It can be difficult for beginners to find the opening and closing points of trades. Copytrading on cryptocurrency allows you to repeat the operations of experts. In this case, the user does not necessarily need to analyze himself. But this way of earning is also not without the risk of losing investments.

The concept of copytrading in cryptocurrency

To earn money on exchanges and trading platforms, users buy and sell tokens and coins. Traders mostly analyze charts, news and statistics on their own. However, customers of exchanges can also trust the forecasts of experts.

Copytrading on cryptocurrency provides for automatic repetition of operations of experienced users. This way of earning money has the following pros and cons.

| Advantages | Disadvantages |

|---|---|

| You do not need to learn the basics of technical and fundamental analysis | On the Internet you can find fraudulent projects that steal clients’ savings instead of copying transactions. |

| There is no nervous tension associated with the fear of opening an erroneous transaction. The user will not lose money due to panic or desire to cover the loss with a new operation. | Most subscriptions are distributed on a paid basis |

| Saving time spent on analyzing and filling order forms | No expert or analyst can guarantee the accuracy of a forecast |

| Trades are opened at the command of experienced crypto traders | Some services offer low-quality subscriptions. Clients risk investing in an unreliable strategy. |

Principle of operation of copying trades

Most sites use this algorithm of automatic trading:

- The user finds a service for repeating transactions (a company, an analyst or a trading robot).

- Having familiarized himself with the terms of cooperation, the client pays for a subscription or otherwise enters into an agreement.

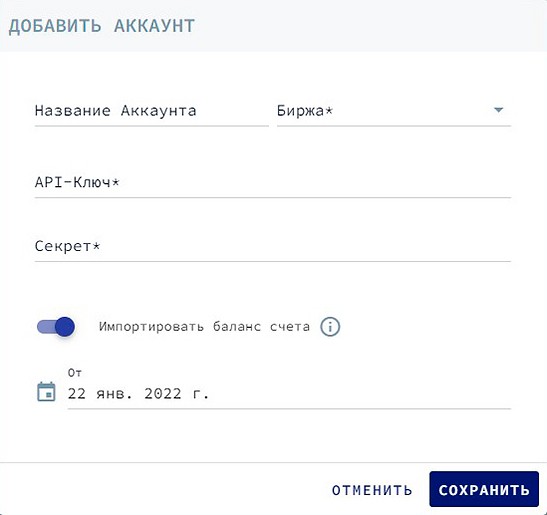

- After activating the service, the user needs to integrate the transaction replication system with the account on the exchange, mostly via API.

- A trading robot or analyst finds the opening and closing locations of trades and transmits this information to the subscriber’s account.

- In the user’s account, orders are placed based on another trader’s signals with profit locking points.

Platform

This is usually a website where visitors must register. After creating an account, the client has a list of strategies for copytrading or analysts offering to repeat their systems. The platform acts as an intermediary. It provides communication between visitors and developers of automated strategies and transmits trading signals to exchanges via API.

Marketplace

Most transactions with tokens and coins are carried out in spot mode. Purchased cryptoassets are credited to the wallets of buyers. This type of transactions is more often used by investors, as it allows you to safely store tokens and coins.

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

Speculative trading is better conducted in the market of derivatives (derivative contracts) and tokenized assets. In this case, crypto traders have access to leverage and the ability to make money on shorting transactions (selling digital currencies).

Most copy trade platforms have strategies for both the spot market and transactions in futures and other derivatives.

Broker

Typically, copy-trading trades are executed on centralized exchanges. Most platforms provide integration with such venues:

- Binance.

- Bitmex.

- FTX.

- Bybit.

The ability to connect trading on signals depends on the availability of the exchange’s API interface and the rules of the copytrading service.

Trader

Signals for opening and closing trades come to the platform from 2 sources:

- From automated advisors. These are applications that calculate the optimal moment to buy or sell an asset using a special algorithm.

- From traders. Experienced users can offer platform clients to copy their signals and forecasts.

