Cryptocurrency has revolutionized electronic payments. Bitcoin was conceived as a platform with anonymous, secure fast and cheap transactions. Not all of what was planned has been realized. Twelve years after the launch of the system, the pros and cons of Bitcoin are clearly visible. The advantages make the coin attractive for investment. However, the minuses cause inconvenience in calculations.

The main advantages of Bitcoin

The main advantage of Bitcoin is that it is both a digital currency and a payment network. Blockchain can not exist without a virtual coin, and vice versa. Such a system works without intermediaries, government agencies and banks.

Bitcoin is the first successful realization of a global digital currency that anyone can store, exchange and transfer to other users regardless of who they are or where they are located.

Decentralization

Blockchain is not tied to a single server. It is a distributed ledger with no single control center. All participants in the network are equal to each other and their activity is not restricted in any way.

No one can block certain transactions, as banks do from time to time. The Bitcoin blockchain is being developed by a team of developers. However, they listen to the community and have no role in governance.

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

Governments and government agencies also do not control transactions of digital assets. Therefore, their employees offer rewards for cryptocurrency hacking.

For example, in September 2020, the U.S. Internal Revenue Service (IRS) promised $625 thousand to a company that will develop software to track digital transactions.

At the same time, Coin Metrics analysts published a report in which they recognized that Bitcoin and the entire cryptocurrency industry have reached a sane degree of decentralization. Since the generation of the first Bitcoin blockchain, the mined coins have been relatively evenly distributed among investors. 48.89% of all addresses were held by holders of amounts up to 0.001 BTC, and 24.16% had between 0.001 and 0.1 BTC in their accounts.

Security

Transactions on the network cannot be traced, which means users’ money is protected. In addition, transactions must receive confirmation before being added to blocks and finalized. This eliminates the risk of someone rewriting the results of transactions or stealing money from the holder.

However, the BTC holder is personally responsible for the safety of his coins. If he or she loses the private key to the cryptocurrency wallet or gives it to a third party, he or she could lose his or her savings.

From this point of view, the security of bitcoin is lower than that of banks. Account holders at financial institutions can cancel disputed transactions to get their money back.

Security issues are acute for cryptocurrency holders while dealing with exchanges. There are many cases of stealing coins from the wallets of trading platforms on the Internet. Therefore, you should not store large amounts on exchange accounts.

Low entry threshold for investment

To invest in bitcoin, you do not need to buy it in its entirety. It is enough to get a fractional part. That is, a certain number of satoshis, into which bitcoin is divided. 1 BTC contains 100 million SATs.

There is no minimum threshold for investing in Bitcoin. You can invest $5 or $500. Depending on the amount of investment, the potential profit will be calculated as well. The only restriction is related to the minimum purchase amount set by exchanges and exchangers.

The low entry threshold makes Bitcoin more popular than other ways of investing capital. For example, on the stock exchange, the minimum deposit is $100.

Control over personal funds

When dealing with regular money, there is a risk of a transaction being blocked or canceled by the bank. Owners of fiat accounts do not have full control over their assets – they can be transferred to other people at interest or invested.

In the case of cryptocurrency, such problems are excluded.

A bitcoin wallet will not fall under sanctions and will not be disabled if its owner refuses to undergo verification on the exchange.

To enter the account, only a private key is needed, which gives control over personal money. The holder of digital currency can perform any transactions with koins without fear of being blocked by the regulator.

No restrictions on payments

The Bitcoin blockchain has transactions worth millions of dollars. For cryptocurrency you can buy real estate, luxury goods and even citizenship of the country of Vanuatu. Antigua and Barbuda is also considering such a method. Owners of digital coins have access to any transactions without restrictions. It does not matter the amount of payment, destination or geographical location of the recipient.

Digital gold

Bitcoin is often compared to one of the most expensive metals. Like gold, it has mining restrictions (the available volume is limited). BTC can also be used to store and transfer value.

Unlike real gold, Bitcoin does not require renting a storage facility or hiring transportation for shipping. Transaction costs for digital currency are much lower than for fiat money.

According to Bloomberg analysts, the first cryptocurrency gradually ceases to play the role of an asset for speculation and becomes a means for savings.

Digital coins have performed well in countries with high inflation and devaluation risks. For example, BTC gained popularity in Zimbabwe and Venezuela, whose residents bought the asset, fearing the full depreciation of national currencies.

New opportunities

Cryptocurrency opens great prospects for users. The coin is simultaneously a means of saving, a way to invest, and also to make cross-border payments without government control.

Smart contracts and multi-signatures find application in business and private life. For example, it is possible to transact with a guarantor when 2 out of 3 signatures are required to validate a transaction.

