The process of listing coins on trading platforms is an important stage for a project that determines its future. After a cryptocurrency is listed on an exchange, the company improves its reputation and increases the number of users. The price of the asset often increases.

Not all companies successfully pass this stage. Entering the open market – new opportunities for further development of cryptocurrency. The launch procedure is an expensive stage for the company, which is divided into several stages.

Large exchange services have strict requirements. The company can be rejected if the experts of the site consider it to be of insufficient quality. Joining the trades has a favorable effect on the level of demand for the coin.

What is the listing of cryptocurrencies on the exchange

In English, listing means adding to the list. In the cryptocurrency sphere, it means the procedure for connecting digital assets to trading on the exchange. As a result, coins become available for purchase and sale. Once listed, the price of a coin will be influenced by the market mechanisms of supply and demand.

How cryptocurrency enters the exchange

The procedure can be launched by the developers of the koin. To do this, you need to submit an application to the relevant crypto exchange. Stages and requirements differ among services. The order of actions is usually as follows:

- Filling out the questionnaire. The purpose of the project, date of creation, link to the source code, official information document (Whitepaper), roadmap, data on developers are specified.

- Analysis of the request by experts of the trading platform. The experts evaluate the profitability of the project.

- A special commission decides whether to add a new asset to the list of trading resources.

- In case of approval, an agreement is signed.

Consideration of the request can take from a couple of days to several weeks.

5020 $

bonus pentru utilizatorii noi!

ByBit oferă condiții convenabile și sigure pentru tranzacționarea criptomonedelor, oferă comisioane mici, un nivel ridicat de lichiditate și instrumente moderne pentru analiza pieței. Suportă tranzacționarea spot și cu efect de levier și ajută comercianții începători și profesioniști cu o interfață intuitivă și tutoriale.

Câștigați un bonus de 100 $

pentru utilizatorii noi!

Cea mai mare bursă de criptomonede unde vă puteți începe rapid și în siguranță călătoria în lumea criptomonedelor. Platforma oferă sute de active populare, comisioane mici și instrumente avansate pentru tranzacționare și investiții. Înregistrarea ușoară, viteza mare a tranzacțiilor și protecția fiabilă a fondurilor fac din Binance o alegere excelentă pentru comercianții de orice nivel!

Companies first apply to unpopular exchanges. They often have softer requirements and simpler procedures. Developers choose this strategy with the hope of a favorable result and growth of quotes, which will attract representatives of other platforms. However, appeals initiated by employees of crypto exchanges are rare.

Indicatori

Specialists of platforms pay attention to such parameters when listing new cryptocurrencies:

- Functionality. Preference is given to cryptocurrencies with practical significance. The use of a koin to solve specific problems is a plus for developers.

- Security. Compliance with the standards of the site is an important factor for getting approval. Insufficient security of the project may entail a hack, which will affect the reputation.

- Professionalism of the team. Some sites request data on developers, their achievements.

- Compliance of the project with legal requirements.

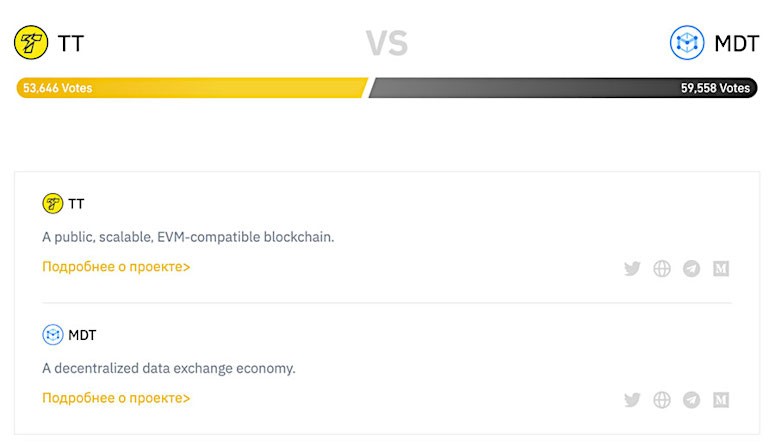

- Prelisting results. After the project has been evaluated by experts, a vote is held among the users of the trading platform. The results of the poll affect the speed of consideration by the commission. Cryptocurrencies that received more votes are studied first.