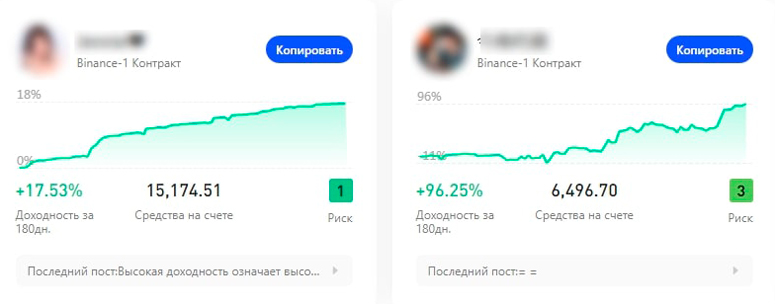

To find subscribers, the trader must demonstrate a positive trading result. Usually, the profitability of the strategy is displayed in percentage and absolute terms.

The number of traders from which one client can buy a subscription to signals is not limited. But the application of several strategies at the same time does not always bring profit. On the contrary, there is an increased risk that one of the analysis techniques will be inaccurate and lead to the loss of deposit.

Investor

Platform clients differ from ordinary crypto traders in that they do not want to independently analyze the situation on the markets. Such users are often called investors, because in fact they invest in a trading strategy and try to receive passive income.

Copytrading services

There are many cryptoplatforms on the Internet that sell signals and subscriptions to forecasts. But not all services are trustworthy for visitors. Private traders and little-known sites can cheat clients by selling random and inaccurate forecasts.

It is recommended to choose services with wide functionality and positive feedback from other users. In addition, it is better to buy signals on platforms that provide free or test mode of access to forecasts.

BingX

The platform positions itself as a social trading exchange. Users are offered a large number of trading tools. But the main direction on BingX is copy trading.

To start working on the exchange, you need to create and verify an account. You can copy any trades (spot, futures). To do this, you will need to set the maximum amount for each transaction.

Since copytrading is designed for beginners, the exchange seeks to reduce potential risks. For this purpose, BingX launched a promotion. New users are offered a subsidy of 10 USDT to cover losses when copying trades. The offer allows leverage up to 10x. The tool acts as a safety cushion when dealing with Bitcoin, Ethereum, Dogecoin and other popular coins.

AIVIA

Allows you to copy traders and trading robots via Binance and Bitmex crypto exchanges. For beginners there is a free mode of using the service. To do this, you need to link a new exchange account to your account. But this offer does not apply to crypto traders who registered through a referral link.

Most strategies require an initial investment from 0.2 BTC.

There are very few offers without a minimum deposit limit. Paid subscription allows you to customize the ratio of investor and trader positions. For example, if a client wants to increase profitability, he increases the volume of trades. The subscription price for a year starts at $238.

Wunderbit

A service for automating trading on exchanges. The site has:

- A built-in terminal for spot transactions.

- Bots for automated trading, including on the futures market.

- Interface for receiving signals from other traders.

Many features are available for free. Visitors are allowed to connect one exchange account and 2 trading bots. The cost of paid subscriptions starts from $9.95/month.

The advantages of the site include the ability to connect via API to the interface of many exchanges, including FTX, Bybit and Kucoin. At the same time, the company independently conducts token and coin exchanges, so customers can engage in crypto trading directly through the platform.

Jet-Bot

A search service for automated trading bots. Demo account operations are available for new visitors. The company provides a test subscription to futures bot signals for up to 3 days.

