The platforms allow to conclude an unlimited number of deals. But a trader cannot open more than 10 positions per hour with proper market analysis. However, some participants make several thousand deals a day thanks to a bot for trading cryptocurrency on the exchange. Programs, unlike a human, work around the clock and analyze more information.

What is a cryptobot for trading

A trading robot is a program with a built-in algorithm of work. It can be connected to an exchange account if the platform provides an API. The program collects the necessary information, analyzes it and creates orders offline.

Working principle

The basis is the algorithm – the programmer can sharpen the application for any strategy. However, there are some limitations:

- Technical analysis. Software can make decisions only on the basis of statistics. Therefore, their work is based on charts, price stack, indicators and so on

- Scenario. Programs are poorly adapted to new conjuncture, since they always act according to the laid algorithm. Profitability depends on the author of the strategy. When developing a strategy, it is necessary to take into account different market situations.

Risks

Programs do not succumb to emotions. It is much easier for them to follow a strategy than for traders. A person can make a mistake or fall into tilt (uncontrolled excitement). And this will definitely lead to losses. However, a bot for trading with cryptocurrency can not be called a panacea for profitable investments. When working with software, the user will face risks:

- Scammers. It is difficult to find a working program for trading. Fraudsters sell dozens with algorithms that bring minus traders.

- Losses. A robot does not always accumulate income. If it brought money in the past, it does not guarantee profits in the future.

- Market behavior. Bots apply only technical analysis. Charts show the growth of bitcoin in the market. But its price can fall sharply on the background of negative news. In September 2021, the value of BTC fell by $4.1 thousand due to the ban of cryptocurrency in China.

Developers are not interested in selling software with a profitability of 30% per month. If the authors of the algorithm are sure of profit, it is easier to invest free capital. $5000 will quickly turn into a solid figure in 1 year.

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

| Month | Amount, $ |

|---|---|

| 1 | 6500 |

| 2 | 8450 |

| 3 | 10 985 |

| 4 | 14 280 |

| 5 | 18 564 |

| 6 | 24 134 |

| 7 | 31 375 |

| 8 | 40 786 |

| 9 | 53 022 |

| 10 | 68 929 |

| 11 | 89 608 |

| 12 | 114 490 |

If you sell a bot with a 30% return on investment, it will be worth hundreds of thousands of dollars.

When to use

A cryptocurrency trading bot comes in handy for saving time. If a trader has a simple and working strategy, he can integrate it into a program to automate trades.

These applications are used to diversify risks. Capital is divided between two accounts. One account is managed by a person and the other by the program. The software is able to cover many more trading pairs when analyzing. Therefore, it will hypothetically be more successful than the trader if both follow the same strategy.

The main types of robots for trading cryptocurrency

The algorithm of work can be adapted to any strategy. There are several types:

- Indicator-based.

- Non-indicator.

- Trending.

- Scalping.

- Flat.

- Arbitrage.

- Price Action.

Indicator

Trading platforms provide a lot of tools for technical analysis. On Binance users will find 100 indicators. With their help, they receive trading signals to buy and sell assets.

A robot can be taught to recognize indicators and follow their advice. On average, 3-5 tools are used for analysis.

Indicatorless

Not all strategies are based on detailed technical analysis. Bots make deals without the use of indicators. These are programs with simple scenarios:

- Buying a cryptocurrency due to a 10% drop in 4 hours or less.

- Selling an asset after a correction and an increase in the rate by 3-5%.

The cryptocurrency market regularly experiences sharp collapses in value. After the fall, the price returns 3-5%. This process is called a correction.

Trending

Programs are sharpened for medium-term strategies. They are based on following the current trend. The value of the asset can gradually grow over 1-2 weeks.

Moving averages are used in the work. When the lines cross, they give a signal to buy or sell.

Scalping

You can make money on insignificant fluctuations. This method of trading is called scalping. Simple indicators are used for forecasting, for example, Bollinger Bands. This simplifies the integration of the strategy into the program.

The effectiveness of trading bots for scalping cryptocurrencies depends on the speed of the Internet. If the buy signal reaches the exchange server with a delay, the yield will be lower than expected.

Flat

The value of the asset fluctuates in the price corridor for a long time. In such situations, the rate changes between support and resistance levels.

The bot is given certain values at which it will buy and sell cryptocurrency. This can be done either with the help of indicators or manually. In the latter case, you will have to regularly adjust the set values.

