As of July 3, 2022, there is a bearish trend in the digital asset market. Quotes of all cryptocurrencies have been slowly declining over the past few months. Trading coins and tokens in such conditions is difficult and associated with a high probability of losing savings. But there are dozens of methods of earning money on cryptocurrencies, and with minimal risks. The article will tell you about 6 of the most popular ways.

Passive methods of earning money on cryptocurrencies

Investing in such ways implies a one-time activity. The investor only needs to choose tools and invest cryptocurrency savings for the period of interest. Further the capital will independently “work” for the investor.

Among cryptocurrency investors, such methods of passive earnings are popular:

- Deposits

- Staking

- Long-term investments.

Deposits

This method involves depositing virtual assets (often for a fixed term) inside cryptocurrency exchanges. Such investments are similar to bank deposits. They are safe and do not require investor participation. In return, the depositor receives only a small profit – usually up to 10% per annum. Sometimes the yield is very low – about 1% for 12 months.

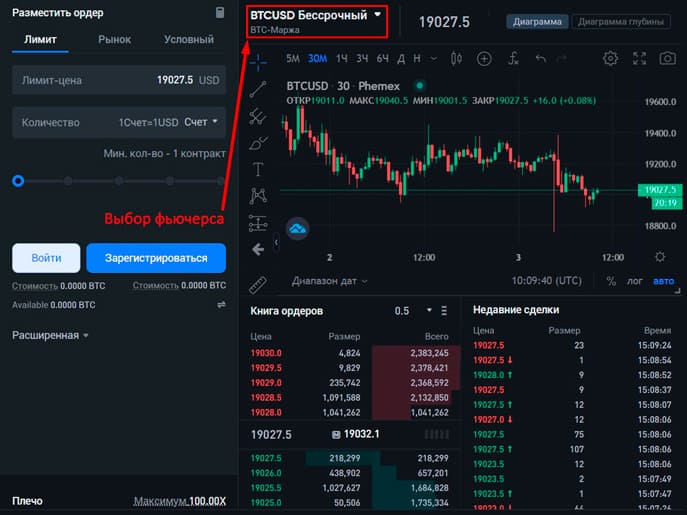

Cryptocurrency deposits can be used on special investment platforms or exchanges. The list of the latter includes, for example, the Singapore-based trading platform Phemex. This is an ecosystem of digital products, including the Phemex Earn service. This tool allows users to safely invest cryptocurrency on flexible and fixed terms.

As of July 3, 2022, the Earn service offers lucrative USDC Stablecoin deposits with an estimated rate of 8.80%. There are also other investment programs:

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

- BTC – 1.20%

- SOL – 0.85%

- ETH – 0.50% and others.

Staking

This method of earning is more profitable than deposits. The value of the annual income can be 100%. At the same time, steaking is one of the ways of depositing savings. But in this case, the investor does not transfer the capital to anyone. Staking implies freezing crypto-assets. The function of blocking investments is provided by some:

- Cryptocurrency wallets

- Exchanges

- DeFi sector services.

It is not uncommon for self-staking to be very expensive. For example, the minimum amount to freeze on an Ethereum 2.0 smart contract is 32 ETH ($34,400 as of July 3, 2022). However, there are steaking pools. They are created by validators already in operation. They collect depositors’ savings to increase the total amount of investments, which positively affects the performance of staking. Pools usually allow clients to invest a little bit at a time (for example, from $1).

Investing savings in staking is often possible within exchange ecosystems – for example, Binance and Phemex. These 2 platforms provide clients with special services for steaking. In the Phemex ecosystem, it is called Phemex Launchpool and is located in the “Passive Income” section. On this service, one by one, temporary steaking pools are opened for depositing different cryptocurrencies. The amount of income varies.

On July 3, 2022, a pool of cryptocurrency NEAR is open on Phemex Launchpool. Its validity period is 14 days. The yield of NEAR pool is 95% per annum.

Long-term investments

This passive way of earning money on digital assets is considered the most dangerous. The result of investments depends on the investor’s decisions and the correctness of his forecasts. For example, with an erroneous positive assessment of the chosen cryptocurrency project, the investor risks losing most of his savings.

