In the 12 years since Bitcoin’s launch, the coin’s exchange rate has increased more than 102.3 million times (compared to its highest recorded price of $64,863 as of mid-September 2021). The first Bitcoin was worth less than 1 cent at the very beginning of its release.

In theory, users could invest a few U.S. dollars in BTC. And due to this become millionaires by 2021. Studying the reasons for the growth of the Bitcoin chart is important for the sake of interest. And also to understand the prospects for further increase in the value of the cryptocurrency should also delve into the principle of issuance. Find out how much to mine 1 bitcoin – less than 1.3 million coins remain available for mining.

How much Bitcoin cost at the very beginning in rubles

The payment system project with Bitcoin was launched in January 2009. An anonymous developer known as Satoshi Nakamoto generated the first block, receiving a reward of 50 BTC for it.

Bitcoin was initially worth $0, as the asset exchange rate is only formed when there is supply and demand. While the cryptocurrency was in the possession of one person, it had no such indicator as a price.

It is believed that the first exchange of BTC to fiat took place a few months after the launch of the blockchain. At the time of its appearance, the initial price of bitcoin in 2009 was zero. But the decentralized payment system attracted users. One of them was Marty Malmy.

5020 $

bonus dla nowych użytkowników!

ByBit zapewnia wygodne i bezpieczne warunki do handlu kryptowalutami, oferuje niskie prowizje, wysoki poziom płynności i nowoczesne narzędzia do analizy rynku. Obsługuje transakcje spot i lewarowane oraz pomaga początkującym i profesjonalnym traderom dzięki intuicyjnemu interfejsowi i samouczkom.

Zdobądź bonus 100 $

dla nowych użytkowników!

Największa giełda kryptowalut, na której można szybko i bezpiecznie rozpocząć swoją podróż w świecie kryptowalut. Platforma oferuje setki popularnych aktywów, niskie prowizje i zaawansowane narzędzia do handlu i inwestowania. Łatwa rejestracja, duża szybkość transakcji i niezawodna ochrona środków sprawiają, że Binance jest doskonałym wyborem dla traderów na każdym poziomie!

He sold 5050 BTC for $5.02. If you translate this amount into rubles at the exchange rate in effect at the time, you could buy about 330 bitcoins for 1 RUB.

The first cryptocurrency users repeatedly complained that they sold coins at a ridiculous price. In particular, Malmy himself, in response to frequent questions about why Bitcoin is so expensive and whether he is upset about the lost profits in 2021, wrote a message on his Twitter account:

“I could have been a billionaire if I hadn’t sold the bitcoins I mined on my laptop from 2009-2012. It’s unfortunate, but we set in motion something bigger than profit.”

How the first bitcoins were mined

Transactions in Bitcoin and many other blockchains are confirmed using the proof-of-work(PoW) method:

- Users send coins.

- Information about the transaction reaches other participants in the network. They use hash functions to check the data against previous records in the blockchain.

- In the process of calculations, one of the traders generates a new block and enters it into the chain. As a reward for the work done, the participant receives a certain amount of new coins.

The first bitcoins were mined in a similar way. Satoshi Nakamoto received 50 coins for generating block #1. The reward for mining is gradually decreasing as a result ofhalving (halving). As of 2021, it is only 6.25 bitcoins per block found.

The value of BTC before trading on exchanges

In 2009, there were no cryptocurrency to fiat money exchange platforms. The BTC rate from the very beginning on the market was formed by agreement between buyer and seller. In October 2009, New Liberty Standard offered to exchange the cryptocurrency at a price of 1,309 coins per 1 U.S. dollar.

The initial value of bitcoin in rubles at the start was less than 1 RUB.

In the future there was such a growth of the coin’s quotations.

| Date | Event |

|---|---|

| May 2010 | American Laszlo Hanech bought 2 pizzas, giving 10,000 bitcoins in return |

| July 12, 2010 | The coin’s exchange rate increased to $0.08 |

| November 6, 2010 | The capitalization (total price) of the project exceeds $1 million. The rate of the asset on one of the first crypto exchanges MtGox reached $0.5 |

| February 9, 2011 | The price of BTC exceeded $1 |

Ability to pay and invest in Bitcoin

The rate of an asset is influenced by its liquidity. It’s prospect for use in everyday life and as a unit of currency. At the time the first blockchain was created, most people were unaware of decentralized financial systems. Under these conditions, participants in the cryptocurrency community could only exchange coins among themselves.

Investing in Bitcoin was not profitable as long as enthusiasts and project developers were involved in transactions. In June 2010, the first draw took place, in which the prize pool consisted of BTC koins.

