Adding coins and tokens to a platform does not guarantee that they will always be available to users. Due to certain factors, exchanges conduct delisting. The procedure involves closing the opportunity to buy or sell cryptocurrency on the platform, stopping trading. Such a planned event by the exchange is announced in advance. The reaction of its holders is more often the sale of cryptoassets, leading to a fall in the rate.

Reasons for delisting

When placing a koin, large platforms impose high requirements on cryptoprojects, valid for the entire period of cooperation. If the developers of digital currencies stop following their rules, then the owners of the trading platform have the right to consider stopping trading. Project managers are familiarized with the requirements and often honestly fulfill their obligations. The main reasons for delisting digital assets are different:

- Small trading volume.

- Low level of capitalization of the project.

- Anonimato.

- Unreliability.

There are reasons for delisting cryptocurrency, which are less common: user complaints and regulators’ decrees.

Small trading volume

Exchanges maintain the operability of the platform at their own expense. For example, they are forced to update hardware and software. This is due to the conduct of garfos over blockchain systems. This term means changing the algorithm of the network or dividing it into 2 different chains.

Exchanges make money on commissions from trading transactions. Sometimes digital currencies become uninteresting to investors and traders, which leads to a decrease in trading volume. If a certain asset does not cover the cryptocurrency exchange’s expenses for its maintenance, it becomes a reason for delisting. An example is the CloakCoin token, which was removed from the Binance and Bittrex platforms in 2019.

Low capitalization

Crypto exchanges often list a digital asset whose company is actively developing in the market and supported by the community. But sometimes the prospects are short-lived, and the level of capitalization drops over time. Then platforms often break cooperation and remove the cryptocurrency from trading.

5020 $

bônus para novos usuários!

A ByBit fornece condições convenientes e seguras para a negociação de criptomoedas, oferece comissões baixas, alto nível de liquidez e ferramentas modernas para análise de mercado. Oferece suporte a negociações à vista e alavancadas e ajuda traders iniciantes e profissionais com uma interface intuitiva e tutoriais.

Ganhe um bônus de 100 $

para novos usuários!

A maior bolsa de criptomoedas onde você pode iniciar sua jornada no mundo das criptomoedas de forma rápida e segura. A plataforma oferece centenas de ativos populares, comissões baixas e ferramentas avançadas para negociação e investimento. O registro fácil, a alta velocidade das transações e a proteção confiável dos fundos fazem da Binance uma ótima opção para traders de qualquer nível!

For example, in 2019, the platform Bittrex announced the stoppage of trading in 17 altcoins. Projects that existed for several years each did not get into the top 500 ranking in terms of capitalization.

Anonymous cryptocurrencies

There are blockchains designed to hide data about transactions, users and addresses from outside observers. Such networks are called completely anonymous. The digital assets of such projects have become targets for removal from trading. Anonymous cryptocurrencies include Dash, Monero and ZCash.

It all started with the hacking of the Coincheck exchange from which these coins were stolen. The lack of ability to track transactions was the reason for the abandonment of anonymous assets. Other crypto exchanges, based on Coincheck’s experience, began to delist the coins.

The second common reason for stopping the trading of anonymous coins was the pressure of regulators in different countries (as of December 2021).

Unreliable projects

Crypto exchanges list altcoins that will generate revenue. This procedure involves checking the project for any possible threats to the site itself and users. Attention is paid to such factors:

- The probability of hacking the exchange. When listing, a full audit of the code of the token or coin is carried out. However, their developers can write a malicious algorithm later and release an update with it. Therefore, the audit is repeated with each change to the blockchain code. In 2014, cryptocurrency exchange Cryptsy was hacked using this method.

- Risk of attack on the project’s blockchain network. Because of the Proof-of-Work (PoW) consensus algorithm, the exchange could lose money. If an attacker controls most of the computing power for blockchain creation and transaction processing, they can damage the network. This vulnerability is called a 51% attack. An attacker will be able to deposit to an exchange, cancel that transaction on the network, and then re-deposit with the same cryptocurrency. Therefore, low capitalization PoW-based coins are removed.

- Risk of regulatory intervention. Financial regulators may recognize the token as a security and require the exchange to delist the cryptocurrency. Regulators are also able to influence the activities of platforms based on legislation.

