Southeast Asian countries are often considered as drivers of the digital assets market. According to the resource CoinMarketCap, the average daily trading volume of the 4 largest South Korean crypto exchanges (Upbit, Bithumb, Coinone, Corbit) in November 2021 is $10.71 billion. More than 260 coins are represented on these platforms, 33% of which come to the market from local projects. Bitcoin accounts for only 15% of total sales, well below the global figure. The top three traded Korean cryptocurrencies are TMTG, ANW, and FLETA. But LUNA, KLAY, KOK have gained international popularity.

Peculiarities of cryptocurrency regulation in South Korea

In 2021, the intergovernmental Financial Action Task Force (FATF) updated the recommendations on working with digital assets several times, calling on countries to strengthen control over the market. Against this background, the cryptocurrency law in South Korea became a logical continuation of the state’s policy aimed at full legalization of the industry.

The new rules came into force in March 2021. The legislator equated exchanges and companies working with digital coins to financial organizations. They are now required to obtain an information security management system (ISMS) certificate, authenticate customer names and comply with KYC requirements. To trade cryptocurrencies, traders need to open an account with an authorized bank, which can be used to deposit and withdraw digital coins.

The country’s financial regulator (FSC) strictly enforces the rules. In September 2021, 35 crypto exchanges (Darlbit, Bitsonic and others) were closed down, whose activities were recognized as illegal. Restrictions also apply to foreign trading platforms. They need to obtain authorization documents from the Financial Intelligence Unit (KFIU).

Also, from January 2022, amendments to tax laws will come into force in South Korea. Citizens will be obliged to pay tax on income from transactions with digital assets worth more than 2.5 million Korean won (about $2.1 thousand at the exchange rate as of the end of November 2021).

Despite the tightened regulation, the demand for cryptocurrency in the country continues to grow. According to Korean media, the number of registrations on the Bithumb exchange in 2021 increased by 760% in comparison to 2020. During the same period, the number of new accounts at NH Nonghyup Bank, Shinhan Bank and K bank increased by 30% (from 1.08 million to 1.4 million).

Popular Korean cryptocurrencies

In November 2021, the analytical company Broker Chooser published a report on interest in digital assets based on the analysis of Google rendition. Experts compared the indicators of September 2020 and 2021. It turned out that most often users were looking for information about fast-growing coins. The top three leaders who showed the largest annual price jump were:

5020 $

bonus pentru utilizatorii noi!

ByBit oferă condiții convenabile și sigure pentru tranzacționarea criptomonedelor, oferă comisioane mici, un nivel ridicat de lichiditate și instrumente moderne pentru analiza pieței. Suportă tranzacționarea spot și cu efect de levier și ajută comercianții începători și profesioniști cu o interfață intuitivă și tutoriale.

Câștigați un bonus de 100 $

pentru utilizatorii noi!

Cea mai mare bursă de criptomonede unde vă puteți începe rapid și în siguranță călătoria în lumea criptomonedelor. Platforma oferă sute de active populare, comisioane mici și instrumente avansate pentru tranzacționare și investiții. Înregistrarea ușoară, viteza mare a tranzacțiilor și protecția fiabilă a fondurilor fac din Binance o alegere excelentă pentru comercianții de orice nivel!

- Shiba Inu. The meme project rose in price by 2.4 million percent (from $0.000000000001 to $0.000008416).

- Dogecoin. The American koin, which received unexpected support from Ilon Musk, rose in price by 9567 percent (from $0.003122 to $0.2944).

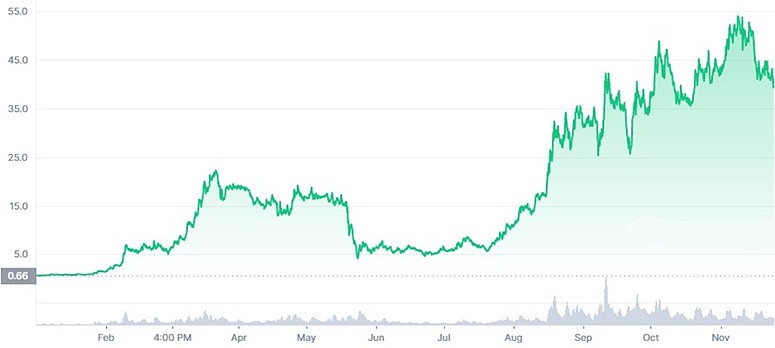

- Terra. The Korean cryptocurrency’s exchange rate increased by 6496% (from $0.3261 to $30.51).

