Fluctuations in the market of digital assets attract traders with the prospect of large profits in a short time. The point of trading is to buy for the minimum price of a coin and sell it on the growth of quotations. Profitable speculation on cryptocurrencies depends on the ability to analyze the current balance of supply and demand, to predict the direction of the future trend.

Features of cryptocurrency speculation on exchanges

High volatility can occur due to the manipulation of the price of assets with low capitalização. Such actions are called Pump and Dump. A group of investors with large capital can influence the price fluctuation due to a lack of liquidity, artificially raising quotes. Once the desired level is reached, massive selling follows, bringing the rate down.

How the cryptocurrency market works

The development team often uses an initial token offering (ICO) to attract investment in the project. After receiving the necessary amount of money, the software part is implemented and the product is prepared for launch. A successful launch brings profits to the first investors who participated in the ICO when trading opens on exchanges.

Traders are attentive to the listing of the coin, because by successfully buying tokens at the very beginning, it is possible to get a profit of 300-400% for a single transaction.

For trading, it is necessary to choose a platform with a convenient terminal and low commissions. Exchanges can be decentralized, where trading takes place between participants directly, or centralized, where speculation on cryptocurrencies takes place within the platform itself.

Short-term and long-term investments

The methods of achieving profit for traders and investors differ significantly. The former trade actively within a day, while the latter hold a deal for a long time.

5020 $

bônus para novos usuários!

A ByBit fornece condições convenientes e seguras para a negociação de criptomoedas, oferece comissões baixas, alto nível de liquidez e ferramentas modernas para análise de mercado. Oferece suporte a negociações à vista e alavancadas e ajuda traders iniciantes e profissionais com uma interface intuitiva e tutoriais.

Ganhe um bônus de 100 $

para novos usuários!

A maior bolsa de criptomoedas onde você pode iniciar sua jornada no mundo das criptomoedas de forma rápida e segura. A plataforma oferece centenas de ativos populares, comissões baixas e ferramentas avançadas para negociação e investimento. O registro fácil, a alta velocidade das transações e a proteção confiável dos fundos fazem da Binance uma ótima opção para traders de qualquer nível!

| Short-term | Long-term | |

|---|---|---|

| Analysis method | Finding entry points based on technical indicators | Fundamental data on technologies used, competitors, community support, general market conditions |

| Trading volumes | Many orders to catch all price fluctuations | Low activity with keeping a position for a long time. Averaging on quotes pullbacks. |

| Profit | Can be calculated in tens of percent for one session. Favorable coincidence and a good strategy bring the user more opportunities for speculation on cryptocurrencies than long-term investments. | Reaches thousands of percent with the explosive growth of cryptocurrency |

| Nível de risco | One can lose most or all of the capital in case of a failed series of trades and when using margin trading | Safer alternative to intraday trading |

Trading and long-term investing fulfill different interests. The first way is to hone skills and deeply understand the mechanics of cryptocurrency markets, while the second can be seen as a type of active saving.

Traders try not to miss even small movements, while investors catch the general direction.

Risks in trading

The probability of losses when speculating in cryptocurrency is associated not only with internal, but also with factors that do not depend directly on the trader:

- Operational. Losses due to technical failures on the trading floor.

- Systemic. A successful attack on leading blockchains or the discovery of a critical vulnerability in cryptocurrency technology.

- Market. A drop in the value of an asset as a result of a strong movement of quotations.

- Slippage. Execution of an order with the difference between the desired and current prices.

There is also a risk in margin trading, when a trader receives borrowed capital for transactions. Leverage allows opening positions up to 100 times the user’s own funds. This gives an increase in profit, but at the same time the level of forced closing of the position approaches the entry point. The use of leverage can be recommended only to experienced traders in combination with stop losses.

How to start speculative cryptocurrency trading

Important elements of the start of trading are the choice of the site, currency pairs, a set of tools for analysis and forecasting. The trader needs to start a wallet, register on the exchange and study the elements of the trading terminal.

Determining the starting capital

The advantage of the crypto market is that you can start trading with a few tens of US dollars. The main rule that should be adhered to is that the loss of this money should not adversely affect the general well-being of the trader.

It is optimal for a beginner to start with 100 dollars. This will allow you to stay on the market long enough to master the tools of cryptocurrency speculation and develop a strategy.

In the case of a positive outcome, the trader analyzes the average yield received to determine the amount of capital for trading. Its size should be sufficient and correlate with the current value of the assets that will be traded. The less funds, the more leverage should be used for transactions. The risk will also be higher.

