Digital decentralized assets that use blockchain technology appeared in 2008. During their existence, they have transformed from an obscure, unsecured piece of program code into a powerful financial instrument. Other coins are constantly appearing, and the principles of investing money are changing. For example, the new most promising cryptocurrencies for investing for the long term in 2024 according to experts are significantly different from those that were relevant 2-3 years ago. This list is constantly updated with the release of projects.

The most promising cryptocurrencies for 2024

Distinctive features of the digital finance market are strong volatility and unpredictability. Most cryptocurrencies (with the exception of stablecoins) are characterized by high volatility. When you consider the fact that there are more than 12,000 different altcoins listed on exchanges at the beginning of December 2021, the question of where exactly to invest money can be challenging.

There are many sites that provide users with information about exchange rates of digital assets, the emergence of new coins, analytical calculations and forecasts from leading experts in the field. Often such resources publish token ratings based on market capitalization volumes or exchange rate fluctuations. This information is very useful to assess the prospects of cryptocurrencies.

Rating criteria

Before adding a virtual currency to your investment portfolio or choosing a digital asset for trading operations on the exchange, it is worth paying attention to the following parameters:

- Capitalization volume. The parameter shows the total value of all coins in circulation. The higher this indicator, the more stable the cryptocurrency and less chance of a sharp drop in its price. Analysts recommend investing in virtual assets, focusing on their place in the capitalization rating. For long-term investments, it is safer to take coins that occupy the first 30 positions.

- The organizers of the project and the development team. Often the documents describing the new platform include people who previously worked in well-known companies related to the Internet, finance or programming. This can positively influence the development of the project, not only guaranteeing the release of a quality product, but also increasing the degree of trust in it from the community. For example, Efforce (WOZX). One of the organizers of the project was designated electronics engineer and programmer Steve Wozniak (Steve Wozniak), who is a co-founder of Apple. For 2 days since the release (December 8, 2020) of the token, its price doubled. Experts believe that Steve’s merit is to be credited for this.

- The number of exchanges where the coin is listed and the volume of daily trading. Here you can trace a direct correlation. The more places where the selected cryptocurrency is traded, and with a high turnover during one session, the better. This indicates the availability of the token and its liquidity.

- The price of the digital asset at the current moment in time. This parameter is not so unambiguous. A cryptocurrency with a high rate may have limited potential for further growth. In addition, Short trades (with a forecast for a fall) will require a large investment of fiat money, otherwise the profit will be insignificant. Therefore, expensive coins (BTC, ETH, BTH, XMR) are more often chosen for long-term investment.

- Information environment. If a startup receives a lot of attention in the media, and information portals constantly publish reviews and interviews with developers and experts, this will be a good sign. Interesting and promising projects attract a lot of attention.

- The scope of cryptocurrency, its usefulness and function. An illustrative example would be the BNB coin. This is an internal service token of the Binance crypto exchange. It was originally created to pay for commissions and transactions within the centralized trading platform. When Binance first appeared on the cryptocurrency market, the price of the coin was low. But as the popularity of the platform gained, the price of the koin went up as well. For the fall of 2021, BNB can be considered as an independent tool for investment and trading. It is also worth considering that if the asset (for working on the exchange) does not solve certain technical problems of the blockchain, and the very idea for which it was created is not new, then with a high probability such a cryptocurrency has no future.

Of course, this is not a complete list of criteria for ranking the most promising projects. There is also a technical component, network performance, as well as regulatory and legal regulation. For example, the prospects for the development of cryptocurrencies in Russia will be greatly influenced by the law № 259-F3, which came into force in 2021.

5020 $

bonus dla nowych użytkowników!

ByBit zapewnia wygodne i bezpieczne warunki do handlu kryptowalutami, oferuje niskie prowizje, wysoki poziom płynności i nowoczesne narzędzia do analizy rynku. Obsługuje transakcje spot i lewarowane oraz pomaga początkującym i profesjonalnym traderom dzięki intuicyjnemu interfejsowi i samouczkom.

