Traders earn income from changes in the quotes of tokens and coins. If the rate of a cryptocurrency grows, the user buys it and keeps it on his wallet until the graph reaches the desired level. But, it is not necessary to purchase the coins or tokens themselves in order to capitalize on the fluctuations in the price of digital assets. Bitcoin futures are a type of contract, the owner of which receives a profit if in the future the currency rate changes in the desired direction. This allows you to make money on crypto-assets without making any effort to store them safely on your wallets.

What are futures

One of the directions of exchange trading is operations with derivative financial instruments(derivatives). This category includes futures, options, swaps, forward contracts. In general, a derivative is a contract that stipulates the rights or obligations of the parties to perform actions tied to the dynamics of the rate of the underlying asset. In particular, a futures contract assumes that on a specified date the seller will deliver goods or currency to the buyer at a predetermined price.

The best exchanges for trading

There is no single criterion for choosing a crypto platform. Some users prefer the largest exchanges. Others are interested in the interface or soft verification conditions. At the same time, fraudulent sites are often found on the Internet. Such services do not conduct real transactions with cryptocurrency and block clients after making a deposit. Therefore, novice traders are recommended to look for exchanges from the top of the rating.

When compiling it, such characteristics of the cryptoplatform are taken into account:

- The number of available assets.

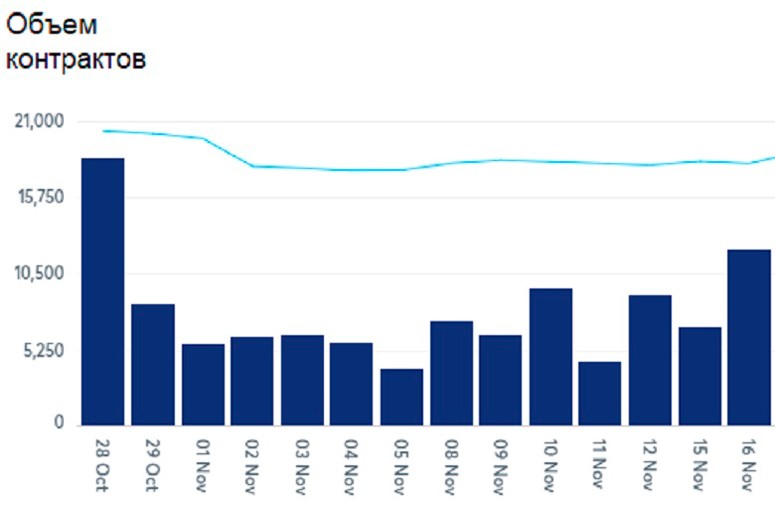

- Average daily turnover.

- The possibility of depositing fiat.

- Reviews of other clients and the assessment of the safety of the service by the specialists of the portal CryptoProGuide.com.

History of origin

Japan is considered to be the homeland of futures contracts. The Dojima exchange appeared in this country as early as in 1730. It was used to trade futures for the delivery of rice. The first derivatives in the USA and Europe were also commodity-based:

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

- In 1848, the Chicago Board of Trade was founded. It traded corn contracts.

- In 1877 futures appeared in Europe. The first platform was the London Metal Exchange.

In the second half of the XX century a new trading instrument appeared – futures on stock indices. These contracts allowed to get profit due to changes in the price of shares of the largest companies. Besides, since 1976 quotations of most world currencies began to be formed on the principles of free market. Traders had an opportunity to earn on the volatility of fiat money.

In 2009, an anonymous programmer using the pseudonym Satoshi Nakamoto launched the decentralized financial network Bitcoin. The first transactions with cryptocurrency were conducted exclusively between users. Later, platforms for trading tokens and coins appeared. Cryptocurrency derivatives became a tool that allows traders to profit from the high volatility of digital money.

How futures work

There are 3 parties involved in speculative transactions on exchanges:

- Buyer

- Seller

- An intermediary (broker or platform).

Futures on cryptocurrency, fiat money or securities are contracts where the seller undertakes to deliver the underlying asset to the buyer at a fixed rate. The exchange acts as an intermediary, controlling in automatic mode the fulfillment of the contract terms.

Who uses them

The main purpose of derivatives is to protect transaction participants from risks associated with increased volatility (rate fluctuations). In spot market transactions (on the terms of immediate delivery), a buyer can lose money due to a sharp collapse of quotations. Futures help to smooth out short-term price fluctuations.

