In the world of digital money, there is rarely a central authority that is involved in the constant issuance of coins, such as the Bank of Russia when issuing rubles. This only applies when a cryptocurrency company issues altcoins in a set amount on a one-off basis. But there are also many projects where the issuance in the blockchain network is done bynodes (nodes). They are rewarded for generating blocks or other activities. The new coins earned by the nodes become part of the cryptocurrency market. This is the issuance. The Proof-of-Work (PoW) consensus algorithm underlies the issuance of digital assets and secures the network. Nodes in cryptocurrency systems with PoW are called miners.

Proof-of-Work algorithm in blockchain

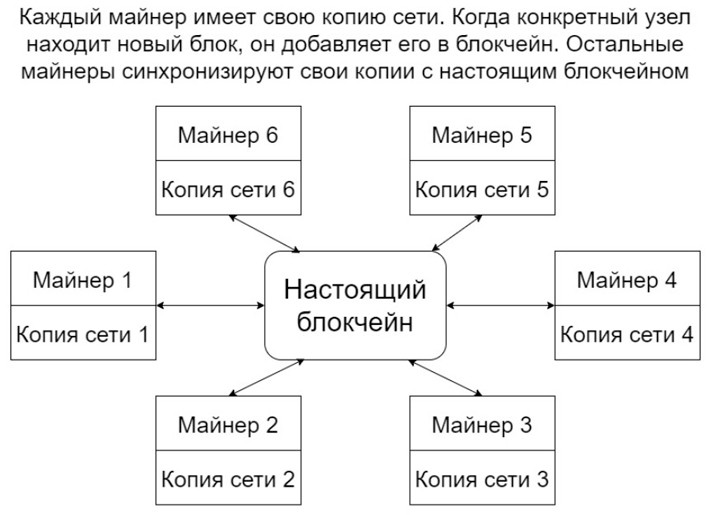

Consensus – agreement on a common issue by all participants in the network. The main work in blockchain is the generation of blocks. It is during their creation that consensus among the miners is required. This is needed to synchronize copies of the chains with the real network to avoid discrepancies.

A consensus algorithm is a scheme or a way to achieve unanimity. In blockchain, it defines the mathematical rules and functions by which the miners will come to a common decision. In 2021, there are 4 major consensus algorithms:

- Proof-of-Work (proof-of-work ).

- Proof-of-Stake (proof-of-ownership).

- Proof-of-Importance (proof of importance).

- Proof-of-Activity (proof of activity – a symbiosis of PoW and PoS).

Specifically Proof-of-Work allows to avoid collisions and errors in the cryptocurrency system (lack of or unfair reward for górnictwo, unsynchronization of copies of the digital network and so on). Under PoW rules, all mining nodes share a single view of the distributed ledger (blockchain).

The complex cryptographic calculations that miners perform with their computer power are also needed to prove that it is this or that node that confirmed a certain digital transaction or added a new block. The other nodes, thanks to the Proof-of-Work algorithm, receive and verify the information, and if the decision is correct, they synchronize their copies of the network.

5020 $

bonus dla nowych użytkowników!

ByBit zapewnia wygodne i bezpieczne warunki do handlu kryptowalutami, oferuje niskie prowizje, wysoki poziom płynności i nowoczesne narzędzia do analizy rynku. Obsługuje transakcje spot i lewarowane oraz pomaga początkującym i profesjonalnym traderom dzięki intuicyjnemu interfejsowi i samouczkom.

Zdobądź bonus 100 $

dla nowych użytkowników!

Największa giełda kryptowalut, na której można szybko i bezpiecznie rozpocząć swoją podróż w świecie kryptowalut. Platforma oferuje setki popularnych aktywów, niskie prowizje i zaawansowane narzędzia do handlu i inwestowania. Łatwa rejestracja, duża szybkość transakcji i niezawodna ochrona środków sprawiają, że Binance jest doskonałym wyborem dla traderów na każdym poziomie!

Differences from PoS

Proof-of-Stake, unlike Proof-of-Work, does not require large computing power. Mining specific coins by PoS involves using the cryptocurrency itself in the mining process. The amount of assets frozen by a node on its account affects its chances of verifying (confirming) the transaction and finding the block in the network. If a node has 1% of emitted coins on its wallet, then on average this is the number of new chain links it will be able to create.

