Bitcoin launched the era of digital money with its emergence in 2009. New types of assets based on blockchain technology began to be developed.

Cryptocurrencies are different from each other. There are thousands of them. Most digital coins are based on the principles that were applied when bitcoin was launched:

- Not issued, regulated or backed by a central authority – such as a bank.

- Based on distributed ledger technology (blockchain).

- Data is protected by cryptography algorithms.

- Users manage their assets through a wallet without intermediaries.

The difference between cryptocurrencies (coins) and tokens

As of November 2021, the number of digital assets on the market is more than 7 thousand with a total capitalização de almost $3 trillion.

Although coins and tokens are forms of cryptocurrency, they realize different functions. The former are built on their blockchain. They are conceived as a form of digital assets. The latter are a unit of balance measurement in an existing blockchain (such as the Ethereum network).

What are the different types of cryptocurrencies and how they differ

The basic blockchain technology allows developers to create a variety of types of digital money to solve many problems. This applies to areas such as finance, healthcare, energy, information storage, privacy, security, machine learning, payments, and content ownership. This is the difference between cryptocurrencies and the functions they fulfill.

5020 $

bônus para novos usuários!

A ByBit fornece condições convenientes e seguras para a negociação de criptomoedas, oferece comissões baixas, alto nível de liquidez e ferramentas modernas para análise de mercado. Oferece suporte a negociações à vista e alavancadas e ajuda traders iniciantes e profissionais com uma interface intuitiva e tutoriais.

Ganhe um bônus de 100 $

para novos usuários!

A maior bolsa de criptomoedas onde você pode iniciar sua jornada no mundo das criptomoedas de forma rápida e segura. A plataforma oferece centenas de ativos populares, comissões baixas e ferramentas avançadas para negociação e investimento. O registro fácil, a alta velocidade das transações e a proteção confiável dos fundos fazem da Binance uma ótima opção para traders de qualquer nível!

Coins of exchange

As the exchange rate of the major coins increases, the fees for sending them increase. To address some of the issues in the free movement of digital assets, projects are emerging to make the process easier, faster and cheaper.

IOTA is one of them. The coin, based on a distributed ledger (DLT), provides secure data transfer and commission-free payments. Another popular cryptocurrency for exchange is Ripple (XPR). The developers set a goal: to create a system with minimal transaction costs and instant execution of orders. Now it is used in close cooperation with financial organizations (banks, payment systems).

Cryptocurrency platforms

New ideas of developers have long gone beyond the simple functions of digital money (exchange, buy, sell), turning into entire ecosystems for new projects:

- The Ethereum blockchain has standards for realizing a variety of tasks. ERC-20 is a common protocol for creating tokens and contratos inteligentes. ERC-721 gave rise to the widely known NFTs (non-replaceable tokens), which are featured in the art market.

- Solana (SOL) utilizes a new method of validation – “proof of history” through a cryptographic timestamp mechanism. The main difference between the cryptocurrency and others is its high throughput (50 thousand transactions per second).

- AVXChange is a global file-sharing service for audio and video entertainment via a decentralized network (P2P). Users can earn money by distributing unique media content.

- Polkadot has created a completely new type of blockchain with a multi-level chain system (parachains). Based on it, hundreds of projects have emerged in the DOT ecosystem – from self-improving smart contracts to the concept of decentralized Internet (Web 3.0).

Exchange Coins

Major trading platforms issue their own cryptocurrency. These coins are mostly developed on Ethereum network standards. Binance Coin (BNB) was also created on the basis of ERC-20, but eventually moved to its own Smart Chain blockchain with support for smart contracts. Tokens in this network operate on its own BEP-20 standard.

As of mid-November, there are almost 167 million BNB in circulation. But the project provides for regular burning of Binance Coin by allocating money from a portion of the commission that was earned by the Binance exchange. The Coin extraction will last until there are 100 million coins left in circulation. This is a deflationary mechanism that affects the increase in the value of the asset.

AppCoins

This is a project of decentralized economy of payments in apps, as well as the creation of a universal digital advertising protocol for smartphones. AppCoins stated that moving the entire mobile product ecosystem to blockchain will make it fully transparent. One example of an improvement is a set of dispute resolution methods, another is a ranking mechanism for the creator that evaluates trustworthiness based on past transactions. The project allows developers to monetize their apps transparently and efficiently. Users, on the other hand, can get the product at a lower price.

Stable Coins

Stablecoins were created as a way to overcome the excess volatility of cryptocurrencies. Their value is tied to real assets:

| Coverage | Descrição |

|---|---|

| Fiat money | The price is based on the amount of reserves held by the financial institution. The main peg to the US dollar is TrueUSD (TUSD), USD Tether (USDT), USD Coin. |

| Criptomoeda | To guarantee the value of a stablecoin, overcollateralization (the size of the collateral is higher than the asset) is applied. The largest representative is DAI. |

| Precious metals | The value is tied to the gold rate: PAX Gold, DGX Gold Token. |

Types of tokens

These are fungible digital assets for trading within the blockchain on the basis of which they were issued.

