At the end of February 2022, Western countries began to impose restrictions on Russia. The consequences of the sanctions have a strong impact on the crypto market in Russia. For example, it is more difficult for users to gain access to trading digital assets. Also, some exchanges impose restrictions on ruble transactions, crediting and withdrawal via Visa/Mastercard bank cards.

Sanctions and the cryptocurrency market

By the evening of March 9, 2022, the governments of some states, directors of many international companies and heads of some virtual platforms have already introduced restrictions for Russian users. The main areas of sanctions are presented in the table below.

| Restrictions | Brief descriptions |

|---|---|

| Blocking of Mastercard and Visa bank cards | Transactions abroad are not available to owners of payment instruments from issuers from the Russian Federation |

| Cryptoplatforms leaving Russia | Such exchanges as Upbit and Bithumb have already finished servicing users from Russia |

| Refusal of mining pools from Russian cryptocurrency miners | By March 9, 2022, Flexpool and Ethermine services refused to work with clients from the Russian Federation |

Visa and Mastercard cards blocked

Late in the evening of March 5, 2022, the founders of the Mastercard and Visa payment systems announced the temporary halt of all transactions on cards issued in Russia. In a few hours this information spread around the world thanks to the media of international and national level.

Visa head Al Kelly said that the reason for the blocking of transactions was Russia’s conflict with Ukraine. As a result, transactions outside the country using Visa/Mastercard bank cards issued by Russian issuers will become unavailable to the population. Also, Russian residents will not be able to use payment instruments from non-local financial institutions inside their state.

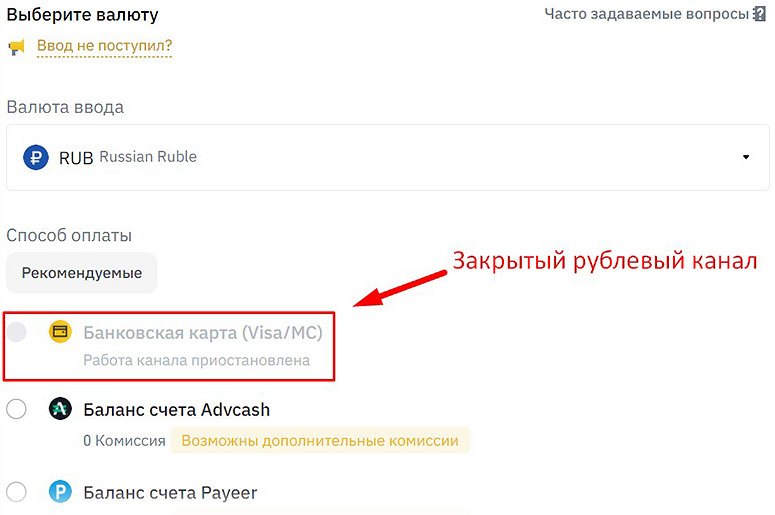

These restrictions affect the crypto market in Russia. For example, on March 9, 2022, the Binance exchange suspended the Visa/Mastercard channel for depositing rubles into trading accounts. Now users from the Russian Federation can deposit RUB only through Advcash and PAYEER, which requires the payment of a larger amount of commissions and causes difficulties when depositing on the crypto platform.

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

Exchanges leaving the Russian market

By the evening of March 9, 2022, crypto platforms Upbit, Bithumb, Korbit and Gopax ended their activities in the Russian Federation. Russian clients of the platforms were blocked. Project managers explained that the IP addresses of users were blacklisted. Also, according to the founder of Upbit, the blocking followed after receiving recommendations from FATF – the Financial Action Task Force on Money Laundering.

In addition, Binance, Exmo and FTX restricted access to Russian users from the sanctions lists of the European Union and the United States. The measures taken do not apply to all clients from the Russian Federation.

Ethermine’s refusal to work with miners from Russia

In early spring, on March 4, 2022, it became known that a large mining pool Ethermine, which brings together investors for joint mining of the cryptocurrency Ethereum, stops working with investors from the Russian Federation. For the first time information about this appeared in the updated user agreement of the service.

