The price of Bitcoin, the most popular digital currency, broke records in 2021. The peak was the $64,000 milestone in April. Then the bitcoin rate fell to $29,800, leading to heated discussions on social media about the cryptocurrency market and the future of blockchain technology. The concerns came amid a renewed crackdown on digital assets by the government of China – the country that founded the world’s most important online marketplace. Financial experts filled in some of the gaps in information and dispelled investors’ fears about the fate of the main cryptocurrency. Many major players expressed their opinion that Bitcoin will still rise or fall in the near future.

Predictions on Bitcoin from experts

Investment offerings related to the virtual currency are still in their infancy. Digital assets are highly volatile. Enterprising investors realize this, reacting to the sharp drop in the value of bitcoin as a buying opportunity. Instead of panic selling off coins and žetóny, they are replenishing portfolios with the main cryptocurrency. A reliable indicator of bitcoin’s long-term prospects is the interest of hedge funds ARK Investment and Bridgewater Associates, which have bought and held digital assets.

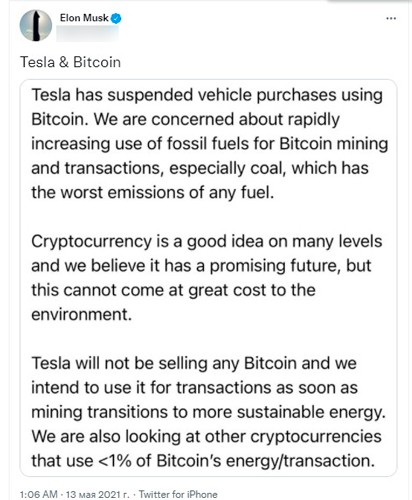

A lot of information noise has arisen around the type of energy utilization in bitcoin baníctvo. The head of Tesla, Inc. Ilon Musk has spearheaded the discussion on the issue. In March, the entrepreneur wrote in his Twitter account, “Now you can buy Tesla for bitcoins.” However, the practice was suspended in May due to concerns that Bitcoin mining and transactions on the network are unecological.

The near-term

Some financial experts believe that the second most popular coin, Ethereum, could overtake Bitcoin in value. However, Bitcoin’s brand value is much higher than other coins and it has a history of more than 10 years. This makes it more trusted by traders compared to other coins released just a few years ago.

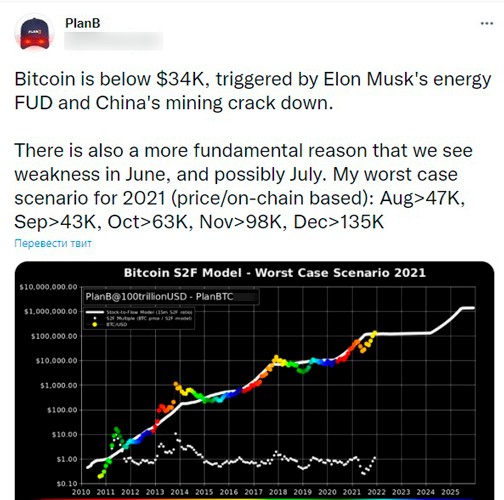

Crypto-enthusiasts are sharing their opinions on Twitter. Bitcoin is predicted to return to its all-time high of nearly $67,000 dollars by the end of October before reaching $98,000 in November. In December 2021, traders believe the coin will surpass the $100,000 mark. Bitcoin will rise further in 2024.

5020 $

bonus pre nových používateľov!

ByBit poskytuje pohodlné a bezpečné podmienky na obchodovanie s kryptomenami, ponúka nízke poplatky, vysokú úroveň likvidity a moderné nástroje na analýzu trhu. Podporuje spotové a pákové obchodovanie a pomáha začiatočníkom aj profesionálnym obchodníkom vďaka intuitívnemu rozhraniu a návodom.

Získajte bonus 100 $

pre nových používateľov!

Najväčšia kryptoburza, kde môžete rýchlo a bezpečne začať svoju cestu vo svete kryptomien. Platforma ponúka stovky populárnych aktív, nízke poplatky a pokročilé nástroje na obchodovanie a investovanie. Jednoduchá registrácia, vysoká rýchlosť transakcií a spoľahlivá ochrana finančných prostriedkov robia z Binance skvelú voľbu pre obchodníkov akejkoľvek úrovne!

At the end of 2024.

In 2021, a survey of 42 digital asset experts was conducted. Many of them agree with the end of 2021 prediction that Bitcoin will rise to $66,280. By 2025, the BTC rate will reach $318,000, and in 2030, $4.28 million will be offered for 1 bitcoin. At the same time, 61% of respondents believe that Bitcoin is undervalued.