The main differences between PoW and PoS are presented below:

| Dowód pracy | Proof-of-Stake |

|---|---|

| PoW miners solve cryptographic problems to calculate the hash of a new block based on the previous block. Whoever comes up with the correct answer generates the chain link. | By Proof-of-Stake, blocks are more often created by the oldest nodes or nodes that have the highest balance on the wallet. Also, cryptocurrency assets of miners are frozen until an agreement is reached. This happens automatically. |

| Blockchains with the PoW algorithm have a technical vulnerability. Miners with a hashrate (the amount of computing power) greater than 50% of the total number in the network can completely control the system. Such a hack is called a “51% attack” in the cryptocurrency user community. | PoS also has this vulnerability. However, due to the peculiarities of the consensus algorithm, the “51% attack” becomes disadvantageous for attackers. The hacker must have more than 50% of the issued coins in the system, and this will inevitably provoke a rise in the rate of cryptocurrency. |

| Under PoW, miners are rewarded for the generation of new blocks and a part of the commission that users pay for the transaction. | Mining nodes in systems with PoS earn cryptocurrency for each confirmed trade operation in the network. |

Hashing algorithms with PoW

Digital currencies utilize cryptographic encryption mechanisms. There are a lot of such hashing algorithms in 2021. Some of them are used in blockchains with PoW.

SHA-256 is part of the SHA-2 family, which has proven to be the most secure and fastest, compared to its predecessor SHA-1. This algorithm was first used in cryptocurrency by Satoshi Nakamoto in the bitcoin coin. SHA-256 easily solved the problem of Bitcoin, because it was necessary to create a balance between high security and speed of the system. This encryption mechanism creates a unique 256-bit fixed-size hash function for each new block from the input information. It takes the average computer millions of years to crack it.

Scrypt is a hashing method that was first used in digital coins by developer Litecoin in 2011. The main difference from SHA-256 is that it reduces the productivity of ASIC hardware (specialized computer hardware sharpened to perform a single task) for Proof-of-Work mining by introducing random characters into the cipher. However, Scrypt has reduced the amount of computation required for GPUs (video cards) and CPUs (processors). Because of this, it is unprofitable to use other hardware.

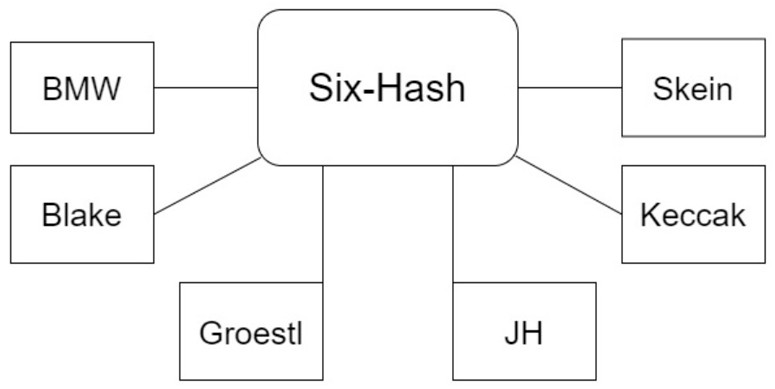

Six-Hash was created to additionally counter cryptocurrencies to asics and was first used in the Sifcoin coin. The algorithm is a sequential chain of different hashing mechanisms. It forced miners to buy 6 kinds of ASIC equipment or use other techniques. Mining with asics became unprofitable, so Six-Hash “facilitated” the task of nodes with video cards. The encryption algorithm also improved the security of the blockchain quite a bit.

X11 is based on the idea of Six-Hash. The mechanism included 11 different hashing algorithms. It was first used by the developer of Darkcoin (in 2021, the coin is called DASH). At first, X11 allowed nodes to efficiently utilize the computer’s CPU for mining. However, as the complexity of mining coins increased, nodes switched to GPUs. For Proof-of-Work mining with X11 hashing, video cards were 5 times more efficient than CPUs.

Required equipment for mining with PoW

To mine cryptocurrency, you need computer equipment. The value of its processing power is proportional to the profit for mining. However, you need to take into account other technical points:

- The amount of electricity required (in kWh).

- The cost of 1 kWh.

Taking into account the cost of electricity, you can calculate the income from mining. For this purpose, it is better to use ready-made profit calculators like BitInfoCharts or CryptoCalc. They take into account the efficiency of the equipment and take the necessary data from the blockchain network.