Asian coins are also leading in terms of popularity: over the year the number of search queries for SHIB increased from 70 to 1.5 million, Terra (LUNA) – by 18 100%. At the same time, Japanese traders more often buy large cryptocurrencies (Ethereum, Cardano).

South Korean investors prefer to invest in local projects (Klaytn, Terra, FLETA and others).

| Criptomonedă | Capitalization in November 2021 ($) | Average daily trading volume in November 2021 ($) | Price in November 2021 ($) |

|---|---|---|---|

| FLETA (FLETA) | 25.85 mln | 3.25 mln | 0,022 |

| AhaToken (AHT) | 63.31 mln | 29.18 mln | 0,023 |

| Nestree (EGG) | 17.03 mln | 1.88 mln | 0,007 |

| Mil.k (MLK) | 114.24 mln | 87.06 mln | 1,46 |

| FirmaChain (FCT) | 66.50 mln | 22.39 million | 0,197 |

LUNA

The native coin of the decentralized payment system Terra “shot” in January 2021, when it raised $25 million in a funding round with Coinbase Ventures, Galaxy Digital, Pantera Capital. Already a month later, the asset rose in price by 1400% (from $1.43 to $21.98). In November, LUNA trades at $42.06 with a capitalizarea de $16.72 billion. The issue of cryptocurrency is unlimited. New coins are created and burned by the system when needed. 875,865,265 units of the asset have already been issued. There are 398,985,869.13 LUNA in circulation. You can buy them on Binance, Kucoin, Huobi Global and other exchanges.

The Terra ecosystem is a payment network built on Monede stabile. Traditional services involve intermediaries that deduct up to 5% of the transaction amount. Terra reduces commissions for merchants to 0.5% and provides a discount to end users of 5-10% of the transaction.

The ecosystem provides 2 types of coins:

- Stablecoins (UST, MNT, KRT and others) linked to traditional currencies.

- LUNA is a native cryptocurrency that regulates the prices of stablecoins and performs management functions (voting, system support, paying rewards to block validatori ).

Terra cooperates with many payment services (Chai), providing fast and cheap cryptocurrency payments. The project is supported by a group of companies and e-commerce platforms from 10 countries, which serve more than 45 million users.

TMTG

Korean cryptocurrency The Midas Touch Gold is positioned by developers as the world’s first virtual coin tied to real gold. The asset can be exchanged for other coins and fiat on exchanges or converted to precious metal at a 1:1 ratio on the DGE (Digital Gold Exchange) platform.

The project is developing a blockchain-based ecosystem for free trading of cryptocurrencies and traditional assets. The platform cooperates with the Korea Gold Exchange 3M, which acts as a supplier of gold. The developers plan to expand the range of real assets with natural resources and bonus certificates.

TMTG is an ERC-20 standard simbol created in the Ethereum blockchain. In November 2021, the asset is ranked at 708 in the CoinMarketCap ranking. The cryptocurrency trades at $0.004545 with an average daily volume of $4.95 million. The market capitalization of the coin is $40.23 million. TMTG issuance is unlimited. There are 8.83 billion units of the asset in circulation. The cryptocurrency can be bought on Bithumb, Bitglobal, Coinone, OKEx and some other platforms.

KOK

Keystone of Opportunity & Knowledge is a blockchain-based digital content platform that competes with traditional media giantsNetflix, YouTube and Play Store. KOK Play’s decentralized ecosystem is changing the rules of the game in the content market by eliminating monopolization focused on profits rather than user interests. The project is created in a combination of artificial intelligence, big data and blockchain technologies, the powerful potential of which ensures transparency, speed and fairness of media distribution. All this is made possible by the system’s internal cryptocurrency KOK.