British analytical service Finder in late September – early October 2021 polled a group of 50 industry experts about where the price of bitcoin will move in the next 10 years.

In their opinion, the main cryptocurrency’s exchange rate will peak at $80,021 and end 2021 at $71,415. Daniel Polotsky, founder of CoinFlip, which operates a network of Bitcoin ATMs, believes BTC will end the year at $80,000.

Morpher CEO Martin Freler says a macroeconomic environment with central banks printing money at will, strong intra-network fundamentals, institutional acceptance and bitcoin-ETFs in the US will push the BTC price to new highs later this year.

In August, analysts at Standard Chartered bank gave a forecast for the first cryptocurrency. According to them, by the end of 2021, the value of the koin will rise to $100,000. Analysts also suggest that a sharp rise in the price of BTC will provoke an increase in the rate of another leading coin – Ethereum. About what will happen to the price in 2022, experts do not say. However, they note that with a high probability the market will continue a bull rally.

Subsequent years

Experts do not give guarantees that bitcoin will fall or rise. It is difficult to make long-term predictions about the value of such a volatile asset.

However, Finder survey participants suggest that BTC prices will rise to an average of $250,000 by 2025 and $5.2 million by 2030.

Still, for the most part, the BTC market still depends on the will of the largest holders of the major cryptocurrency.

What will happen to bitcoin in the near future

The BTC price forecast was also made by Bloomberg in September 2021. In this report, analysts evaluated various crypto assets and their expected performance in the coming months. In the case of bitcoin, the experts suggested that BTC could grow significantly in 2021. The report says that the major cryptocurrency is likely to approach the $100,000 mark this year.

Price growth

Nick Spanos, co-founder of decentralized platform Zap Protocol, agrees with many analysts. After a slight drop in the value of BTC, the investor urged cryptocurrency traders not to panic and defined the decline in the rate as false. He is also convinced that Bitcoin’s value will rise to $100,000 by the end of 2021.

On the other hand, the CEO of Xapo Bank decided not to predict the value of Bitcoin for 2022 and beyond. He believes that the BTC rate will rise for a long time. Bitcoin price may reach the level of $1 million per coin as early as 2027.

Bill Noble, an analyst at cryptocurrency research company TokenMetrics, believes in the growth of Bitcoin and believes that by early 2022, the value of the asset is more likely to reach $75,000 than to fall to $25,000.

Popular expert Adam Beck suggests that Bitcoin’s value could rise to $3 million in the next five years.

Ali Mizani, director of FiCAS AG, gave correct predictions of BTC price dynamics back in 2016 and 2018. Regarding the near future, his answer was simple. As for the end of 2022, according to Mizani, the price of the main cryptocurrency will definitely rise to $200,000 and may well reach the $300,000 mark.

Analysts of the famous Kraken exchange have little doubt that BTC will grow to $90,000 by the beginning of 2022. They also noted that over the past 6 months the value of bitcoin, despite high volatility, has grown by 10% or more.

Pantera Capital analysts believe that the price of Bitcoin will go up to $115,000 by the end of 2021. Also, the fund noted that it is not worth comparing the growth of the Bitcoin rate in 2017 and now, because at that time most projects existed only on paper. In 2021, the interest of many central banks in issuing their digital currencies increased because of the possibility of attracting new users.

Price drop

Wall Street has a much less optimistic outlook for Bitcoin’s dynamics. Managers of large investment funds surveyed by CNBC are confident that BTC will close in 2021 with a drop to $30,000. The decline in the price of the main cryptocurrency will not end there.

JP Morgan analysts are also very pessimistic about bitcoin. They do not rule out that the BTC rate will fall to $20,000 in early 2022.

Correction

After a prolonged decline in the price of bitcoin in the summer of 2021, the coin began to gain growth again. By October 15, the BTC rate reached a 24-hour high of $63,000 after information appeared online that the first Bitcoin Exchange Traded Fund had been approved by the U.S. Securities and Exchange Commission (SEC). The bitcoin-ETF began trading as early as October 18, 2021, marking a historic day. Those who invest in digital assets using the HODL strategy should not fear a correction. If the price of BTC drops to a tipping point, it is wise to buy more assets. Short-term investors should calculate all risks before believing in unconditional growth. We should not rule out the few statements that the market will lead the bitcoin price downward.

Altcoins are coming

Some digital assets have started to seriously compete with Bitcoin. Experts say that such coins are helping to increase the overall confidence in BTC, and it’s not a good idea to expect them to replace Bitcoin.

