In 2017, drawings from the CryptoPunks collection were given away for next to nothing. Already after 4 years, the price of characters reached hundreds of thousands of dollars. The most expensive was sold at Sotheby’s auction for $11.75 million. “Covid” simbol #7523 (Alien) was added to the collection of the main shareholder of DraftKings Shalom McKenzie. In 2023, anyone can create and sell a digital painting in the form of an NFT token. Paying buyers should be sought on industry marketplaces.

The concept of an NFT token

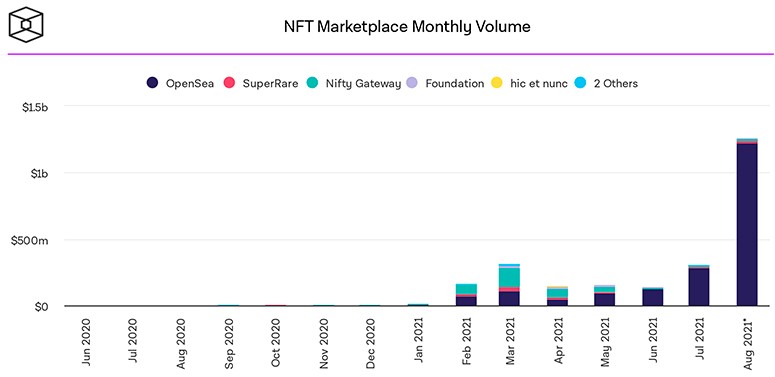

Non-fungible tokens have become one of the hottest trends in the crypto industry in 2021.

According to Chainalysis, by the end of December 2021, $40.9 billion was locked in the NFT segment. In comparison, analysts at UBS and Art Basel valued the global art market at $50.1 billion.

The popularity of digital artifacts has attracted a large number of retail investors to cryptocurrency exchanges. Chainalysis calculated that almost 75% of transactions in the segment were transactions of up to $10,000.

An NFT is an asset that registers ownership of a digital object on the blockchain. It can be compared to a certificate of value ownership:

5020 $

bonus pentru utilizatorii noi!

ByBit oferă condiții convenabile și sigure pentru tranzacționarea criptomonedelor, oferă comisioane mici, un nivel ridicat de lichiditate și instrumente moderne pentru analiza pieței. Suportă tranzacționarea spot și cu efect de levier și ajută comercianții începători și profesioniști cu o interfață intuitivă și tutoriale.

Câștigați un bonus de 100 $

pentru utilizatorii noi!

Cea mai mare bursă de criptomonede unde vă puteți începe rapid și în siguranță călătoria în lumea criptomonedelor. Platforma oferă sute de active populare, comisioane mici și instrumente avansate pentru tranzacționare și investiții. Înregistrarea ușoară, viteza mare a tranzacțiilor și protecția fiabilă a fondurilor fac din Binance o alegere excelentă pentru comercianții de orice nivel!

- An artwork.

- A gif.

- A music track.

- A video clip.

- A collector’s item (stamps, cards, badges).

- Jewelry, etc.

In an open blockchain, all tokens can be exchanged for the same tokens. But NFTs work differently. Each such asset is unique and contains identifying information recorded in a contract inteligent. It can be sold, exchanged, stored. Unlike cryptocurrencies, which have the same properties and value, it will not be possible to settle with non-mutually exchangeable tokens.

To sell a digital artwork in the form of an NFT token

First, you need to create a piece of artwork. It can be anything:

- A drawing.

- A virtual landscape.

- A gifka.

The main condition is uniqueness. But in order for the work to find its buyer, it is necessary to focus on the market. NFT technology is 90% supported by the crypto community. This is a separate category of traders and investors with their own values and their own economy. To understand them, you need to “brew” in this environment: follow the news, participate in chat rooms, communicate with those who have experience in creating and selling digital items.

You can create one NFT token or a whole series.

The most successful collections in 2021:

- RTFKT Capsule Space Drip – the team produced 152 3D characters with audio. Lots sold for prices starting at 4.4 ETH ($17.7 million at December 2021 exchange rates). In December 2021, the studio was bought by Nike. The price of the deal was not disclosed.

- Galaxy Eggs is a set of 9999 meta-universe eggs with futuristic designs. Annual sales of digital objects on OpenSea amounted to 13.8 thousand ETH ($55.2 million at December 2021 exchange rate).

- Clon X – a series of 20k avatars was sold in November for over $100m.

Site Selection

In 2023, NFT technology is supported by a number of blockchains:

- Ethereum.