Arbitrage

The rates on the exchanges are different. If the difference covers the margin – the commission for the transaction and transfer of cryptocurrency – the asset is bought and sold on another platform.

Arbitrage transactions usually bring less than 1%. Therefore, conducting them manually is not profitable. For the strategy to give a tangible profit, the search for assets, buying and selling are entrusted to software. In 1 day, 200 transactions with a yield of 0.1% will yield 20%.

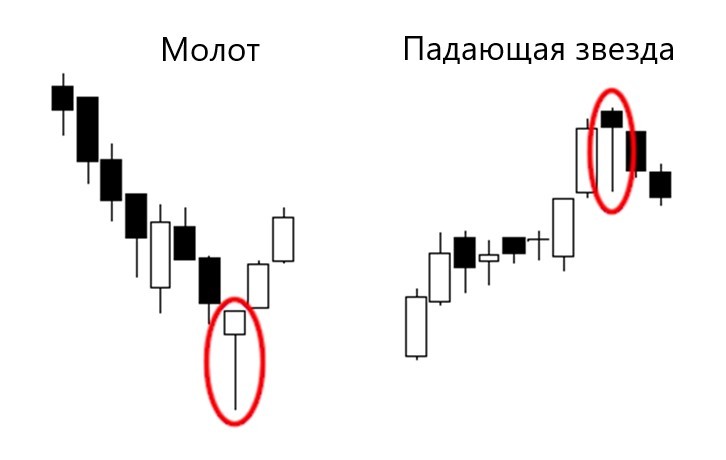

Price Action

This is a variant of a non-syndicator bot. It analyzes the market based on price.

- If the next candle sets a new low, supply is stronger than demand. The value of the cryptocurrency is highly likely to continue falling.

- If the next candle sets a new high, demand is stronger. In the near future, the price of cryptocurrency will grow by several percent.

In the realization of the strategy, simple figures help:

- Hammer – signaling a rise in value.

- Shooting star – the price of the asset should decrease.

Rating of the best bots for cryptocurrency trading in 2024

Dozens of programs from different developers are sold on the market. Some of them managed to show good profits in the past. But this does not guarantee income in the future. Trust the best bots for cryptocurrency trading should be such an amount that the trader can lose without harming the financial situation.

| Name | Price | Exchanges |

|---|---|---|

| Veles.Finance | 20% of net profit, but no more than $50 per month | Binance, ByBit, OKX, Gate.io. Huobi |

| CryptoRobotics | From 15% per profitable trade on a profitshare system or a monthly subscription starting from $11 | Binance Futures, Bybit, Demo Futures, Bybit Inverse, Binance, OKX, Exmo, Gateio, HTX, Kraken, Bitfinex, Binance.US, KuCoin, Bybit Spot, Demo Spot |

| Revenuebot.io | 20% of profits, but no more than $50 per month | Binance, Bitget, HTX, Bybit,Gate.io,OKX |

| GRIN4 | 25% of income | Binance, Huobi, OKX, Bybit, Gate.io, Kucoin |

| Cryptorg | Free to trade on the internal exchange or from $30 per month | Binance, OKEx, BitFinex, Bittrex, HitBTC |

| 3Commas | From $14 per month | Binance, Bittrex, Exmo, Huobi, Coinbase and others |

| Stratum Bot | Free or from $13 per month | YoBit and Binance |

| Zignaly | Free | Binance, KuCoin, BitMEX, VCC Exchange and FTX |

| Botee Trade | From $60 per month | Binance and Bitfinex, |

| Apitrade | 50% of profit | Binance, KuCoin, Kraken, Bitmax, GDax and others |

Veles.Finance

Veles.Finance is a simple and convenient platform for creating bots. The functionality is designed for both beginners and experienced traders. For beginners there are ready-made settings starting with a deposit of $1. Experienced traders can add TradingView strategies, set stop losses and choose from 20+ indicators.

Veles takes a 20% commission on each successful trade, but no more than $50 per calendar month. Upon registration, new users are given a $10 bonus to spend on testing the platform.

CryptoRobotics

CryptoRobotics is an automated cryptocurrency trading platform that provides cryptobots with various strategies including day trading, swing trading, and scalping. The bots operate on spot and futures markets and execute trades based on algorithms using various oscillators and indicators.

The platform supports leading crypto exchanges such as Binance, Bybit and others, allowing trading through a single interface. Users can test bots on demo exchanges with a balance of 3000 USDT without financial risks. The demo balance can be replenished. Monthly subscription and profit-sharing are available, where payment is only a percentage of profits for successful trades.

