In cryptocurrency mining, rewards are earned for performing complex mathematical calculations on video cards, asics, and processors. This consumes a lot of energy. Gradually, developers began to move to more environmentally friendly consensus algorithms. In 2012, Proof-of-Stake appeared, which rewards investors for blocking assets in the protocol. Staking on Binance is a convenient alternative to crypto mining. You don’t need to buy expensive equipment, there are no deposit requirements either – you can earn income from any amount.

What is steaking

In Proof-of-Stake, the right to verify transactions and generate new blocks is given to validators who have blocked a certain amount of digital assets in the protocol. They are rewarded for this. An important advantage of PoS-mining of cryptocurrencies is the lack of requirements for the power of equipment. It is possible to receive income even from a smartphone.

The amount of profit depends on the rules of a particular blockchain, the volume of the bet and the term of placement.

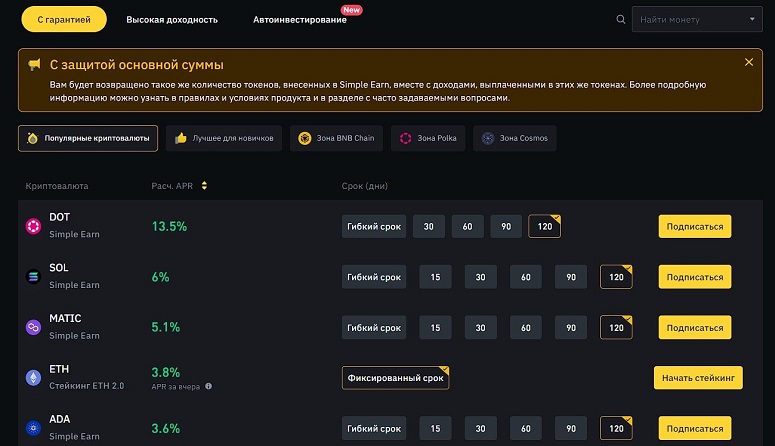

It is possible to earn money from blockchain assets in any network on the PoS algorithm. For example, staking is available for Ethereum, Cardano, Cosmos, Solana, Tron and other cryptocurrencies. Digital assets have different profitability (using the most popular offerings as of September 2023 as an example).

| Moeda | Term | Yield (%) |

|---|---|---|

How it works on Binance

Cryptocurrency staking is carried out according to the general rules – participants block assets, and in return receive a reward. The Binance exchange is one of the largest validators. The company combines customers’ bets into one and blocks the entire volume on its behalf. Investors receive income once a day to a spot wallet in the cryptocurrencies placed. There is no network commission to pay for accruals.

5020 $

bónus para novos utilizadores!

A ByBit fornece condições convenientes e seguras para a negociação de criptomoedas, oferece comissões baixas, alto nível de liquidez e ferramentas modernas para análise de mercado. Suporta negociação à vista e alavancada e ajuda os principiantes e os operadores profissionais com uma interface intuitiva e tutoriais.

Ganhe um bónus de 100 $

para novos utilizadores!

A maior bolsa de criptomoedas onde pode iniciar de forma rápida e segura a sua viagem no mundo das criptomoedas. A plataforma oferece centenas de ativos populares, comissões baixas e ferramentas avançadas para negociação e investimento. O registo fácil, a alta velocidade das transacções e a proteção fiável dos fundos fazem da Binance uma excelente escolha para os comerciantes de qualquer nível!

Due to the large turnover of Binance, staking through the exchange is in some cases more profitable than direct placement. For example, according to the rules of the Cosmos blockchain, users can receive coins from the PoS protocol for 21 days after creating a withdrawal request. Binance customers are refunded on the day their subscription ends (with a fixed term) or in 3-5 days (with early unlocking). There are other features of how staking works on Binance:

- Quota. The exchange sets a limit on the maximum amount of cryptocurrency from one client.

- Minimum bet amount. The size is individual for each coin.

- Blocking period. Periods from 30 to 90 days and indefinite staking are available. In the first case, the rates are higher.

Risks and profitability

Binance clients can receive up to 20% per annum in staking. The yield depends on the coin and the term of placement. The more volatile the asset, the higher the interest rates. Highlight such risks of blocking coins in Binance Staking:

- Loss of account data. It is necessary to keep a copy of the password and access code to Google Authenticator in a safe place. You should also keep your email and cell phone details to which your account is linked. Access codes will be sent to them, and if entered incorrectly, operations will be blocked.

