Cryptocurrency market participants are constantly looking for ways to earn assets. In addition to trading and staking, investors choose liquidity farming. Decentralized exchanges and popular CEX offer to become a provider. The article discusses what liquidity farming is on Binance. The site’s clients can earn passive income for adding coins to the pool.

Definition of liquidity farming

There are many ways in which market participants can earn cryptocurrency. One of them is liquidity farming. It allows traders to add assets to pools and in return receive rewards in the form of transaction fees from other users.

Pharming is based on an automated market maker (AMM), which is responsible for maintaining constant liquidity. Each pool contains 2 digital tokens or fiat assets. Users who blockchain their coins in exchange for rewards are called providers.

This way of earning is especially popular on decentralized exchanges Compound, Uniswap, SushiSwap and others. Participation in farming helps maintain sufficient liquidity for trading.

Differences from steak farming and income farming

There are 3 main ways to make money in DeFi products. Liquidity farming is often compared to income farming. Both methods involve investors putting their cryptocurrency into a pool to earn rewards. However, in income farming, blockchain assets are typically used as collateral for lending and borrowing.

Staking is the foundation of PoS ( Proof-of-Stake) blockchains. Under this strategy, users lock their assets for a certain period of time to keep the network running. Stakers become validators who ensure that every transaction is secure without the involvement of a third party. In return for their work, they receive rewards in the same tokens.

5020 $

bonus dla nowych użytkowników!

ByBit zapewnia wygodne i bezpieczne warunki do handlu kryptowalutami, oferuje niskie prowizje, wysoki poziom płynności i nowoczesne narzędzia do analizy rynku. Obsługuje transakcje spot i lewarowane oraz pomaga początkującym i profesjonalnym traderom dzięki intuicyjnemu interfejsowi i samouczkom.

Zdobądź bonus 100 $

dla nowych użytkowników!

Największa giełda kryptowalut, na której można szybko i bezpiecznie rozpocząć swoją podróż w świecie kryptowalut. Platforma oferuje setki popularnych aktywów, niskie prowizje i zaawansowane narzędzia do handlu i inwestowania. Łatwa rejestracja, duża szybkość transakcji i niezawodna ochrona środków sprawiają, że Binance jest doskonałym wyborem dla traderów na każdym poziomie!

Farming and income farming are the riskiest strategies. Investors can lose money due to fraudulent platform developers, bugs in smart contracts, and volatile losses.

Comparison with a regular deposit in a bank

In pharming, a cryptocurrency market participant places his assets on a decentralized or managed exchange and receives rewards in the form of tokens. The process can be compared to opening a deposit in a bank – the user also deposits funds into the account of the organization, and in return takes a percentage of the deposit amount. Payments can be made monthly, quarterly or at the end of the term. The table shows a comparison of the two ways of earning money.

| Stan | Farming | Deposit in a bank |

|---|---|---|

| High, often exceeding 50% APR. | Low. For example, in September 2023, Sberbank offers to open a ₽100,000 deposit at 8.83% APR. | |

| Potential losses in case of platform hacking and high market volatility. | Safer as depositors’ money is protected by the government’s insurance system (SSV). However, there is a risk of inflation, which can reduce the real value of savings. | |

| Yields are constantly changing, leading to unexpected losses. | Investors are given a fixed interest rate. | |

| It is possible to withdraw money from the pool at any time. | Usually the minimum deposit period is 1 month. If early withdrawal is not stipulated in the contract, it will not be possible to take the money earlier than the set period. |

Types of products in the liquidity farming on Binance

Binance offers to place tokens on the built-in decentralized exchange Liquid Swap. There are 2 types of pools:

- Stable. Uses a hybrid automated market maker model to facilitate transactions and pricing between stablecoins. This promotes low slippage and more stable rewards.

- Innovative. Utilizes AMM with a constant average value. Cryptocurrencies or fiat assets are traded in this pool. Prices are determined by changes in the exchange rate, rewards are unstable.

The mechanism for generating returns

Users earn money by providing liquidity for other clients of the exchange. The main stages of farming:

- A market participant contributes assets to the pool. This can be cryptocurrency or fiat money.