- Binance Smart Chain (BSC).

- Tron.

- WAX.

- Polkadot and others.

Each network uses its own standard to issue non-mutualizable tokens. In Ethereum, this is ERC-721. BSC creates assets on BEP-721. ETH remains the market leader. The largest marketplaces and digital object minting services (Opensea, Rarible, Mittable) operate on this platform. Marketplaces available on BSC: Refinable, AirNFTs, Bakery Swap and others.

In 2023, there are a large number of marketplaces that host different types of digital art collections. Marketplaces (Opensea) handle many categories. Other sites (Rarible) help sell NFT token in specific niches: art art, games. Here are a few factors to consider when choosing a platform to trade digital items:

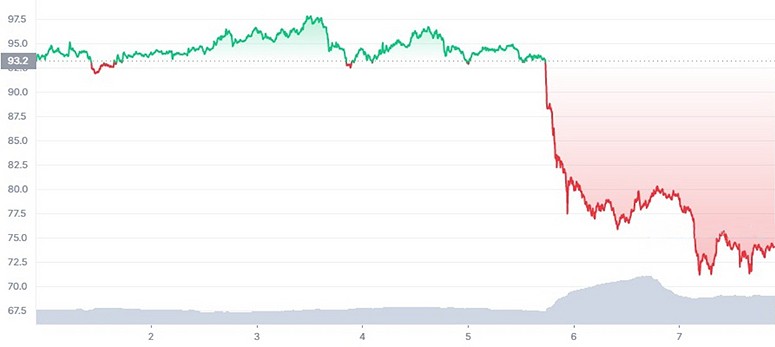

- Liquidity. The value of NFT objects is determined subjectively by users. Therefore, reselling lots can be difficult. Some marketplaces offer proprietary solutions to increase asset liquidity. For example, Binance creates a natural bridge between trading and NFT platforms.

- Taxe de tranzacție. Different marketplaces have transaction fees ranging from 2.5-15%. This amount includes gas fees, deductions to the service or the author.

- Experience. The first NFT tokens were seen as collectibles. In 2021, their functions expanded. For example, Decentraland and Axie Infinity have created new ecosystems where participants can trade and exchange value regardless of platform.

How to assign an NFT token to a work of art

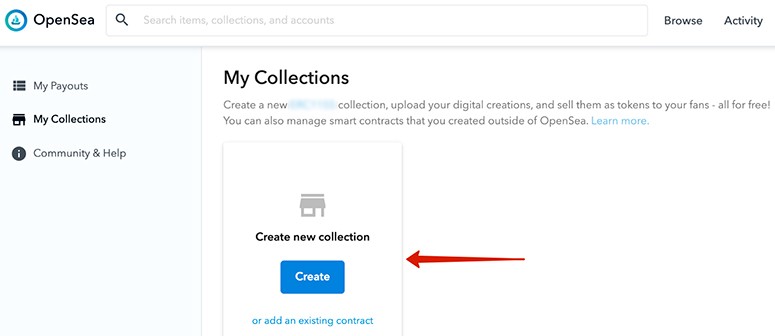

To digitize a painting, you need to connect your wallet to the chosen platform. Different markets support certain types of storage. For Ethereum-based services, Metamask, Trust Wallet and other wallets are suitable. In 2023, NFT tokens are more often traded on Opensea. Generalist estimates that this platform holds almost 97% of the market. On Opensea, it’s easy to convert a painting into an NFT token:

- Register an account. On the site, you need to select Create, and in the drop-down tab, you need to select Submit NFTs.

- Create a new collection. You should click Create new collection. Then you need to come up with a title, description, logo.

- Upload objects. The platform works with JPG, PNG, GIF, MP3, MP4, SVG, WEBM, WAV, GLB, OGG, GLTF files. Allowed size is 100 Mb.

- Confirm the operation. You need to click Add New Item. Then you should accept the custom terms and conditions. For better ranking of the lot in the search engine you can describe its properties or add statistics.

Minting a non-mutualizable token on Opensea is completely free. To sell a digital artwork, you need to activate the Sell function. Some services offer to fill out a trade request even at the generation stage (Rarible).

Create an auction

The author can set a fixed price for the lot or sell it to the highest bidder. The optional Bundle feature allows multiple items to be auctioned at the same time. To create an auction:

- Select an NFT token from the collection. Click on Sell.

- Assign a transaction type (auction).

- Specify the starting price, minimum bid and bidding duration (from 3 days to a month).