Mining on video cards is a common mining method in 2021. More than half of cryptocurrencies with PoW support this method. GPUs prove to be efficient in Proof-of-Work with almost all hashing mechanisms. However, for example, it is not profitable to use graphics cards for SHA-256.

ASICs are efficient mining hardware. Encryption mechanisms like Scrypt, X11 are designed to increase the resistance of this computing machinery. But by 2021, ASICs for mining coins using these algorithms have still been created. However, the bulk of ASICs are programmed to work with SHA-256 and Ethash (Ethereum).

In 2021, mining coins on the computer processor lost relevance. This method was actively used by miners at the dawn of the development of cryptocurrency. Even a bitcoin developer mined BTC using the CPU of his computer up to block #36,288. But in 2021, there are few cryptocurrencies left that can be effectively mined with a CPU. However, the well-known digital coin Monero (XMR) is among them.

Top 5 pools for Proof-of-Work mining

In 2021, it is possible to mine cryptocurrency in cooperation with other nodes. Such mining is more popular than single mining. In pools, the reward is fairly divided between nodes depending on the amount of computing power supplied. In such mining, it does not matter who generates a block in the cryptocurrency network. If a participant invested 3% hashrate of the total in the pool, he will receive 3% of the reward for creating a link of the blockchain.

Co-mining is possible thanks to special cryptocurrency services. They collect the computing power of participants and exploit it to mine digital coins in the blockchain.

PoW mining pools use different reward payment systems. Once the blockchain is obtained, the cryptocurrency is divided among the participants according to their rules. In 2021, there are 2 popular systems:

- PPS. Under this scheme, the pool participant receives remuneration regardless of the result: he invested computing power – so he has the right to a part of the received cryptocurrency. The PPS system is considered fair to miners. However, with it pools have to create a reserve to pay rewards to participants and may incur losses. This happens, for example, due to long periods between blocks. To mitigate the damage, pools with PPS raise the commission to 7% and take the transaction fee to themselves.

- PPLNS. For this system, the speed of block generation or round time is important. Under PPLNS, the pool pays the participant a reward for a fixed number of time periods. If miners take a long time to create a new block, the number of coins they receive increases. When the network links are generated one after another, the reward decreases. The PPLNS system is beneficial for pools and miners who work through one platform for a long time.

When choosing a service, it is important to consider its reputation. You can check its reputation by looking at the reviews of miners on the Internet. At least a good pool should not delay the payment of rewards.

Binance Mining Pool

The pool was launched by the Binance exchange in 2020. The platform allows for PoW and PoS mining. The pool supports SHA-256 and Ethash mechanisms with commissions of 2.5% and 0.5% respectively. The main coins for mining are BTC, BCH, BSV, ETH. Thanks to the Smart Pool tool, the user’s hashrate is automatically redirected between them to the most profitable digital currency.

The Binance platform positions its pool as a good solution for beginners and experienced miners, because it uses FPPS, PPS+ and PPS systems. However, the platform warns users that mining requires powerful equipment.

EMCD

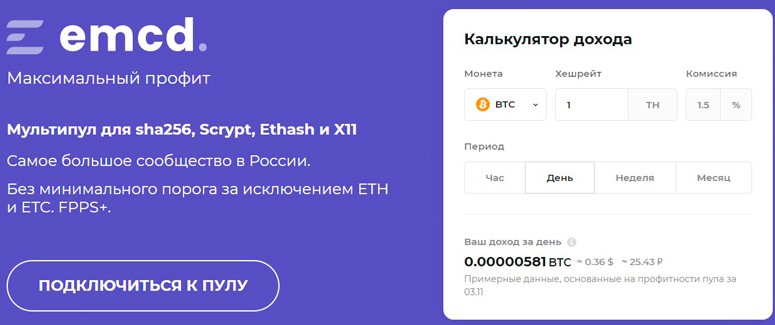

The platform was founded in 2018. It is one of the main pools for Russian miners. New users are attracted by the large number of features of the platform. EMCD Tech has developed for customers:

- Own revenue calculator.

- An algorithm for switching between coins to increase profits.

Also, EMCD uses the AsicBoost method that speeds up Bitcoin mining by 20% to increase revenue.

The platform is a multipool. It supports the mining of coins with hashing mechanisms SHA-256, Scrypt, Ethash, X11. When working, a commission of 1.5% of the reward is charged.

EMCD correctly transfers the payment to miners. Rewards to digital nodes for working with cryptocurrencies come daily from 16:00 to 17:00 MSC. If there are any questions, the user can contact tech support. It works 24/7.