The main disadvantages of Bitcoin

Despite the large number of advantages, bitcoin still has disadvantages. The following disadvantages can be highlighted:

- Partially controlled by the state.

- Unstable and volatile asset.

- Conversion to fiat money entails fees that are often costly.

- Transactions are immutable. Once the money leaves the wallet, it cannot be recovered.

- The user interface in most bitcoin apps is still not secure from bugs and hacks.

Difficulty of mining

It takes a lot of resources to get new bitcoins. In the early days, coins could be mined with ordinary processors. As the complexity increased, mining was already carried out on video cards.

Over time, farms of GPUs appeared. Finally, the evolution of mining led to the creation of ASIC devices. Application Specific Integrated Circuit – Application Specific Integrated Circuit.

The complexity of mining is constantly increasing. The farms created today will mine less bitcoins after a while. It will take more investment to get the same amount of BTC coins

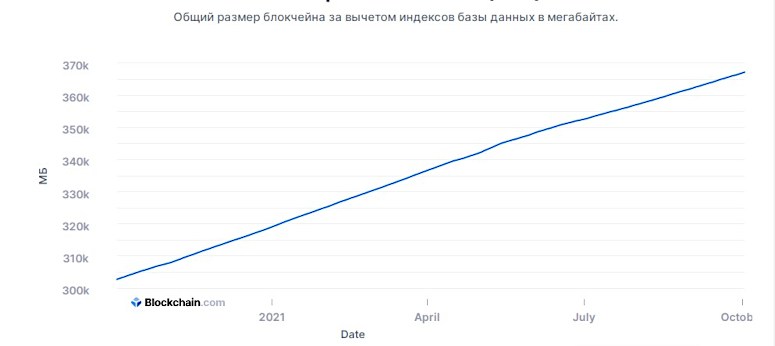

Blockchain size

Every month, the weight of the Bitcoin network increases. In 2015, the blockchain size was 30 GB. In 2018, it increased to 190 GB. In October 2021, it will take 367 GB of free hard disk space to install a fat BTC wallet like Bitcoin Core on your computer.

The growth of the network is due to its scaling, increasing number of transactions and accumulating history of all transactions. The trend will only increase in the future.

Another problem is unspent cryptocurrency withdrawals. They appear as a result of unconfirmed transactions when coins are returned to the original wallet. The blockchain also records this action. In the fall of 2021, the size of such blocks does not exceed 4 GB, but it continues to grow.

Lack of support

Considering the advantages and disadvantages of bitcoin, it is worth noting another disadvantage. The first cryptocurrency does not have a support team that can solve user problems the way the teams of Skrill or WebMoney payment systems do.

Blockchain development is handled by developers and the community. But in the absence of an operator, there is no full-fledged support from the project. The user has to solve all issues on his own or address the community, which includes the developers.

BTC rate volatility

In April 2021, the price of bitcoin exceeded the mark of $63 thousand, but in May it fell to $35 thousand. In July, the rate of the first cryptocurrency fell to $29.7 thousand. And in early November, it trades for $61.5 thousand. Volatility scares potential investors and prevents the mass use of Bitcoin as a means of payment.

There is no guarantee that the price of the coin will continue to rise in the future. Many investors are betting on BTC’s deflationary model. A planned decrease in issuance that should result in demand outstripping supply. But that doesn’t mean that in the future, the community won’t shift its attention to another coin it deems more promising.

Bitcoin reacts to any external events. For example, Ilon Musk’s remarks in favor of the digital currency in January 2021 initially contributed to its growth. But after the businessman changed his point of view, along with the ban on mining in China, the rate collapsed by tens of thousands of dollars.

The coin attracts inexperienced investors with large savings. When bad news emerges, they start selling the asset, driving down its price.

| Date | Event | BTC rate change |

|---|---|---|

| January 2021 | Ilon Musk published a tweet in support of bitcoin | The asset grew in value from $28 to $37.7k in 14 days, and after a few more weeks it broke the $50k mark. |

| May 2021 | Tesla has suspended sales for Bitcoin | The coin’s exchange rate fell from $57k to $46.2k in 14 days |

| May 2021 | Chinese authorities banned mining in 4 major provinces | BTC lost 33% of its price in 10 days. The coin’s exchange rate fell from $46.2k to $30.8k. |

| September 2021 | The Chinese government imposed a ban on all financial transactions with cryptocurrencies | Bitcoin fell in price from $52.8 thousand to $39.6 thousand. |

Regulation

Cryptocurrency is decentralized and has no single center of issuance and management. However, states are trying to establish control over the circulation of coins by introducing mandatory identity verification for investors and traders.