The initial idea was submitted by one of the participants of the official forum of the project. The prize pool amounted to 500 bitcoins. The jackpot went to a user with the nickname Vasiliev.

The possibility to pay with digital currency appeared in the second half of 2010. One of the participants of the cryptocommunity posted an ad on the forum for lawn mowing services. The cost of the work was specified in American dollars.

However, other users suggested applying the coins to everyday transactions using a prepaid bank card service. Money from them was then converted into BTC.

The official market price of the first cryptocurrency

Quotes of digital assets are formed on exchanges and exchange platforms. The trader creates an order, in which he indicates at what value he is ready to carry out the transaction. The second party confirms the existing application or sends its own. If the seller’s minimum price matches the buyer’s order, the transaction is executed.

Previously, most transactions were carried out in P2P mode. That is, the exchange directly between users. Later, there was access to buying cryptocurrencies on exchanges.

Therefore, now the market value of digital assets is determined by the stack of orders on trading platforms.

Reasons for the price increase

The bitcoin rate was influenced by such factors:

- The popularity of decentralized financial transfer technology. The lowest price for Bitcoin acted at a time when only a few people knew about cryptocurrencies. Now digital assets have many supporters. They and support the quotations of tokens. The possibility of mining blocks led to the emergence of a new way of earning money (mining). Despite the high competition, interest in this activity remains high.

- Media and bloggers. Since the first review of cryptocurrencies came out, the topic of blockchain technology is actively discussed on information resources. The growth of BTC quotes in 2017 and 2020-2021 is largely due to the constant discussion of this topic.

- The emergence of exchanges and investment platforms. The first transactions on the exchange of digital assets for fiat were conducted through forums and blogs. This was inconvenient for the parties and reduced the intensity of trading. Today, it is cheapest to buy tokens and coins on exchanges where there are conditions for active trading.

- Reliability of the system. Large investors were wary of investing in an unfamiliar technology. While the coin was worth 1 dollar, the trader was not afraid to lose such an amount. When Bitcoin capitalization exceeded $1 million, the issue of security came to the forefront. There has never been a single successful blockchain hack that would have resulted in the theft of all users’ money. In the early days of crypto, the risk of a 51% attack was often mentioned. This is a method of stealing coins. The fears have not been confirmed. Major players have tapped into the trading of digital assets.

- Legal status. In the beginning of the journey, cryptocurrencies seemed something artificial and marginal. As digital assets grew in popularity, government agencies recognized tokens and coins as a means of payment. Germany, Sweden, Russia, and other countries have legalized cryptocurrency transactions.

- Speculative interest. At the beginning of sales, the BTC rate was near one mark for a long time. Now the volatility of the asset has increased. Large traders buy cryptocurrency during the period of price correction. Then they wait for the continuation of the uptrend and sell at a favorable rate. Such speculative operations positively affect the quotations of tokens and coins.

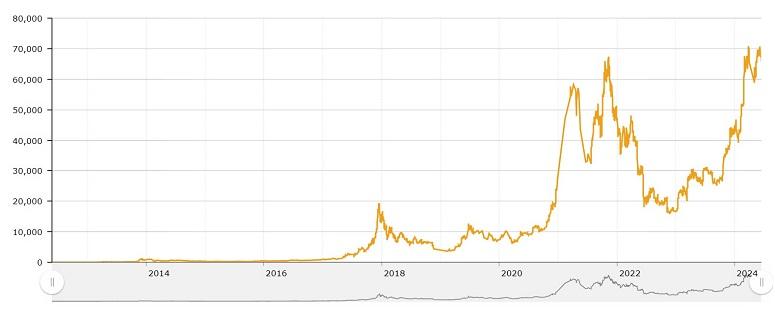

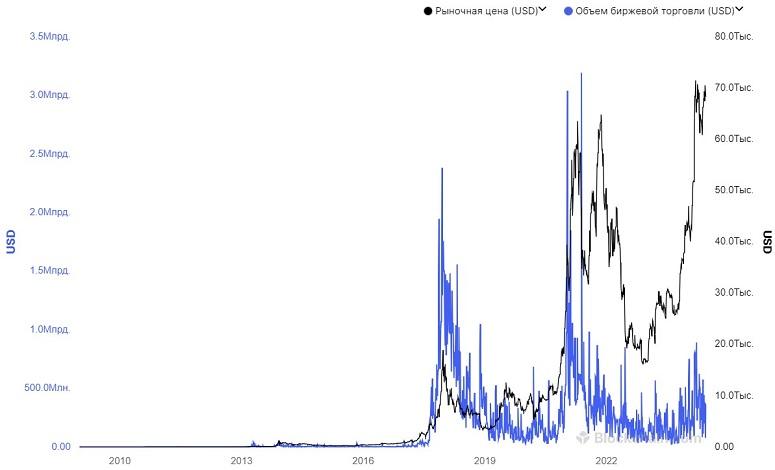

Price graph for the entire history by year

The least bitcoin cost the least at the dawn of the launch of the network. In 2009, the price of the asset did not exceed 1 cent. Over the next decade, BTC quotes predominantly grew.