Zdobądź bonus 100 $

dla nowych użytkowników!

Największa giełda kryptowalut, na której można szybko i bezpiecznie rozpocząć swoją podróż w świecie kryptowalut. Platforma oferuje setki popularnych aktywów, niskie prowizje i zaawansowane narzędzia do handlu i inwestowania. Łatwa rejestracja, duża szybkość transakcji i niezawodna ochrona środków sprawiają, że Binance jest doskonałym wyborem dla traderów na każdym poziomie!

Cheap

Altcoins, whose value does not exceed $5, are of interest as a tool for investment and trading on the exchange. By analogy with shares, these coins are also called penny tokens.

The advantage of such assets is that some of them have a great growth potential and under certain conditions can bring the investor a profit that is many times higher than the investment.

Siacoin (SC)

The internal currency of the platform of the same name, which was developed for secure and confidential placement of data in cloud storage. The project started in 2013, since then it has been constantly developing. SC token shows a slow but stable growth in value. Examining the graphs of price changes, you can distinguish 2 periods when the rate rose sharply and then declined at the correction stage (January 2018 and April 2021). However, analysts attribute these jumps not to the instability of the coin, but to the general growth of the cryptocurrency market. Therefore, Siacoin can be considered as a reliable asset for investment. In 2 years, the price of the coin has increased 10 times – from $0.0016 to $0.016 (as of October 3, 2021).

Cardano (ADA)

Despite the low value of the coin, it is a very promising cryptocurrency. After the release of the koin (fall 2017), its capitalization reached a volume of $500 million in just 1 week. After 2 years, the analytical website Sentiment recognized Cordano’s project as the fastest growing. After another 2 years, on October 2, 2021, ADA coin at a price of $2.29 took the 3rd place in the ranking by capitalization size. Organizers call this digital asset a next-generation cryptocurrency.

Verge (XVG)

A coin, the main priorities of which developers call anonymity, speed of transactions and ease of use. The project was launched in 2014 and was called DogeCoinDark. But 2 years later, the organizers rebranded it (so that the coin was not associated with DOGE) and XVG appeared. The altcoin blockchain was based on the code of the Bitcoin distributed ledger, in which the following technologies were integrated: Wraith Protocol, SPV (atomic swaps), i2P and TOR encryption scheme. The confidentiality of asset transfers is only a means to the main goal of making the use of cryptocurrency a common public thing. To make blockchain technology freely used not only by programmers and stock traders, but also by ordinary people in everyday life. Over the past year (as of October 2, 2021), the value of the coin has increased 5 times from $0.004 to $0.02.

Tron (TRX)

Positions itself as an environment where content creators can communicate directly with their audience. By eliminating centralized platforms, whether streaming services, app stores, or music sites, the cost of content to users will be lower because it won’t include middleman commissions. Considering that the entertainment sphere (online games, movies, music, fine arts, social networks) is rapidly digitizing, the project ideas are finding more and more followers and active customers. As the popularity of the altcoin grows, so does its prospects as a financial asset. Therefore, analysts now see TRX not only as a means of payment for author’s content, but also as a tool for investment. In the rating of Coinmarketcap website, the coin occupies the 30th position, and its price has increased 4 times over the past year – from $0.046 to $0.094 (as of October 4, 2021).

Lumens (XLM).

The native coin of the Stellar platform. The project’s interests lie in the financial sphere. It unites payment systems, banks and private users. The main function of the altcoin is the rapid transfer of monetary assets of different types with simultaneous conversion and minimal commission (a kind of universal exchanger). Also on the Stellar blockchain, new tokens can be issued for initial coin offerings. At the beginning of October 2021, XLM ranks 25th in terms of capitalization, and its price has changed from $0.07 to $0.31 over the past year.