The second way of using derivatives is to make money on the decline in the rate of the underlying asset. If a trader expects the quotes to fall, he sells the futures, receiving a fixed amount of money from the counterparty. If the forecast is accurate, the price of the asset falls by the contract execution date. At this point, the trader buys the securities or currencies specified in the contract at a lower price and transfers them to the second party of the transaction, keeping the difference between the initial and final value.

Types of contracts

Depending on the underlying asset, futures can be divided into the following categories:

- Commodities (commodities). This list includes contracts for the delivery of gold, oil, grain and other commodities.

- Stocks. The underlying asset in such contracts is securities of companies.

- Index contracts. The basis is a basket of several securities. The most common stock indices are S&P 500 and DAX 30.

- Currency. Under the terms of the transaction, the buyer receives fiat money or remuneration from the seller, if the rate of the asset has changed in the desired direction.

- Cryptocurrency futures. The profitability of these contracts depends on changes in the price of tokens, coins or their indices.

The second criterion by which derivatives can be divided into several types is the terms and settlement procedure. On stock and currency exchanges there are such types of contracts:

- Term. They are concluded for a week, month, quarter or year. The expiration date is specified in the contract. On this date, the parties make a settlement based on the current price of the underlying asset.

- Indefinite. Do not have an expiration date. The owner of the derivative can sell it to another trader at any time.

- Deliverable. After expiration, the buyer receives the underlying asset specified in the contract.

- Settlement. Does not provide for delivery of goods or currency. Only monetary settlement takes place between the parties.

- Inverse. Profit or loss is calculated in the base currency. For example, if a trader bought a BTC futures, he will receive a profit in bitcoins, not in USDT or American dollars.

Risks

Any method of speculative trading can lead to losses. There are no perfect market analysis strategies. If the exchange rate of the underlying asset changes in the opposite direction, the trader loses money. Besides, there are additional risks when dealing with derivatives:

- Forced closing of the position due to lack of margin. Operations with derivatives are often conducted with leverage (leverage). The exchange provides the trader with a loan that can be used in trading. But if the collateral amount on the deposit is insufficient, the platform forcibly closes all the client’s positions.

- Loss of capital due to a sharp increase or decrease in quotes. Leverage allows you to buy assets not only with personal, but also with borrowed money. This helps to increase profits. But if the trader made a wrong forecast, losses from margin trading exceed losses from ordinary spot transactions. For example, if a client uses x100 leverage, his deposit will be burned due to a rise or fall of quotes by only 1%.

Impact of futures on the crypto market

Derivatives transactions are often used by large investors, funds and corporations. This type of contract is used to hedge risks. Investment funds can buy Bitcoin futures to hedge their investments in gold, securities or fiat money. The emergence of derivatives has boosted interest in the digital currency among major players.

At the same time, derivative contracts can negatively affect the price of the underlying asset. According to experts, one of the reasons for the prolonged collapse of the Bitcoin exchange rate in 2017 was the emergence of bitcoin futures. Traders got the opportunity to short the cryptocurrency, and panic started in the market. As a result, by the end of 2018, the BTC rate fell to around $3200.

Pros and cons of trading

The main advantage of operations with derivatives is the possibility of earning not only on the growth, but also on the fall of quotes. But trading cryptocurrency futures carries additional risks for the trader.

| Advantages | Disadvantages |

|---|---|

| Ability to trade with leverage. | Inability to wait out an unfavorable period with an open trade. If a trader uses leverage, he risks losing his deposit due to high volatility. |

| Receiving income from the decline in the rate of crypto-assets. | The need to study the specification of contracts. Unlike spot trades, beginners need to understand what the initial and maximum margin, funding rate and other terms are. |

| The trader does not need to store tokens and coins and protect the wallet from hacking. | The buyer has no physical control over the cryptocurrency. Derivatives transactions on exchanges usually do not involve the actual delivery of tokens and coins. Purchased assets cannot be invested in lending or staking. |

| Ability to hedge positions. If the user has invested coins in staking, he risks losing profit as a result of a collapse in quotes. In this case, it is possible to conclude a contract for a decrease in the rate, securing the investment. |

Bitcoin futures

Cryptocurrency derivatives are contracts on the future price of tokens and coins. Bitcoin futures are linked to the exchange rate of BTC to the American dollar or stablecoins (USDT, USDC). This type of contract is available on both classic and cryptocurrency exchanges.

