Cryptocurrency exchange Binance

Large platforms attract users with a choice of trading pairs, acceptable commissions and good liquidity. Cryptocurrency exchange Binance topped the rating as the most visited platform in 2021. Binance hosts transactions with 383 major and 158 derivatives, making the platform the market leader in digital assets.

- Bitcoin trading fee 0%

- A large list of traded cryptocurrencies and investment instruments.

- High liquidity.

- Ability to deposit fiat money, including via bank transfers, cards and P2P service.

- Affiliate Program Availability.

- The need for verification with proof of identity with a scan or photo of documents.

- Uncomfortable dialog window of the support service. Impossibility to contact the support team via e-mail.

Binance Services

The main activities of the platform’s clients are spot market operations and leveraged trading (margin trading). In addition, the Binance crypto exchange provides visitors with:

- Operations with derivatives (futures, options, leveraged tokens).

- P2P-exchange.

- Purchase of cryptocurrencies for fiat money. Payment via credit or debit cards and bank transfer systems is supported.

- Lending and farming.

- Cryptocurrency loans.

- Transactions with tokenized shares. This service will only be active until October 2021.

- Earnings from providing liquidity to the DeFi pool.

Features of the Binance exchange

The platform takes the leading position in the rating in terms of the number of available instruments and average daily trading volumes. Binance was founded relatively recently (in the summer of 2017), but quickly overtook competitors due to a wide range of services and impeccable reputation.

Until mid-August 2021, the advantage of the project was the possibility of anonymous crypto trading. There were restrictions on working with fiat and strict withdrawal limits, but the company did not require mandatory account verification. In August, the platform faced bans in several European countries, including the Netherlands, Italy, and the UK. Therefore, the platform’s management decided to introduce mandatory verification.

History

The online cryptocurrency trading exchange Binance started operating in July 2017. The initiator and head of the project was Chinese entrepreneur Changpeng Zhao. At the time of its foundation, the company operated in Hong Kong. Later, the management decided to move the main office to Malta. Simultaneously with the launch of the crypto exchange with the help of ICO released a native token of the platform Binance Coin (BNB). Already in 2019, the number of users exceeded 15 million, and the daily turnover of funds reached 3 billion dollars.

Regulation

Crypto exchange Binance has an ambiguous legal status. In 2021, the company faced a number of restrictions: the authorities of China, the UK and Canada warned Binance about the inadmissibility of financial activity without a license. According to the statement of the project managers, the necessary permits are expected to be processed in the near future. But at the time of writing, there was no information about valid financial licenses.

5020 $

bonus dla nowych użytkowników!

ByBit zapewnia wygodne i bezpieczne warunki do handlu kryptowalutami, oferuje niskie prowizje, wysoki poziom płynności i nowoczesne narzędzia do analizy rynku. Obsługuje transakcje spot i lewarowane oraz pomaga początkującym i profesjonalnym traderom dzięki intuicyjnemu interfejsowi i samouczkom.

Zdobądź bonus 100 $

dla nowych użytkowników!

Największa giełda kryptowalut, na której można szybko i bezpiecznie rozpocząć swoją podróż w świecie kryptowalut. Platforma oferuje setki popularnych aktywów, niskie prowizje i zaawansowane narzędzia do handlu i inwestowania. Łatwa rejestracja, duża szybkość transakcji i niezawodna ochrona środków sprawiają, że Binance jest doskonałym wyborem dla traderów na każdym poziomie!

Available cryptocurrencies and popular trading pairs

There were 436 tokens and coins traded on the exchange in August 2021. On the spot market (exchanges with immediate delivery), 1,576 pairs were available. In addition, the company supported 158 cryptocurrency derivatives, including futures contracts and classic European options.

Exchange token

The Binance ecosystem is backed by its own cryptocurrency. Binance Coin (BNB) native token is used for:

- Reductions in payment fees and commissions.

- Speculative trading

- Receiving cryptocurrency loans.

In August 2021, there were approximately 162 million BNB in circulation. The company buys and burns tokens quarterly to maintain demand. The plan is to maintain their number at 100 million.