Long-term investments imply opening trading positions for a period of 1 year or more. Before such investments, it is necessary to conduct a thorough fundamental analysis of coins and tokens. Potentially long-term cryptocurrency investments can bring high profits. Participants in the market of digital assets know many cases of quotes growth by 1000% and more.

It is better to buy cryptocurrencies in large amounts for a long period of time through centralized exchanges. Many popular trading platforms offer users low commissions and high liquidity of trading pairs. For example, the value of fees from spot transactions within Phemex is 0.10%. At the same time, this platform gives traders access to derivatives (derivative instruments).

Centralized exchanges usually have the lowest trading commissions. For example, decentralized platforms charge an average of 0.30% on each transaction.

Other ways to make money on cryptocurrencies

There are many methods of investing digital assets with minimal risks. Among them are popular and those methods that require periodic or regular activity from the investor. At the same time, such methods are often more profitable than passive investments.

The following methods of investing with the lowest risks bring high income:

- LiquidityPools (Liquidity Pools)

- Farming (profitable farming)

- P2P (peer-to-peer trading).

Liquidity Pools

Liquidity Pools are needed to enable trading on cryptocurrency pairs. Liquidity Pools are only available on decentralized exchanges (DEX). This is due to the specifics of such trading platforms. DEXs operate using smart contracts, not trading cores.

Liquidity Pools are some kind of repositories of digital assets from specific trading pairs on decentralized platforms. The provision of Liquidity Pools increases the speed of trading transactions within DEXs and reduces the amount of slippage (price changes during exchanges). For this reason, decentralized exchanges pay Liquidity Pools investors. Investor rewards consist of commissions that the platform charges traders.

Usually, the value of the premiums is 0.20% or 0.25% from the trades on trading pairs. The calculation of daily profit is made according to the following formula: investment amount / total pool collateral * daily trading volume * commission rate. For example: $1 thousand / $1 million * $2 million * 0.25% = $5 for 24 hours.

Investments in Liquidity Pools require the investor to be active. This is due to the following recommendation: you need to monitor the profitability of the provided pools and change them as needed to increase the final income.

Farming

Profitable farming is a very popular method of investing. Farming came about because of the concept of liquidity pools. The earnings for securing Liquidity Pools are considered low. Previously, it attracted investors weakly. Then the developers of decentralized exchanges came up with the idea of issuing so-called “LP-tokens” to investors. They need to be staked to earn additional income. At the same time, DEXs pay bonuses for pharming with their service tokens. In this way, decentralized platforms emit their own cryptocurrencies and incentivize investors to provide Liquidity Pools.

The returns on depositing LP tokens vary widely. For example, as of July 3, 2022, the Biswap platform has a minimum farming yield of 2.13% (DAI-USDT) and a maximum yield of 218.71% (GST-USDC).

There is a nuance to income farming – the available pools for LP token steaking change periodically. For this reason, investors have to regularly search for other Liquidity Pools and reinvest capital in them.

P2P

By July 3, 2022, peer-to-peer platforms have become very popular. They allow you to trade cryptocurrencies directly with other clients of P2P systems. But more often users use such platforms to buy or sell digital assets for fiat.

The safety of transactions is guaranteed by intermediaries. Usually, they create arbitration functions (to resolve disputes) and automatic algorithms to freeze the savings of the seller of digital assets. After the buyer makes the payment, the second party to the transaction only has to confirm the receipt of funds. Then the cryptocurrency is transferred to the balance of the first exchange participant.

On peer-to-peer platforms, you can set your own transaction rates. For this reason, the most active users of P2P platforms often become traders of cryptocurrencies and fiat. They put their commission – about 1% of the market price of assets – into the exchange rates.

With a large turnover of funds, investments in P2P can bring very high profits. For example, having made a day of transactions for $10 thousand, the merchant will receive $100 of net income.