New

If you look at the statistics of the resource Coinmarketcap in the “Recently added” section, you can notice that the site’s rating is replenished daily with 5-15 altcoins. Not all of them will become a significant tool in the market of digital assets, most projects fail. But if you identify a promising coin and invest in it at the start, it is realistic to get a good profit.

It is difficult to choose among new projects, and the result often depends on luck. Therefore, such investments are a risky venture. Still, below are some pretty interesting young startups that came out in 2021.

Mina Protocol (MINA)

A young cryptocurrency gaining popularity and potential in 2024. Positioned as the coin with the lightest distributed ledger thanks to its fixed blockchain technology. The size of its blockchain is 22KB.

Flow (FLOW).

An internal coin of the platform of the same name, whose specialization is among the interests of creators of decentralized applications or games. Flow users will be able to quickly exchange virtual and fiat currencies between each other, which is convenient for crypto traders.

Chia (XCH)

The native coin of the Chia Network project, which develops a decentralized network for storing data. This determines the difference in the mining of this coin. To mine XCH, not the computing power of computers, but the free space of HDD and SSD disk drives are used.

SFP

A new cheap cryptocurrency with growth prospects, a service token of the popular hardware wallet SafePal. This coin is allowed to pay commissions for transactions and trading on the platform. Also, token holders can receive rewards for coin staking and are entitled to participate in voting on the development of the project.

Best for buying

Investing money in digital assets can be done without much risk. There are several coins that have already confirmed their solvency and resistance to market fluctuations. The profit from such investments will be less, but the risk of losing savings is also minimal.

The top positions of the list of reliable assets are occupied by bitcoin and etherium. Further opinions differ, but many analysts recommend the list of coins described further.

Bitcoin (BTC)

With this coin, the history of cryptocurrency began. Skeptics believe that the Bitcoin blockchain does not meet modern requirements in terms of security, capabilities (you can not create full-fledged inteligentne kontrakty) and scaling of the network. Despite this, the first digital asset is the most trusted, accounting for the bulk of money turnover in the crypto market – 40.78%.

Ethereum (ETH)

Takes the 2nd place in terms of capitalization. The main advantage is the technology of smart contracts (it was first realized on the Etherium platform). It is needed for DApps developers and can be used in a variety of areas (creation of new tokens, games, opening decentralized services).

Litecoin (LTC)

The token is based on the Bitcoin blockchain code, in which the developers made several changes. As a result, the speed of transaction processing has increased, the process of mining has been simplified, and new blocks are generated every 2.5 minutes (4 times faster than in the Bitcoin network). As of December 2021, LTC is ranked 24th in the CryptoProGuide.com rankings.

Cardano (ADA)

This coin was immediately developed as an official means of payment. The project has a very strong team of engineers, programmers and financial experts. In August 2021, Cardano was allowed to list ADA on Japanese crypto exchanges, which are characterized by very strict rules. This is an important fact that shows a degree of trust. It also gives the belief that this cryptocurrency will grow in the near future.

Tron (TRX).

An emerging blockchain project that allows you to exchange, buy or sell copyrighted content without the services of intermediaries. The developers’ ideas have found application in the gaming industry, DeFi (decentralized financing), social services and DApps. The online entertainment sphere is booming and is valued at $1 trillion. This shows well that TRX, a growing cryptocurrency, has a long-term vision for 2024.