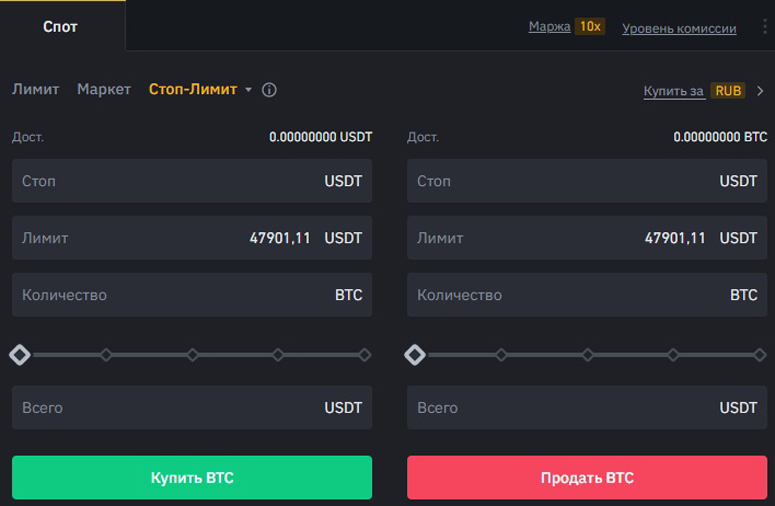

Types of orders

Different types of bids are available in the spot market:

- Market. Immediate sale or purchase at the current price.

- Limit. The order is added to the order book and executed as soon as the quotes reach the level set by the trader.

- Stop-limit. A market order that specifies a limit value and a stop price. Once the quotes reach the set mark, the order is activated. The order is then entered into the book as a limit order.

- OCO (canceling transaction). 2 orders are added to the book at the same time. The triggering of one cancels the other.

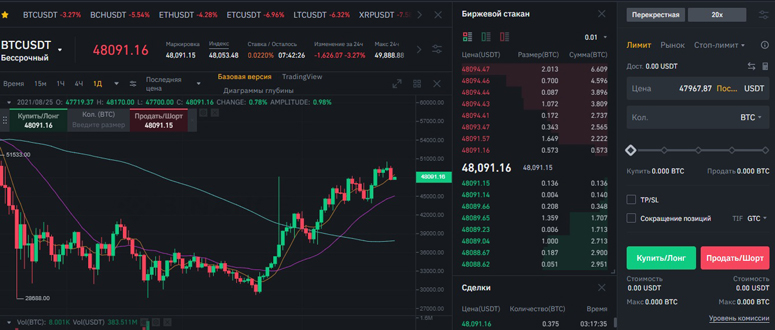

Menu for selecting order type

Terms of employment

Requirements for users are published on the official Binance website in the Terms of use section. Users are entitled to register on the exchange:

- Visitors who have reached the age of 18.

- Residents of any countries, except for the United States, Malaysia and the province of Ontario (Canada).

- Customers who have not previously created accounts on the site.

- Not included in the restrictive or sanctions lists of the UN Security Council.

Additional restrictions apply to certain trading and investment instruments. In particular, futures, options and leveraged tokens are not available to users from the Netherlands, the UK, Italy, Canada and Hong Kong. Australian authorities prohibit its residents from any transactions with anonymous koins (XMR, ZEC, DASH).

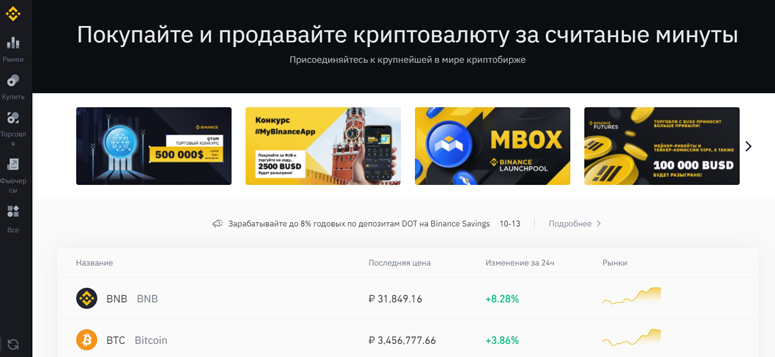

Mobile app

In the upper right corner of the website there is a link to download the mobile program for Android and iOS smartphones. The application contains the following sections:

- Markets. List of trading pairs and charts of cryptocurrencies.

