Initial Coin Offering or Initial Coin Offering is a convenient way to raise funds for the launch and development of blockchain startups. The debut realization of the mechanism for attracting investments took place in July 2013. Jay Willett got investors interested in the idea of a bitcoin add-on. This would increase the functionality of the payment system. The developer offered to buy ICO tokens for Bitcoin promising that with the development of the project their price would increase.

Startup Mastercoin (later the name was changed to Omni Layer) collected 4.7 thousand BTC during the crowdsale, at the exchange rate of that time – $0.5 million. But a few months later, the price of bitcoin increased, and the project’s asset increased 10 times. A year later, Vitalik Buterin (founder of the Ethereum platform, on which smart contracts can be deployed) also organized an ICO. The initial coin offering attracted 31.6 thousand BTC or $18.5 million.

With the development of the crypto market, interest in ICOs and related tokens increased. The boom came in 2017, when a record number of projects were launched. Most of them (about 90%) turned out to be scams and closed down immediately after collecting assets. Some of the startups are still working (January 2022), but do not show significant results. Only a few projects became successful (Polkadot (DOT), EOS).

The concept of ICO tokens

The initial coin offering has 2 purposes. The main one is to raise money to finance the project (the work of programmers, marketers and managers). Another task of the tokensale can be called informational promotion of the startup. Since such events attract the attention of the entire crypto community, people become interested in new ideas and developments. This is how a support group – a community – is formed.

ICO tokens are a digital asset that the project organizers offer to buy to investors at a fixed price. Coins are not mined by mining or forging. The issuance is done in advance in a limited volume.

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

The initial offering of coins takes place in several stages:

- Private Sale. A preparatory stage when a white paper and a roadmap for the startup are published. The purpose of the private sale is to attract “benchmark or anchor” investors. The value of ICO tokens is lowest at this stage.

- Presale. During the presale period, a lot of promotional activities are carried out. On thematic forums and in the media, all the developments and innovations of the new platform are covered. Support groups are registered on Facebook, Twitter, Telegram and Discord.

- Crowdsale. The main stage of the tokensale, when the entire planned part of assets is realized. All altcoins are sold, subject to limited issuance.

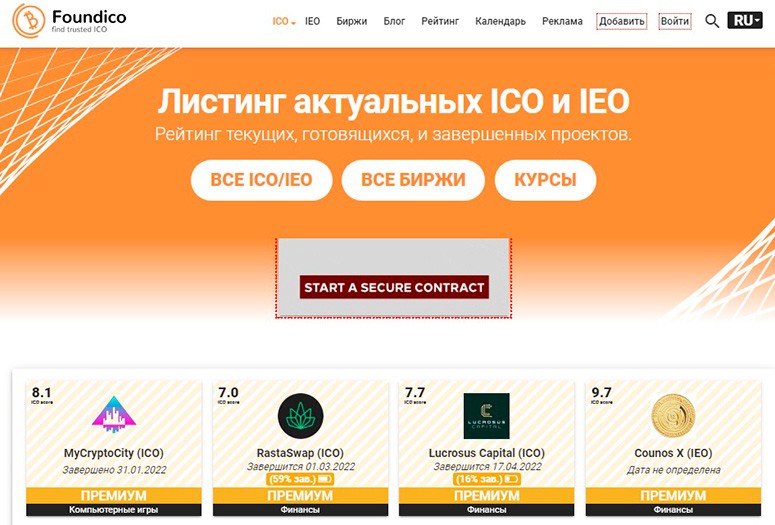

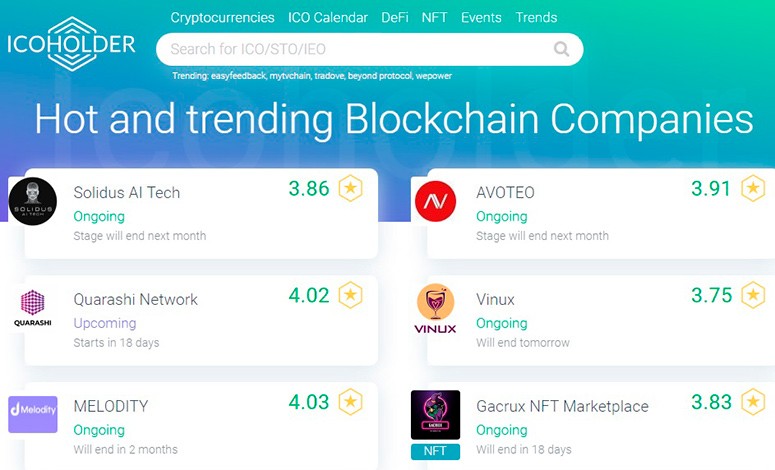

Digital asset price monitoring services collect crowdsales in a separate list – the cryptocurrency ICO calendar.