Predictions on the value of Bitcoin in the future

The outlook for the main cryptocurrency depends on several factors. Analysts predict 3 scenarios for the dynamics of the BTC rate:

- Decrease in quotations to the levels of 2018 or even 2014. Opponents of cryptocurrencies consider bitcoin a bubble that is bound to burst. There is a small chance that the asset will depreciate in value altogether. Since only fiat money will be used in everyday transactions.

- Preservation of the current quotes. The exchange rate can be in the range of $10,000-$50,000 for several years. Cheap bitcoin is disadvantageous to coin holders. At the same time, new traders will not buy BTC because of the lack of perspective.

- Updating record levels. Cryptocurrency has no limit for growth. Therefore, the price of Bitcoin may reach $100,000 and even $1 million in the coming years.

Podsumowanie

Bitcoin had no value at the time of the blockchain launch. Quotes of the coin appeared only after the first exchange transactions were carried out. In October 2009, the BTC rate did not exceed a tenth of a cent.

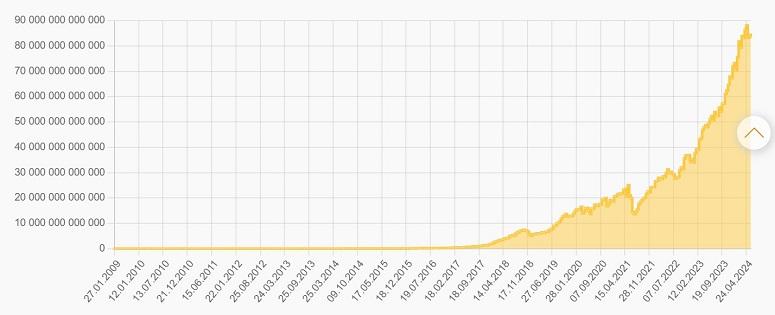

The popularity of blockchain technology, the interest of large investors and media hype had a positive impact on the quotes. In 2021, the capitalization of the project exceeded $1 trillion.

Analysts are not sure whether this dynamics will continue. On the one hand, the BTC rate can continue to grow actively. At the same time, there are warnings from skeptics about the inflated price of cryptocurrencies and the inevitable collapse.

Często zadawane pytania

🤔 Can bitcoin fall to 2009 levels?

Quotes of any asset depend on supply and demand in the market. In theory, it is possible that tokens and coins will cease to be of interest to buyers and fall in price to zero.

But 2009 and 2021 are different in that there are now many more users aware of crypto-assets. The idea has found support from advocates of decentralized finance and is unlikely to be completely forgotten.

❓ Where is the best place to watch cryptocurrency quotes?

The exchange rate of tokens and coins differs on different platforms. If a trader needs accurate data, it is recommended to watch quotes on the website of the exchange on which the user conducts transactions.

❕ Why is mining in 2021 less profitable than 10 years ago?

This is influenced by 2 factors: a decrease in the reward for a mined block and an increase in competition. In 2009, miners used to get 50 BTC. Today, the profit is only 6.25 bitcoins. In addition, the complexity of mining blocks has increased. Many large farms and pools are involved in the process.

❌ Can there be a new cryptocurrency that will repeat the success of Bitcoin?

Interesting projects emerge regularly. In 2021, Mina and Solana were such promising starts. But now it is difficult to talk about the emergence of a real competitor for the Bitcoin network.

😱 What other curiosities have been associated with the low initial price of cryptocurrency?

In July 2010, a user under the nickname Xunie posted an ad asking people to order a game for him. The subscription cost $10. In return, he offered 1250 BTC. Forum members refused to help on such terms, stating that they were ready to buy the game for no less than 1600 bitcoins. Today, the person who fulfilled the request would be a millionaire with a capital of about $6.25 million.

Czy w tekście jest błąd? Podświetl go myszą i naciśnij Ctrl + Enter.

Autor: Saifedean Ammousekspert w dziedzinie ekonomii kryptowalut.