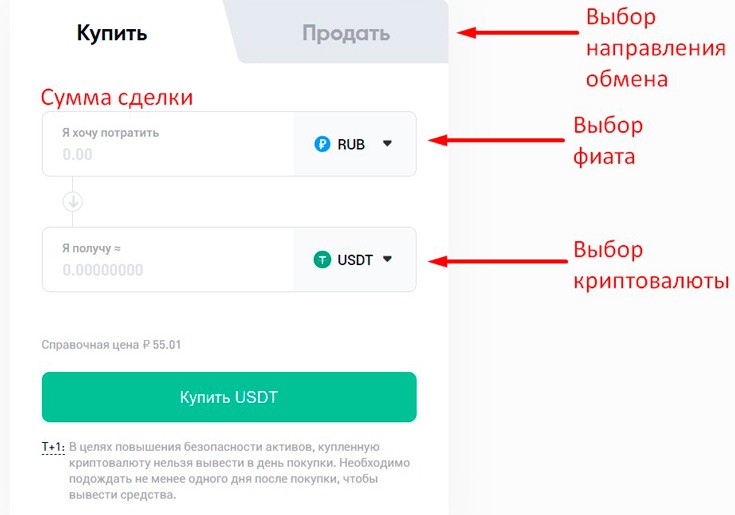

There is a peer-to-peer service in the Phemex ecosystem. You can open it by going to the “Buy Cryptocurrency” section to the “Buy Cryptocurrency on P2P Market” page. This tab presents an order form with 2 directions of exchanges:

- Buy

- Sell.

At the bottom of the order-form the reference price of cryptocurrency in fiat is indicated. If the exchange rate is satisfactory, you need to click on the “Buy” or “Sell” button (depending on the selected direction of the transaction).

Which exchanges to use to earn money with minimal risks

The following trading platforms can be used to profit from cryptocurrency investments.

| Name | Exchange Type | Description |

|---|---|---|

| Phemex | Centralized | The exchange was launched in November 2019. After about 30 months, 5 million users have registered on the platform. Phemex has reached an average daily trading volume of $4.4 billion. The platform has also evolved into an ecosystem of cryptocurrency products. It provides users with access to the P2P and derivatives marketplace, as well as several passive investment tools. |

| Binance | Centralized | This exchange was established in July 2017. In 5 years of operation, Binance has become the most popular centralized cryptocurrency ecosystem. Tens of millions of traders are registered on the platform. The total trading volume within the exchange is $7.2 billion on average. Users of the ecosystem can operate derivatives and make peer-to-peer exchanges. Binance also has features for safe passive income. |

| Biswap | Decentralized | This platform launched in May 2021. After 13 months, the decentralized exchange has become one of the best exchanges on the BNB Smart Chain (BSC) blockchain. This was facilitated by the cooperation with the Binance platform. Biswap provides customers with 7 tools to earn money on cryptocurrencies with minimal risks and other services. |

What is risk diversification

From Latin, the term translates as “expansion”, “diversity”. In cryptocurrency trading, diversification is the distribution of investments in several investment instruments. This approach allows you to reduce the risk of capital loss in case of a decrease in quotes of one or more digital assets.

Often diversification reduces the final profit. In return, the investor receives almost guaranteed income (due to the distribution of deposits) over a long distance. At the same time, diversification can be done in different ways. For example:

- Buy 10 cryptocurrencies in the long run with all the money.

- Buy 5 cryptocurrencies for 50% of savings and invest the remaining amount in staking.

- Invest in 5 passive earning instruments.

Combinations can be invented endlessly. At the same time, the more investment instruments will be used, the lower the overall risk will be.

Summary

As of July 3, 2022, there is a clear bearish trend in the cryptocurrency market. Quotes of many digital assets have fallen 3-10 times from their peaks in the fall of 2021. For this reason, trading is dangerous right now. But there are ways to make money on coins and tokens with minimal risks:

- Deposits

- Staking

- Long-term investments

- Liquidity pools

- Farming

- P2P trading.

Investments in liquidity pools and income farming are only possible on decentralized exchanges. But the other methods of earning money are also available in many centralized crypto ecosystems.

Error in the text? Highlight it with your mouse and press Ctrl + Enter

Author: Saifedean Ammous, an expert in cryptocurrency economics.