DeFi tokens

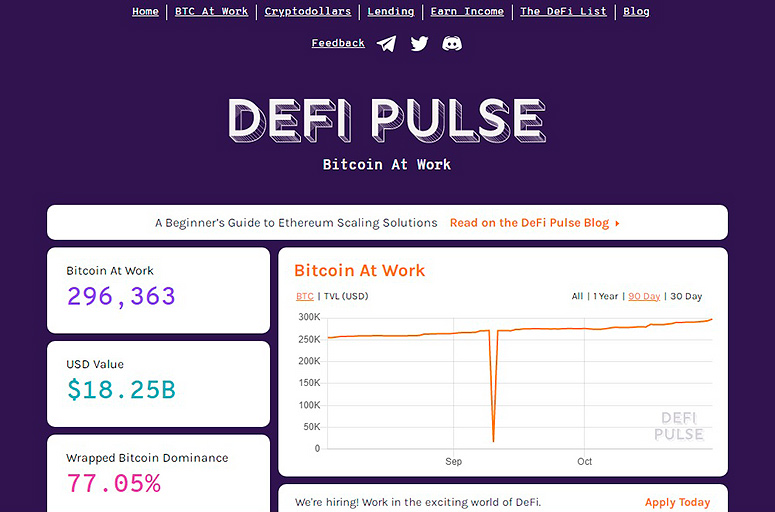

Decentralized finance is a concept that brings together blockchain projects that perform functions similar to banking services. The popularity of this direction of the cryptoindustry is growing avalanche-like.

If in May 2020 DeFi platforms operated with amounts of about $950 million, a year later it was $87 billion (data from the Defipulse website). The systems offer their clients lending, staking, derivatives, risk insurance and payment services. The advantage is the absence of intermediaries in the form of banks or brokers. Smart contracts fulfill their role.

If we consider the volume of market capitalization as a criterion for the prospects and reliability of DeFi-tokens, their rating will look like this (top 7 positions according to the site Coinmarketcap as of December 2021).

Terra (LUNA).

The platform is designed to integrate digital assets into the global financial system. For this purpose, it developed a protocol for issuing and storing stablecoins, in which the role of LUNA’s internal coin is to maintain exchange rate stability by changing (issuing or burning) the volume of money supply.

Uniswap (UNI).

This is an internal token of the DEX platform of the same name. The project is designed to exchange ERC-20 altcoins without the participation of classic crypto exchanges. There is no need to register and confirm your identity. Ethereum wallet (for example, MetaMask) is enough for the transaction.

Avalanche (AVAX)

This project implements a new consensus protocol, which is designed to run DeFi applications. The speed of transactions is 4500 Th/s. At the same time, the platform supports the full scope of financial instruments used in the Ethereum ecosystem, of which it is a direct competitor. In December 2021, AVAX is on the 9th line of the ranking by capitalization.

Chainlink (LINK).

A relatively young project (the launch of the network was in the summer of 2017), which immediately attracted attention. Smart contracts cannot communicate directly with data from the outside world, for this they need intermediaries (oracles). The Chainlink platform represents a whole network of such independent sources. It has no competitors in this niche as of December 2021. The native LINK coin occupies the 22nd position in the list by capitalization.

Wrapped Bitcoin (WBTC).

A very interesting project. WBTC is a token developed on the basis of Ethereum distributed ledger (ERC-20 format). At the same time, its rate is linked to the price of bitcoin. This allows to take advantage of the liquidity of the main cryptocurrency and the possibilities of smart contracts implemented in the Etherium system. At the end of 2021, WBTC is ranked 89th in the CryptoProGuide.com ranking.

Fantom (FTM).

The first digital currency to utilize DAG (directed acyclic graph) technology. It is a new approach to solving the scalability of the system. The speed of transfers is ensured by simultaneous processing and confirmation of several transactions (in theory tens of thousands).

Dai (DAI)

A fixed-rate token (stablecoin) pegged to the US dollar. Developed on the Etherium blockchain. The platform itself is managed by a decentralized autonomous organization (MakerDAO). It is a transparent mechanism controlled by the Maker Protocol through smart contracts. Any changes to the DAI code can only be decided by a general vote of the permanent members of the system.

NFT-tokens

Non-fungible coins are a relatively new phenomenon in the world of virtual currencies. Closely related to it is the concept of tokenization. Simply put, NFTs are unique indivisible digital assets that confirm ownership of a certain object of the real or virtual world. Such coins were first created in 2017, when Larva Labs released a series of CryptoPunks collectible cards. Each token corresponded to a certificate of ownership for a single image. At the time of release, they were priced between $0.5 and $5. 4 years later, some of them were sold for tens and hundreds of thousands of dollars.