Escolha de uma bolsa

For a newcomer to trading, it is best to start getting acquainted with cryptocurrency trading from centralized exchanges (CEX). This is due to the convenience of moving funds and buying cryptocurrency for fiat money. Decentralized platforms (DEX) offer a high level of security and anonymity:

| DEX | CEX | |

|---|---|---|

| Vantagens | Confidentiality of transactions | High transaction speed |

| Security of cryptocurrency. Coins are stored in users’ accounts until the transaction is completed. | Greater liquidity of the market | |

| Many new altcoins appear only on such exchanges | Convenient ways to withdraw funds | |

| Desvantagens | Lack of many trading tools | Users’ money is stored on the exchange’s servers |

| Low liquidity | Identity verification procedure |

With the growing popularity and trading volume of digital assets, the speed of operation and information exchange becomes an important element. Centralized exchanges are good for cryptocurrency speculation, while decentralized exchanges offer high security to users.

The best platforms for trading

When choosing a platform, you should pay attention to the following criteria:

- Trading volumes.

- Customer feedback.

- The size of commissions.

- Payment systems available for withdrawal of funds.

Selecting an asset for speculation

Trading currency pairs are represented by the following combinations: altcoin/bitcoin, altcoin/altcoin, fiat/bitcoin(altcoin). There are factors that affect the volatility of the exchange rate and the value of cryptocurrencies:

- Media publications. Positive news leads to an increase in value.

- Project benefits. Meeting the needs of the industry to solve practical problems attracts investors.

- Statements by market participants.

An important indicator, besides the level of price fluctuations, is the liquidity of a currency pair. The higher it is, the easier it is to open or close a position at market value without slippage.

The trading asset should be predictable and have the necessary amount of historical data for technical analysis.

Choosing a trading strategy

Any plan of action for making trades is necessary to eliminate the strong influence of emotions when managing a trading account. Now there are many different approaches to determining a strategy in the market for speculating in bitcoins or other cryptocurrency:

- Day-trading. Opening and closing of positions takes place in one trading session. The main emphasis in determining the entry or exit point is on technical analysis.

- Scalping. A high-frequency strategy with the shortest time horizon (from a few seconds) for saving a position. It is practiced by traders who understand the mechanics of the market and are able to determine the cyclicality of price movements. The profit of one transaction is relatively low, about 1%, but due to the large number of trades the profit reaches tens of percent per session.

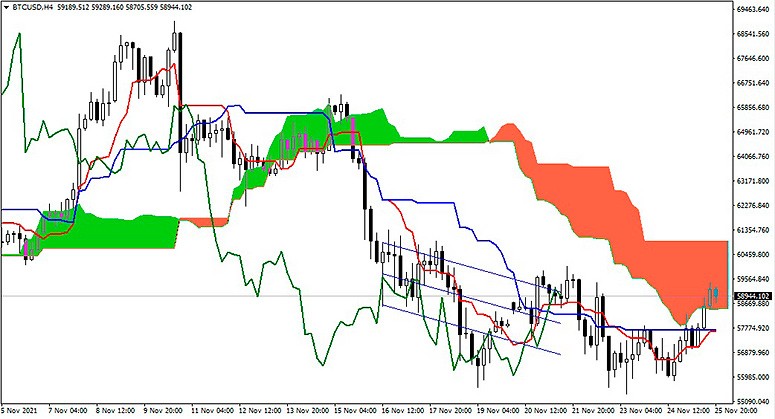

- Trend trading. Long-term strategy, which provides for profits on the general direction of market movement. It is based on análise fundamental and trend indicators on large time intervals (from one day and above).

- Arbitrage. Earning on the discrepancy of the rate of one asset on different exchanges and trading platforms. For this strategy, the speed of trader’s reaction is important, as the window of opportunity is very fleeting while the imbalance persists.

Important concepts in cryptocurrency trading

There are terms that the user encounters from the very beginning when making a trade. They need to be familiarized with and interpreted correctly when opening an order:

- Spread. The difference between the maximum buy price and the minimum sell price. The smaller the gap between them, the more liquid the market is.

- Trend Line. Determination of the main direction of price movement when the following peaks and troughs are higher or lower than the previous ones.

- Support and resistance levels. Price rebound can occur from them, when participants place pending positions to buy or sell, respectively.

- Stop Loss. When the price level set by the trader is reached, an order is automatically opened to limit the loss. Its inverse analog – take profit – serves to fix the received profit.

Fundamental analysis

This is a method of analytical approach to assessing the value of an asset based on publicly available data on the volume of transactions, the total computing power of the network, the number of new addresses. As a result, it can be concluded whether the cryptocurrency is overvalued or undervalued. In the first case, it should be sold, in the second – to buy.

Fundamental analysis was formed on stock exchanges, so it does not always give objective results of crypto market research. This is due to the low liquidity and high correlation of altcoins with bitcoin. As the whole industry matures, new accurate methods of analyzing exchange prices will emerge.

Technical Analysis

Forecasting the future based on historical data from the past. Consists of looking for repeating patterns to study the pattern of price behavior. The basis for such analysis is the charts of quotes. It does not seek to determine the fair price of the asset or consider macroeconomic reasons for the movement, only the volume of open positions, pending orders and their impact on the psychology of the behavior of participants.

TA does not work on charts of coins with small market capitalization. Such assets are susceptible to manipulations, it is easier to pamp and dump them.

