The growing market of digital coins attracts a large number of investors, and along with them, the activities of scammers are also becoming more active. Cryptocurrency skimming brings huge profits to criminals. The active development of the market and the lack of legal regulation in many countries only play into their hands.

What is a cryptocurrency scam

Every year, new and promising coins are created on the digital currency market. Many products contribute to the industry. But there are others created by scammers. Their actions have led to the emergence of the myth that cryptocurrency is a financial pyramid scheme.

Cryptocurrency scam is a project that stopped paying or never transferred money to investors at all.

Individual cryptocurrency startups are created with the goal of collecting bitcoins from users and closing down. New HYIP platforms that promise high income but quickly stop withdrawing funds can be attributed to this category.

Razões

Often startups have a promising idea, but do not withstand competition in the market. Some of them cease operations due to external factors, while others make money by deceiving gullible depositors.

The main reasons for scam in the cryptocurrency industry:

5020 $

bónus para novos utilizadores!

A ByBit fornece condições convenientes e seguras para a negociação de criptomoedas, oferece comissões baixas, alto nível de liquidez e ferramentas modernas para análise de mercado. Suporta negociação à vista e alavancada e ajuda os principiantes e os operadores profissionais com uma interface intuitiva e tutoriais.

Ganhe um bónus de 100 $

para novos utilizadores!

A maior bolsa de criptomoedas onde pode iniciar de forma rápida e segura a sua viagem no mundo das criptomoedas. A plataforma oferece centenas de ativos populares, comissões baixas e ferramentas avançadas para negociação e investimento. O registo fácil, a alta velocidade das transacções e a proteção fiável dos fundos fazem da Binance uma excelente escolha para os comerciantes de qualquer nível!

- The project did not plan to pay money. A new product is created solely for profit and closed as soon as the number of investors drops.

- Outside parties gained access to the project. This is the most common type of scam. But sometimes the creators report the hacking of the resource and theft of funds to hide irregularities in the work.

- Employee error. Often this person is fictitious.

- Problems with payment systems. The startup justifies the lack of money by the failure of partners to fulfill their obligations.

- Blocking of accounts. Experienced investors quickly recognize deception and send complaints to the regulatory authorities. The regulator conducts a check, based on the results of which it blocks the company’s accounts.

- Technical problems. Failures in the work of the site, hosting or security systems can lead to the fact that users lose access to the resource and to their money.

- If investors are no longer interested in the project, its owners suffer losses. Then the developers decide to close the site.

If it is proven that the theft of investors’ money is committed intentionally, the platform can be considered a scam. One of the largest ICO scams was recognized as the PRIZM project. The startup was created for Russian users. However, investors were inactive in buying the new cryptocurrency. The project entered the Indian market, where it attracted $2.6 million in a short period of time.

Varieties

Depending on the method of fraud, cryptocurrency scam can take different forms. Some schemes require more time for realization. Others quickly reach the goal thanks to the activity of the creators.

When bitcoin began to gain popularity, attackers founded the BitConnect platform. The organizers promised investors a return of up to 40%. It was assumed that profits would be created by a trading robot, but in 2017 the platform stopped working.

By time

Scam projects have different durations:

- Short-term – the time of operation does not exceed a few months.

- Long-term – can operate for many years.

The OneCoin project was founded in 2014. The developers claimed that they had created a promising product that could solve many financial problems of users. Investors invested money in anticipation of the cryptocurrency’s growth. But in 2017, the creators of OneCoin simply disappeared. Investors lost $4 billion.

In terms of complexity

In the past few years, the number of fraudulent schemes in the cryptocurrency market has increased. In 2021, investors can identify scam projects by many parameters. One of them is the complexity of the structure:

- Simple scheme – promoted extremely aggressively to find investors as quickly as possible.

- Scam of medium complexity – contains a detailed description of the conditions and development plan, history of creation, information about the developers and other data.

- Long-term scam resources can be difficult to recognize. They withdraw money while there is a large inflow of new investors, have a growth in capitalização and offer interesting investment plans.