- Decrease in the value of assets. The cryptocurrency market is highly volatile. Sometimes a coin loses up to 90% of its value in a short period of time. When placing assets in steaking for 30-90 days, the user may miss a convenient moment to fix.

Advantages of staking on Binance

It is possible to place cryptocurrencies in the PoS protocol independently. To do this, you need to deploy a node or find a reliable validator. Steaking on Binance in 2024 is technically easier. There are other advantages:

- Low entry threshold. The minimum bet for most coins starts at $10-20.

- You can put together a portfolio in one interface. Blockchain self-blockchain will require downloading separate blockchain wallets.

- Lack of commissions. Binance does not charge network fees for staking. If an investor freezes assets without the assistance of the exchange, you need to pay for placement, deposit withdrawal and each profit claim.

- Early unlocking option. In case of force majeure, users can get the money earlier. When self-depositing, early claiming of assets is often not supported.

Brief description of the Binance Earn section

Binance is the largest international platform, so the site is translated into more than 50 languages, including Russian. To work, you need to pass KYC (upload a photo or scan of your passport and take selfies). Spot and futures terminals are available for trading. Options for additional earnings are collected in the Binance Earn section:

- Staking. Users put coins in the PoS protocol with a fixed yield. It is possible to choose the term of investment – no profit is paid in case of early claim.

- Deposits. Binance customers can lock any assets presented on the exchange. The platform guarantees the return of the initial volume of coins and the payment of interest income. Rates on deposits are not fixed and can change under the influence of external factors.

- Farming. Users supply assets to liquidity pools or exchange tokens at a discount (35% cashback in BNB) in the Swap tokens tab.

- Bicurrency Investments. Participants are invited to bet on the price of a cryptocurrency by a specified date. If the prediction is correct, the exchange pays out income in stablecoins, in case of error – in cryptocurrency. In the section you can bet on the price of only the most liquid coins (ADA, LTC, ETH). Bitcoin steaking on Binance is also available.

- Range Bound. The tool allows you to earn during the sideways movement of the crypto market. Clients bet on the price being in a specified range during the subscription period. If the rate has never exceeded the boundaries of the zone before the end of the term, the user receives a reward. In case of an error, a fixed amount (1.5-3%) is deducted.

Steaking capabilities on Binance

The Proof-of-Stake protocol is one of the most popular methods of protecting the blockchain from external interference. When blockchain assets are blocked, users receive rewards and also participate in supporting the functionality of the network. Several hundred PoS coins can be frozen on the Binance exchange. Investors choose an indefinite subscription or fixed staking in crypto on Binance. In the second case, the reward is higher. In case of premature termination, no interest is paid.

Binance customers can also invest in decentralized projects. DeFi-stacking allows you to earn in dApps in the simplest way possible. There is no need to choose reliable applications, create a wallet, store private keys.

ETH2.0.

Ethereum developers have been preparing an update of the consensus algorithm since 2020. The transition to PoS increased the speed, security, scalability of the blockchain. To deploy a node on the Efirium network, you need a minimum of 32 ETH, so small investors delegate their cryptocurrency to validators. Binance is one of the largest. In April 2023, after the implementation of the Shanghai update (EIP-4895), there was an option to withdraw ether from staking.

On Binance, you can bet from 0.0001 coins. The exchange assumes the costs and risks of penalties. For this, 10% is charged from the profit of users. The rest of the fee is transferred daily to customers’ spot wallets.

In September 2023, ETH2.0 was charged 3.8% for staking ETH2.0. The rate is not fixed and changes dynamically depending on market conditions. The reward begins to be distributed one day after the cryptocurrency is blocked (T-2 mode).

DOT slot auction

The Polkadot blockchain is a platform for launching cryptocurrency projects. New chains work in parallel in the ecosystem and utilize the power of the parent network. That’s why they are called parachains. To be added to Polkadot, a startup must rent a cell (slot). For this purpose, votes are held – users place a DOT on their favorite parachain. Projects that get a slot reward the participants who supported them.

You can vote via Polkadot wallet or partner exchanges. In the second case, additional bonuses are awarded.

Binance launched support for DOT slots in 2021, but today the option is not relevant. Since 2022, there are no new auctions on the platform.

