When people talk about making money from cryptocurrency, they most often mean passive investing – a strategy with a minimum of action and a long time to hold a deal. However, there are also other ways. For example, scalping on Binance is a trading method in which a trader makes many trades with a small take profit. The strategy involves constant market analysis and high intensity of actions. Scalpers often use two or more monitors simultaneously. This method requires quick reaction, attentiveness, emotional stability. It takes a lot of time, so it is considered the most difficult and is not recommended for beginners.

Definition of cryptocurrency scalping

This is a strategy for earning money on small price movements. To get income, it is enough to close 1-2 points in the plus. In a day, the trader makes dozens (when working manually) or hundreds of transactions (using algorithms).

Most often orders are opened on the trend on M5 or M15. It may not coincide with the daily or weekly trend.

A scalper follows the slightest market changes and quickly rebuilds. During the day he can open deals on different instruments (coins).

Principles of earning

In scalping on Binance, you do not need to wait long for profits, so the strategy is recommended for dispersing the deposit. However, beginners often fail to set a stop loss due to unwillingness to receive a loss and lose the contribution. For profitable trading you need to:

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

- Develop a strategy. It is important to select signals that close in the plus in most cases.

- Establish risk management rules. A profit/loss ratio of 3 to 1 is often recommended. However, this will not work in scalping. More than 70% of deals are closed in the plus, so it is enough to set a stop equal to the take.

- Monitor different instruments. In manual trading it is enough to check 2-3, in algorithmic trading – all liquid coins. It is necessary to enter the most probable deal.

- Take a rest. This is especially important in manual trading. A person cannot keep concentration for more than 2-3 hours in a row. Therefore, it is necessary to take breaks or stop trading. Otherwise, the scalper will make mistakes due to fatigue.

- Do not allow long losing streaks. On some days, technical analysis works well, on other days – all signals close in minus. After 5-10 losing trades in a row, it is recommended to stop trading on a real account. You need to switch to a demo or stop.

Is it possible to earn and potential profit

The level of income depends on the quality of the chosen strategy and the trader’s ability to stick to it. The trading system should be tested on history for at least 3-6 months. During this time, hundreds of signals have been received, profitable and unprofitable series have happened.

Beginners often stop trading after a minus and switch to another strategy. Or they do not follow the established rules, which also leads to losses.

If the strategy is followed, a trader can earn up to 100% of the deposit per month. The result strongly depends on the market. Therefore, it is recommended to withdraw profits regularly.

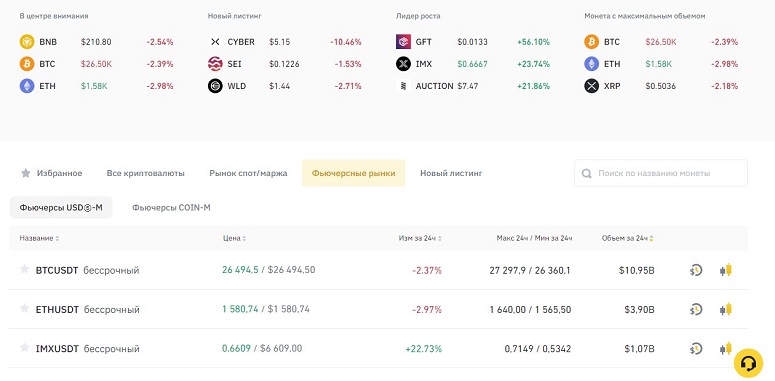

Which markets on Binance are suitable for scalping

Traders catch small price movements and trade for the entire deposit in each trade. To improve results, leverage (5-20) is used. Therefore, scalpers work more often on futures. However, sometimes it is more profitable to use illiquid but more volatile instruments. They do not provide crediting, so users trade on the spot market.

Commissions for scalping

The trader pays a service fee to the exchange for each trade. Investors can ignore such costs, but for a scalper it is a significant amount. Therefore, you should choose the exchange with the lowest commissions.

Increasing the fee even by 0.01% can turn a profitable strategy into a losing one. On average, exchanges charge 0.1-0.2% on spot and 0.005-0.05% on futures. Traders with large turnovers can get VIP status.

Useful tools for scalping on Binance

When opening trades, traders do not take into account the fundamentals. These factors affect the price only in the long term. Scalper trading is based solely on the application of technical analysis tools. Speculators look for local levels on a tick, 1M or 5M chart. Indicator signals and trading volumes are used for confirmation.