- Coins are used by other traders in transactions on a decentralized exchange. At the same time, the investor retains ownership of the assets.

- The client of the exchange is credited with a portion of the commissions that the platform receives for token exchanges conducted. The amount depends on the share in the pool.

- The user withdraws the rewards or sends them to the platform again.

It should be noted that the profitability is constantly changing. There is also a probability of loss of funds in case of sharp changes in the price of coins.

Potential profit can be calculated with the help of a calculator on Binance.

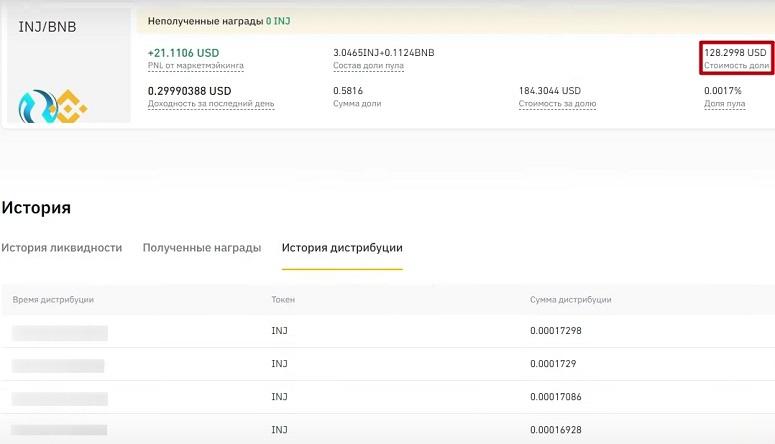

The remuneration of liquidity providers is made up of several components. On Binance, farmers have 3 sources of income:

- A portion of the trading commissions for all buying and selling of assets in the pool.

- Interest from floating rate deposits.

- Promotions that are held to incentivize participants to farm liquidity on Binance.

Calculation of share value

When a user adds liquidity, the exchange determines how much of the pool is made up of the deposited tokens. This share includes 2 digital assets. The percentage changes online and depends on the total amount invested in the pool. The indicator is displayed in the right window when depositing coins or in the “My Share” section.

You can also calculate the value of a share manually. For example, a trader has deposited 10 Tether coins and 10 USD Coin. Let the total amount deposited by other investors be 50 USDT and 50 USDC. The calculation is done using the formula: 100 × (number of user coins / total pool). In this case, the investor’s current share is: 100 × (20 / 100) = 20%. If a trader owns such a percentage, the result will be 2 USDT and 2 USDC.

To calculate the value of the cryptocurrency share, you need to multiply the number of tokens by their exchange rate beforehand and sum up the resulting values.

How to start farming

Any cryptocurrency market participant can become a liquidity provider on Binance. However, first you need to create an account and go through the verification process. This requires providing photo proof of identity documents (passport or driver’s license). When they are verified and approved, the trader will be able to fund his account and become a participant of liquidity farming on Binance.

Required skills and knowledge

Farming provides opportunities for passive income. However, this complex strategy requires an understanding of how decentralized exchanges work, awareness and caution. To be successful at farming, investors also need to:

- Understand the basics of APR (Annual Percentage Rate). The Annual Percentage Rate reflects the current profitability of a trading pair. This rate depends on the total number of participants and the amount of money they invest. Understanding the APR will help determine potential returns and risks.

- Know how to analyze tokens. This way of earning is associated with risks, so you need to research the cryptocurrency development team, the technical architecture of the project and other factors that can affect the rise or fall in the price of the coin.

- Follow the news and trends in the DeFi sphere. The decentralized finance sector is rapidly evolving. It is important to keep up with the latest news and trends in order to make informed decisions.

You also need to know what the yield and potential profit depends on. Several factors can be distinguished:

- Competition. The more traders who add coins, the lower the APR and the share of each investor will be. New pools usually offer high yields.

- Asset volatility. If a coin is characterized by sharp price jumps, it can affect the final profit.

- The magnitude of fees. Farming involves paying transaction fees. High commissions can make the investment unprofitable.