Representatives of the Bitfly management company explained that the decision was made on a legislative basis. The creators of the service were guided by the regulation “On Combating Money Laundering and Countering Illegal Financial Transactions.” Restrictions on Russian and Belarusian miners were introduced to ensure the impossibility of circumventing the U.S. sanctions requirements.

As of March 9, 2022, it is known that Ethermine has not yet blocked clients from the Russian Federation. However, Russian users will soon be forced to switch to other mining pools for ETH mining. By the late evening of March 9, 2022, dozens of threads have already been opened on thematic forums to discuss the best platforms.

Other restrictions

Part of the cryptocurrency exchanges themselves impose sanctions against Russians. Here are a few restrictions:

- Disabling trading pairs with the ruble. For example, on February 26, 2022, the creator of the Kuna Exchange announced such a decision. The news was published in the official Telegram channel of the founder of the platform.

- Stopping the registration of new clients from the Russian Federation. On February 26, 2022, the crypto exchange CEX reported about the introduction of such a restriction. At the same time, already created accounts of Russians registered less than 120 days ago were blocked.

- Stopping ruble transactions. For example, from February 26, 2022, all CEX users cannot make deposits in RUB and withdraw funds, as well as take loans in this national currency.

Further development scenarios

As of March 10, 2022, the situation in the field of cryptocurrencies remains unstable. Almost every day new restrictions are undertaken against Russian users of digital assets. Some sanctions are imposed by exchanges on their own, while others are imposed at the request of various governments and foreign financial regulators.

Blocking of Russian cryptocurrency accounts

Coinbase platform CEO Brian Armstrong said on March 4 that he believes it is mandatory for all users to have easy access to virtual assets. The head of the cryptocurrency platform explained his opinion by the fall in ruble quotes on Forex and currency exchanges. Armstrong said that for customers from the Russian Federation digital assets are a “lifeline” that helps to keep savings.

However, the head of Coinbase reminded that the exchange operates under the jurisdiction of the United States. If the government of this country demands to block all crypto accounts of Russian users, the platform will have to comply. A similar situation is with many centralized exchanges that have official registration in different countries.

Massive demands from governments to block Russian digital accounts could trigger the collapse of the cryptocurrency market in the Russian Federation.

Easing restrictions

The heads of most digital exchanges promise to reconsider the imposed sanctions against crypto users from the Russian Federation when the conflict between Russia and Ukraine subsides. The situation on the market of virtual assets will most likely begin to stabilize after its end.

Recommendations

Due to the imposed sanctions, Russian users started to face problems in the cryptocurrency market and even lose funds invested in virtual coins and tokens. But there are 4 basic recommendations, if you follow them, you can be able to save your invested money:

- Withdraw investments from centralized exchanges. The best way to secure capital is to transfer cryptocurrency to another payment system or digital coin.

- Switching to decentralized exchanges (DEX). Such platforms are not subject to laws and government requirements. At the same time, there are usually no trading accounts as such on DEX, so there is actually nothing to block.

- Cryptocurrency conversion through exchanges and P2P services. Such platforms will allow owners of digital assets to quickly buy and sell digital assets for rubles, dollars or other currencies in the future.

- Application of non-custodial crypto wallets. On the servers of such storages there is no information about clients’ registration data and private keys from user addresses. Developers of such software simply can not block wallets even at the request of the government or regulator.

Conclusion

At the end of February 2022, Western countries began to impose tough economic sanctions against the Russian Federation. Their consequences affected the domestic cryptocurrency market. By March 9, 2022, users from the Russian Federation increasingly began to encounter problems when interacting with digital platforms.

Some Russian clients lost access to their savings on exchange accounts altogether. However, in most cases, this is due to the aggravation of harsh economic conditions by restrictions from the platforms themselves. To avoid losing your investments, you should follow 3 basic recommendations:

- Cashing out accounts.

- Switching to DEX.

- Operating non-custodial cryptocurrency software.

Is there a mistake in the text? Highlight it with your mouse and press Ctrl + Enter

Author: Saifedean Ammous, an expert in cryptocurrency economics.