When they were launched

Operations with the first derivative contracts on Bitcoin appeared in 2016 on the crypto exchange Deribit. But such activities were carried out without regulatory approval. Deribit is registered in Panama, a state with loyal legislation. At the same time, the authorities of the United States, Japan, Canada banned their citizens from trading on this platform.

Legal transactions with derivatives began in December 2017. CME bitcoin futures became the first Bitcoin contract approved by the US regulator. This instrument is traded on the Chicago Mercantile Exchange, which attracts not only crypto traders but also institutional investors to the market.

In Russia, the law regulating digital money came into effect on January 1, 2021. But despite the legalization of cryptocurrency transactions, the Moscow Exchange has not yet opened access to bitcoin futures trading.

How to start trading BTC futures

To earn money on derivative financial contracts, you should perform the following actions:

- Select a trading platform.

- Create an account and pass verification (identity verification).

- Make a deposit.

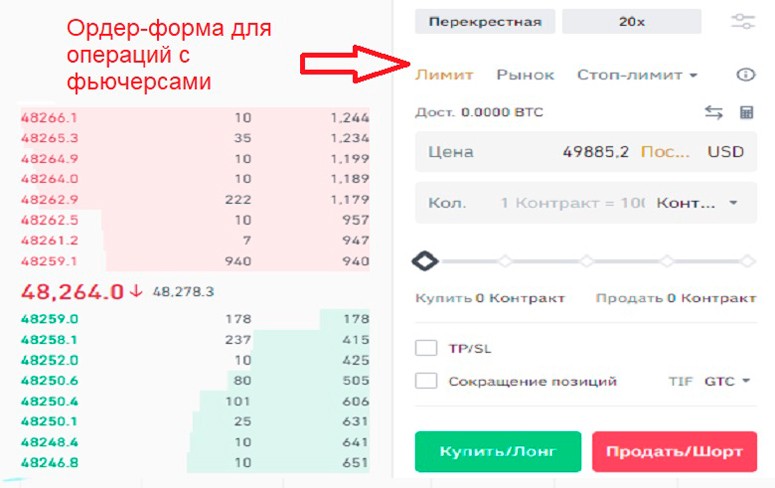

- Find a contract of interest and fill out an order-form(a request to buy bitcoin futures).

Choosing an exchange

In December 2021, CryptoProGuide.com ranked 571 trading platforms. Most crypto exchanges focus on spot transactions, but many also have access to the derivatives market. Newcomers may have a difficult time choosing the best platform. When evaluating a crypto exchange, it is recommended to study the characteristics of the platforms.

| Characteristics | What to look for |

|---|---|

| Trading conditions | Commissions on deposits, withdrawals. Rates of fees for trading operations. |

| List of available assets (contracts) | Number of tokens and coins, availability of several types of bitcoin futures (regular, perpetual, inverse). |

| Leverage | Possibility to use borrowed money to conclude a transaction. |

| Security measures | Two-factor authentication, anti-phishing password and other methods of account protection. |

| Withdrawal conditions | Limits and restrictions for profit withdrawal. |

| Company reputation | Availability of information about developers, feedback from other traders. |

Trading conditions

The financial result of transactions with bitcoin futures is affected by the commissions and fees set by the crypto exchange. Usually, the user has to pay:

- Depositing money into the account

- Transaction fees

- Leverage fees

- Withdrawal fees.

The higher the amount of fees, the more difficult it is to conduct profitable trading. Therefore, before creating an account on the crypto exchange, it is recommended to study the User Agreement and other sections of the site. In addition, you can reduce costs in such ways:

- Choose an exchange with bonuses for new customers.

- Find a company that issues an internal (service) token. Usually holders of this cryptocurrency receive a discount on trading operations.

- Check with the support team about the presence of a loyalty program for the most active customers.

Account registration and verification

After choosing a platform, you need to create an account. Usually the registration button is located on all pages of the site, including the main page. Registering an account usually requires entering an email address, password and phone number. After that, the user needs to perform such actions:

- Confirm e-mail. The verification code will be received in an email from the platform.