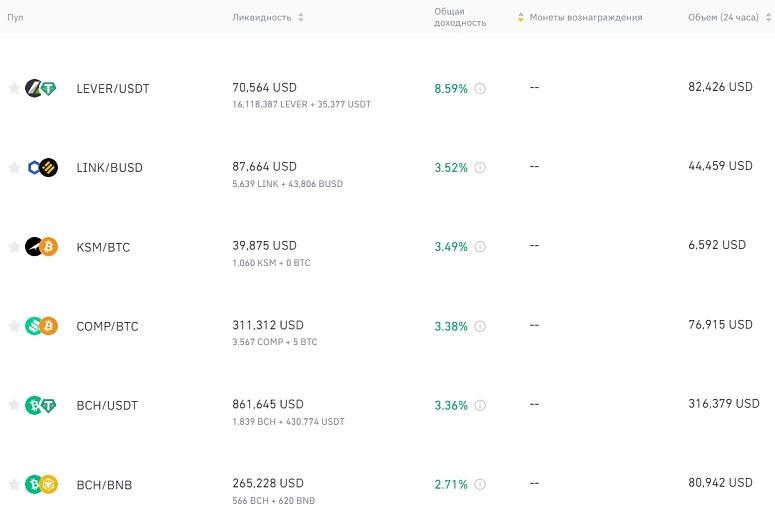

- Choice of cryptocurrency. Some coins can be more lucrative. For example, the APR on the USDT/BTC pair as of October 2023 is 0.6%, while the APR on LINK/BUSD is 3.15%.

How to add and remove liquidity

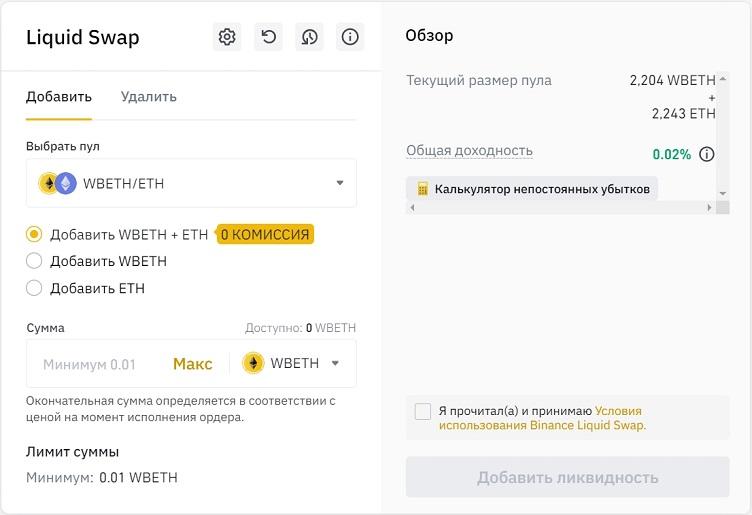

Any registered and verified user of the exchange can place tokens in the pool. Instructions on how to participate in the liquidity farming on Binance:

- Refill your exchange account.

- Open the Earn section in the top menu.

- Hover over the “Farming” tab and go to “Liquidity Farming”.

- Select a trading pair.

- Specify the tokens to be added to the pool. If 2 assets are placed, it is enough to write the amount of the first one. The system will automatically calculate how many other coins should be added.

- Enter the amount of investment. On Binance there are limits. They depend on the trading pair. For example, in USDT/BTC you can add at least 150 Tether coins, and in USDT/BNB – 10.

- Study the details of the transaction.

- Click on the “Add liquidity” button.

Information about the pool can be found in the “Overview” tab. There you can track changes in the share and yield percentage. To remove coins, you need to:

- Open the “Liquidity” tab.

- Select a trading pair from the list.

- Specify tokens. If the trader chooses one asset, the exchange will automatically convert the second one.

- Enter the amount.

- Click on “Delete”.

It should be taken into account that when withdrawing one token, users are charged a commission. It is deducted from the final amount.

To collect the awards, you need to click on the “Get” button in the upper right corner of the page in the “Overview” section. The assets will be credited to the spot wallet.