Collecting isn’t the only use of non-interchangeable tokens. They are also used in the following areas:

- Finance – futures, options, insurance

- Online gaming

- Media production – music videos, music, videos

- Medicine

- Patent law

- Real estate.

Theoretically, any object, digital product or rights to own anything can be tokenized. This opens up very great prospects for the development of the NFT-direction.

In the spring of 2021, queries about NFT in search engines overtook words like cryptocurrency, DeFi and blockchain.

How to choose the best cryptocurrency and token

The virtual currency market is represented by thousands of coins. Many have great potential and will show good value growth in the near future, which will bring their holders tangible profits. The prospect of cryptocurrencies in the near future is ambiguous for different coins. Therefore, the main issue for investing in virtual money is choosing the right token. There are many criteria, having studied which you can assemble a profitable investment portfolio with a small risk of incurring losses. Selecting cryptoassets for investing money, it is worth checking such factors:

- Investor interest. If large companies or venture capital funds invest in a particular digital asset, it is worth paying attention to it.

- A realistic and understandable roadmap. If the creators of the token plan the development of their project for several years ahead, then there is a chance that it will not be abandoned immediately after fundraising (ICO, IDO) and the cryptocurrency will grow in value.

- Capitalization and high volume of transactions on exchanges. The higher these indicators are, the more reliable the coin is.

- Positive information background in the media and on thematic forums. Community activity in social networks – shows people’s interest in this blockchain project.

- Coin issuance. From the number of issued tokens depends on how much this cryptocurrency will be subject to inflation. This is especially important for long-term investments.

Experts’ opinion and the prospects of cryptocurrencies

Adrian Zdunczyk is an analyst of the crypto market in the global community. He is known under the nickname CryptoBirb, and he gained his popularity for his very accurate forecasts of bitcoin rate changes and analysis of its price highs.He is also the founder of the BirbNest trading platform.

According to Zdunczyk, many altcoins are severely undervalued. There are at least 5 blockchain projects that can bring profits that are 1 or 2 orders of magnitude higher than the invested funds. His TOP of promising future cryptocurrencies for 2024 looks like this:

- Ferrum Network (FRM)

- Linear (LINA)

- Radix (XRD)

- Starterra (STT)

- Synapse network (SNP).

In early December 2021, these coins have a low capitalization and are cheap, but Adrian predicts a new altcoin season is coming when there could be a sharp rise in the price of these tokens.

Matthew Siegel is the head of digital asset analysis at investment firm VanEck. His predictions also apply to altcoins. He points out that when bitcoin rose in value by 1.75% in August 2021, Cardano (ADA) and Ripple (XRP) were up 32.48% and 42.69% respectively. Therefore, Matthew believes that investors should bet on fast-growing cryptocurrencies gaining popularity and great potential in the near future:

- Polkadot (DOT)

- Cardano (ADA)

- Solana (SOL).

The last one on the list is an emerging crypto that will shoot up and be able to compete with etherium. This is Matthew Siegel’s opinion.

Lyn Alden – founder of Alden Investment Strategy believes that etherium will reach the price point of $5000 in 2022, but as a financial instrument it is significantly inferior to bitcoin (the most profitable and promising cryptocurrency for investment). However, she noted that altcoins have a high failure rate and can even be fraudulent, so financial contributions should be treated very carefully. The only coins that Lyn Alden singled out from the variety are Cardano and Solana.

The rest of the crypto assets did not interest the investor, she called them smoke and mirrors.

John Vasquez is a former banker who has completely switched to digital assets. He is also the founder of the training platform 3T Warrior Academy. On social media, he is known by the nickname Coach JV.

Since he is a short-term trader, his preferences are also on the side of altcoins. Vazquez predicts a correction in the bitcoin exchange rate as early as the end of 2021. Once the price of the main cryptocurrency drops, it will be the time for other coins. The trader calls it a parabolic run. To his subscribers in TikTok (which are almost 1 million), he advises to invest in Ethereum, Vechain, XRP and Cardano.