RevenueBot

Revenuebot.io – cloud-based software for trading cryptocurrency on different exchanges has been working since 2018. To customize the algorithm, programmers provide many parameters. In return, users give 20% of net profit per month. But not more than $50.

Developers allow the simultaneous launch of several bots. This will allow you to quickly test different strategies. It is very easy to set up the program through myAlpari. The user will not have to download additional software to the computer.

GRIN4

GRIN4 is a bot for automated trading suitable for both beginners and advanced traders. Users can choose SMART-mode with a ready-made strategy or customize their own. GRIN4 connects to 6 exchanges: Binance, Bybit, OKX, Huobi, KuCoin, Gate.io. The service offers more than 20 technical indicators, instant opening and closing of positions, alerts in Telegram.

After registration on the platform, users get 3-day access and $25 on the balance to pay the commission. In the free plan, the service retains 25% of clients’ profits. Traders can also buy a subscription, the cost of which starts at $50 for 1 month and ends at $360 for a year.

The platform offers other features as well:

- A trading terminal that allows you to switch between exchanges and set stop losses.

- A wallet aggregator for quick access to assets.

Cryptorg

This is a cryptocurrency broker that allows you to trade on multiple exchanges simultaneously. Users are provided with free software for making transactions on internal platforms. If a trader wants to apply the robot on third-party exchanges, the tariff will cost from $30.

The developers offer detailed documentation for setting up the program. It interacts with all current indicators. It is also possible to set limits on profit and loss.

3Commas

This is a full-fledged trading terminal with an automatic trading function. The software has been working since 2017 and supports 23 platforms. Programmers sell ready-made strategies, while allowing users to change parameters.

There is a free trial period, but with limited functionality. The initial version costs $29, while the professional version costs $99. If you buy a one-year subscription, you can get a discount of up to 50%.

Stratum Bot

A simple cryptobot with autocustomization. It is designed for trading on the YoBit exchange (free) and Binance (from $13 per month). Unlike previous programs, the functionality of Stratum Bot is limited. The developers have laid down only 3 basic strategies:

- Scalping.

- Long.

- Short.

Zignaly

Cloud trading software for customization via browser. The developers offer to use more than 40 signals or set your own parameters to the algorithm.

Zignaly provides not only a bot, but also a full-fledged platform. The service can be used for free. But then you will have to make a deal through the internal interface. Developers can deduct an additional commission for each exchange.

Botee Trade

Software with flexible strategy customization, which is launched via the cloud and locally. The developers provide a demo version and a free trial for 7 days. The bot makes deals on any popular stock exchange.

To access the advanced functionality, you need to buy a subscription. Botee Trade developers provide 3 tariff plans at $60, $120 and $270 per month. With each level the user increases the allowable deposit for trading, receives additional support and notifications.

Apitrade

A full-fledged trading robot for 25 exchanges. The developers provide ready-made algorithms. Users will not be able to create and integrate their own unique strategies for cryptorobots.

The creators promise a refund after 7 days if the results are unsatisfactory. When using the program, traders give back 50% of profitable trades.

How to choose a bot

Passive income seduces beginners. The rating of the best bots for cryptocurrency trading did not include all available programs. In the network there will be found several dozens.

Even if the user manages to buy a profitable software, the market conditions will change, and the program will no longer bring income. When looking for a helper in trading pay attention to:

- Promises of developers. Only fraudsters will guarantee income without risk. There are no robots without unprofitable transactions.

- Profitability. Aggressive strategy can bring 50-100% for a month. But when trading for a long time prefer conservative algorithms.

- Deposit protection system. Competent risk management allows to reduce potential losses. For this purpose, bots are programmed to place Stop Loss orders. If the cryptocurrency fell by 5-10%, the software sells the asset.

- The cost of the advisor. Developers mainly offer two payment options. Subscription for a month is favorable for holders of large capital. If a beginner trades a small amount, for example $500, then it is cheaper to give the developer a percentage of profit.

- Liquidity providers. The more exchanges that can be connected to the robot, the better. This will positively affect the spread – the difference between the buying and selling rates.

- Bot customization. There are ready-made solutions on the market. Such programs usually show high and stable data. Traders with a working strategy prefer a crypto exchange robot with flexible settings.