Risks of pharming liquidity on Binance

This way of making money can be very lucrative. However, like other cryptocurrency market products, pharming comes with risks. Here are 2 major potential problems that liquidity providers on Binance may face:

- Cryptocurrency price decline. The digital asset market is characterized by high volatility. The coin’s exchange rate can fall drastically within a short period of time. This will affect the final profit.

- Financial problems of the platform. Binance is one of the largest cryptocurrency exchanges. But even such a popular platform has a risk of financial problems that can lead to bankruptcy or insolvency. Among the reasons are cyberattacks, regulatory issues, and mismanagement of users’ money.

Non-permanent losses

This is another risk associated with pharming. Non-permanent losses occur due to changes in market conditions while the assets are in the pool.

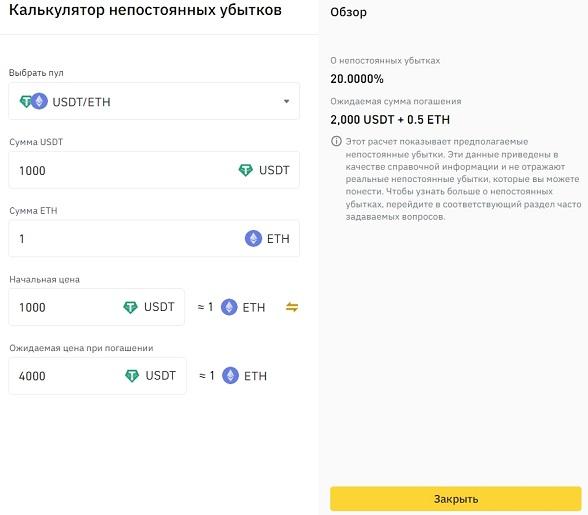

For example, a provider has chosen the USDT/ETH pair. Ethereum was worth $1000 at the time the liquidity was added. The user contributed 1 ether and 1000 digital dollars to the pool, which contains a total of 10 ETH and 10 thousand USDT. The investor’s share is 10%.

If the Ethereum exchange rate rises to $4000, arbitrage traders will start adding more USDT to the pool and removing ether until the asset ratio reflects the current value of the altcoin. In this case, the total number of coins will be 5 ETH and 20k USDT.

Since the investor owns 10%, he would receive 0.5 Ether and 2,000 Stablecoins (or $4,000). However, if he just kept these coins in his wallet, the total asset value would be $5000. The non-permanent loss in such a case is equal to 20%, or $1000. But farming can still be profitable, because usually the rewards from commissions cover the losses.

The non-permanent loss occurs even if the asset’s rate rises.

You don’t have to calculate the potential losses yourself. Binance provides a calculator that helps to establish the expected repayment amount and the percentage of non-permanent losses.

Trading fees

Binance charges fees for adding and removing one token from the pool. The amount of the commission depends on the cryptocurrency.

You also need to take into account the slippage that occurs due to depositing or withdrawing coins in large quantities. You can set the allowable spread percentage in the Liquid Swap terminal by clicking on the gear icon. If the slippage is large, the exchange system will send a warning.

Zalety i wady

Farming is a popular way to earn money in the decentralized finance sector. It has its advantages and disadvantages, which should be studied before participating in the activity. More details – in the table.

| Plusy | Minusy |

|---|---|

Często zadawane pytania

🔔 What is slippage?

It is the spread (difference) between the current token rate and its price when placing an order. Slippage can occur due to high volatility or lack of liquidity in the market.

📌 Does pharming on Binance support API?

Yes. Detailed instructions on how to connect can be found on the exchange’s website.

🔥 At what frequency are rewards accrued?

The number of earned assets is updated every hour.

⚡ How can I reduce non-permanent losses?

You can invest in pools with stablecoins. They are protected from non-permanent losses because the price of assets remains within a narrow range. But you need to keep in mind that such trading pairs offer small returns.

📣 On which DeFi platforms can I become a liquidity provider?

Such an opportunity is offered by Uniswap, PancakeSwap, Curve Finance and others.

Błąd w tekście? Podświetl go myszą i naciśnij Ctrl + Enter

Autor: Saifedean Ammousekspert w dziedzinie ekonomii kryptowalut.