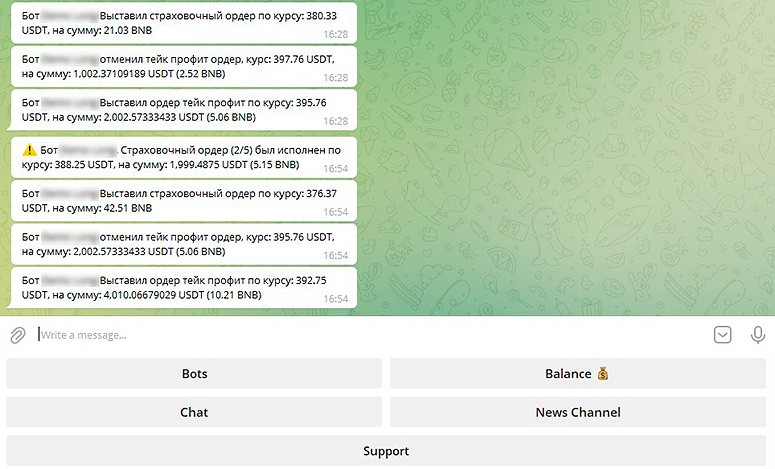

Jet-Bot conducts transactions through the Binance exchange. Notifications about transactions are sent to the client’s account in Telegram messenger. The subscription price for the trading system in January 2022 was from $10/month.

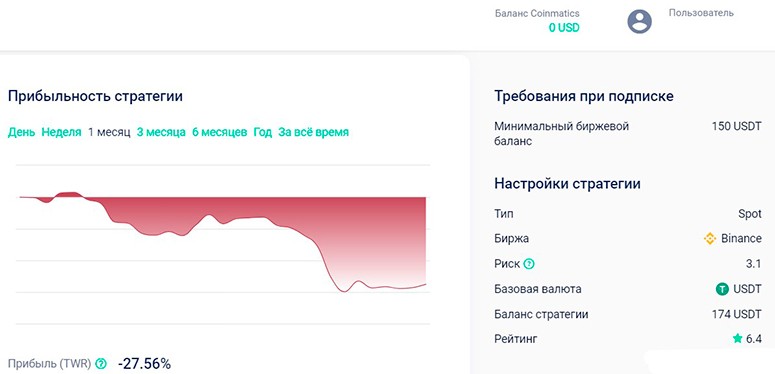

Coinmatics

The platform provides 2 types of services:

- Free distribution of signals in Telegram.

- Automatic copying of transactions of experienced traders.

Coinmatics allows you to integrate your client’s account on Binance, FTX, OKX and Bybit exchanges. The monthly subscription price starts from $10. But some traders host free bots for advertising. In addition, visitors can attract new customers by receiving bonus koins for each referral. These units of account serve as a means of payment for subscribing to signals and copying trades.

How to choose a trader

An investor risks losing an investment due to incorrect trading signals. Therefore, it is important for beginners to learn how to choose good and successful traders. It is recommended to follow these tips:

- Read a detailed description of the strategy. If this information is not publicly available, you can ask the developer a question in a private message or via social networks.

- Carefully study the history of transactions. It is better to evaluate the results over a long period of time, at least a year. In addition to history, you should look at the statistics of transactions, maximum drawdown and risk level.

- Look for feedback from subscribers. If the trader or the platform is engaged in deception, there is a probability that victims will indicate their contacts on other sites.

Copytrading on cryptocurrency removes from the investor the obligation to analyze, but this method is not without risks. Any strategy can turn out to be unprofitable.

You should not invest in trading signals and copy trading services borrowed money or those finances, the loss of which will harm the interests of the client.

Frequently Asked Questions

❓ Why are some bots and signal services available for free?

It often serves as an advertisement of the trader or bot. This is how users can evaluate the reliability and profitability of a strategy.

💰 How much can I earn from copying trades?

The percentage of profitability depends on the volume of transactions and the market situation. In January 2022, the best strategies on the Coinmatics platform yielded up to 20.05% profit.

🔎 Do crypto trader copy services verify crypto traders before adding them to the rating?

Most sites have moderation and strict conditions on the reliability of the strategies. For example, on Aivia, to find investors, you need to show the history of transactions that the trader has previously conducted on the crypto exchange.

📲 What is the minimum amount to invest?

It depends on the trader’s conditions and platform requirements. But taking into account the average profitability of strategies, it doesn’t make sense to invest less than $100. When planning your budget, you need to take into account the subscription price and commissions for cryptocurrency exchange.

🤖 Can I connect several bots to one exchange account?

Yes, usually platforms do not limit the number of simultaneously available strategies.

Is there a mistake in the text? Highlight it with your mouse and press Ctrl + Enter

Author: Saifedean Ammous, an expert in cryptocurrency economics.