One of the problems with cryptocurrencies is inconvenience. Users have to install wallets on PCs and exchange coins for fiat in advance to spend tokens. Because of this, they are mostly used by miners and traders. Popular exchanges, including Binance, have decided to fix this problem. However, it is still unknown how to get a Binance card in Russia and when such an opportunity will appear. It works in test mode in Europe.

Basic information about the Binance Visa card

Externally and according to the principle of operation, it is similar to a bank debit card. You need to replenish a special account in advance to pay with it in stores. The cryptocurrency card is issued in 2 variants:

- Virtual

- Physical.

Both have the same conditions, but the first users receive immediately after registration, and the second will have to wait.

Working principle and features of the card

Binance Card is connected to Visa, so all transfers are made through it. The user can buy goods and services in any place where there is a bank terminal of this PS. At the same time, there is no need to look for devices that accept BNB or BTC, since the exchange and the payment system have implemented an exchange mechanism. How it works:

- The user applies Binance Card to the terminal.

- Visa transmits the information to the exchange.

- Binance exchanges money at the current exchange rate and sends fiat.

- The merchant receives payment.

This is the main feature of the card – convenience. A person does not need to calculate spending and buy euros or dollars in advance, losing money due to the commissions of several services.

5020 $

bonus pentru utilizatorii noi!

ByBit oferă condiții convenabile și sigure pentru tranzacționarea criptomonedelor, oferă comisioane mici, un nivel ridicat de lichiditate și instrumente moderne pentru analiza pieței. Suportă tranzacționarea spot și cu efect de levier și ajută comercianții începători și profesioniști cu o interfață intuitivă și tutoriale.

Câștigați un bonus de 100 $

pentru utilizatorii noi!

Cea mai mare bursă de criptomonede unde vă puteți începe rapid și în siguranță călătoria în lumea criptomonedelor. Platforma oferă sute de active populare, comisioane mici și instrumente avansate pentru tranzacționare și investiții. Înregistrarea ușoară, viteza mare a tranzacțiilor și protecția fiabilă a fondurilor fac din Binance o alegere excelentă pentru comercianții de orice nivel!

The website displays the card balance in the currency of the country in which the “plastic” was registered. The amount in fiat depends on the exchange rate of tokens and can change during the day.

The tool works with 15 cryptocurrencies, so Binance added the ability to line up coins by spending priority. The feature comes in handy when one of the tokens has gone up in price and a person wants to spend it before the next rate drop.

In addition to paying for services, users can withdraw money from ATMs. Any terminal connected to Visa will do. It is only necessary to enter the PIN-code and choose the amount up to €290.

For those who prefer NFC, it is possible to link the card to Google Pay and Samsung Pay. It is not yet possible to add Binance “plastic” to Apple’s payment system.

Card design

The exchange issues Visa Card only in black color with a silver logo of the platform. There is no option to customize the design in 2023.

Supported cryptocurrencies

Although the platform sells and buys more than 100 coins, the card balance is topped up with only 15 tokens. Among them: BNB, BUSD, USDT, BTC, SXP, ETH, ETH, EUR, ADA, DOT, XRP, AVAX, SHIB, LAZIO, PORTO, SANTOS.

Those who have not previously owned cryptocurrencies and have not been following the exchange rates should buy stablecoins. USDT, BUSD are pegged to the dollar, so their price does not change so much, unlike BNB, BTC, ETH. They are more reliable and stable, because of which the balance in fiat will not suddenly decrease by more than 10%.

Card limits

Limits depend on the type of Binance Card. Plastic gives more opportunities, including withdrawal of funds through ATMs. It is worth considering all the limits.

It is worth noting that the volatility of coins will not affect the limit. If the user exchanged 0.1 BNB for €30, and then the cryptocurrency goes up in price 2 times, the exchange will not count €60. Prices at the time of the transaction are taken into account.

Cashback and its size

The disadvantage of the cryptocurrency card is a weak rewards system. Cashback is paid depending on the amount of BNB on the wallet. Other coins do not affect it. The exchange determines the amount of cashback taking into account the average monthly balance.