- Buy. Purchase of tokens and coins for fiat.

- Wallet. Deposit and withdrawal of money.

- Personal cabinet. Account settings menu.

Chart of a trading pair in the mobile application

Desktop application

On the official website of the Binance exchange, you can download a terminal compatible with Windows, Linux and macOS. The application interface differs slightly from the browser version:

- The main menu is on the left side of the screen, not the top.

- Charts of trading pairs and other trading tools occupy more space.

- The lower part of the application contains informers (interactive buttons with current asset quotes).

The disadvantages of the terminal for PC include high requirements for processor performance. On laptops and outdated computer models, the program may noticeably slow down the work.

Desktop version of the application

Bonuses

The company regularly holds promotions and pays rewards to active traders.

At the time of the article, bonuses such as these were offered:

- Rebate for makers in futures trading.

- Vouchers for buying open-ended contracts. The bonus is received by those traders who replenish the balance of the futures wallet in the amount from 300 BUSD (Binance stablecoin). It will be required to fulfill the conditions on the trading volume. It must be at least 10,000 BUSD.

- Contests with a prize fund of up to $500,000.

Trading on Binance

Traders have a lot of options:

- Spot trading.

- Operations with derivatives.

- Margin trading.

- Buying cryptocurrency for fiat.

- Exchanges on P2P-platform.

Spot trading

Transactions with immediate delivery of crypto-assets can be made in 2 ways:

- Through the “Conversion” service. In this case, orders are not entered into the book and are processed according to the Over-the-Counter principle. OTC-trading is convenient for one-time purchases of cryptocurrency. The second advantage is the absence of commissions.

- Through the terminal. To do this, go to the “Trading” tab. In the pop-up menu, you can choose which version of the terminal (classic or advanced) the trader wants to use.

Interface of spot market transactions

Margin trading

Leverage (leverage) allows you to increase the volume of transactions. Margin trading requires:

- Register at a crypto exchange.

- Take a test to know the basics of the specifics. When opening the section for the first time, a corresponding notification will appear.

- Choose the type of account. There are 2 modes for this: Cross (borrowed funds can be used to purchase any assets) and Isolated (the loan is issued for the purchase of a specific token or coin).

- Make a deposit to a margin account. It should be noted that when depositing by any method, the money is first credited to the spot wallet. Transfer to the margin account is made via myAlpari.

- Go to the necessary terminal.

- Borrow money by clicking on the “Borrow” button in the order-form. Specify the required amount.

- Open a transaction. Trading is conducted in the same way as on the spot market.

- After the transaction, return the borrowed funds by clicking on the “Repay” button at the top of the form.

P2P

Peer-to-Peer transactions allow fiat and digital money to be exchanged directly, without the involvement of a cryptocurrency exchange. This method can be used for:

- Purchases of tokens and coins for fiat. Unlike direct deposit, the P2P service allows you to purchase cryptocurrency for cash, through recharge terminals and with the help of wallets in other payment systems.

- Additional earnings. Owners of crypto exchanges or individuals can register as a P2P merchant and earn profit by providing services.

Such exchanges are only available to verified users.

When paying with fiat money, the cryptocurrency is first blocked on the seller’s account. Only after he receives rubles, dollars or other monetary units are the coins transferred to the buyer’s balance. This protects against fraud.