The choice of scheme depends on the goals and capabilities of attackers. If the developers have enough money and have a good legend, they will create a resource that will bring income for a long time. The main goal of an ordinary pyramid is to collect money and leave the market.

The main signs

Experienced investors analyze offers before taking part in them. Cryptocurrency scam can be identified by several signs:

- Frequent failures in the work of the site (meaning that the creators do not plan to invest in the development of the project).

- Technical support does not respond to customer questions.

- Problems with the withdrawal of money.

- Changes in working conditions (the project increases profitability and actively buys advertising).

- A large number of negative reviews.

- Decrease in traffic.

It is also worth analyzing the idea of the project. If the resource promises high income, but does not give information about the source of money – most likely, it is a scam.

Examples of scam in cryptocurrency projects

According to the analytical company Chainalysis, fraud became the most popular type of Internet crime in 2020 (54% of the total number of violations). However, compared to 2019, the revenue from scams decreased significantly (from $9 billion to $2.7 billion). Over the same period, the number of payments to fraudulent addresses increased from 5 million to 7.3 million (up 48%).

The largest scam in 2020 was Mirror Trading International. The organizers of the scheme seized the assets of more than 471 thousand investors for the amount of $589 million.

Pyramids and Ponzi schemes

Scammers use a large number of ways to defraud clients. The most famous scheme was invented by Charles Ponzi:

- The company accepts money from investors, pledging to return them after a certain time with a profit.

- The developers find the next investors, whose assets pay interest to the first clients.

- To fulfill its obligations to the depositors, the company attracts new participants.

- Organizers disappear with clients’ money as soon as the project starts to operate at a loss.

A Ponzi pyramid is a system that pays money to investors and those who attract them. The scheme has no end and is illegal in most countries.

Mobile apps

Along with regular mineração on computers, there is another type that works on portable devices. However, not all users participate in cryptocurrency mining willingly.

Attackers create mobile applications with a miner. The product is sold on official platforms or on other resources. Individual applications offer mining on remote servers. Users buy the product, but receive a program that only beautifully visualizes the mining of coins.

Phishing

The old ways of deceiving investors also do not lose relevance. One of the most famous is cryptocurrency phishing. Fraudsters on behalf of companies send a letter to the victim’s email, which may contain an interesting offer, a notification of a large transfer, an alert about logging into an account and other attention-grabbing information.

The user follows a link to a fake exchange or wallet website, which usually does not differ from the official one in terms of functions and design. The client is offered to enter account details, which will be received by the attackers. The unsuspecting user will lose access to the Personal Cabinet, or assets will be withdrawn from his account.

ICO projects

New cryptocurrency technologies are incomprehensible to ordinary people. This is being taken advantage of by attackers.

The first ICO was held by the Mastercoin project in 2013. The funding round attracted $5 million from investors. Fraudsters used this idea. In 2017, the startup LoopX appeared, which offered the development of a trading algorithm that brings income to traders. During the ICO, fraudsters managed to raise $4.5 million. After the project creators disappeared with the money, and investors were left with useless fichas.

| Project | Year of ICO | Investment amount ($) |

|---|---|---|

| Pincoin | 2018 | 660 mln |

| Tezos | 2017 | 232 million |

| Centratech | 2017 | 32 million |

| ToTheMoon | 2017 | 27 million |

| Opair | 2016 | 1 million |

2017 was a breakthrough year for ICOs. 382 projects participated in funding rounds and raised $11.9 billion. More than half of them turned out to be fraudulent. Scammers received $1.34 billion In 2018, ICOs were replaced by IEOs. Initial exchange offerings involve trading platforms that work with promising teams and promote their tokens to their users. The new method of crowdfunding has significantly reduced the number of fraudulent schemes in cryptocurrency.

HYIP project

Rising cryptocurrency prices and investor attention attract scammers. Another way to deceive users is a HYIP project. This is a pyramid scheme in which each new participant provides the income of the previous one. The operating time of the site depends on the activity of depositors. As soon as the project begins to bring losses, it will be closed.