Fixed Staking

In this concept, users lock funds in the protocol for a predetermined period of time. The bid is updated daily. In 2023, the offer is valid for more than 100 coins, including SOL, BNB, ADA, ATOM and others. The full list of assets can be seen in Simple Earn – Fixed. The option has these features:

- Funds are deducted from the spot wallet and displayed in the Earn section.

- Auto Subscribe feature is available. When the contract expires, the asset is re-locked at current rates. If the product is not available – moves to a deposit with flexible terms.

- In case of early demand, the coins will be returned within 72 hours, the interest is withheld by the platform.

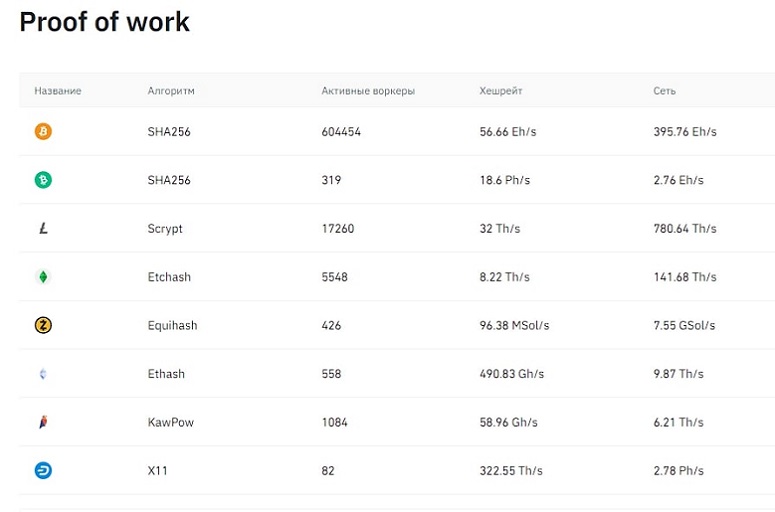

Mining on GPUs and ASICs

In 2020, Binance launched the Mining Pool. At first, only bitcoin could be mined, but later other coins (LTC, ETC, ETHW) were added. The option quickly became popular – in September 2023, Binance Mining Pool was the third highest BTC hash rate in the world (63.25 EH/s).

All clients of the exchange have access to mining on GPUs and ASICs. You need to choose a coin, buy and configure the equipment. The actual parameters can be viewed in the mining account. If everything is done correctly, the page will display wokers.

Profits are transferred to the spot wallet once a day, there is no minimum amount.

Adding coins to fixed staking

The option is available in the Simple Earn menu. You can find the desired cryptocurrency through search or select the “Match my assets” setting. The list will display bids for coins with a non-zero balance on the spot wallet. To place a bid you should:

- Select a cryptocurrency.

- Specify the subscription period, amount and agree to the terms of service.

- Confirm the transaction.

It is impossible to change the terms of the transaction after the blockchain. To add more tokens, you need to create a new order. Active bets are located in the “Wallets” menu (Earn).

Bonuses and commission discounts

Only assets from the spot wallet can be staked on Binance. If there are not enough coins, they are bought in the trading terminal or exchanged. The second method allows you to get a commission discount (30-35% in BNB). The algorithm is as follows:

- Autorizar na plataforma.

- Go to the “Finance” section.

- Select the Liquid Swap tab. Click on the item “Exchange”.

- In the terminal, select coins for conversion and specify the quantity. At the bottom under the application window, information on the transaction is displayed – slippage, rate and commission cashback.

Before the operation, you can familiarize yourself with the available rewards. To do this, you need to click on the “View all” button at the top of the screen. After the conversion is complete, you should return to the page and transfer the bonus to the spot wallet. You will need to click on “Get All” at the top of the screen.

Earnings statistics

At the top of the Earn page you can see the client’s profit for the last day and the total profitability by instruments for the last time. To get the details, you should click on the “Analyze” button. The distribution of assets by instruments and the profit for the specified period (from 7 days to 1 year) will appear.

Early closing

You can withdraw assets at any time. Coins will be transferred to the spot wallet 72 hours after the request is created. The withdrawn rewards will be deducted from the subscription amount. To close the bid early you need to:

- Go to the “Wallets” section.

- Select a bet.