- Confirm phone number. To do this, the crypto exchange sends an SMS message or makes a call.

- Fill out the registration form. Many sites require you to specify your first name, last name, country of residence and date of birth.

- Confirm agreement with the rules of the service.

- Pass verification. Crypto exchanges are required by regulators to perform KYC (user identification) and AML (verification of the legitimacy of the origin of money) procedures. The most common way of verification is to examine scans or photos of a new client’s passport. Some exchanges have stricter verification procedures that require video recording.

- Customize the account. Most services do not allow clients to trade without activating two-factor authentication. Even if this security measure is not required, its connection is necessary to protect against hacking.

- Deposit fiat or crypto assets. In 2021, transactions with debit/credit cards or bank transfer systems on most platforms are only allowed after verification. Depositing cryptocurrency can sometimes be done by anonymous customers as well.

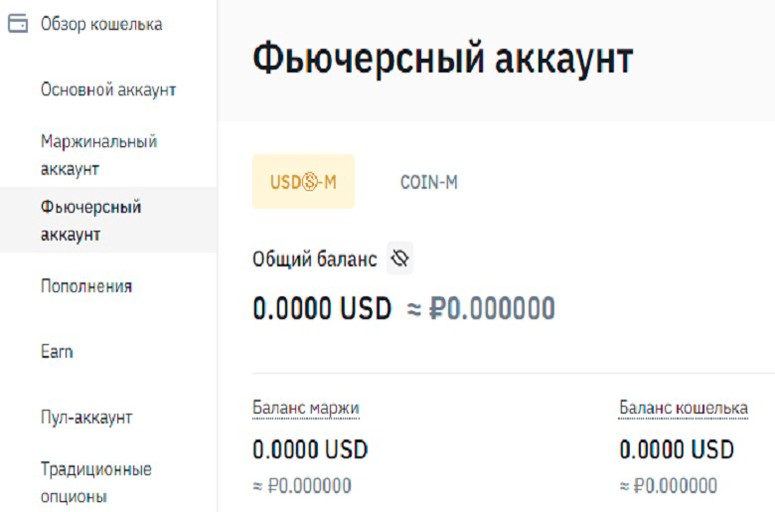

Replenishment of the futures balance

Depending on the specialization of the exchange, there may be several internal accounts in the personal profile. On most platforms, the deposit is credited by default to the account for spot trading. In this case, the client needs to:

- Make a deposit (in fiat or cryptocurrency).

- Make sure that the money is credited to the balance.

- In the personal cabinet, find the menu for depositing tokens and coins into the account for futures trading.

- Send the money to the appropriate sub-account.

Futures Contract Settings

The settings for derivatives trades are different from spot trades. Beginning traders should understand the meaning of terms such as:

- Expiration

- Initial and maintenance margin

- Contract size

- Maximum leverage

- Funding Rate.

Futures on the cryptocurrency exchange may have other parameters. For example, different platforms have different rules for closing unprofitable positions. In some cases, the balance of such a trader is zeroed, in others – can become negative.

Symbol or ticker

Derivative instruments have a price link to the underlying asset. Usually the name of the futures contains the ticker of the underlying currency and a prefix denoting its type. For example, on the Binance exchange, the symbol BTCUSDT is assigned to open-ended bitcoin contracts. This means that the yield of the instrument is calculated based on the exchange rate of the BTC/USDT trading pair.

Tick size

In traditional and cryptocurrency trading, there is a concept of “pip”. This is the minimum value by which quotes in the terminal can change. In relation to bitcoin futures, a more relevant parameter is the tick size. This is the minimum step of change in the price of the contract. The higher the tick size, the stronger the dynamics of quotes affects the trader’s balance.

Minimum number of contracts for buying

In December 2021, the price of one bitcoin was about $48,000. Beginning crypto traders don’t always have enough money to buy a whole coin. But the minimum volume of derivative contracts differs from exchange to exchange. In particular, traders on the CME can order from 5 BTC, and on smaller crypto platforms transactions with tenths and even hundredths of bitcoin are available.

Before concluding a transaction, it is important to check the contract specification. This is especially true for exchanges that provide leverage. If the transaction is too large, the trader risks losing the deposit quickly.

Expiration

Regular bitcoin futures have an expiration date for the contract. On this day, settlement between the parties to the transaction takes place:

- Delivery futures involve the transfer of coins or tokens to the buyer.