Previous extremums of quotes are important because when approaching them, the market often has similar behavior patterns as in the past. Traders try to place pending orders at price levels in order to catch pullbacks. Different strategies and techniques look at the sequence of actions in the event of a breakout or bounce from these support and resistance lines. There are several statements that are the basis of technical analysis:

- History Repetition. Traders in similar circumstances form similar movement dynamics.

- Prices take into account all information. It is enough to study trading volumes and cost dynamics to obtain a forecast of the trend direction.

- Quotes are subject to trends. An individual price change may seem random, but the aggregate for a certain time interval forms trends.

Trading tools

An extensive arsenal of tools is offered for making transactions on the exchange to increase convenience and profitability:

- Short and long positions. In the first case, an asset is sold for its subsequent redemption at a low price. In the second – it is bought in the hope of its growth.

- Stack and its depth. The aggregate of current open orders. It allows estimating the imbalance of supply or demand and the volume of liquidity.

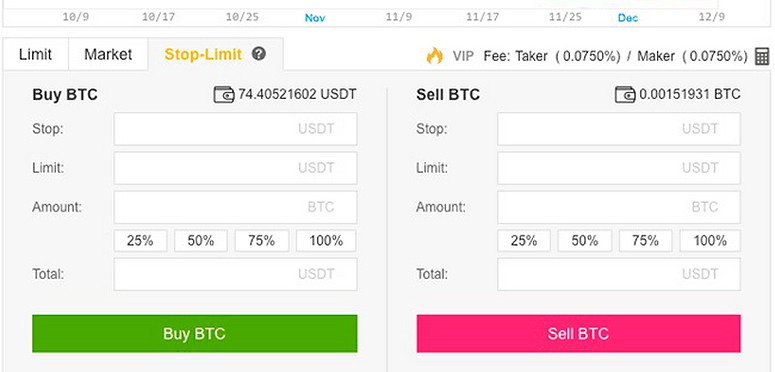

- Limit orders. The order guarantees that it will be executed at a price not worse than the set price.

- Leverage Tokens. Allows trading with leverage, but without margin and collateral requirements as in margin trading.

Technical indicators

These are mathematical algorithms. They graphically represent calculations based on price, trading volumes, open positions, and allow you to make predictions about price movements:

- RSI is an indicator that illustrates the oversold or overbought nature of an asset based on the rate of change in quotes.

- Fibonacci lines – help to determine the current resistance and support levels. The sequence of numbers: 0%; 23.6%; 38.2%; 61.8%; 100%, where 0 and 100 are at the minimum and maximum of the previous period, respectively.

- SAR – in English means “stop and reversal”. It determines the trend direction and possible points of its change. It is widely used for placing moving pending orders (trailing).

- OIshimoku Cloud is a complex system of indicators that gives an understanding of the direction of movement.

Speculative trading tips for beginners

Beginning traders should start with the amount of capital that allows them to open trades, but the loss of which will not have a significant impact on their lives. It is recommended to gradually learn all the subtleties: from simple controls in the trading terminal to building your own strategy on different timeframes. The difference between a successful trader is limiting losses with stop losses and systematic trading, sticking to their own rules. It can take a long time to learn and hone your skills, so it’s good if trading on the stock exchange is not your only source of income. And keeping a log of trades will help to evaluate not only the results, but also the trader’s psychological motivations.

Resumo

There is a lot of money to be made in trading on cryptocurrency exchanges, starting with a small amount of capital. However, it requires a significant amount of experience and knowledge. Downs and ups, crises in the world markets – this is a part of trading that every participant needs to go through and develop a scheme of action for all cases. The less the results of work will put pressure on the trader, the easier and faster the stage of initial accumulation of knowledge will pass.

It is recommended to consider trading as a hobby until the profitability reaches a level that allows one to live from the money earned on the stock exchange.

Perguntas frequentes

❓ What is a stop-out?

A forced closing of a position at current market prices. This occurs when the amount of the deposit approaches the current loss. On some exchanges there is a practice of incomplete liquidation of an order until the balance level is above the stop-out.

✅ What is the minimum amount of capital to start trading?

Each platform has its own rules that set the lower limit. For example, on Binance it is $10.

🔎 How do I calculate the size of a position, taking into account the level of risk?

A trader determines how much capital he is willing to risk in this trade. Let’s say it’s 1% of one thousand dollars in the account, and the stop loss is 5% of the entry point. Then: 1000*0,01/0,05=200. The position size under the given conditions should be $200, and the maximum loss will be $10.

💡 What are Japanese candlesticks?

A graphical representation of price dynamics for easy perception of information by a trader. Many terminals have a function to switch between bars, candlesticks and lines.

💰 Why do prices fall?

Cost is based on supply and demand. If sellers outnumber buyers, quotes go down.

Há algum erro no texto? Destaque-o com o mouse e pressione Ctrl + Entrar

Autor: Saifedean Ammousespecialista em economia de criptomoedas.