Bitcoin is the first cryptocurrency with secure transactions without intermediaries. The main digital asset is based on blockchain. This technology is superior to traditional financial products, offering less bureaucracy and more transparency. Cryptocurrency banks are already being created. They allow for efficient asset management.

Banks and blockchain technology

The banking industry is in a complex relationship with blockchain. On the one hand, the technology offers opportunities to simplify financial processes. On the other, it is seen as a threat to established models. The following advantages of blockchain can be highlighted:

- Fraud reduction. Banking systems are built on a centralized database. It is more vulnerable to hacking. Blockchain is a distributed ledger where each block contains a timestamp and packets of individual transactions with a link to the previous block. This transparent database allows for quick detection of suspicious behavior.

- Identification. Financial institutions spend up to $500 million a year to comply with KYC and AML regulations. Blockchain will allow bitcoin banks to access independent customer verification.

- Getting rid of bureaucracy. Smart contracts can be programmed to execute financial transactions after reaching a certain set of criteria.

- Cross-border transfers. Bank transactions are only relevant within a country. In addition, such payments are subject to high fees. The problem can be solved with blockchain, as it has no geographical restrictions.

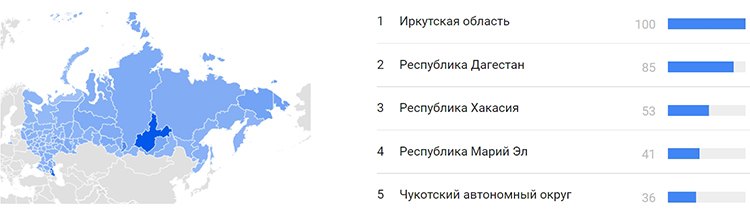

Russian legislation on cryptocurrency regulation

In July 2022, a law was signed that banned the use of digital coins as payment for goods and services. This is a clarification for No. 259-FZ of July 31, 2020.

Cryptocurrency is equated with property. It can be inherited, bought, exchanged and stored for investment purposes.

Conversion to a card is taxable (the prime rate is 13%). If the coin was bought for $10 and sold for $100, it will amount to $12.35.

Russian banks for cryptocurrency

The Central Bank of the Russian Federation is relentlessly warning citizens about the dangers of acting with digital coins. In October 2022, there are no banks working with cryptocurrency in Russia yet. You can not create an account, buy or sell bitcoins. This is due to the lack of regulation of the industry. But customers can use cards to buy on conversion platforms and exchanges.

5020 $

bônus para novos usuários!

A ByBit fornece condições convenientes e seguras para a negociação de criptomoedas, oferece comissões baixas, alto nível de liquidez e ferramentas modernas para análise de mercado. Oferece suporte a negociações à vista e alavancadas e ajuda traders iniciantes e profissionais com uma interface intuitiva e tutoriais.

Ganhe um bônus de 100 $

para novos usuários!

A maior bolsa de criptomoedas onde você pode iniciar sua jornada no mundo das criptomoedas de forma rápida e segura. A plataforma oferece centenas de ativos populares, comissões baixas e ferramentas avançadas para negociação e investimento. O registro fácil, a alta velocidade das transações e a proteção confiável dos fundos fazem da Binance uma ótima opção para traders de qualquer nível!

Some banks are developing blockchain-based projects:

- Sberbank – in 2018 launched a blockchain lab. There, financial industry products and their application in the cryptosphere are studied. Among the achievements we can highlight the automation of transactions with smart contracts, decentralized control of trading operations, creation of a distributed register of bank guarantees.

- Alfa Bank – in 2016 conducted the first letter of credit transaction via smart contract, in 2020 developed a platform for S7 Airlines agents and another for the self-employed, and in 2022 announced the creation of infrastructure for tokenized transactions.

- Tinkoff – in 2017, Oleg Tinkov announced plans to issue his own cryptocurrency TinCoin. However, this did not happen. But in 2022, the bank is creating a platform for transactions with digital assets.