Miningrigrentals

Cloud mining is a technology of mining cryptocurrency with the help of rented computer equipment. The method is suitable for users of digital assets who do not have personal equipment. For example, Miningrigrentals has 13 mining centers in 2021. A mining node can rent a share of the company’s equipment in them.

This cloud mining pool was established in 2014. Little information can be found about Miningrigrentals. The company does not disclose the location of the main office and the founder of the pool. However, miners speak positively about working at Miningrigrentals.

The main difference of the pool is the ability of users to rent equipment for cryptocurrency mining for a period from 2 hours to 2 months. Also here you can rent your computing power to other miners.

The payment of remuneration is made in Bitcoin and Litecoin coins. However, Miningrigrentals offers to mine different cryptocurrency with hashing by:

- SHA-256.

- NeoScrypt.

- Quark.

- X11.

- X13 and many others (around 100).

Because of this, pool users have access to mining hundreds of digital assets. The platform charges a separate commission for mining different coins.

Minergate

Users of the platform created in 2014 consider it one of the largest and most reliable. The pool was the first to provide nodes with the possibility of full-fledged combined mining. The new system realized the possibility of simultaneous work of individual nodes in several Proof-of-Work blockchains.

In 2021, Minergate is a pool with the technology of mining through the cloud. However, its participants can use the method of traditional mining through special software from the company. It is possible to mine 7 popular coins:

To mine classic Bitcoin, a Minergate client needs to buy a cloud mining contract. You can do this on the official website of the platform.

Zpool

The platform was created in 2015. For all the time of Zpool cryptocurrency company has scored an average rating of 2.9/5. This is conditioned by the presence of 3 minuses:

- Sometimes delayed payment to miners.

- Profit withdrawal is available only in Bitcoin coins.

- The official website hangs from time to time.

The mining pool does not require the user to register. Also in 2021, Zpool offers mining of 191 digital coins using 83 different hash algorithms. The commission for mining varies between 1-1.75%. Some coins support the new FlexFee system – the higher the processing power of the user’s hardware, the lower the platform fee.

Problems and prospects for use

Every consensus algorithm is not perfect. However, in addition to disadvantages of use, they have advantages over each other:

| Problems | Perspectives |

|---|---|

| “Proof-of-work” requires a large amount of electricity from the miner. The algorithm is inefficient. | PoW does not allow miners to utilize the Nothing-at-Stake problem that the PoS mechanism has. It involves using “non-existent” resources to create an alternative blockchain. |

| Large cryptocurrency companies make more profit with PoW mechanism, compared to single miners, because the former can buy more efficient asics or other equipment. | Proof-of-Work protects the network well, because each node needs to confirm the fidelity of cryptographic calculations. |

| The Bitcoin blockchain is less decentralized than the developer intended. In 2021, more than 50% of the hashrate is in the hands of 5 large pools and cryptocurrency companies. By pooling together, they could carry out a “51% attack”. | The presence of cryptocurrency on the balance does not affect the result of mining. PoW requires only high power of computer equipment. In turn, this additionally protects the blockchain from DoS attacks. |

Często zadawane pytania

✔ Which cryptocurrency first introduced PoW?

The Proof-of-Work mechanism was used by the creator of Bitcoin, the first ever cryptocurrency.

🚹 Who suggested the use of Proof-of-Work?

PoW was recommended for digital currencies by developer Hal Finney. In 2009, the enthusiast became a key person in testing the Bitcoin payment system, as Satoshi Nakamoto conducted the first 10 BTC cryptocurrency transaction with it.

❓ Why did coins become ASIC-resistant?

The main reason is the developers’ fear that users will centralize their project. In the initial stages of development, blockchains of different crypto coins have a low hash rate, and ASIC hardware has very high computing power, so it is easier to conduct a “51% attack”.

❌ SHA-256 is an outdated encryption mechanism?

Unequivocally this algorithm is no longer new. However, even in 2021, a lot of cryptocurrency developers use SHA-256 for their blockchains.

❕ Which mining pool should a beginner choose?

It is better to start with platforms that pay remuneration according to the PPS scheme. It is recommended to consider pools with low commissions and a large selection of cryptocurrencies.

Błąd w tekście? Podświetl go myszą i naciśnij Ctrl + Enter

Autor: Saifedean Ammousekspert w dziedzinie ekonomii kryptowalut.