- Click on the “Redeem” button.

- Agree to the terms and conditions and confirm the transaction.

DeFi-staking

The direction of decentralized finance has been gaining popularity since 2020. Users are attracted by high rates in steaking and additional opportunities (lending, farming, token exchange). All transactions are carried out by smart contracts under predetermined conditions (without the participation of third parties). DeFi-staking on Binance has such features:

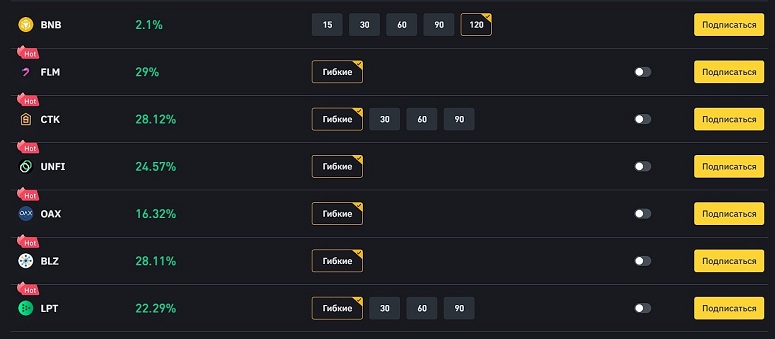

- High profitability. Investments in top assets rarely yield more than 10% per annum. DeFi is a relatively new industry, so rates above 100% can be found here.

- Low entry threshold. The minimum transaction amount is $1.

- There is no need to pay network commission. All costs are taken care of by Binance.

- High reliability. DeFi-staking is not yet regulated. Therefore, there are a lot of fraudulent projects on the market. Binance conducts a careful selection and offers customers only verified platforms.

Exploração mineira

Users can block assets in liquidity pools, working on the principle of an automatic market maker. To do this, 2 coins are placed in equal proportion. Thus, investors create a liquidity reserve for other clients who need to exchange with minimal slippage. For the provision of assets, remuneration is paid – transaction fees and a bonus from Binance.

Liquidity mining brings higher returns, but the risks are higher as well. In staking, the deposit return is guaranteed in the tokens placed. In farming, only the client’s share of the total pool is fixed. The number of tokens can vary, the result depends on many factors.

Adding cryptocurrency

The Binance platform offers clients to take advantage of DeFi. The exchange acts as an intermediary and does not guarantee the return of funds. Instructions for subscribing to DeFi-staking:

- Authorize on the exchange and go to the Earn section.

- Select the menu item “Steaking” and then “DeFi-staking”.

- The page will display a list of available coins, subscription terms and interest rates. You need to select an offer and click on the “Start Steaking” button.

- Specify the amount of cryptocurrency and agree to the subscription terms.

- Sign the transaction.

There are 2 formats of DeFi-staking available on Binance – flexible and fixed terms. In the first case, you can increase the amount of blocked cryptocurrency. To do this, you need to select an instrument and click on the “Add Assets” button. With a fixed subscription term, a new order will need to be placed.

DeFi-staking statistics

The history of bets is placed in the Earn tab in the “Wallets” section. To do this, you need to click on the “Analyze” button. On the page you will need to filter the results to see the profitability of DeFi projects only.

On what conditions it is possible to close early

Binance reserves the investor’s right to interrupt the blockchain. At the same time, the conditions are different for DeFi-staking with a flexible and fixed term. In the first case, you can withdraw your funds at any time, only the income for the incomplete day is withheld. In the second case, the user will lose all accrued income in case of early demand for tokens. The time of return of assets to the spot wallet depends on the characteristics of the blockchain.

Indefinite Staking

In this mode, there is no need to choose the period of blockchain coins. You can block funds for any period of time. Withdraw – at the right time without loss of interest. This format is suitable for medium-term traders. To place assets, go to the Simple Earn section and select the “Flexible” tab.

The profitability of perpetual staking is low due to the high costs of the exchange. On average, they pay 0.5-2%.

How to choose a coin for staking on Binance

On the Earn page, you can familiarize yourself with the interest rates for all available digital currencies. As a rule, the more reliable the project, the lower the yield. This is due to low risks of scam or a significant decrease in the value of the asset. When choosing a coin for steaking, it is recommended to do the following:

- Select several cryptoassets with an acceptable yield. It is better if they are digital currencies of different types (tokens of lunchepads, blockchains, top coins).