The system consists of 7 levels. The first one pays 0.1% and it is enough to keep 0 BNB, and the last one will require 600 BNB, but the amount of reward increases to 8% from each purchase.

The card account balance is calculated for the past 29 days, including yesterday. It is not necessary to constantly keep a certain stock of tokens to get a new level, as the average amount is taken into account.

If a user kept 650 BNB for 28 days and withdrew money on the 29th day, he will get the seventh level. The exchange will determine that 627.5 BNB was lying around each day.

Card issuer

Binance Card issuance in Europe is handled by Swipe. The manufacturer opens physical payment instruments and binds them to digital assets. It is worth noting that it is not yet possible to create a virtual Binance Card in Russia and Kazakhstan.

Available countries

Cryptocurrency Visa Card is issued only in the states that are members of the EEA. It can be ordered in Western and Eastern Europe, Greece, Iceland, Ireland, and St. Maarten.

For those who have a passport of another country, there is a possibility to bypass the restriction. It is necessary to temporarily move to Europe, and then complete the process of identity verification and confirm the address of residence. After that, it will not be difficult to make a plastic card.

Is it possible to order in Russia

In the Russian Federation, it is impossible to issue a Binance Card. This service was not offered to Russians from the very beginning. In 2022, due to EU sanctions, the country was disconnected from the Visa payment system, and the cryptocurrency exchange restricted access to functions.

It is not known when it will be possible to open a Binance Visa card in Russia. At the same time, it is not necessary to go to Europe for a while to get a “plastic” there. The payment system has left the Russian Federation, so the country is not connected to the international infrastructure of Visa. Consequently, cards in Russia can not exchange data with the exchange and be used to pay for goods.

Advantages and disadvantages of the Binance card

This is a new way of buying services, which brings cryptocurrencies closer to everyday life. With a plastic card, users can pay with digital assets without exchange for fiat and additional commissions. Everything happens in automatic mode. Other advantages of Visa Card:

- Support for 15 popular cryptocurrencies.

- Ability to add to Google Pay and Samsung Pay.

- No commission and annual service fee.

- Work in all countries where Visa is available.

Of the disadvantages, it is worth highlighting the fact that full verification of identity is required, as well as a limited number of countries. In the future, the exchange plans to connect new regions.

How to get a virtual and plastic card Binance

Become the owner of a debit Visa can any user of the platform who lives in the territory of the EEC. Before issuing a Binance card, you need to pass identity verification with address confirmation. Then it will remain:

- Open the “Finance” section of the website.

- Click on “Binance Visa Card”.

- Fill out the questionnaire.

- Click on “Order a card”.

Within a day, a virtual one will appear in your personal cabinet, and the plastic one will be delivered by mail. The exact term depends on the country and the issuer’s workload.

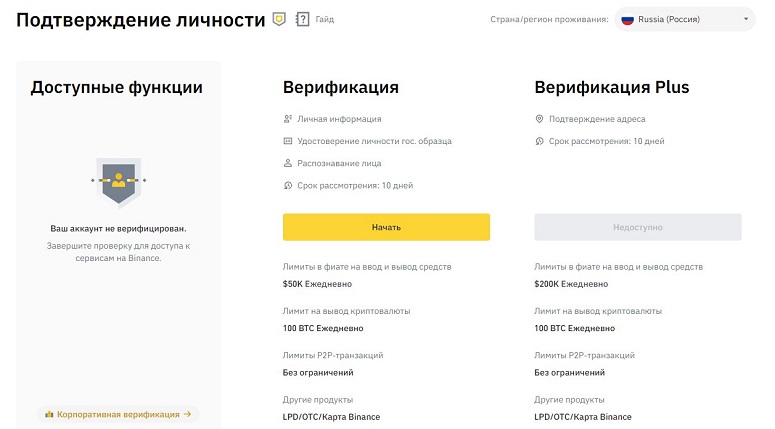

Verification of identity to obtain a card

This is a mandatory procedure on all centralized exchanges. It is necessary to verify the personal data of the client and to ensure the safety of system users. Thanks to full de-anonymization of identity, Binance will easily find fraudsters and pass the information to the police.