Listing fees

Including a company in trading instruments is a costly process for its founders. The amount of the fee depends on the popularity of the platform. The prices of large exchanges for cryptolisting can reach millions of dollars.

However, there are ways to go through the procedure for free. For example, some small exchanges may not charge a fee. Large ones sometimes hold promotions, within the framework of which the service is free. A good example is voting among users on Binance. The winning coin gets the right to a free listing.

It is impossible to name the exact exit price. The data are contained in confidential contracts, which stipulate a condition of non-disclosure.

The table shows the approximate listing fee (information collected on forums).

| Nume și prenume | Preț |

|---|---|

| Kraken, Bithumb, Coinbase, Poloniex | |

| Exmo, Huobi Global, KuCoin | |

| Yobit | |

| Coinexchange | |

| Kuna, Tradesatoshi |

Binance CEO Changpeng Zhao mentioned in a statement that no amount of money will make them list low-quality projects. He encourages developers to think about whether their cryptocurrency is good enough in the first place. To prove his words, he reminded that such projects as Efirium, Lightcoin, EOS, Ripple were added for free.

However, the founders of the companies are ready to invest large sums. Successful listing with major exchanges is a sign of the quality of the coin, which attracts new users.

Delisting

Getting a project listed on a trading platform does not guarantee that it will stay there forever. The service can delist a company from the resource. The coin can be removed from the platform for several reasons:

- Changes on the part of regulators.

- Hacking of the cryptoproject.

- Complaints from traders.

- Developers do not adhere to the development plan.

- Lack of price growth over a long period of time.

- Low liquidity.

- Non-compliance with the rules of the crypto exchange.

- Fraud on the part of developers.

If the price often rises when the asset is included in the trades, delisting has a negative impact on the exchange rate. The removal of cryptocurrency from the trading platform is perceived negatively by traders. Users realize that the project is unpromising and sell the asset.

Strategies for earning on the listing

Expecting an increase in the price of the asset, traders can profit when the koin enters the open market. The principle of earning is simple:

- Tracking news and looking for companies planning to list.

- Buying the asset before it hits the exchange.

- Selling the koin after it is listed.

It is important to get the timing right. Beginners are recommended to sell koins within a few days after the coin enters the market. If the user knows how to analyze the corecție phase, it is possible to wait for a higher price.

It is important for traders to assess the risks and pay attention to:

- The popularity of the trading platform. The release of the coin on small exchanges may not cause the expected growth of quotations.

- Prospectivity of the coin. Entering the open market does not always affect the dynamics of coin sales.

- Credibility of news and publications. The announcement may not be true. It is recommended to check information and trust official sources.

The best exchanges for making money

Services build strategies for accepting new assets in different ways:

- Binance. The platform’s goal is to add as many quality coins as possible and create liquidity.

- Kraken. The resource offers few tools for trading. Coins are carefully selected. Attention is paid to cryptocurrencies with the highest turnover.

- Bitstamp. The service is focused on European digital assets and works in this region.

385

103

Some crypto exchanges bring anycoins to the market without properly analyzing the project. The main thing is to attract an audience of traders. Often these are Asian services.

Choosing a crypto exchange, developers should look at:

- Reliability and security of the resource.

- Limitations of the platform.

- Efficiency and globalization of the service.

- The price of the procedure.

Rezumat

The inclusion of cryptocurrency in the list of resources available for trading is an event that largely determines further trends in the development of the project. Thanks to the listing, companies can:

- Increase investor interest in the koin.

- Expand the user base.

- Increase the reputation of the project and the level of trust.

- Increase capitalizare.

- Gain new prospects for development.

For traders it is a great opportunity to earn on short-term investments.

Întrebări frecvente

💵 How much does listing cost?

The price of the procedure is individual and is negotiated between the exchange and the platform.

🤝 Do all applicants get listed on the open market?

A crypto exchange can reject a company at any of the verification stages.

🔻 Will the coin’s exchange rate drop after delisting?

Most likely, this process will have a negative impact on the price of the asset.

😟 Can exchanges add fraudulent projects?

If the trading platform does not carefully select applicants, this situation is possible.

🤔 Which digital currencies are more likely to end up on leading crypto exchanges?

Coins with useful functionality, a proven development team and a large community successfully pass the verification procedure.

O greșeală în text? Evidențiați-o cu mouse-ul și apăsați Ctrl + Introduceți

Autor: Saifedean Ammous, un expert în economia criptomonedelor.