most obvious ones:

- Choose reliable exchanges that have already made a name for themselves in the market.

- Use spot trading, for which you do not need to borrow funds from the site. The use of margin threatens beginners with the loss of a significant part of the bank.

- Allocate free funds that can be painlessly lost.

- Withdraw part of the profit after the transaction.

- Do not regret a missed opportunity. If the asset has already risen in price, and the user did not have time to enter it, it is better to pick up another coin for trading.

- Constantly study materials on cryptocurrency trading.

Frequently asked questions

💻 Which exchange to choose for trading Bitcoin?

The list on our website presents the leading platforms. Among them there are exchanges that accept deposits in rubles.

💰 How to buy Bitcoin?

After choosing a platform, you need to register and replenish your account. Next, open a trading terminal and place a market or limit order. After it is closed, BTC will be on the user’s balance.

📊 What strategy to choose for trading Bitcoin?

Scalping takes a lot of time. Trading on the trend allows you to place fewer orders, but get a good profit. Buy and hold BTC is suitable for investing.

💵 What is the fee for withdrawing Bitcoin from the exchange?

Each platform has a different fee.

📈 How to analyze the value of Bitcoin for the coming days?

To do this, you need to learn how to work with the chart and with glasses.

❓ What is better: investing or trading?

There is no unambiguous answer to the question. Investing requires less time and knowledge. For trading, you need to learn how to work with the chart.

Error in the text? Highlight it with your mouse and press Ctrl + Enter