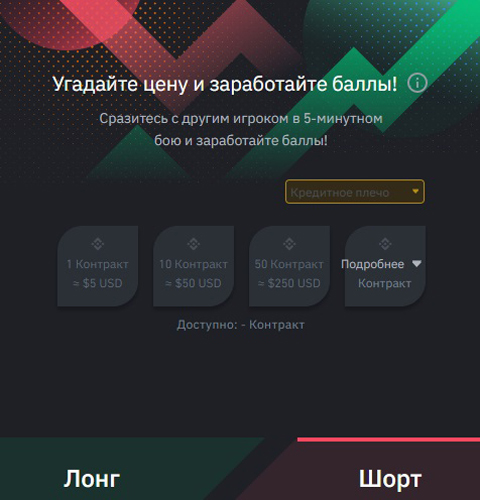

Derivatives

On the Binance crypto platform, traders have access to several types of derivatives. The list of traded derivatives includes:

- USD-M and COIN-M futures.

- Leveraged tokens.

- Options.

- Predictions for changes in cryptocurrency quotes over the next 5 minutes. This instrument is included in the list of derivatives on the site, although it is more like a gambling contest.

Trading predictions on quotes changes

Futures

Perpetual and quarterly contracts with redemption in USDT and BUSD tokens (USD-M), as well as with payment in cryptocurrencies (Coin-M) are available. Futures trading is available through the Derivatives section of the main menu. To get started you should:

- Register on the website.

- Visit the “Derivatives” tab, then open “Futures”.

- Take a quiz on knowledge of the peculiarities of transactions with derivative instruments. This survey helps to protect beginners from losing their deposit due to too risky trading.

- Transfer funds to a futures account.

- Set up leverage and select position mode (one-sided or hedging).

- Specify the order type and the number of derivatives to be purchased.

The correct choice of the position mode is important:

- One-sided allows opening trades only in the direction of buying or selling. For example, if a trader believes that the price of BTC will grow, he becomes long. When changing the position, the previous order will be automatically closed.

- Hedging mode. Allows you to trade simultaneously in both directions. This option is useful for large traders who use futures contracts as a way to reduce risks rather than as an independent tool for earning money.

Options

The trading platform provides access to the Vanilla Options instrument. This type of asset is also called European options: the holder of the derivative requires settlement only on a specified date. The basic unit is Bitcoin. Options are traded in a separate section of the site, opened through the “Derivatives” menu.

Opportunities to earn money on Binance

The Finance section offers additional ways to generate income:

- Steaking.

- Lending.

- Investing in liquidity pools.

- Earnings on DeFi tokens (Liquid Swap).

- Cryptocurrency loans.

- Mining pool.

- NFT-tokens.

Steaking

Users can earn passive income by providing assets to validate transactions in blockchains running on the Proof-of-Stake algorithm. The Binance cryptocurrency exchange offers such types of steaking:

- Ethereum 2.0. Great changes are expected in the Etherium system: the network is moving to a new protocol. In this regard, clients are offered to transfer ETH coins to the staking. This is a long-term type of investment: assets cannot be returned until the launch of the Shard Chains scalability mechanism. But in return for the ETH transferred to the shakedown, the administration will credit the investor with the tokenized asset BETH. This currency can be used in trading operations on the exchange. The probable profitability of ETH 2.0 tokenization reaches 20%. The duration of the asset lock-in is unknown. The update is expected to launch as early as 2022.

- Fixed Staking. This investment method involves the temporary transfer of PoS blockchain crypto-assets at a predetermined interest rate. The lock-in period for coins ranges from 15 to 90 days, with expected returns as high as 34% for some coins:

| Moneta | Duration of steaking | Minimum investment | Bid |

|---|---|---|---|

| FARM | 15/30/60/90 days | 0,2 FARM | To 33,52% |

| EZ | 30/60/90 days | 10 EZ | To 29% |

| DEXE | 30/60/90 days | 5 DEXE | To 25,66% |

- DeFi-stacking. Decentralized Finance (DeFi) is a gaining popularity in the cryptocurrency market. DeFi-stacking allows platform tokens to be transferred to the management of Binance. The company places DeFi assets on behalf of investors and pays their owners a profit.