At different stages of the initial offering, the cost per 1 token is different. The earlier an investor participates in a crowdsale, the lower the price.

Difference between a token and a coin

In the 13 years since the emergence of bitcoin (January 2009), the cryptocurrency market has grown tremendously. At the beginning of 2022, the number of different types of digital assets exceeded 9 thousand. Most of them are developed according to the principles that were laid down by Satoshi Nakamoto in the first virtual currency:

- Decentralization – provided by blockchain technology.

- Absence of intermediaries – to transfer funds, you only need to know the address of the recipient’s cryptocurrency wallet.

- Anonymity – the transaction information that is recorded in the blockchain does not contain personal data.

Despite the common mechanisms of action, the functions of cryptocurrencies can differ. Some of them are used only as a financial instrument (means of payment or investment). Such digital assets operate on a unique distributed ledger and form a common payment system with it. The unit of such cryptocurrencies is a coin or koin.

Tokens are referred to as a payment element that has a purpose within the system. They are usually developed for specific purposes based on already existing blockchains.

Types of ICO tokens

Depending on the purpose, an investor can use native cryptocurrencies in different ways. The following types of tokens are distinguished.

Utility tokens

The presence of utility tokens gives the holder the right to use the services offered by the issuer. It is possible to get a discount or premium account.

Security tokens

This type of digital currencies provides the holders with the opportunity to receive dividends or confirms the right to a share in the project assets. In terms of parameters, security tokens are similar to classic shares or securities. That is, they are immediately secured by authorized capital, precious metals and even real estate rights.

Security tokens must be approved by the U.S. Securities and Exchange Commission (SEC).

Platforms tokens

Many cryptocurrency exchanges issue internal altcoins to increase liquidity and stimulate trading activity. Token holders receive:

- A voice in determining the development path of the trading platform.

- A discount on commission fees.

- The ability to replenish the exchange wallet and withdraw fiat money in larger amounts.

The main platforms for cryptocurrency projects

When launching a startup, developers often use a ready-made blockchain of another system. It is modified or an add-on is added to increase the speed of transaction processing and solve scalability problems. The list of platforms that are frequently used includes:

- Ethereum is the first project to start using smart contracts. With the help of Etherium, it is possible to tokenize valuable assets (shares, loans, lottery tickets, etc.). The convenience of the platform for developing new tokens is that there are ready-made templates that can be used for different purposes (ERC-20, ERC-721, ERC-1155).

- Tron is an ecosystem for developing and running decentralized applications (DApps), in the environment of which it is possible to organize the issuance of native tokens. Like Ethereum, the platform has its own token standards – TRC-10 (basic), TRC-20 (custom) and TRC-721 (for non-mutually exchangeable coins).

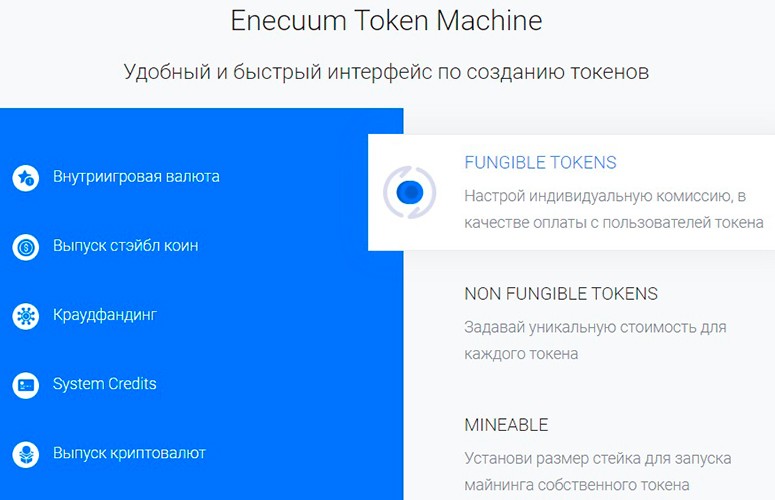

- Enecuum – the platform uses a new type of branched blockchain (HyperDAG) that can run on mobile masternodes. In addition, the developers have introduced a smart contract – SHARNELL. With the help of it, new coins are launched.