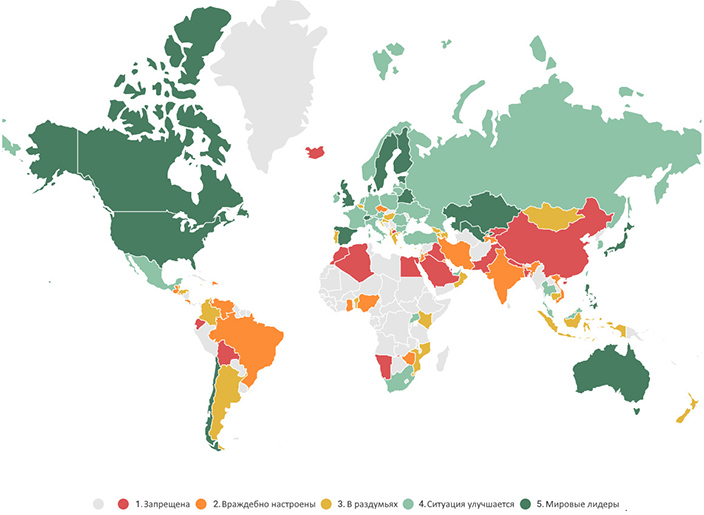

Global banks with support for cryptocurrency

Financial institutions often prohibit transactions with digital coins. This is due to its popularity among fraudsters. But still, many organizations in the US, Canada and Europe have integrated with crypto payment processing services.

SEBA

This Swiss company aims to provide users with seamless integration between traditional currencies and digital assets. Services include liquidity management, trading, and loans.

Wirex

Based in London, but has branches throughout the European region.

The financial organization offers a functional debit card. For example, in-store purchases are rewarded with a 0.5% cashback in BTC.

The bank also offers an instant trading platform where customers can exchange at the current rate their cryptocurrencies for fiat money and vice versa.

Barclays

The UK bank initially denied the impact of cryptocurrency on the global financial system. However, over time, it changed its opinion and strategy. The organization offers Smart Investor trading platform, debit and credit cards.

Solarisbank

The German company provides APIs for digital banking to industry giants such as Samsung. The bank now works with cryptocurrency. This is made possible through a partnership with Luxembourg-based exchange Bitstamp.

BankProv

The financial organization was the first in the industry to offer crypto loans backed by ether to its customers. The company has implemented deposit insurance for up to $250 thousand. The bank cooperates with cryptocurrency companies and software developers.

Bank Frick

This is a modern wealth management institution. The company allows clients to open accounts to trade and safely store digital assets. Transactions are carried out in dollars, Swiss francs and euros.

Simple Bank

The bank started as a modern fintech startup. Customers can make direct buy and sell transactions using Bitcoin, Litecoin, Ripple, Ethereum and others. The trading platform features InstantSend technology that processes transactions quickly by automating the process.

Types of cryptocurrency banks

This term can be considered a misnomer. Cryptobanks are not technically them. They offer the same functions as traditional institutions: customers can participate in lending and borrowing, and spend money using cards. However, these services have not been legally recognized.

Experts prefer to call such organizations special purpose financial institutions.

This new category combines 2 sectors: traditional system and blockchain technology. For example, Choise (before rebranding Crypterium). The bank works with bitcoins in Russia, but residents of the Russian Federation can replenish the cryptocurrency wallet only from a third-party service.

The table summarizes the pros and cons of cryptobanking.

| Vantagens | Desvantagens |

|---|---|

| Financial accessibility. Customers can use the services regardless of income level or country of residence. | Market volatility. Cryptocurrency prices fluctuate on a larger scale than other asset classes. |

| 24/7 access. Usually, cryptocurrency platforms don’t differentiate between business and free hours. If a user wants to borrow on Friday night, they don’t have to wait until Monday morning. | Fraud risk. For example, El-Sgurto has received a lot of negative reviews. The bank accepts cryptocurrency in Russia. Clients from the Russian Federation report that they can not return the invested money. The administration of the project does not get in touch. |

Centralized banks

These organizations have internal management and regulation. Therefore, identity verification is required before accessing services.

We can distinguish 2 such cryptobanks:

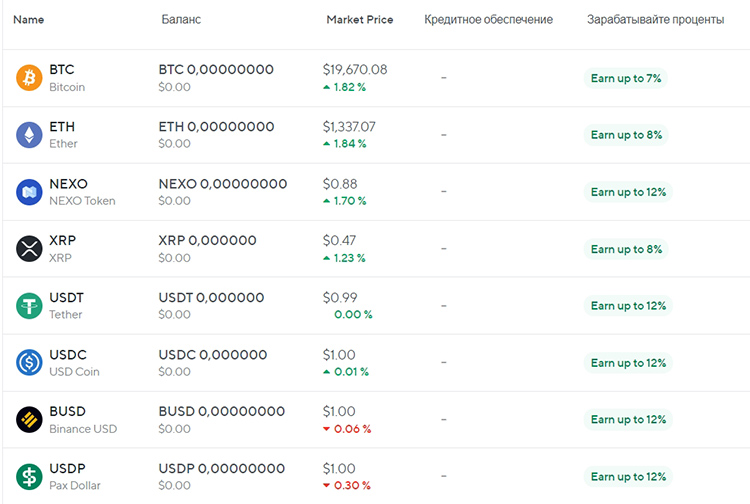

- Nexo is one of the first digital lending projects. The platform allows customers to deposit fiat money and cryptocurrencies, receive fixed compound interest on deposits on a daily basis. There is a credit card. Cryptocurrency is used as collateral, converted to fiat when making purchases. There is also a cashback of up to 2%.

- BlockFi is a New York-based financial institution founded in 2017. Customers are offered a credit card. The custody of funds is managed by Gemini Exchange in accordance with US federal laws.

Decentralized banks

There are no intermediaries in such institutions. Everything works through smart contracts and peer-to-peer services. Lenders and borrowers from any part of the world can become members of this system.

| Vantagens | Desvantagens |

|---|---|

| Transparency. Customers interact with each other directly. No one can impose an opinion or influence their decision. | Lack of oversight. No supervisory bodies to look into problems and errors. |

| Accessibility. Transactions are initiated from anywhere in the world. | Risks. Deposits are not insured; cyberattacks are possible. Extreme market conditions, other operational and technical difficulties may result in temporary or permanent stoppage of withdrawals and transfers. |

| Data Storage. Information cannot be altered or tampered with. | |

| Savings. Users do not have to pay high fees. |

Criteria for choosing a cryptobank

Digital market account providers guarantee that users’ funds will be safe. However, this is not always the case. When choosing an organization, several key factors are taken into account.

Segurança

The first thing to look into is how accounts and funds are protected. A cryptobank should keep user tokens in cold storage. In addition, it will be a plus if the institution has implemented insurance coverage. Account settings should include two-factor authentication, SMS codes, or email confirmation links.

In August 2022, cryptobank Nuri declared bankruptcy due to difficult market conditions. However, customers’ funds remained safe thanks to insurance coverage from Solarisbank AG.

Functionality

There are several points here:

- Switching to and from fiat currencies. It is important to investigate how easy it is to move between the new and old financial systems.

- Supported currencies. Some organizations only work with basic digital assets.

- Credit or debit card. Such tools make it easier to manage crypto assets.

Passive income

Cryptocurrency banks offer interest-bearing accounts and loyalty programs. Firms borrow the user’s money to lend to other customers. For this, they pay interest. Passive income can be earned for deposits, using the platform’s own token, as cashback.

How to open an account in a cryptobank

The procedure for registering an account is similar to the traditional one. To do this, you will need to enter personal data and pass verification. You can consider the algorithm on the example of Nexo – a licensed cryptobank in the United States:

- Register an account. To start working with Nexo, you first need to create an account. This takes a few minutes.

- Go through identification. Nexo is required by law to verify users. You need to provide personal information. It includes full name, city, address, phone number, type of business, employment status, source of income, and origin of assets. The platform will then ask to upload a government-issued ID. Verification usually takes a few minutes, but sometimes the process can take up to one business day.

- Open a deposit. Now you can fund your account. This provider accepts transfers in crypto assets and fiat money. If you choose the latter, you can transfer in dollars, euros or pounds sterling.

- Receive interest. Once the account is funded, the client will start earning. Interest will be paid on a daily basis.

Perguntas frequentes

😎 Why use cryptocurrency banks when there are exchanges and exchangers?

It’s easier and faster. These platforms combine the functionality of crypto exchanges, exchangers and P2P services. With banks, customers use digital currency in the same scenarios as regular money.

👀 How to buy virtual coins in Russia?

You can use conversion services or P2P platforms and pay for the application from the card.

🤔 Is cryptobanking safe?

Yes, but there are risks. If the company doesn’t have a license, customers’ money can be stolen or blocked. In June 2022, cryptocurrency exchange Celsius suspended user withdrawals.

🔴 Do cryptocurrency banks have their own tokens?

Yes. Nexo, for example. Customers use it to become a member of a loyalty program and get increased annual interest.

📃 Do I have to pay taxes for cryptocurrency in the Russian Federation?

In Russia, digital assets are recognized as property. You need to pay tax only on income.

Há algum erro no texto? Destaque-o com o mouse e pressione Ctrl + Entrar

Autor: Saifedean Ammousespecialista em economia de criptomoedas.