Dogecoin, for example, which originated for the sake of a joke, entered the top 10 cryptocurrencies by market capitalization in 2021. This is partly due to the coin’s social media PR by the head of Tesla, Inc. Ilon Musk. More serious contenders for Bitcoin’s place are Ethereum and Ripple, 2 coins based on proprietary blockchains that have an advantage over Bitcoin in terms of speed and transaction processing fees. This can also include Solana, which is updating historical highs on a weekly basis.

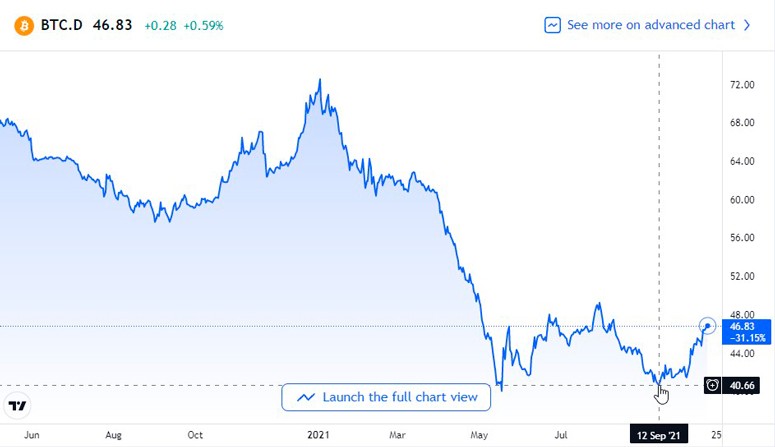

However, Bitcoin’s dominance ratio, which measures the market capitalization of the main cryptocurrency relative to the total market value, has increased to around 44% in October 2021. The increase in this ratio reflects BTC’s recent outperformance relative to alternative digital assets, a trend that some analysts believe will continue into Q4 2021. Although altcoins outperformed in August, investors gradually began to shift from other cryptocurrencies to bitcoins starting in September.

Efirium, the second coin in the world by market capitalization, is still inferior to the main cryptocurrency. The ETH/BTC trading pair is trying to consolidate around 0.065 and provide support for Ethereum against Bitcoin. Ether’s market capitalization continues to dominate other altcoins. According to a report by CoinDesk Research, due to the introduction of non-fungible tokens(NFT), decentralized finance(DeFi) and other applications on the Ethereum blockchain, we should expect ETH’s market capitalization to increase.

Mike Novogratz, who actively criticizes Dogecoin, sees no obstacles to the growth of the first cryptocurrency. According to the investor, bitcoin will cost $150,000 already by the middle of 2022. In the future, this growth will become significant, and the market total value of Bitcoin will exceed the capitalization of gold.

The best exchanges to buy BTC

Choosing a platform to trade cryptocurrency depends on the investor’s financial goals. There are many exchanges, each with its own disadvantages and advantages. When choosing a platform for cryptocurrency trading, you should consider security, user interface, liquidity and the number of available assets. The data for some platforms as of October 2021 is shown in the table:

| Platform | Number visitors, mln | Trading volume per 24 hours, $ billion | Number of cryptocurrencies | Number of fiat currencies |

|---|---|---|---|---|

| Binance | 250,3 | 11,76 | 374 | 46 |

| Coinbase | 127 | 1,35 | 74 | 3 |

| Kraken | 25,8 | 0,5 | 69 | 7 |

| Huobi Global | 9,2 | 2,8 | 331 | 50 |

| Bitfinex | 5,9 | 0,4 | 139 | 4 |

| Gemini | 5,8 | 0,09 | 49 | 1 |

| Bitstamp | 3,5 | 0,2 | 30 | 3 |

The table with information about the best exchanges to buy Bitcoin coins is up to date as of the second half of October 2021.

Frequently Asked Questions

📊 What does the price of bitcoin depend on?

The cryptocurrency market is driven by supply and demand.

💰 How much to invest in bitcoin?

The main rule is to invest exactly as much as you can afford to lose. Experts recommend: the purchase amount should not exceed 5% of the portfolio.

❗ What coins should I buy in 2024?

Depends on the strategy. Long-term investors are recommended to purchase cryptocurrency on a regular basis (once a month/week) for the same amount.

🕜 When is the best time to buy bitcoin?

Long-term investors should purchase Bitcoin by strategy, without waiting for the price to drop. Short-termers should find the most favorable entry point when confident that the rate will go up.

🐳 Who are bitcoin miners?

They are people or organizations that have enough BTC to influence or even manipulate the value of the currency.

Is there a mistake in the text? Highlight it with your mouse and press Ctrl + Enter

Author: Saifedean Ammous, an expert in cryptocurrency economics.