- Settlement contracts are executed by reconciling the initial and final price of the underlying asset. The final financial result is recorded in the client’s account. If the trader’s forecast is correct, he gets profit and his deposit grows. In the opposite case the loss is fixed.

The open-ended derivative instruments have no expiration date. The trader can cancel the transaction at any time. But the settlement with the bitcoin futures holder will be carried out at the current market price.

Maximum leverage

Many exchanges provide clients with borrowed money. This capital can be added to your own and used to secure contracts. Leverage is the ratio of a trader’s personal funds to the total account balance. For example, if a user deposits 1 BTC and buys crypto-assets, the price of which is equivalent to 10 bitcoins, we can say that he trades with leverage x10.

The maximum amount of leverage is set by the exchange so that the company does not risk losing money due to traders’ mistakes. On most crypto platforms, leverage does not exceed x100. If the leverage is greater than the maximum limit, the transaction will be forcibly closed. Therefore, before performing a derivatives transaction, you need to check the platform’s terms and conditions.

During the trading process, it is important to keep an eye on the current amount of leverage. Leverage increases when the quotes of the underlying asset change in a direction unfavorable for the client. If the leverage approaches the maximum mark, it is necessary to close the position (fully or partially) or deposit more money.

Initial margin

To open a transaction with leverage, a trader must have a margin amount on his account. Initial margin is the money that will be debited if the price changes in the opposite direction. Usually the amount of margin is a little lower than the maximum leverage possible.

Maintenance margin

If the purchase of bitcoin futures is unsuccessful, the exchange risks a loss. Therefore, most platforms have written in the contract specification the amount that should be in the account when the trade is open. If the size of the maintenance margin decreases, the exchange forcibly closes the position. Usually before this, the trader receives a notification about the need to add money to the account (margin call). But in case of a sudden change in quotes, the user will not have time to make a deposit. Therefore, the only way to avoid margin call and closing positions is to trade with a small leverage.

Liquidation fee

If a transaction with derivatives is forcibly closed, there are 3 options for the development of events:

- The client’s balance becomes 0.

- After the position is closed, the user has a small amount left on his account. Usually it happens if the market has moderate volatility.

- After closing the transaction the account balance becomes negative. If quotations sharply increased or collapsed, the exchange does not have time to complete the transaction. Losses from a failed transaction exceed the trader’s personal money.

Some platforms in such a situation change the balance to 0. But the rules may state that the client must reimburse the losses of the exchange when using leverage. In this case, a negative balance will remain on the trader’s account.

Funding rate

Trading in open-ended futures contracts is similar to spot transactions. The trader can keep the position open for an unlimited period of time. But cryptocurrency prices are constantly changing, which makes it necessary to synchronize the movement of spot and futures quotes.

For this purpose, exchanges apply a funding rate – a regular commission paid by traders for an open position. If the spot price of the underlying asset rises, buyers send this fee to sellers. In a falling market, the fee is charged to users who take short positions.

Typically, the funding rate is calculated and paid once per day. When trading perpetual futures, it is important to keep track of its changes, otherwise every day the contract is held, the trader’s deposit will decrease.

Traded currencies for BTC futures

Most contracts on stock and commodity exchanges are settled in fiat: American dollars, euros, yen. This partially applies to cryptocurrency platforms as well. But on many exchanges, bitcoin futures are traded in other digital currencies. Stablecoins – tokens with a fixed rate – are more often suitable for this purpose:

- Tether (USDT)

- USD Coin (USDC)

- Binance USD (BUSD).

Trading Strategies

Operations with bitcoin futures largely resemble regular spot trading. To make a profit, a trader needs to:

- Choose a trading strategy (a set of rules and techniques that determine when to open and close trades).

- Conduct market analysis, wait for a convenient moment to make a transaction.

- Buy or sell the derivative.

- Wait for the transaction to be completed or fix the result ahead of time (if it is allowed by the exchange rules).

Scalping

The rate of tokens and coins is characterized by high volatility. In particular, in December 2021, Bitcoin fell in price by almost 18% per day. In such cases, the trader does not have to conduct long-term trading.