Lending

On the crypto platform, you can invest digital assets on floating or fixed interest rate terms. In addition, at the bottom of the Savings page, there is a separate “Shares” column, which shows special (temporary) offers with increased returns:

| Active (ticker) | Rate type | Loan term | Expected return |

|---|---|---|---|

| BTC | Floating | Not limited | 0,50% |

| USDT | Floating | Not limited | 1,20% |

| FUN | Fixed | 14/30/60 days | 45/10/15% |

| UFT | Promotional offer | 15 days | 60% |

| VITE | Promotional offer | 30 days | 16% |

Investing in liquidity pools

Decentralized cryptoasset exchange platforms usually operate on the Liquid Swap principle. Unlike classic exchanges, orders to buy and sell assets are not entered into the order book. Parties add tokens to the common pool, taking the opposite cryptocurrency from it. When assets are held in Liquid Swap, the trader receives additional rewards. As of August 2021, the expected returns from investing in Liquid Swap pools ranged from 1.64% (for the ETH/BETH pair) to 67.41% (in the AVA/USDT bundle).

Crypto-loans

It is possible to borrow against other digital assets. To do this, you should:

- Go to “Finance”, open “Crypto-loans”.

- Select the desired asset and the one that will be transferred to the exchange as collateral.

- Specify the loan term (from 7 to 180 days).

- Click on the “Confirm loan” button.

Repayment of credits is done manually on the order page.

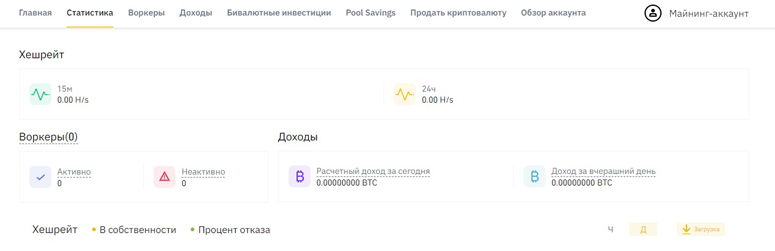

Mining pool

Clients can earn money by mining new blocks in systems based on the Proof-of-Work algorithm. To connect to the mining pool you need to:

- Prepare the equipment. The company’s website provides recommendations on how to choose it.

- Create a sub-account in Binance Pool.

- Get an address to connect the farm.

Statistics of hashrate and revenue from coin mining

NFT

Binance operates a marketplace for trading non-fungible tokens. NFTs are unique assets that are digital versions of graphic, sound, or text files. The platform allows trading in non-mutually exchangeable tokens on auction terms.

Registration on the official website

To create an account, you must provide a phone number or e-mail address. You also need to make up a password. The final stage of registration on the site is to verify the number or e-mail. The welcome letter (or SMS) will contain a 6-digit code, which should be entered in the activation field. During the first visit to the site, the user receives an invitation to verify the account. This procedure is now mandatory.

Verification of identity

Until mid-2021, Binance traders could remain anonymous. Since August, the management decided to tighten the rules:

- New users are required to undergo interim verification to access any transactions.

- Existing customers until October 2021 can withdraw money (not more than 0.06 BTC), cancel active orders and close current transactions. Other transactions require intermediate or advanced verification.

The identity verification procedure is carried out in stages:

| Verification | Limitations | Documents to be provided |

|---|---|---|

| Basic | It is forbidden to deposit money. You can withdraw up to 0.06 BTC per day. Only closing current positions is allowed. | It is enough to provide personal information in the questionnaire. |

| Intermediate | The daily limit for deposits and withdrawals (in fiat money) is $50,000. Up to $500,000 can be transferred per month. There are no restrictions on cryptocurrency deposits. The daily limit for withdrawal of digital assets is 100 BTC. Access to all transactions is open, a branded card can be ordered. | Passport or ID card. In addition, you should confirm your identity with a photo. |

| Extended | The daily limit for fiat transactions has been raised to $200,000 and the monthly limit to $2,000,000. | Documents proving your residential address. |

Basic verification takes a few hours. In case of intermediate and extended verification, the application processing time can be increased up to 10 days.