- Confirm the action. Click Post your listing.

New Opensea clients must activate their account. To do this, send a transaction with a zero value, paying for gas. When the auction ends, the highest bidder will get the lot. If there are no relevant bids, the transaction will close without a sale.

According to OpenSea rules, the starting price of a lot is at least 1 ETH. After the purchase, the seller transfers the NFT token to the new owner. The transaction fees are paid by the sender. Their amount is fixed: 2.5% of the transaction.

Set your own price

In trading non-mutualizable tokens, return on investment is important. To decide at what price to sell a digital object, you need to consider several factors:

- The seller’s reputation, rarity, and the origin of the item. An NFT token issued in a single copy by a famous artist is more valuable than an artifact created by a novice creator.

- Minimum prices for relevant lots in the NFT system. Need to monitor offers on trading platforms.

- Taxe de tranzacție. A fixed-price transaction assumes that the cost of sending the lot is borne by the seller. In January 2022, the commission on the Ethereum network is 0.012 ETH ($37.92). If you offer the job cheaper, the transaction will be unprofitable.

A fixed price for a lot can be set at the stage of selecting the type of sale. To do this, click Set Price and confirm the action with the Post your listing button.

Sell several lots at once

The Bundle function is activated according to the standard algorithm:

- Select a tokenized piece. Press the Sell button.

- Assign the Bundle transaction type (group a lot with other lots for sale).

- Check all the required objects.

- Set the settings for the collection (title, description, characteristics).

Whoever buys the bundle will get all the items included in it. You can group up to 30 NFT tokens in this way to pay for the transfer only 1 time.

Best marketplaces for selling NFT tokens

In January 2022, there are more than 50 trading platforms operating on the digital artifacts market. Some promote their own projects and the value created in them (Axie Marketplace, Decentraland). Others aggregate digital art objects in a specific niche (Rarible). Still others work in a marketplace format and offer different types of NFT tokens.

| Platform | Date of creation (year) | Trading volume in the first week of 2022 ($) | Number of users from January 1 to January 7, 2022 (people) |

|---|---|---|---|

| Opensea | 2017 | 881.78 mln | 163.03 thousand |

| SuperRare | 2018 | 2.54 million | 206 |

| Rarible | 2019 | 17.26k. | 2.11k. |

| Foundation | 2020 | 26.74 mln. | 11.78 thousand |

Opensea

The largest NFT-marketplace steadily holds the leading position in the market. The average daily sales volume on Opensea amounts to tens of millions of dollars. The platform combines tokenized collectibles, digital art and other NFT-assets.

Transactions on the service are done through a smart contract. Artifacts are stored on users’ wallets, and once sold, they pass to new owners.

Opensea provides a convenient space for trading NFT-tokens and takes a commission of 2.5% of the transaction. The service runs on the Ethereum platform. In order for users to save on network fees, the system implements the Polygon blockchain, which converts ETH into cheaper WETH for transactions.

SuperRare

The service brings together connoisseurs of digital art. On SuperRare, artists exhibit assets created on the Ethereum blockchain. Digital paintings can be sold at a fixed price, through an auction or simply displayed in their own gallery. In order for a work to get into the trading platform, it must pass moderation.

Thanks to a strict selection process, only high-quality works are presented on SupeRare. The average transaction price in January 2022 is $31.6 thousand. Buyers are charged a commission of 3%. But sellers pay a whopping 15%. This amount includes the cost of gas for minting the token and exhibition in the gallery. When a work is resold, the platform pays 10% of the transaction to its creator (royalty).

Axie Marketplace

The platform sells characters and in-game items from the game of the same name. Axie Marketplace’s pet marketplace is completely open and controlled by members. Lot prices are set based on supply and demand. Axie pets can be purchased for resale or to participate in the game. Each participant must have at least 3 pets to start.

The platform runs on the Ronin sidechain. All payments are made in WETH coins. To buy axi, you need to fund your account by transferring the amount from Ethereum via Ronin Bridge. The transaction fee is 4.25%. It is paid by the seller. From 2021, the fees go to the community fund and are distributed among AXS token holders. The buyer pays only for gas when topping up Ronin with Metemask or another Ethereum wallet. These fees vary depending on the category of transaction and the speed of the transaction. The faster the transfer, the higher the fee.

Rarible

One of the first NFT-marketplaces is consistently among the top ten largest markets by capitalizare. Rarible offers a simple interface for creating non-mutualizable tokens and a quick listing. To put a digital painting up for auction, an artist does not need to go through moderation. It is enough to fill out a form to post the lot.