For example, on American exchanges it is impossible to trade without confirming one’s data with personal documents. Similar things are happening in Europe. In addition, regulators are developing new measures to control cryptocurrency transactions.

It is possible that in the future, outlets accepting bitcoin as payment for goods will be obliged to verify customers. This means that the state will be able to link the wallet and its owner.

High commissions

Satoshi Nakamoto created Bitcoin as a fast and cheap way to transfer money. But already in 2021, the average commission in the network exceeds $2 per transaction. And users increase the fee amount on their own to speed up the transaction.

For comparison, in many electronic payment systems that work with fiat money, the commission for internal transfers is not charged or is much lower than in the bitcoin network. For example, in the WebMoney system it is 0.8%. To transfer $100, you need to pay only $0.8.

Long transfers

The speed of transactions is another weakness of bitcoin. Sometimes transactions take place within minutes. But some transfers may not reach the recipient for hours. Users have to pay hefty fees to get their transactions onto the blockchain faster. In comparison, in electronic payment systems (Visa, WebMoney, Skrill), all internal transactions are almost instantaneous.

Back in 2019, young bitcoin millionaire Eric Finman cited slow transfers on the first cryptocurrency’s network as one of its biggest problems. But Bitcoin.org founder Charlie Shrem disagrees with him. He is convinced that the low speed of BTC transactions is a distraction. Since there were many ways to transfer money quickly in the world before Satoshi Nakamoto’s project was created. The real value and main advantage of bitcoin is in its resistance to censorship and lack of government control.

Underdeveloped infrastructure

Bitcoin is the first cryptocurrency on the market. In 2024, all popular exchanges, exchangers and P2P platforms support the ability to work with the asset. BTC coins can be bought on any trading platform and used to pay for goods online.

However, there is a difficulty to expand the circulation of cryptocurrency in terms of infrastructure. The disadvantage of bitcoin is that it does not have its own ecosystem.

Apart from a distributed registry and wallets, there is nothing in the network. Developers plan to launch smart contracts to expand the ways in which coins can be practiced.

Prosperity of the shadow market

Digital money has become a kind of calling card of the Darknet. It is a problem for many nations that hinders the implementation of coins in the economy. Cryptocurrencies have taken the shadow internet to another level. Here, illegal substances are traded, other illegal actions are committed, and all settlements are made in digital coins.

Bitcoin quickly took root on the darknet because of the lack of regulation. No one can trace a transaction, and this plays into the hands of criminals. According to unofficial data, various shadow forums are visited by more than 80 thousand people per day. Therefore, states perceive cryptocurrency not as a technological breakthrough, but as an enemy of economic, political and social systems.

Bitcoin’s prospects

The first cryptocurrency was created more than 12 years ago, and during this time it has grown in value tens of thousands of times – from $0.001 in 2009 to $67 thousand in 2021. However, with regard to the prospects of BTC, analysts’ opinions differ.

Some are convinced that the asset in the future will be able to take a place next to fiat currencies and gradually become a global means of payment. Others believe that the coin will lose most of its audience, which will pay attention to new technological solutions.

Bitcoin gained popularity due to decentralization, anonymous and fast payments, and the absence of transaction limits. But one of the main factors behind the growing demand for the coin remains the fact that its price periodically updates historical highs, allowing investors to get richer.

It is difficult to say whether bitcoin will be used as a means of payment in the future. This requires stability, which the asset has not yet achieved, and certain steps on the part of states. Internationally, there is no clear understanding of what BTC should be in order to become a new settlement instrument.

Frequently Asked Questions

👽 Who controls bitcoin?

It is a decentralized project that has no owner. The work of the network is supported by enthusiasts. BTC has its own community, where the fate of the project is collegially decided and directions for development are determined.

👥 Who is involved in the issuance of BTC?

Hundreds of thousands of users participate in the issuance of cryptocurrency, who mine coins with the help of farms on video cards and productive ASIC-miners. There is no single authority that controls the issuance of BTC.

🤝 Why is bitcoin trusted?

BTC was the first realization of cryptocurrency – free money that is not controlled by a bank, government. Information in a distributed network cannot be changed or deleted. This makes the blockchain invulnerable to manipulation and fraudulent activities.

💵 How to make money with BTC?

You need to buy an asset cheaper and sell it more expensive. Coins can also be mined for the purpose of realization or held in the hope of price growth.

💎 Is there a physical equivalent to Bitcoin?

No, the coins exist as information on digital media.

Is there a mistake in the text? Highlight it with your mouse and press Ctrl + Enter.

Author: Saifedean Ammous, an expert in cryptocurrency economics.