Each type performs specific functions, depending on the usage. A single token can fall into multiple categories, so these groups are not mutually exclusive.

Exchange tokens

Large platforms issue these to increase liquidity, stimulate trading activity, or facilitate community management. Basically, these cryptocurrencies are characterized by privileges for holders:

- KuCoin Token (KCS) is an asset of a financial services operator of a Hong Kong-based trading platform. As a bonus program, the exchange’s fees are distributed to the holders of these tokens.

- Huobi or HT is a decentralized digital asset based on Ethereum. It is a loyalty points system on the platform, where large holders can buy themselves VIP status with discounts on trading operations.

- OKB is a token of the OKEx cryptocurrency exchange. Holders participate in voting to make decisions on the platform’s activities. The amount of discounts on commissions depends on the amount of OKB in the holder’s account.

DeFi

Decentralized Finance is a marketplace for borrowing between participants with a high level of security, which has reached a capitalization of $100 billion in 2 years, starting in 2020, and continues to grow.

Each token is designed to function in a corresponding financial application. They are usually created on the same blockchain where the native project resides. The difference between cryptocurrencies lies in the functions they perform:

- Fees. Facilitate the collection of generated payments.

- Governance. Give voting rights in DeFi protocols and allow owners to influence the day-to-day operation and development of the project.

- Collateral. If there is a shortage on the borrowing platform due to user loans being liquidated, any imbalance will be covered with these tokens. They are vital for protocols that create artificial assets or use cryptocurrencies as collateral.

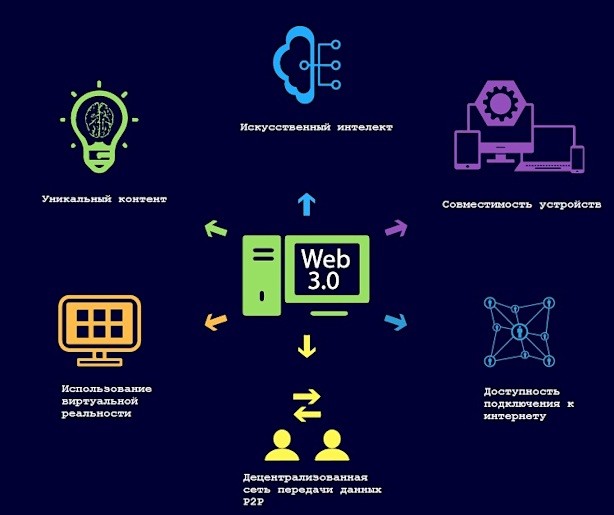

Web 3

The Internet of the future must fulfill several criteria:

- Personal data is owned by users, not corporations.

- Secure transactions are carried out

- Information exchange is decentralized.

The main role in the first phase of the transition is played by technology companies to develop solutions to these complex problems.

The Polkadot project is developing a network of distributed processing nodes to exchange information between any type of blockchain and build multi-level parallel chains (parachains). The test network uses a Proof-of-Authority consensus mechanism and supports horizontal information transfer. Data and tokens are sent to parachains via Relay Chain, but the ultimate goal of the project is for information to be transferred between nodes without this mechanism. This will ensure a fast and direct exchange of information.

The Polkadot development team has launched the Web 3 Foundation, which provides $100K in funding to new projects that aim to grow the DOT ecosystem. As of November 2021, more than 300 applications have been approved. The grants are used to develop blockchain-integrated decentralized applications (DAapps) that provide a high level of transparency, speed and access. The executable code is written in the blocks of the blockchain and cannot be changed from the outside.

The Syntropy team launched the NOIA Network project to overcome the low bandwidth of the Internet by finding optimal network routing. Instead of using central servers to cache web content, participants can reserve unused bandwidth or free computer space for data storage, being rewarded with NOIA tokens. The ecosystem created includes a set of tools and libraries, the Syntropy Stack. It is designed to create, automate, scale and optimize encrypted connections between any device or service. With this, any developer can integrate secure connectivity capabilities into their applications.

ERC-20

Many projects when improving their own products start by issuing tokens on this network.

Some of the biggest ones are:

- Chainlink (LINK). A network of oracles providing data integration for smart contracts from the outside world. For example, information about an insurance claim can be uploaded to the blockchain with their help, and the fulfillment of the terms of the contract will be triggered. Capitalization: $15.7 billion as of November 2021.

- Wrapped Bitcoin (WBTC). This is a bitcoin that has been converted for use on the Ethereum blockchain. The WBTC token allows users to interact with various decentralized applications as well as DeFi. Capitalization: $15.7 billion.

- Vechain (VEN). The project is based on the digitalization of physical objects through Vechain IDs. Identifiers are stored in a blockchain and sent via smart contracts – for example, to add data or to transfer ownership of a product during its production. Capitalization: $11.2 billion.