Value dynamics and price growth

In January 2021, the total market capitalization of cryptocurrency was $774 billion, and in 10 months this amount tripled to $2.58 trillion, with bitcoin accounting for 44.55%. Such a global growth of the digital asset market has its own reasons:

- The rate of cryptocurrency is not regulated by any body or organization, so its price is formed as a result of the balance between supply and demand. Research conducted by the American holding company Fidelity Investments (one of the largest in the world) has shown that the growth of bitcoin’s exchange rate in 2021 is not due to speculative schemes. The demand for the main cryptocurrency is due to the characteristics of the coin itself (convenience and speed of transactions, anonymity, a tool for financial transactions and investments).

- Digital assets attracted the attention of institutional investors, many hedge funds began to recognize bitcoin as a real asset that will help to save invested funds from inflation. This led to an increase in demand and the value of cryptocurrency.

- Any attempts to regulate the turnover of digital assets by government agencies affect the change in the exchange rate. For example, China introduced a strict ban on the use and mining of cryptocurrency. This news caused the bitcoin exchange rate to plummet (May 21, 2021). When Chinese “miners” began to move to other countries with their equipment and hash rate returned to the old values, the price of the first cryptocurrency began to rise.

- The fluctuations in value are affected by the stability of the software. Conducting hardforks or softforks can increase or decrease the price of a digital asset.

There are many more factors that influence the rise and fall of the rate. The prospect of cryptocurrency depends on the specifics of the coin itself, its blockchain, specialization, community activity.

Possible risks

Despite the growth of the cryptocurrency market and the benefits of using virtual money, digital assets have a number of disadvantages. Financial transactions with digital assets are subject to the followingrisks:

- Cryptocurrency exchanges shutting down. Over the year 2020, 75 platforms have ceased operations. The reasons are different: bankruptcy, change in legislation, hacker attacks or simply the disappearance of the management with all the assets. Users often do not have time to withdraw their money and lose it.

- High volatility. The cryptocurrency market is a phenomenon quite young and not fully formed. Many financial laws suitable for fiat currencies and securities do not apply here. Therefore, there is space for the realization of speculative schemes, traders can easily lose all assets, even having an economic education.

- Impossibility to cancel a transaction. Actually, this is often credited to cryptocurrency, but do not forget that an error of only 1 sign when making a transfer will lead to the loss of electronic coins, you can not return them. Similar is the case with the loss of a key or mnemonic phrase. In this case, access to the wallet will be closed.

It is estimated that about 30% of bitcoins are lost irretrievably for this reason.

The perspective of cryptocurrencies is a complex area of modern economics. All the mechanisms that influence the price of an individual digital asset have not yet been fully revealed. Therefore, you need to be cautious about investment projects related to virtual currency.

How to buy promising coins

Services where you can buy or exchange your favorite cryptocurrency, there are many. These are exchanges, exchange sites, automatic bots, some wallets, electronic payment systems (WebMoney, Advcash, Payeer). The choice depends on the buyer’s tasks. If coins are purchased for trading purposes, it is better to buy them immediately on the exchange (where there is an opportunity to enter fiat money). If tokens will be needed for settlements (for content, services or goods) within the platform, then they should be purchased through native wallets. This will reduce the transaction chain and commission costs.

Valuation of the future asset

The main issue for crypto investors is the choice of coins in which money will be invested. To ensure that the venture does not turn out to be unprofitable, you need to find out the following:

- What is the reputation of the organizers and the development team.

- How volatile the coin is.

- What opportunities the project has for further development.

- Technical aspects (blockchain, matching protocol, scaling).

- What is the market capitalization of the coin.

In addition, the choice of an instrument for investment depends on the size of the budget, the timing of the investment and the degree of risk the buyer is willing to take.