Cluster and tick charts

The most popular way of presenting stock market information is candlesticks or bars. Users receive data only on closing prices, opening prices and the direction of the rate for a given period. With the help of clusters, you can look inside a candle and see how many transactions have taken place in the market at each price level.

Scalpers don’t like to be tied to a timeframe because even 1 minute is a long time. You have to wait for the period to end before you can open an order. Tick charts contain all trades as a broken line (1 point = 1 executed order). In a minute, either 10 or 100 orders can go through. You can see it on a tick chart (you can’t see it on a candlestick chart). Therefore, it can be used to make more informed decisions.

Exchange stack and transaction feed

Medium-term traders analyze price charts, but for scalpers, the number of executed orders and market sentiment are more important. This information can be obtained from the Exchange Stack and Deal Feed. Some scalpers do not open a classic candlestick chart at all. Decisions can be made on the basis of such data:

- Spread. When the spread narrows and large orders appear in the stack, the probability of a strong movement in one direction increases.

- Liquidity. By the density of orders, the trader can understand what maximum order volume is safe to take. If it is higher than the total, the scalper will affect the quotes.

- Trend. If there are a lot of orders in different directions – there is a sideways movement in the market.

- Trading activity. The indicator helps to determine the possible volatility of the movement.

Indicators for scalping

Short-term traders use them only to confirm a decision or as an auxiliary tool. Many scalpers add a moving average to the chart. It can be used to quickly determine the prevailing trend. However, scalpers never open orders for a breakout or a rebound from it – they have a low probability of working out. They also use:

- Bollinger Bands – show the likely range of volatility. Bands are often broken especially on small timeframes, so you should not open trades on a breakout. Reaching the top or bottom is a signal to take profits.

- Relative Strength Index (RSI) – shows the probability of continuation of the trend.

- Ishimoku Cloud – shows local support and resistance levels, as well as the direction of the trend.

Suitable order types

The cryptocurrency exchange offers traders a wide range of orders – you can use stop, limit, split or price following orders. However, only market and pending orders are needed for scalping on Binance. When trading from density, traders enter at a predetermined price. It is necessary to look carefully in the stack – if the situation changes, it is necessary to remove the order.

When a pattern appears on the cluster chart, one should enter the trade as soon as possible. Therefore, the trader creates a market order.

Specialized programs

Scalpers need to react quickly to changing market conditions. Therefore, it is important to use software with a set of tools to accurately analyze the market. Scalpers customize robots to perform routine operations.

TradingView

This is one of the best terminals for trading and analyzing the market. Traders view candlestick and cluster charts, add vertical and horizontal volumes, built-in and custom indicators. TradingView has a strong community – you can share a trading idea or read the thoughts of other scalpers.

Binance clients can view TradingView charts directly in the trading terminal. To do this, you need to check the corresponding checkbox in the settings.

CScalp

This is a free terminal for scalper trading on financial markets. The developers adapted it for cryptocurrency trading. Users have access to such tools:

- Exchange stack. You can open, close trades and set stops with a click of the mouse.

- Chart. You can customize the candlestick or cluster view.

- Risk Calculator. This tool is used for scalping on Binance futures. You can use it to calculate the allowable drawdown.

- Financial result. Users can use the terminal for trading on several exchanges at once. The window displays the total P/E value.

Selecting a trading instrument

Fundamental for scalpers does not matter much. They close trades at the slightest change in the trend and put short stops. The main thing is liquidity, volatility and good trading conditions. You should also pay attention to the working out of signals.

There are coins, with which it will not be possible to use technical analysis. They are often manipulative assets, a large share of which is in the hands of the team and “whales”. It is hard to predict the behavior of large participants, so it is better to use more predictable coins.

How to estimate volatility and trading volumes

There are 362 coins that can be traded on Binance. Assets differ in liquidity and daily quote range. As a rule, the lower the trading volumes are, the easier it is to accelerate the price. On illiquid, you can raise the quotes by 10-20% even with a deal for $300. That is why you need to make trading decisions:

- Add the ATR indicator to the chart. It shows the average volatility for the specified number of candles. You can evaluate the range for the day and the last hour. You should not take night time into account when analyzing.