KYC is an acronym from the phrase “know your customer”. This procedure is found everywhere – in banks, on cryptocurrency exchanges, at cell phone operators. You should not worry about the safety of information. The contract with the platform provides for the transfer of information only in special cases, for example, at the request of law enforcement agencies.

To use all the functions of the platform and order a plastic card Binance Visa, you need to pass a basic verification of identity. To do this, send:

- A completed questionnaire.

- A scan copy of a passport or driver’s license.

- A photo of the face.

Verification takes up to 10 days, but usually moderators change the status in the personal account within 1-2 days. “Verified” account is enough to use a plastic card, Binance Pay and other services. How to pass identity verification:

- On the exchange’s website, go to the “Verification” section.

- Choose a country, and then – one of the levels.

- Enter personal information.

- Specify location data and phone number.

- Upload a document photo and face scan taken through the app.

- Send.

It is worth downloading the official program in advance. It is not possible to upload pictures to the site.

Cost of issuance and delivery terms

Virtual and plastic cards are offered for free, but the post office may require money for transportation. The physical one is issued in 2-3 days, and shipping takes about a week. On average, users wait about 5-8 days. In countries where there is no issuer, the period increases to 14 days.

Customers can track the status in their personal cabinet. If there is a delay or the exchange refuses to issue a “plastic”, there will be a notification about the reason.

How to use Binance Visa

The card in operation does not differ from bank cards. The only difference is that before buying cryptocurrencies are exchanged, and the “plastic” itself is connected to the exchange.

Card activation

To start using a payment instrument, you need to finish binding to the account. When the status changes to “Shipped”, the “Activate” button will appear next to it. It should be clicked on, and then:

- Enter the CVV-code on the back of the “plastic”.

- Rewrite the PIN-code on the screen. It is not displayed in the cabinet, but it can be viewed by passing 2FA.

After binding, it will remain only to transfer cryptocurrency to the balance. The card already works and is ready for purchases.

Available payment transactions

Owners of a debit Binance Visa can perform the same actions as with a bank “plastic”. Users pay for goods and services in any physical and online stores that accept “Visa”. There is no special limitation of countries where “plastic” does not work.

To buy a service with the card, you need to replenish its balance in advance, and then simply attach it to the terminal. If there is enough money on the account, the operation will take 1-2 seconds.

Blocking

Binance has provided an opportunity to freeze and delete the instrument in case of loss or leakage of details. To do this, you need to open the profile and click on the “Card Blocking” button. If desired, it can be unfrozen by confirming the identity with 2FA.

Although the exchange offers the “plastic” for free, reissuance will cost €25. The amount is deducted directly from the wallet.

Întrebări frecvente

🛒 Should I buy stablecoins?

Yes. They are more stable than standard assets. If a person does not plan to make money on the rate growth, this option is better suited, especially for cryptocurrency Visa Card.

💳 Is it possible to replenish the balance by card number?

No. Payments are accepted only to the linked wallet. You can see its address in your personal cabinet.

📌 What happens if the payment is rejected?

After exchanging the cryptocurrency for fiat and refunding the money, the user will receive euros, not tokens.

🤑 Why is there no dollar on the P2P exchange?

Because Binance was used to circumvent EU sanctions, the platform blocked access to two currencies for Russians. In 2023, it is impossible to pay in euros and dollars.

✨ How to change the priority of cryptocurrencies?

This is done on the card page, which shows the balance and the list of coins. To put a different priority token, you need to move it up with the mouse.

⚡ What is Binance Pay?

This is the payment system of the exchange, which works in the same way as services from Apple and Google. It allows you to buy goods for cryptocurrencies, quickly send coins and perform other transactions.

Eroare în text? Evidențiați-o cu mouse-ul și apăsați Ctrl + Introduceți

Autor: Saifedean Ammous, un expert în economia criptomonedelor.