- Carefully study the technical documentation (white paper). Cryptocurrency should be interesting for long-term investment.

- Participate in contests and developer airdrops. It is possible that a certain number of tokens can be obtained for free.

How to start steaking on Binance

All users who have confirmed their identity have access to the functionality. To start earning on steaking cryptocurrency on Binance, you need to choose tools and replenish the deposit. Experts recommend assembling a portfolio to diversify investments. But you need to take into account that with a negative external background, all coins will fall – some more, others less. Therefore, it is worth following the bitcoin trend and macroeconomic news. The best result will bring the strategy of buying and locking digital assets at local BTC lows (after the release of good statistics in the United States).

Making a deposit

Binance has open licenses for providing financial services in the US and Europe. Therefore, the administration strictly fulfills the requirements of regulators. In 2022, after the introduction of sanctions, the exchange suspended direct replenishment from Russian cards. Also, Binance removed from the P2P-platform the ability to transfer money to the plastic of sanctioned banks and through the fast payment system (FPS).

In the spring of 2023, some of the restrictions were removed. However, by September, the requirements were tightened again – on P2P allowed to trade only in the currency of verification, from the listing removed YUMopeu, AdvCash, Payeer. Now Russians can pay for applications with cards of 6 domestic banks.

A subsidiary project of Binance – Pexpay, which allows you to perform transactions prohibited on the main exchange. However, the platform was shut down. This led to a drop in liquidity on Binance P2P and an increase in exchange rates. Therefore, it is more profitable to exchange rubles for USDT or other coins on third-party platforms and send to Binance by digital transfer.

Buying cryptocurrency

Users can exchange stablecoins for any coins available on the platform through the trading terminal. Instructions:

- Make a deposit using a convenient method.

- Go to the spot terminal.

- Click on the ticker and find the coin in the list.

- Select a trading pair.

- Enter the amount of cryptocurrency and select the type of order (market or limit). If necessary, specify the transaction price.

- Confirm the transaction.

It is more profitable to convert cryptocurrencies between each other through the “Exchange” service in the “Cryptocurrency Farming” section. You can buy coins in one transaction and get 30-35% cashback in BNB. Stablecoins are not supported in the service.

How to cancel staking

Investors place assets according to a predetermined plan. But sometimes it has to be modified. For example, you can cancel staking and invest money with a higher yield. The instructions are as follows:

- Go to the “Wallets” section and open the Earn tab.

- Click on the “Product” button.

- Find the “Steaking” field, then the desired coin.

- Click on the “Redeem” button.

- Specify the quantity of the asset.

- Confirmar a operação.

Difference between steaking and deposits on Binance

In both cases, the exchange pays users for blocking assets on their accounts. The principle of operation of deposits is similar to a traditional bank deposit. The company uses customers’ money to issue loans or investments and shares the profits generated. Coins remain in Binance accounts, so users can withdraw funds at any time. Payouts are made instantly.

Staking is the placement of assets in the PoS protocol. Nodes verify transactions, create new blocks, and receive a reward. To participate in staking, a validator must block coins in the protocol. The more assets it has, the higher the earnings.

This is done for security purposes – if abuses are noticed, the steaknode will be fined. In case the abuses are not detected immediately, the coins are left frozen for another 2-4 epochs after the block is created. Therefore, Binance cannot transfer funds instantly after creating an early withdrawal request. To compensate for the costs, the exchange writes off the listed interest income in fixed-term products.

Deposits section on Binance

In 2022, the exchange has changed its interface. The “Deposits” and Fixed Staking” tabs have been changed to Simple Earn. According to the developers, this simplifies and makes it more convenient to use the tools. For the end user there is no big difference between deposit and staking. Only the accrued reward and subscription terms are important. Customers can sort offers by lock-in period or see all available options for selected cryptocurrencies.

Floating Rate

On the Simple Earn platform, you can place assets for any term. To do this, you need to select the “Flexible” tab. The rate on most coins does not exceed 1-2% and can change daily depending on the situation on the crypto market. Subscription to products with flexible terms has a number of features:

- The section has all the coins available on the platform.

- You can withdraw cryptocurrency at any time. Accrued interest income is not written off.

- Blocked assets are allowed to be used as collateral for crypto loans or transferred to another user via Binance Pay.