- Add a moving average to the chart of vertical volumes. This will help to quickly see candles with abnormally high and too low values. After observing the stack, the average transaction size on the instrument will become clear. You can set the highlighting of clusters with high volumes in a different color.

Tips for evaluating charts

It is extremely important for scalpers to choose the time for trading. For example, breakout strategies are best used in the American session or at the opening/closing of London. On a pullback, you can take at night or during the daytime (12:00-14:00). When evaluating charts, you should pay attention to the following factors:

- The general trend on the daily chart. In case of a pronounced longing trend (vertical growth) short signals even at 1M are poorly worked out.

- Average liquidity. Some coins do not allow using the working lot. The trader will not be able to quickly enter and exit.

- Volatility. The coin is not suitable for trading if the average ATR on a minute chart for 14 candles exceeds the stop. The probability of working off signals will be low.

Risk management in scalping

In short-term trading it is necessary to follow a strategy. When developing a risk management system, you need to take into account such points:

- The profit/loss ratio depends on the probability of working out signals. The lower it is, the smaller the stop should be.

- It is necessary to slowly increase the working lot. The user can raise the volume only when increasing the capital by 5-10 times. This will allow you to get into the plus even after a losing series.

- It is not necessary to keep more money on the account than is used for trading. Then, when the exchange is blocked or the scam of the coin, the trader will have funds to continue working.

Tips and Strategies for Scalping on Binance

Traders use different approaches to trading. There is no unambiguously best way, each can bring profit in a particular period. The table contains the main strategies for scalping cryptocurrencies on Binance.

| Category | Method | Comment |

|---|---|---|

It is necessary to clearly follow the chosen strategy. It is possible to assess the results only after completing a large number of operations. Therefore, you should not make hasty conclusions after a losing day or week. To analyze the results, it is useful to keep a trader’s diary.

Patterns and determining the entry point

The strategy prescribes the conditions for opening, maintaining and closing a transaction. Before trading on a real account, it is necessary to test the patterns. Traders can use such signals:

- Rebound from density. The scalper looks for large orders in the stack, puts out a limit order and a stop. With a high probability the level will not be passed the first time, and the trader will be able to take a small profit.

- Volume carryover. The trader observes clusters. With a pronounced trend, maximum orders are concentrated at the top or bottom of the candle. If the location has changed, it is a signal to enter the continuation of the trend. A large trader has appeared, which can set the momentum.

- Breakout of the sideways trend. Consolidation is formed for at least an hour. Good signals are supported by growing volumes.

Transaction technique in scalping

The main rule is to follow the strategy. It is necessary to clearly define the conditions for opening an order and exiting the transaction. It is necessary to understand what the scalper makes money on. Usually it is stops/margin calls of other participants or level protection by a large trader.

If the signal does not work (if the zone of interest is mistakenly defined), it is necessary to exit the position. There is no point in waiting for the stop level to be reached.

Examples of scalping on Binance

Short-term trades can be made on the spot and futures markets. You need to have money in both wallets to open an order. You should act quickly, sometimes there is no time to transfer. The algorithm of opening a deal is as follows:

- Analyze the market situation.

- Select coins.

- When a signal appears, open an order to buy or sell an asset.

- Set the stop and take.

- Wait for the order to be closed.

FAQ

📱 Can I scalp on Binance from my cell phone?

In theory, yes. However, it will not be possible to do it quickly, the user may not be able to react to changes in time.

✨ How to determine the order size when scalping?

In one transaction is not recommended to risk more than 0.2-0.5% of the account. It is necessary to calculate the allowable amount of loss in dollars, the levels of entry and cancel the signal. This data should be entered into the calculator to calculate the lot.

📌 Can I open several orders for different coins?

In theory, yes. However, scalpers do not do this. It can lead to too big a loss (if all orders close at the stop).

📢 What tools do scalpers use to find support and resistance?

Levels from the tape of trades and the stock stack work best. However, traders also use other methods: figures (“Flag”, “Head and Shoulders”), Fibonacci grid, trend channels.

🔔 What are the advantages of scalping cryptocurrencies over other markets?

Digital coins are volatile. This allows you to find trades at any moment. On stocks, good movements are possible only during the American session.

Is there a mistake in the text? Highlight it with your mouse and press Ctrl + Enter.

Author: Saifedean Ammous, an expert in cryptocurrency economics.