Account security and protection

Binance employs mechanisms to counteract hacking:

- Two-Factor Authentication (2FA). Can be conducted via email, SMS, Google app, or hardware security key.

- Anti-Phishing Code. This cipher is added to every official support email. Allows you to distinguish original messages from phishing messages.

- Address whitelist. When enabled, money withdrawal will be available only to the wallets specified in the list.

- Device management. When connecting a desktop or mobile application, the user sees information about logging into the account and operations with it. This allows you to promptly detect hacking.

Two-factor authentication

The 2FA mechanism is considered to be the most reliable method of account protection. By default, two-factor authentication is performed by phone number or e-mail (depending on the method used to activate myAlpari). To increase the level of protection, you should use the Google Authenticator application. You can enable two-factor authentication in the “Security” section of the settings (displayed as an icon with a picture of a person in the upper right corner of the screen).

Additionally, you can set up login only from installed devices, withdrawals from specified IP addresses.

Trading Terminal

Users have access to 2 types of interface in the browser version:

- Classic. Suitable for beginner traders.

- Advanced. Provides full access to all instruments in one screen.

To switch between terminals one should use the “Trading” section located at the top of the page. In the classic interface a trader sees blocks:

- Announcements and advertisements bar. It is located in the upper part. It consists of several links to current news (messages about listing of cryptocurrencies, bonus offers, contests).

- In the left part of the terminal there is a stock exchange glass. A characteristic feature is a large depth of the order book. It contains 19 orders closest to the market price.

- In the center of the screen there is a chart of a trading pair. You can switch the quotation display mode from the original one to the one provided by the TradingView service.

- The trading pair selection menu is located to the right of the chart. Assets are divided into several categories (BTC, BNV, Altcoins, Fiat). A window with information about the latest transactions is located next to it.

- The order form is located below the chart. Even below is published information about the latest and active orders of the crypto trader.

The classic version of the terminal.

How to trade on Binance

For a spot exchange on a crypto exchange, you should:

- Authorize on the site.

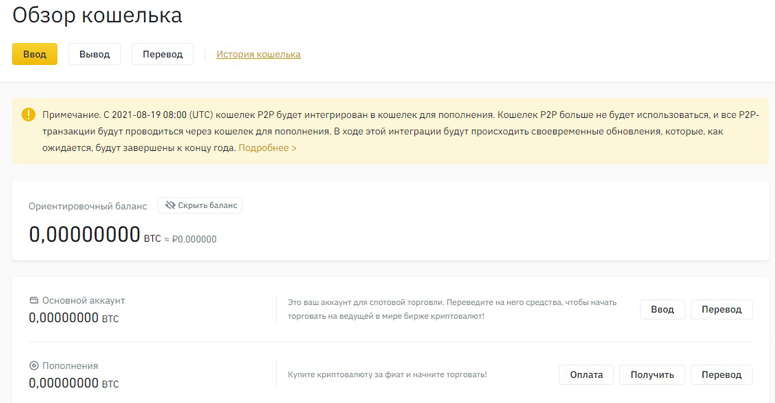

- Make a deposit to the main account. If the money is on accounts for P2P deals, futures or margin trading, it should be transferred through the “Wallet Overview” section.

- Go to the terminal. In the “Trade” menu you can select the interface (modes “Conversion”, “Classic” or “Advanced”).

- Fill in the order-form and click on the “Buy” or “Sell” buttons.

API trading and use of trading robots

The crypto exchange provides automatic access to the markets through third-party websites and apps. For API trading you need to:

- Perform verification (KYC). The account must pass intermediate or advanced verification.

- Connect two-factor authentication.

- In myAlpari, select “API Management”.

- Specify the name (label) of the new key.

- Press the “API created” button.

A separate type of trading robot is used for tax reporting. This tool allows you to store the history of all transactions and transfer financial information to declarations.

The Tax Reporting API has read-only access and can only be created once.

For this purpose, it is necessary:

- Pass verification.

- In the API Management section, select the button for creating the tax reporting interface.