Where to start

If the software brings stable profits, the developers are unlikely to share the strategy. Users have nothing left but to integrate algorithms on their own. To realize such a task requires a fairly large amount of knowledge.

Learn the language of trading

There is a terminology for cryptocurrency traders. To freely navigate the market, every beginner will have to familiarize himself with it. To begin with, general terms are studied:

If a trader intends to create his own robot, he must learn how and when to trade on his own.

Learn the capabilities of bots

When using robots, you will have to understand some parameters. Most programs have in their settings:

- DCA (Dollar Cost Averaging) level. Assumes the purchase of the asset in case of a fall. The bot invested some bitcoin at a rate of $50,000. However, the price went down and fell to $48,000. The robot buys the asset again, counting on further growth. The DCA level allows you to set several such limits, at which the algorithm will not sell unprofitable coins, but on the contrary, will buy them at a low rate.

- Order Grid. An advanced transaction system that allows you to open multiple positions on a single asset. The value of BTC is $50,000. The robot can place 3 buy orders at $49,000, $48,000 and $47,000, and sell orders at $51,000, $52,000 and $53,000. This system is most effective in a flat market.

- Trailing Stop and Trailing Buy. Pending orders with dynamic value of buying and selling. Trailing Stop allows to fix the maximum profit. The order follows the price while it is rising. But if the rate falls by a set percentage of the maximum value, the deal is closed. Trailing Buy works in the opposite direction. The order follows the price as long as it decreases. If the price grows by the set percentage of the minimum value, the bot will conclude a buy deal.

- Stop Loss and Take Profit. Simple pending orders, when the bot automatically determines the acceptable loss or desired profit. These values can be customized manually. A trader sets Stop Loss at 10%. If the rate drops by the specified value after the purchase, the bot will close the trade.

- SOM (Sell Only Mode). If the robot buys a lot of cryptocurrencies in a short period of time, it will no longer open new positions. To do this, current orders must bring a plus or Stop Loss must be applied.

These are just basic approaches. They are peculiar to most trading robots. Some programs may offer an extended list of parameters for customization.

Learn basic technical analysis

When creating a trading robot for cryptocurrency, the user needs to understand strategies on his own. The software can not be taught fundamental market analysis. Therefore, focus on technical. There are different methods:

- Scalping – trading on minor market fluctuations.

- Technical analysis Schwager – the author familiarizes readers with basic concepts and ready t systems. The book is available in Russian.

- Wave analysis – based on the cyclicality of the market. The movement of value is often repeated. For example, you can see similar figures on the chart.

In technical analysis, indicators are involved. Depending on the style of trading, it is necessary to determine the effective tools.

Understand the strategies to customize the bot

After mastering the technical analysis of the market, it remains to teach the robot to find entry points independently. To write an algorithm from scratch, a trader will have to understand the basics of programming. Instead, it is easier to use ready-made bots with flexible settings.

Developers provide a skeleton with many parameters. The trader specifies:

- Indicators to look for signals.

- Market entry conditions.

- Types of orders and their parameters.

- Trading pairs.

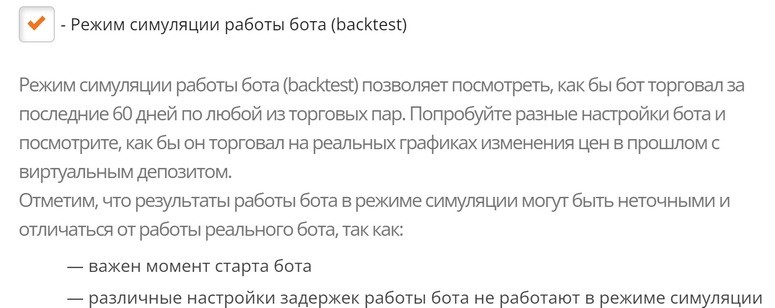

Test

There are two ways to make sure that the software is effective without risk:

- Demo account – allows you to make deals in real time on virtual currency.

- History – you can run a simulation of quotes from 2015 to 2021 to evaluate the bot’s actions under different market conditions.

Diversify

Several robots are involved to reduce risks. Each one trades according to a unique strategy. If one of the algorithms is unprofitable, the losses can be compensated by successful trades of the second software.

For diversification, several assets are traded at once. On average, choose 5-10 most promising cryptocurrencies on the market with high liquidity.

Learn to unload bags

In the course of trading, positions with a large drawdown are formed. Depending on risk management, there is an acceptable loss for each trader. For a conservative strategy it is 10-15%, and for an aggressive strategy – 40%.