Fixed Rate

The exchange rewards investors who hold coins for a long period of time regardless of market conditions. Such customers can lock in assets in Simple Earn fixed-rate products. In this case, only the term is known in advance. The rate can change daily.

Each product has a quota (maximum number of coins). The limits are also subject to change. In case of early claim, the client will lose the accumulated income. Binance can provide 5% cashback on the withheld interest.

Coins are deposited for 90 days. The user will receive income daily, but the entire amount can be withdrawn only after the end of the subscription.

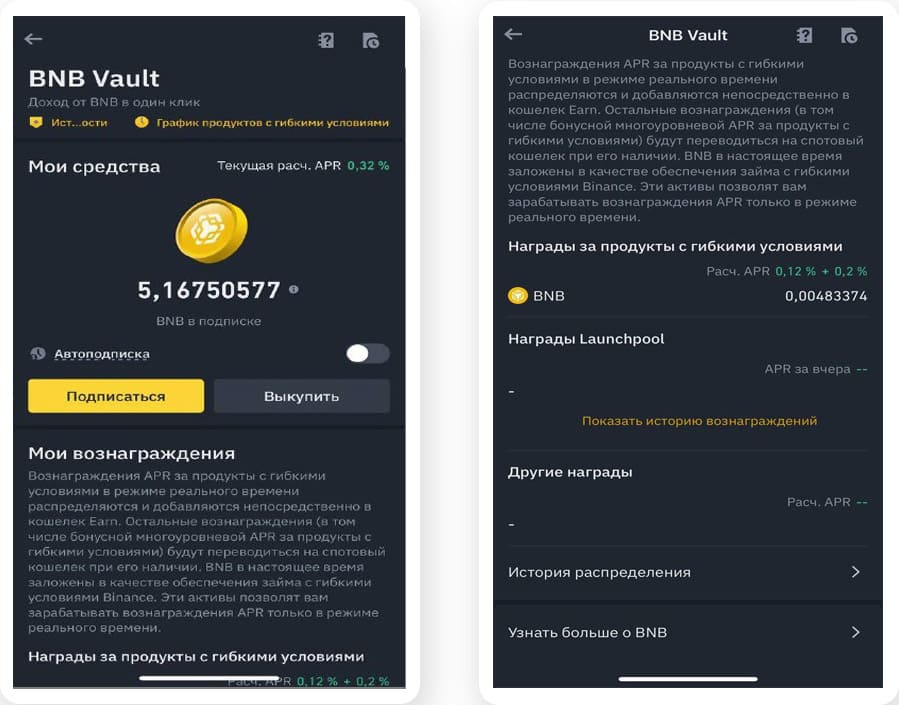

BNB Vault service

In this section, you can get profit for blockchain exchange token from several sources at once – Simple Earn tools and participation in Launchpool projects. The rate is divided equally between all startups. Income is accrued according to the rules of each specific project. The service is suitable for users who cannot devote much time to investments. The exchange keeps track of all new opportunities.

FAQ

📢 What are the risks of investing in DeFi-stacking?

The Binance exchange acts as an intermediary. The company selects the most reliable projects, but does not guarantee the return of funds in case of dApps problems (project scam or smart contract bugs).

✨ How to build a portfolio for steaking?

A large share of the capital should be allocated to reliable coins with fundamental ideas. The remaining amount (5-10%) can be used to buy tokens of promising games and meme coins.

🔔 How to reduce the risks of investing in liquidity mining?

According to analysts’ forecasts, the crypto market will see sideways movement until 2025. This is a favorable period for investing in liquidity pools. Tokens of new projects will bring more, but from USDT staking on Binance you can get a more predictable income.

🛒 Should I buy cryptocurrencies specifically for steaking?

It’s risky. The highest rates are offered by new projects. Yields can change quickly. It is better to study startups and invest in promising tokens with the expectation of multiple growth. Income from staking should not be the main one, but as a pleasant bonus.

🤑 How much can I earn in staking on Binance?

The profitability depends on the market phase and the chosen assets. When investing in reliable cryptocurrencies, the profit will amount to 5-15%. Investments in new coins can bring 50-150% per annum.

Erro no texto? Realce-o com o rato e prima Ctrl + Entrar.

Autor: Saifedean Ammous, especialista em economia da criptomoeda.