- Save the access keys. In the future they can be used in services of automatic generation of financial reports.

How to top up the account

Deposit methods available on the platform include:

- From a plastic card.

- Through bank transfers.

- With cryptocurrency.

- With the help of AdvCash, Payeer, Simplex, Mercuryo and other partner sites.

Deposit and withdrawal menu

Fiat currency

To make a deposit you should:

- Go to the “Main Wallet” section, select “Deposit”.

- Specify the currency. As of August 2021, deposits are available in EUR, GBP, AUD, RUB, UAH, BRL, HKD, KZT, NOK, PEN, PHP, TRY, UGX. However, direct deposit in USD is temporarily limited.

- Choose a deposit method. Depending on the currency it can be bank transfer, credit or debit card, intermediary sites.

- When depositing using Visa, Mastercard or P2P service, you need to pass verification.

- After being redirected to the deposit page (for example, for Simplex or AdvCash), you should fill out the payment form and confirm the application.

Kryptowaluta

The following coins and tokens can be deposited on Binance: BTC, ETH, USDT, BNB, EOS. To deposit digital assets, you need to go to the “Main Wallet” section and click “Cryptocurrency Deposit” on the right side of the screen. After that, you should select the asset and create a deposit address. Cryptocurrency will be credited depending on the number of confirmations set by the system (for BTC this number is 2, for ETH – 12).

Minimum deposit

The amount of the transfer depends on the currency used and the deposit method. As of August 2021, the following restrictions apply.

| Contributed asset | Minimum deposit |

|---|---|

| Kryptowaluta | 0,00000001 (in any coin) |

| Euro (P2P exchange) | 10 |

| Ruble (P2P exchange) | 500 |

| UAH (P2P-exchange) | 100 |

Withdrawal

Exchange customers can send funds to a personal cryptocurrency wallet, bank card or EPS account. To withdraw fiat, it is necessary to:

- Pass verification.

- Click “Main wallet”, then click “Withdrawal”.

- Select currency and payment method.

- Specify details and confirm the operation.

When withdrawing fiat, these fees apply:

| Method of payment | Transaction fee |

|---|---|

| Visa (EUR, GBP), Payeer (RUB) | 1% |

| Visa and Mastercard (RUB) | 250 RUB |

| AdvCash, SettlePay, GEO Pay (UAH), bank transfer | 0% |

To withdraw funds to a cryptocurrency wallet, you should connect two-factor authentication beforehand. After that, in “Withdrawal” you need to select tokens or coins and specify the address for crediting money.

The minimum transfer amount, daily limit and network fee depend on the selected cryptocurrency. In addition, the limits are affected by the level of verification.

Binance Commissions and Limits

Spot trading fees depend on the volume of trades over the previous 30 days and the number of BNB tokens in the trader’s balance. In addition, a maker (limit order creator) pays less than a taker (client using market orders). More details in the table:

| Poziom | Volume of orders for 30 days (BTC) | Balance (BNB) | Komisja | |

|---|---|---|---|---|

| Taker | Maker | |||

| VIP 0 | ≥ 0 | 0,10% | 0,10% | |

| VIP 1 | ≥ 50 | ≥ 25 | 0,10% | 0,09% |

| VIP 2 | ≥ 500 | ≥ 100 | 0,10% | 0,08% |

| VIP 3 | ≥ 20 millions | ≥ 250 | 0,042% | 0,06% |

| VIP 4 | ≥ 100 millions | ≥ 500 | 0,042% | 0,054% |

| VIP 5 | ≥ 150 millions | ≥ 1000 | 0,036% | 0,048% |

| VIP 6 | ≥ 400 millions | ≥ 1750 | 0,03% | 0,042% |

| VIP 7 | ≥ 800 millions | ≥ 3000 | 0,024% | 0,036% |

| VIP 8 | ≥ 2 billions | ≥ 4500 | 0,018% | 0,03% |

| VIP 9 | ≥ 4 billions | ≥ 5500 | 0,012% | 0,024% |

Support Service

There are several ways to get help:

- Find answers to the most common questions yourself in the “Support Center” section, a link to which is located at the bottom of the site. All articles in the Help Center are available in Russian.