Earn in the HYIP can be only at the start. But if the site does not cause interest among users, even the first investors will lose money.

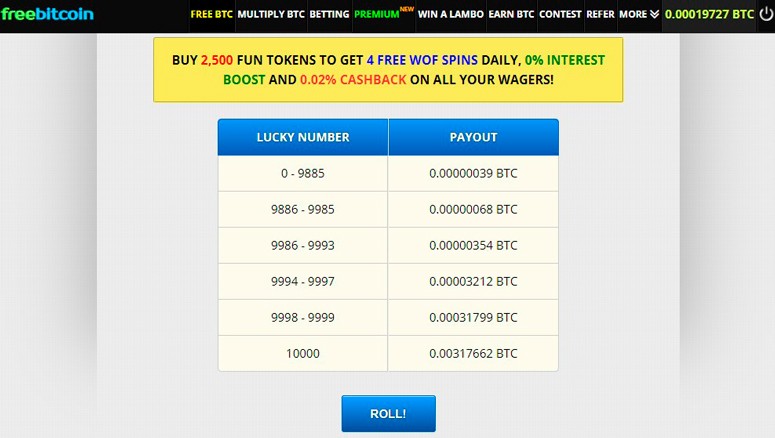

Cranes

The main way of mining digital coins is mining. But back in 2010, there were sites that paid users satoshi for performing certain actions. In 2021, cryptocurrency cranes continue to work in a modified form. To get a reward, you have to pass a captcha, and the site usually has a lot of banners.

The cranes make money from advertising and pay users a small percentage of the profit in satoshis. But not all players can get the money. Withdrawal is available only after the minimum amount is dialed. Scam resources do not pay the promised reward to users at all.

Extração de nuvens

Many investors are interested in creating a source of additional income, and this requires assets. Some simply buy cryptocurrency or mine coins in the classic way, while others consider cloud mining. In 2021, mining digital assets on remote servers is especially relevant. With the rise in the value of bitcoin and video cards have increased in value by more than 60%.

Cloud mining is buying or renting equipment to make money. The average investment payback time is 12 months or more. Scam projects take advantage of the popularity of the method and promise significant income to attract the attention of investors. However, the profit from mining coins on remote servers can not be higher than from traditional mining.

How to protect your funds

Scammers use various ways to scam customers, from promising big profits to giving away coins. If the offer is too attractive, it is most likely a cryptocurrency scam. A few recommendations that will help to secure your investment:

- Ignore suspicious emails and social media posts. Any user’s account can be hacked.

- Check website names before entering account information. Scammers often use apps that change the official site to a fake one.

- Analyze the offer, checking it for signs of fraud.

Attackers also distribute software online that can disable the computer and compromise the user.

Resumo

Knowing the main signs of cryptocurrency scam, you can learn to quickly recognize it among interesting offers. In 2021, regulators and exchanges are fighting fraudsters. The latter use new technologies to verify and protect assets.

Perguntas mais frequentes

⛔ Can large projects like Binance go down?

It is unlikely. The platform operates openly and tries to comply with all the requirements of the jurisdictions in which it operates.

❗ Are projects that offer to make money on the volatility of cryptocurrencies a scam?

No, because the investor knows about the risks in advance and agrees to them by accepting the rules of the service.

❔ Is it possible to invest in a project that does not look like a scam, but does not have feedback from other investors?

If after analyzing the proposal does not look too attractive, you can try. However, you should not invest a lot.

💸 What to do if the site does not pay money?

Most likely, it will not be possible to return the investment. It is better to accept the experience and forget about the platform.

💰 The company declared bankruptcy – does this mean that it soskamil?

If the project has officially confirmed insolvency, it can not be considered a fraud. One should remember that investment is always a risk.

Há algum erro no texto? Realce-o com o rato e prima Ctrl + Entrar.

Autor: Saifedean Ammous, especialista em economia da criptomoeda.