Scalping is a methodology in which transactions are concluded on a daily basis. A trader holds a position for several hours or even minutes, counting on the profit from the high volatility of the asset. Indefinite futures are usually used for scalping:

- The trader analyzes the market and finds a profitable point to buy the asset.

- An order is created in the terminal to purchase bitcoin futures.

- If the forecast was correct, the trader waits for the quotes to change and closes the position.

Scalping attracts beginners with high profitability. But this strategy carries the risk of deposit loss due to the constant use of leverage. In addition, daily trades increase the trader’s workload. Because of this, beginners risk making mistakes. Therefore, scalping is recommended for experienced users.

Short-term trading

On most platforms, futures expiration occurs every 3 or 6 months. Closer to the contract execution date, it becomes easier for traders to study the market and make a forecast on the final rate of cryptoassets.

In short-term strategies , technical analysis comes first. Users add indicators – mathematical formulas that help to predict the dynamics of quotes. This strategy is better suited for beginners, as it gives the opportunity to test different tools and techniques.

Medium-term trading

Large traders and investors try to make deals less frequently, but get maximum profit from them. Medium-term operations are those that last more than a few days. In this case, fundamental analysis – the ability to assess the prospects of cryptocurrency – comes first. To do this, traders research:

- News, statements of experts and analysts.

- Technical documentation of cryptocurrency projects.

- The situation in the world economy, geopolitics.

- General sentiment in the cryptocurrency market.

For competent medium-term trading, you need to have a good understanding of economic processes. The rate of cryptocurrency can change for the period of the contract by tens and even thousands of percent. This gives a chance to get a high income. But if a trader opened a deal in the wrong direction, due to the peculiarities of margin requirements, he will not be able to wait out the unfavorable period. Therefore, medium-term trading is recommended for experienced users.

Tips for beginner traders

On the Internet, you can find many techniques and manuals for learning how to deal with cryptocurrency futures. Some of them are distributed on a paid basis. But before buying an indicator or tutorial, you need to realize that no strategy guarantees profit.

Any method of cryptotrading carries the risk of losing your investment. This happens especially often with beginners. Beginners should not deposit borrowed money or funds without which their normal life will be disrupted.

Beginners often make similar mistakes. A novice crypto trader can:

- Make a deposit on an unverified exchange or fraudulent website.

- Send cryptocurrency to the wrong wallet address.

- Make a mistake while analyzing the market.

- Set incorrect order settings.

- Close a profitable trade too early or, conversely, hold it until the trend changes.

- Try to get your money back by making new transactions hoping for luck and intuition.

To prevent such mistakes from leading to loss of capital, it is recommended to practice on a free demo account beforehand. This option is available on several exchanges, including Binance and Currency.com.

Summary

A futures contract is a derivative financial instrument that obligates parties to make a transaction in the future at a predetermined rate. Initially, such contracts were entered into in relation to commodities and securities. In 2017, the Chicago Mercantile Exchange (CME) included bitcoin futures in the list of traded assets.

Derivatives trades have several advantages:

- The opportunity to capitalize on falling quotes.

- Leverage provided by the exchange.

- The ability to hedge the risks of other transactions.

But derivatives trading is more complicated for beginners. Traders need to understand the terminology and study the specification (characteristics) of each instrument.

Frequently asked questions

❌ Are all cryptocurrency futures tied only to the Bitcoin exchange rate?

No, CME launched derivatives trading on Ethereum in December 2021. In addition, some exchanges have contracts tied to the price of cryptocurrency indices.

🚹 Which type of futures is best for beginners?

Beginning traders are recommended to choose open-ended contracts. In this case, there is no need to assess the probability of growth or fall of quotes by the expiration date.

✅ Where is it better to trade: on a regular or cryptocurrency exchange?

The advantage of stock and currency platforms is reliability and official status. But novice traders can choose crypto exchanges with lower trading limits and simplified registration rules.

❔ What is the difference between analyzing futures transactions and spot transactions?

In general, the same methods apply. But when buying bitcoin futures, you need to be able to determine what the price will be on the expiration date of the contract.

❗ Why don’t all exchanges have derivatives?

Regular traders are more likely to trade on the spot market. Due to the lower prevalence of bitcoin futures, not all platforms provide access to this instrument.

Is there a mistake in the text? Highlight it with your mouse and press Ctrl + Enter

Author: Saifedean Ammous, an expert in cryptocurrency economics.