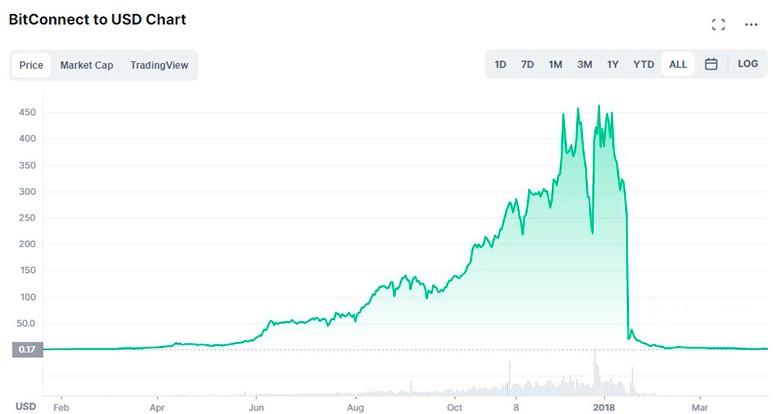

- Fraud. BitConnect token appeared in 2016 and gained capitalization of $2.6 billion. The project offered users 40% of income per month for storing BCC cryptocurrency. It was accused of fraud by Vitalik Buterin (creator of Ethereum) and Charlie Lee (developer of Litecoin). Many cryptocurrency exchanges began to stop selling and buying the token. In 2018, BitConnect depreciated in value and turned out to be a financial pyramid scheme.

The removal of the cryptoasset from the exchanges was influenced by an ordinary scandal with the entrepreneur Craig Wright. He wanted to sue one of the Twitter users for insults. The entrepreneur actively supported the Bitcoin SV project and expressed his willingness to pay $5 thousand in BSV coins for the release of personal data of the offender. After such a statement, crypto exchanges Binance, OKEx, Kraken and others removed the coin from trading.

What to do in the case of delisting a coin

Crypto exchanges warn users in advance about the suspension of trading. There are 2 possible options for the development of events:

- The first – the digital currency is traded only on one platform. The only way out is an early sale. News on the Internet spreads at high speed, so the rate will collapse quickly.

- The second – altcoin is traded on more than one cryptocurrency exchange. The holder of coins can transfer them to another platform or sell them. The price of the digital asset will fall depending on its credibility and the exchange that delists it.

The investor needs to follow the development of the project, news, capitalization and trading volumes. This will reduce the probability of losses when the coin is removed from the platforms.

Examples of delisting a cryptocurrency

In the digital money market, such a procedure is not uncommon, especially on large platforms. For example, Binance often stops the trading of altcoins. This is due to the high requirements of their placement and content on the platform. The table shows 5 examples of delisting coins and tokens.

| Cryptocurrency, exchange | Date (dd.mm.yyyyyy) | Reason |

|---|---|---|

| INS – Binance | 11.09.2020 | Low activity (trading volume) |

| XMR, ZEC, DASH – Bittrex | 15.01.2021 | Banned by financial regulators |

| BTCD, BTM, EMC2, GRC, POT, NEOS, VRC, XBC – Poloniex | 25.09.2018 | Low liquidity, lack of project development |

| XMR in UK – Kraken | 26.11.2021 | State law changes on anonymous digital assets |

| TRX, ADA in the US – eToro | 26.12.2021 | Pressure from US financial regulators |

Resumo

Crypto exchanges reserve the right to implement a trading suspension of any digital asset. The procedure is carried out only after warning traders and investors. The reasons for delisting cryptocurrencies are different, and sometimes are not named at all. In order not to lose money on investments, you need to study the project, monitor its development, as well as the level of capitalization.

Perguntas frequentes

Is listing a paid procedure?

Its cost depends on the agreements between the crypto exchange and the project. It is rumored that large platforms place tokens and coins for $1-2.5 million. However, some listings are free of charge.

🏢 What is the likelihood of a fraudulent asset being listed on a crypto exchange?

Major platforms (Binance, Coinbase, OKEx) allow listing only after a strict step-by-step verification of the company. Therefore, the probability of this happening is extremely low, which is not the case with small crypto exchanges.

💰 How to earn on the listing?

This event has a positive effect on the rate of digital currency. You can find a company that plans to list on one of the major crypto exchanges and invest in the asset.

❓ What does a listing give companies?

The level of trust increases, capitalization increases, there are more prospects for further development.

💡 Why are anonymous crypto assets being taken off the market?

The main reason is their possible use in illegal activities. Most of the developed countries treat XMR, ZEC and DASH with caution.

Erro no texto? Destaque-o com o mouse e pressione Ctrl + Entre.

Autor: Saifedean Ammousespecialista em economia de criptomoedas.