- EOS.IO – a platform for developing e-Commerce services, trading tools, exchanges and other blockchain projects.

- Waves – the project offers a wide range of tools for creating custom tokens. The advantage of the platform is its intuitive interface, which is suitable for those who do not have extensive knowledge of blockchain technologies. It is the first ecosystem developed for launching ICOs.

Principle of token distribution

When conducting a crowdsale of a cryptocurrency unit between participants, different distribution models are applied.

| Name | Description |

|---|---|

| Fixed sale | The principles of coin distribution are known before the auction (prescribed in the White Paper). Their quantity and price do not change. If after the tokensale the minimum amount is not collected (softcap), all assets will be returned to the owners. |

| Non-fixed distribution | The model is characterized by the absence of limits on the value of 1 coin. The price is determined after the end of the crowdsale depending on the number of participants and the size of the investment. |

| Fixed auction | The number of coins sold is tied to the hardcap. This means that the price of the cryptocurrency is determined by the market mechanism. When the maximum amount needed for funding is reached, the distribution will stop. |

| Non-fixed auction | The reverse situation. The number of coins is finite, but there is no upper limit to the amount collected. The investors who have offered the highest price can be the first to bid. |

| Hybrid model | A variant when a distribution is used that combines different parameters of the main models |

How to buy and sell ICO tokens

When an investor decides to invest in the development of a blockchain project through participation in a crowdsale, he needs to study the conditions under which the initial offering will take place. Important indicators:

- The price per unit of cryptocurrency.

- Minimum amount for investment.

- ICO token distribution model.

- The availability of a native wallet for the project.

Information can be obtained from the White Paper or in messages that the organizers distribute through the community – social networks, thematic forums, aggregator sites.

The next step is to register on the company’s website. The organizers are interested in attracting investors. Therefore, the instructions for filling out the participant questionnaire are detailed. The process takes 10-20 minutes. In some cases, it is necessary to undergo KYC (identity verification). This can lead to a slight delay, since the processing of personal data is carried out in manual mode.

After authorization on the site in myAlpari, it is necessary to select the number of altcoins for purchase and transfer funds.

As assets for investment, stable cryptocurrencies (BTC, ETH, TRON) or stablecoins are often used.

If the required amount is collected during the tokensale, all participants will receive their share of coins. They can be immediately sold on the exchange, if the token manages to be listed, or kept – in the hope that the price will rise.

Bottom line

Participating in an ICO can be a good way to invest money. The process itself is not complicated and does not require an understanding of the principles on which cryptocurrency is based. The main problem is the lack of unified legislative regulation. Many startups turn out to be fraudulent and investors simply lose their savings.

To better navigate the ICO space, you can turn to sites that collect data on current projects. Some of these resources provide analytical assessment of startups and calculate the probability of receiving high income.

Frequently Asked Questions

❗ Is it possible to lose digital assets or fiat when participating in an ICO?

Yes. Unfortunately, this happens frequently. Only 10% of startups are successful and turn a profit.

💡 There are tracker sites and aggregators with information about crowdsales. Can their ratings be trusted?

Large resources value their reputation and do not disseminate knowingly fake data. But you should double-check everything yourself.

💻 What is the best platform to create custom tokens on?

The most popular network is Ethereum, about 90% of new coins are issued on it.

❓ What are DApps?

Decentralized applications are programs that exist in a distributed ledger or P2P network environment. They do not have a single point of control.

🧾 How much of the information you need is in the white paper and roadmap?

The white papers outline the main ideas and developments that will be used in the startup.

Is there an error in the text? Highlight it with your mouse and press Ctrl + Enter

Author: Saifedean Ammous, an expert in cryptocurrency economics.