Developers have provided coin holders with 3 directions for earning money:

- Participation in virtual games.

- KOKminerit.

- Investing in digital currency.

KOK coin entered the markets in early 2020. The rapid growth of the rate occurred in 2021: in 11 months, the asset added more than 1400% in value (from $0.25 in January to $3.58 in November).

KOK’s market capitalization is $385.02 million. This provides the asset with a 259th place in the CoinMarketCap ranking. The total supply of coins is 5 billion. However, the KOK issue is not limited. The developers plan to issue as many units of currency as needed to support the growing ecosystem. In November 2021, there are 107,333,422.49 KOK in circulation.

BORA

The media business is a highly competitive niche. Another Korean project provides a direct link between content creators and consumers. BORA is a decentralized entertainment platform that offers incentives to participants:

- Users get quick access to quality games, movies, music, educational programs and opportunities to multiply savings.

- Content developers can easily deploy applications on the BORA blockchain (BApps), test them and bring them into the ecosystem for rapid commercialization.

The project collaborates with international teams that create digital products in various fields (IT, entertainment, education, healthcare, investment).

The BORA digital currency is a native token for all platforms created on the blockchain of the same name. This ensures the crypto coin’s growth in the long term.

BORA is traded on Upbit, Bithumb, Coinone and other cryptocurrency exchanges in November 2021. The current price of the asset is $1.32. The average daily sales volume is $927.90 million. BORA ranks 100th in the list of the largest projects by capitalization on CoinMarketCap with a value of $1.13 billion. Coin issuance is unlimited. The total supply is 1,205,750,000 coins. There are 861,250,000 BORA coins in circulation.

KLAY

The native token of the Klaytn decentralized network was issued in 2019 by GroundX, a subsidiary of KAKAO. KLAY runs on its own network (Mainnet) in 2021, presenting businesses and developers with convenient access to the blockchain. The hybrid platform combines the functions of public and private systems:

- Decentralization.

- Distributed management.

- High transaction speeds.

- Scalability.

This makes Klaytn one of the most efficient and easy-to-manage platforms for creating digital applications (dApps) of any complexity. The decentralized nature of the platform allows it to be used in many areas, including digital asset management, collection and trading. This attracts the attention of institutional investors (Piction Network, Humanspace, Wemade Tree) to the project.

In 2021, KLAY’s exchange rate was on the rise thanks to high-profile partnerships (Observer, Kai Protocol, Triumph X, Binance). At the price peak in March, the coin was worth $4.25.

In November, the asset is trading at $1.5. KLAY is ranked 50th in the CoinMarketCap rating with a capitalization of $3.79 billion. The issuance of digital currency is unlimited. 10,729,262,426 crypto coins have already been issued. There are 2.53 billion KLAY in circulation.

Rezumat

At the peak of the ICO boom in 2017, South Korea accounted for 25% of global cryptocurrency turnover. Tightening regulations for 3 years reduced interest in digital assets in the country. In 2021, Korean investors are actively investing in crypto coins again, with turnover several times higher than the local stock market.

Întrebări frecvente

❓ What is the “Kimchi Premium?”

It is the difference in the price of bitcoin in the Korean and global markets. It is 15% in 2021.

💰 Which Korean coin has shown the biggest growth in 2021?

LUNA’s exchange rate has increased by more than 6000% since January. The asset is trading at $39.21 in November 2021.

🏢 Which Korean exchanges are in the global top in terms of capitalization?

In November 2021, Bithumb is ranked #17 on CoinMarketCap ($2.85 billion), while Upbit is ranked #19 ($9.21 billion).

🔑 Which major cryptocurrencies are popular in South Korea?

Ethereum, Cardano, EOS, and Qtum have strong positions in the country in 2021.

🔎 What taxes do Korean miners pay?

The country’s new cryptocurrency law has equated BTC and other koins as digital assets. The tax on mining will be introduced in 2022 and will amount to 20% of the price of coins mined in a year.

Există o greșeală în text? Evidențiați-o cu mouse-ul și apăsați Ctrl + Introduceți

Autor: Saifedean Ammous, un expert în economia criptomonedelor.