Choosing an exchange to buy

Platforms for trading operations with cryptocurrency are very many, new ones are constantly appearing. To orient yourself in all the variety of exchanges, it is easier to use the ratings that are compiled by expert sites. For example, CryptoProGuide.com.

It is worth paying attention to the following aspects:

- Availability of a demo account – the opportunity to practice without spending real money. There are few such platforms for 2021.

- Convenient deposit and withdrawal of assets.

- The number of traded pairs.

- Good support service.

Buying a coin for a long term

The main indicator that you should focus on when planning a long-term investment is the stability of the cryptocurrency. You should not choose coins that show jumping changes in the rate. More reliable are those that are at approximately the same level and rise in price gradually, without jerks.

You can also look (in news or informational materials), who of the major investors invest in the project. If it is a well-known hedge fund, there is more confidence in such an asset.

Best exchanges for buying cryptocurrencies

New platforms for trading cryptocurrency appear constantly. Each exchange has its own differences in available services, the number of traded pairs and so on. Before you open an account on the platform and deposit money on it, you need to carefully study all the nuances. Especially it concerns the security of the placed assets. The table shows several popular crypto exchanges.

| Wymiana | Year of opening | Traded pairs | Margin trading | Fiat | Futures | Hacking incidents |

|---|---|---|---|---|---|---|

| Binance | 2017 | 965 | Yes, leverage x125 | RUB, UAH, KZT, EUR, others | Tak | In spring 2019, 7000 BTC were stolen as a result of a hacker attack. Users have been reimbursed for the damage. |

| Bybit | 2018 | 58 | Yes, leverage x100 | Deposit via any bank card | Tak | Was not |

| EXMO | 2014 | 180+ | Yes, leverage x10 | Major fiat currencies, deposit via card and QIWI | Nie | There was a hack at the end of 2020. 6% of the total volume of cryptocurrencies on the platform was stolen. The damage was recovered. |

| Bitfinex | 2012 | 299 | Yes, leverage x3.3 | EUR, USD, GBP, JPY | Tak | August 2016 – 119,756 BTC stolen, 28,000 returned. December 2017 and February 2020 – major DDoS attacks. |

| OKEx | 2014 | 539 | Yes, x10 on spot and x125 on derivatives | Bank card support | Tak | February 2020 – DDoS attack disrupted the activities of the exchange, there was no theft of funds. |

Tips for beginners

Before you start investing money in digital assets or trading on the exchange, you should thoroughly research the topic.

The world of the cryptocurrency market is developing very quickly, there are new opportunities, trends, ways to earn money (the great popularity of DeFi from 2020 and the real boom of NFT-tokens in 2021).

There are many thematic communities in social networks. It is advisable to join the most active groups. This will help to keep up with the latest news about blockchain projects.

When registering on exchanges, you should immediately study all instructions. The top platforms offer good training materials.

Często zadawane pytania

❓ What is the best way to invest in cryptocurrency: choose one coin or invest in several promising altcoins?

Experts recommend assembling one of the investment portfolios: 40% BTC, 30% ETH, 20% DeFi, 10% blockchains v3 or 80% of the top 3 positions according to Coinmarketcap rating, 15% of new tokens with average rate and growth prospects, 5% of penny tokens.

🔎 How many different cryptocurrencies are available on the exchange in total?

Each platform presents its own set of trading pairs. Some are repeated across most exchanges, while others are only represented on one. According to Coinmarketcap, the total number of coins at the end of 2021 is 13,333.

Such firms often employ good specialists. However, this will not be a guarantee of avoiding the loss of invested funds.

💡 Which crypto exchange is the largest and most significant?

If you take the volume of daily turnover of funds as a selection criterion, the best one is Binance.

💰 What is the minimum amount to buy futures or derivatives on the exchange?

Crypto exchanges offer different conditions to their users. On Binance, it was possible to invest from 10 USDT.

Błąd w tekście? Podświetl go myszą i naciśnij Ctrl + Wprowadź.

Autor: Saifedean Ammousekspert w dziedzinie ekonomii kryptowalut.