Drawdowns are especially hard on the emotional state of beginners. To avoid such stress, they trade on free capital, which is not afraid to lose.

There are several ways of working with bags:

- Closing a position. The user sells the asset, and the proceeds go to new transactions. If they turn out to be successful, the losses are quickly compensated.

- Waiting for a rebound. Popular coins often not only return to previous positions, but also set new historical highs. If a trader invested in bitcoin, and the coin’s rate fell, you can wait for the price to rebound. This takes from 1 week to several years.

- DCA. In aggressive trading, assets are often bought up when they fall. On the one hand, it increases the risk, but on the other hand, it averages the purchase rate. Due to this, it is easier to bring the operation to a plus when the value rises.

- Start shorting a position. Many exchanges allow you to make deals on the downside. For this purpose, small capital and leverage are used.

The trader can independently teach the bot to work with bags or periodically intervene in its actions, review transactions and close positions manually.

Advantages and disadvantages of bots for trading

If you compare a robot with an ordinary trader, a number of pros and cons are distinguished.

| Advantages | Disadvantages |

|---|---|

| Passive income – a correctly configured bot brings profit on a regular basis. | Complexity – it takes months to create and test a working algorithm |

| Strategy testing – programs are useful in testing trading methods for efficiency. | Technical analysis – robots are not able to assess the impact of important news on the market |

| No emotional pressure – while the bot is trading, the trader can abstract from the market. | Low percentage of working bots – most of the programs with ready-made strategies on the market bring losses |

| Accuracy – the software strictly follows the laid down rules | Obsolescence – if the software started to make many losing trades, its trading strategy does not work anymore |

| Scalability – programs cover much more trading pairs than traders do | Margin – developers charge a commission for using ready-made bots |

| Speed – a robot analyzes the market and concludes deals faster | Risks – in case of a losing strategy, a significant part of capital is quickly lost. |

| Apitrade | 50% of profit |

Conclusions

Profitable trading software is a utopia for novice investors. Creating such programs requires a comprehensive approach. Expended funds and efforts do not always pay off. However, this does not mean that profitable bots do not exist.

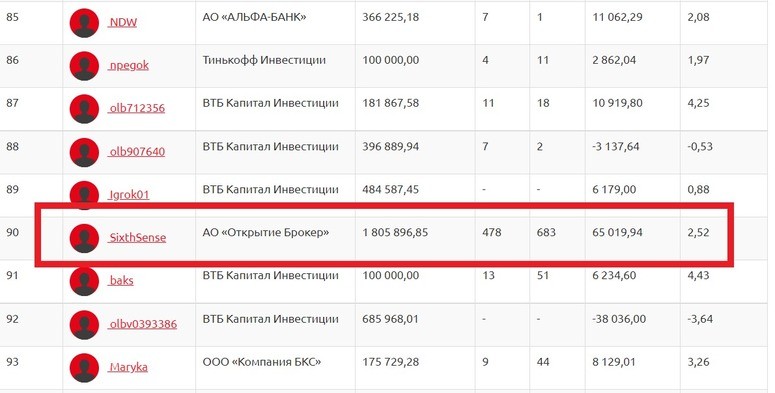

During one trading day on October 10, 2021, SixSense trader made 683 trades with a total return of 2.52%. He most likely used a bot.

Frequently Asked Questions

❓ Why does a good cryptocurrency exchange trading robot become unprofitable?

The algorithm shows income in a bull market when the price is rising. In a bearish trend, it does not know how to analyze, so it gives a negative result.

💰 What is the optimal deposit for trading through the bot?

Any amount can be entrusted to the robot. Limits are set when making a deal, for example, buying an asset for 10% of the deposit.

🔍 Which exchange is suitable for bots?

Preference is given to sites with high liquidity. When using short-term strategies, pay attention to the remoteness of the server. Scalping requires fast data transfer.

🔗 Are trading robots allowed on cryptocurrency exchanges?

Yes, many marketplaces provide an API. This is the key to authorize third-party software and make trades.

📱 Can a trading robot steal money?

The API key allows you to make trades. But you’ll need manual confirmation to withdraw funds. Secure exchanges require you to follow a link via email, enter a code from SMS or Google Autentithicator.

A mistake in the text? Highlight it with your mouse and press Ctrl + Enter.

Author: Saifedean Ammous, an expert in cryptocurrency economics.