The commission for the transaction is paid by both parties. For the buyer and seller, it is 2.5% each. The author of the artwork also pays fees for the gas used to mint the NFT token.

The developers plan to transform Rarible into a decentralized autonomous organization (DAO). For this purpose, RARI’s internal cryptocurrency has been integrated into the system. Holders of the asset can vote on the development of the platform and curate submitted works.

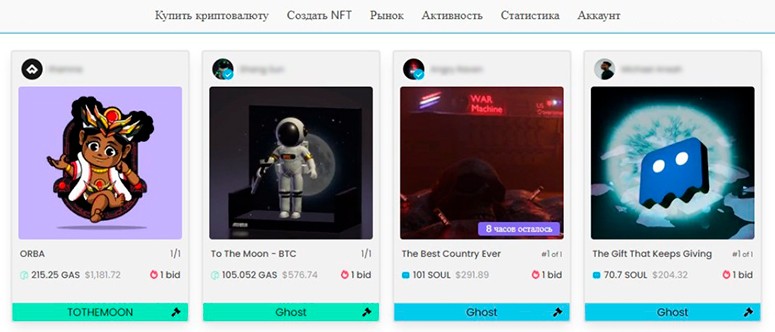

Ghost Market

The first crosschain platform for trading digital items. On Ghost Market you can sell artifacts created on the networks:

- ETH.

- BSC.

- NEO.

- Polygon.

- Phantasma.

Sellers are verified and pay a commission for placing a picture: 100 SOUL ($0.07) and 20 KCAL ($3). To work with the platform you need to bind a wallet. For ETH it is Metamask or Trust Wallet, for NEO – Teemo, Neonline, for Phantasma – Ecto or Poltergeist. The author can receive up to 50% of the transaction amount as royalties from each resale of the work.

In January 2022, the platform features 4.22 million digital paintings from 3,17,000 artists.

Foundation

The platform brings together artists and creators of digital art. Foundation operates on the Ethereum blockchain and does not have access to users’ private keys. Transactions take place using smart contracts. NFT tokens and cryptocurrency are stored on participants’ wallets and transferred to the parties after payment.

The platform takes a commission from sellers in the amount of 15% of the transaction amount. The authors of the paintings also pay for the gas used to mint the token. Famous artists and newcomers exhibit their works on Foundation. For example, the New York Times sold a digital image of a columnist for $560k.

Viitorul NFT

In 2021, the market of non-interchangeable tokens experienced a real wave of hype. Experts predict the trend will continue in 2023. But the current NFT boom is not as important as the fact that the new asset class certifies ownership in a digital format. This opens up great opportunities for their application.

NFT technology is transforming the art field. Now all an artist has to do is link a token to a piece of artwork and put it up for auction. Sales of paintings are automatic. The amounts of online deals are much higher than traditional ones. Game developers release characters and equipment in the form of digital artifacts and sell them on marketplaces. Athletes and musicians are minting NFT tokens, offering rare content and other perks to buyers.

Technology can greatly simplify the buying and selling of real estate by reducing the cost of third-party involvement. The legal side of the deal is detailed by Forbes experts. In 2021, Mintable and Opensea platforms placed offers to sell homes as NFTs. The deals did not take place for unknown reasons. However, experts are confident that already in the near future, non-mutually exchangeable tokens will find a real application in the real estate sector.

Întrebări frecvente

💰 Is it possible to sell a digital painting for fiat?

In 2023, NFT items are traded on marketplaces. These platforms support settlement in cryptocurrencies and do not accept fiat.

✅ Which blockchain should I choose to mint NFTs?

It is possible to issue non-mutualizable tokens in Ethereum, Neo, Polygon, Tron and other networks. ETH remains the market leader in 2023.

❓ In what format should I upload pictures to Opensea for translation to NFT?

The service works with JPG, PNG, MP3, MP4, GIF and other files.

🔎 What are the fees for selling a tokenized drawing on Opensea?

The marketplace charges the seller 2.5% of the transaction.

📲 Do I have to pay to list an NFT collection on Rarible?

The service charges a commission for selling artifacts at 2.5% of the transaction amount. The authors of the artwork also pay for the gas that is consumed in the creation of the token. There is no commission for placing a lot.

Există o eroare în text? Evidențiați-o cu mouse-ul și apăsați Ctrl + Introduceți.

Autor: Saifedean Ammous, un expert în economia criptomonedelor.