- Send a request to employees. Authorized customers have the “Support” icon displayed on the right side of the screen. In addition, there is a link to the help section at the bottom of the page.

- Make a complaint or suggestion via the “Send Feedback” menu.

To the negative sides in the review of the Binance exchange, a complicated process of communication with the support team should be noted. In order to open a chat with the company’s employees, you must first select the appropriate subject of the request, and then click on the “Transfer to support” button.

Exchange specialists help only during daytime hours. If contacted at night (Moscow time), the user will have to wait several hours for a response.

Additional services

In addition to the trading terminal and investment offerings, Binance has:

- Binance Academy training section.

- Affiliate referral program.

- Payment gateway.

Training

At the bottom of the homepage, there is a link to the Binance Academy section. In the learning center you can find more than 280 articles containing information about cryptocurrencies and the basics of trading on the exchange. From the materials in the section, beginners will learn:

- What are digital assets, blockchain, mining.

- How to engage in crypto trading, create orders and analyze the markets.

- What investment products the site offers.

- How to ensure the safety of personal savings.

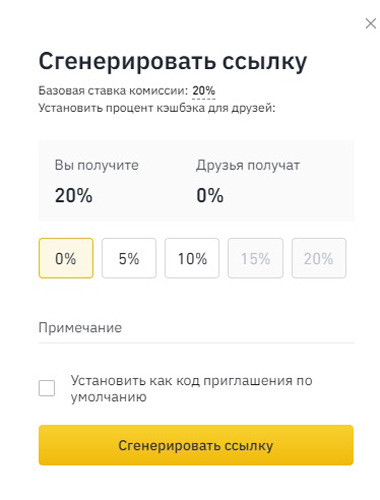

Affiliate referral program

Users can attract new visitors and receive remuneration for it. The advantage of the exchange is the ability to choose a bonus for themselves and for the referrals brought in. In the “Affiliate Program” section, the client can generate up to 19 links. Each of them can be set a different ratio of reward for the user and the referrals attracted by him. The basic reward rate is 20% of the paid commissions. If a partner’s balance contains more than 500 native BNB tokens, the reward for a referral increases to 40%.

Menu for customizing the size of the reward

Payment gateway

Cryptocurrency transfers are becoming more and more common every year. Many online stores and services allow customers to pay for goods and services with digital assets. With the help of the Binance Pay section, exchange users get the opportunity to quickly and safely transfer cryptocurrency to sellers. After authorization on the site, the client creates a wallet, from which any transaction is carried out in one click. Binance Pay allows not only sending but also accepting payments, so the service is suitable for entrepreneurs.

Wnioski

The Binance platform was on the first place in the rating of crypto exchanges in 2021. This service is characterized by a wide list of available trading pairs and instruments for investment.

It is possible to fund the account with fiat and digital currencies, trade on the spot market, work with leverage. Investors have access to crypto-loans, lending, staking and liquidity pools. In addition, exchange partners receive remuneration for attracted referrals.

Często zadawane pytania

❓ How to trade tokenized shares on Binance?

In July 2021, this service was restricted. Management banned new applications for tokenized shares. Already issued securities will continue to be held by the depositary (CM-Equity AG), but from October 2021 customers will not be able to deal with these assets via the platform’s website.

💵 Is deposit available in USD?

As of August 2021, the acceptance of USD was limited. Users could only apply USD on the P2P exchange.

✅ Does Binance have an option to delete a profile?

On the “Manage Account” page, there is a button to disable the Personal Account.

⚖ Does the exchange work with legal entities?

During the verification process, companies can select the “Switch to Enterprise Account” option. The company will be registered as an institutional client.

🚹 Does the company’s security service require additional documents for verification?

Usually it takes no more than 1 working day to verify your identity. In rare cases, the administration may request documents not included in the list. Additional requests from the security service are processed manually and take several working days.