The Ethereum network standard for launching new tokens contains a set of rules and conditions that projects must meet in order to be included on the blockchain.

This ensures that tokens of different types will work equally and predictably in the Ethereum system. Almost all digital wallets support the ERC-20 standard cryptocurrency.

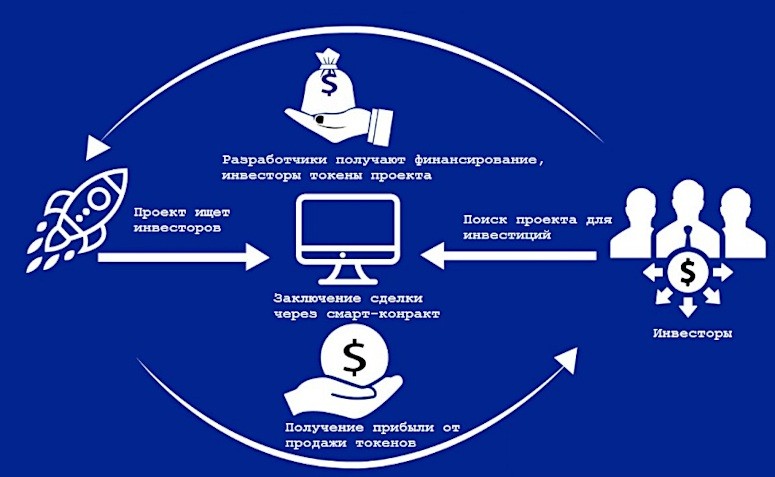

ICO

The initial token offering is conducted to raise investment and finance the final stage of the project. Future shareholders buy coins, and the funds received by developers are used according to the roadmap. It is believed that after the launch of the project, the price of initially issued tokens will grow several times, and investors who believe in the idea will realize them with a large profit. However, only 10% of all cryptocurrency startups succeed. There are several reasons for this:

- There are a lot of fraudulent projects. During the heyday of ICOs (2017), about 65% of all offerings were created to be fraudulent.

- The risk that the idea remains unrealized until the end.

- The released coin loses out to its already existing counterparts.

Security tokens

This is a unique digital record issued on the blockchain that represents a share in an external asset. A company wishing to distribute shares to investors can use a security token (STO), which offers the same benefits as traditional securities (shares), voting rights and dividends. Since blockchain is at the core, the pros are inherited from it:

- Immutability.

- Openness and availability of information.

Which cryptocurrencies and tokens to choose for investment

Being in search of an investment object, it is necessary to analyze what the project offers to the market, what problem it solves, whether it has already active competitors. The idea should be global, promising and feasible. An important factor is human resources. It is necessary to assess whether the developers can cope with the tasks and whether they have a successful experience of launching crypto-projects.

Interesting coins for investment:

- Polkadot (DOT). The project aims to integrate cryptocurrencies by creating a network that connects different types of blockchains so they can work together. This merger could change the way digital currencies are managed. Between September 2020 and October 29, 2021, the token’s exchange rate rose 1,400% from $2.93 to $44.19.

- Solana (SOL). Designed for the development of decentralized finance (DeFi), DApps and smart contracts. The blockchain runs on hybrid proof-of-share and proof-of-history mechanisms that help process transactions quickly. The SOL price started at $0.77. By October 29, 2021, the value was $201.91, an increase of 26,000%.

- Shiba Inu (SHIB). Created in mid-2020. Operates on the Ethereum network. At an initial price of $0.0000000014, SHIB is still trading below one cent, but its value has grown to $0.00007567, a 5,400,000% increase.

Resumo

Cryptocurrencies are different and are no longer just an object of speculation. Retail and institutional investors are taking digital assets seriously. They choose them not only for short-term profits but also for long-term investments. It is obvious that cryptocurrency is more than a passing fad for many. Hundreds of projects are evolving and changing the way the world thinks. The products they offer are so innovative that it may take humanity decades to implement them into everyday life.

Perguntas frequentes

❓ What are DApps?

Decentralized applications are digital programs that exist and operate on a blockchain or P2P network of computers and are outside the purview and control of a single authority.

🤷♂️ What is the difference between an ICO and a listing on an exchange?

ICO – selling a small volume of issued cryptocurrency among investors at a fixed price. Listing – starting to sell coins through an exchange to all comers, where the value is set by supply and demand.

🤔 What are collateralized tokens?

It is a smart contract where the cryptocurrency acts as collateral. When the prescribed conditions occur, the locked asset is transferred as a fulfillment of the arrangements.

📜 Project roadmap – what is it?

A step-by-step presentation of the strategy, list of tasks and tools that are needed to realize the final product.

Um erro no texto? Destaque-o com o mouse e pressione Ctrl + Entre.

Autor: Saifedean Ammousespecialista em economia de criptomoedas.